Hang Seng Index Futures: Bulls Taking a Breather Near 25,000 Pts

rhboskres

Publish date: Mon, 14 Feb 2022, 08:41 AM

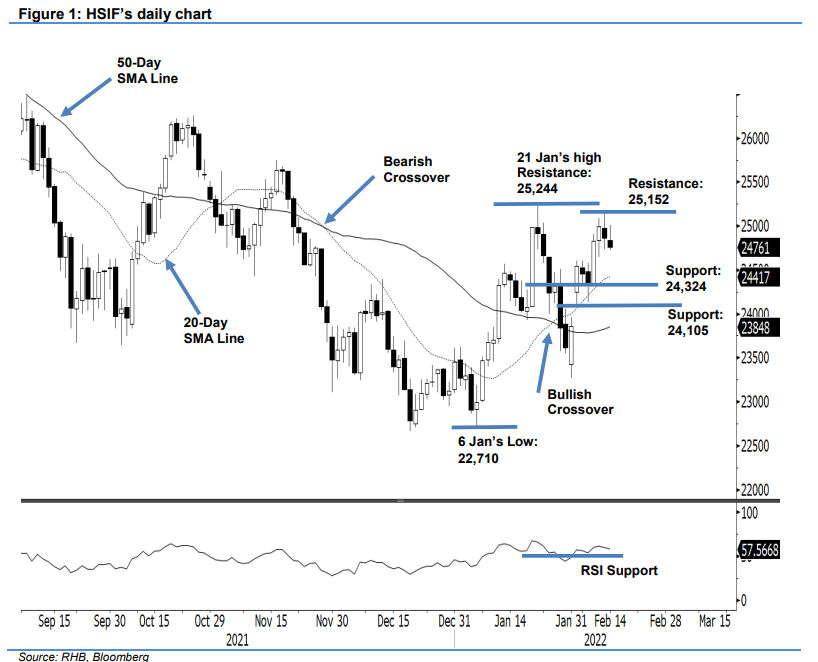

Maintain long positions. The HSIF’s upside momentum halted at the 25,152-pt resistance level, where it pulled back 130 pts to settle the day session at 24,860 pts. During the evening session, negative momentum dragged the index lower – it retreated 99 pts and last traded at 24,761 pts. As mentioned in our previous report, if the index experiences profit-taking, we expect strong support to be found near the 20-day SMA line. As long as the index continues to stay above the moving average line – charting a “higher low” pattern – the bullish structure would be deemed as intact. We make no changes to our positive trading bias until the stop-loss is breached.

We recommend traders stay with the long positions initiated at 24,704 pts or the close of 9 Feb’s evening session. To manage downside risks, the initial stop-loss is revised higher to 24,000 pts from 23,662 pts.

The immediate support is adjusted higher to 24,324 pts – 8 Feb’s close – followed by the 24,105-pt – the low of 4 Feb. Conversely, the immediate resistance is pegged at 25,152 pts – 11 Feb’s high – followed by 25,244 pts, or the high of 21 Jan.

Source: RHB Securities Research - 14 Feb 2022