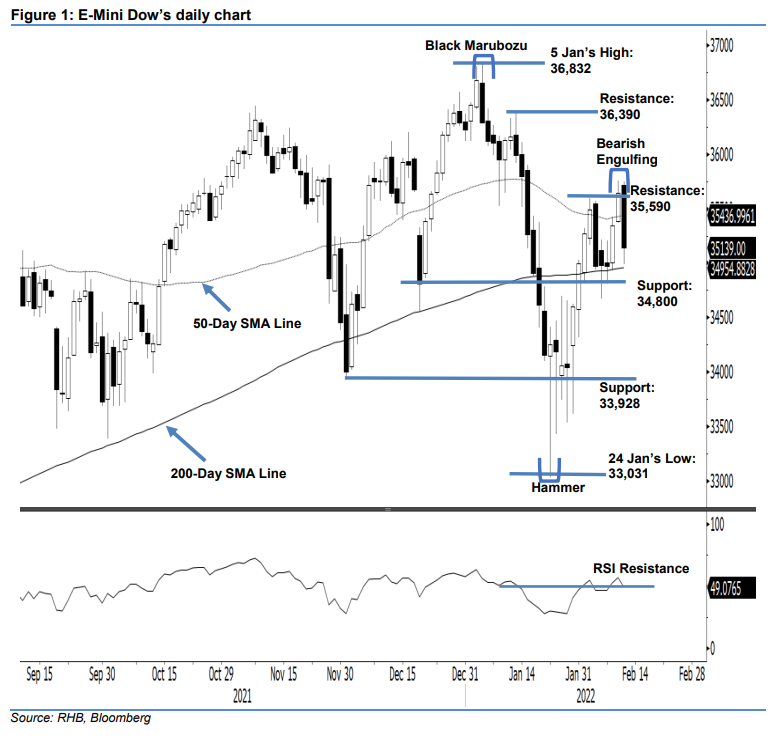

E-Mini Dow: a Pullback to Retest the 200-Day SMA Line

rhboskres

Publish date: Fri, 11 Feb 2022, 05:49 PM

Maintain long positions. The E-Mini Dow failed to sustain above the 200-day SMA line, declining 502 pts to settle at 35,139 pts. The index began Thursday’s session on a positive note, gapping up to open at 35,717 pts. After touching the 35,750-pt session high, it moved sideways for most of the session. Sentiment turned negative during the US session, with the index plunging to the session’s low of 34,990 pts and closing in negative territory – printing a fresh Bearish Engulfing pattern. The RSI has fallen below the 50% threshold – suggesting weak momentum – with the 50-day SMA line acting as a strong resistance level. If correction continues, and the index drops below the 200-day moving average line, we expect negative momentum to follow through towards the lower support level at 33,928 pts. For now, the index remains above the 200-day SMA line. We hold on to our positive trading bias.

Traders should retain the long positions initiated at 34,997 pts or the closing level of 31 Jan. For risk management purposes, the stop-loss is placed at 34,800 pts.

The first support is revised to 34,800 pts, followed by 33,928 pts or the low of 1 Dec 2021. Conversely, the immediate resistance is revised to 35,590 pts, which was 2 Feb’s high, followed by 36,390 pts or 13 Jan’s high.

Source: RHB Securities Research - 11 Feb 2022