Hang Seng Index Futures - Retracing to Test the 20-Day SMA Line

rhboskres

Publish date: Tue, 15 Feb 2022, 08:46 AM

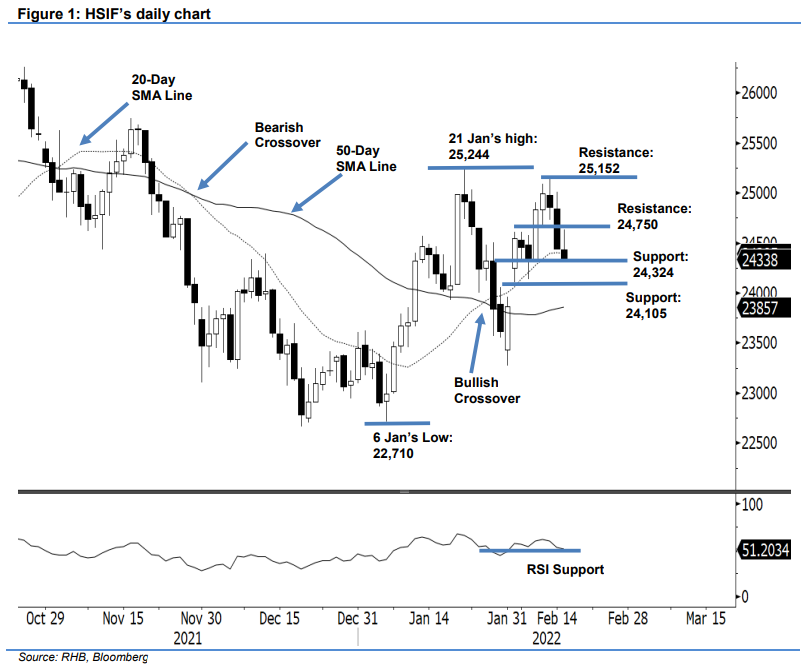

Maintain long positions. The HSIF underwent a correction for the second consecutive session, losing 423 pts to settle at 24,437 pts. Sentiment turned risk-off on Monday, after the index gapped down to open at 24,659 pts. It then rebounded to test the day session’s 24,739-pt high before reverting downwards to the low of 24,431 pts ahead of the close. Negative momentum continued during the evening session, with the index retreating 99 pts. It was last traded at 24,338 pts. The weakness in price action is in tandem with the rounding down of the RSI indicator – both suggest that the correction phase is taking place now. If selling pressure persists, the index may fall below the 20-day SMA line support level and head towards the 50-day SMA line. A breach of the 24,105-pt support level may see the formation of a “lower low” bearish pattern. We will keep our positive trading bias until the stop-loss is triggered.

Traders are advised to retain the long positions initiated at 24,704 pts or the close of 9 Feb’s evening session. For risk management, the initial stop-loss is set at 24,000 pts.

The immediate support remains at 24,324 pts – 8 Feb’s close – followed by the lower support at 24,105 pts or the low of 4 Feb. The immediate resistance is pegged at 24,750 pts, followed by 25,152 pts, which was the high of 11 Feb.

Source: RHB Securities Research - 15 Feb 2022