WTI Crude: Firming Up to Propel Towards the USD100.00 Level

rhboskres

Publish date: Tue, 15 Feb 2022, 08:48 AM

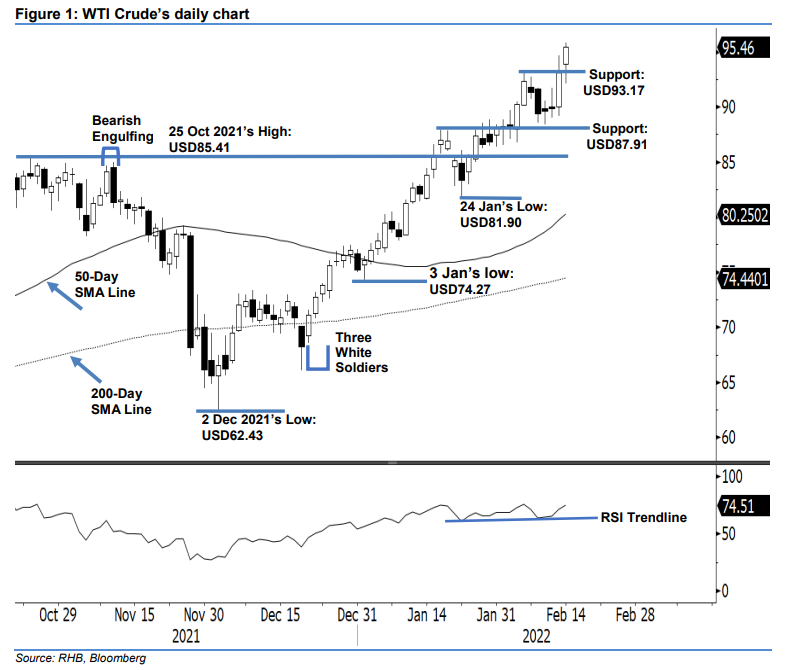

Maintain long positions. The WTI Crude continued its bullish momentum as it surpassed the immediate resistance yesterday – gaining USD2.36 to settle at USD95.46. The commodity started the session at USD93.91 and whipsawed between the low and high of USD92.09 and USD95.82 throughout the session. It rebounded strongly from its intraday low towards printing the day’s high before the close. The bullish candlestick with long lower shadow indicates the bulls are gaining control above the recent high and the WTI Crude is set to move towards the USD100.00 threshold. Nevertheless, we expect the bulls to take a breather after hitting this level in the coming sessions. As such, we keep to our bullish trading bias.

Traders are recommended to maintain the long positions initiated at USD73.79 or the closing level of 23 Dec 2021. To manage the trading risks, the trailing-stop threshold is set at USD87.91, ie the high of 19 Jan.

The immediate support is marked at USD93.17 – 4 Feb’s high – and followed by USD87.91, which was 19 Jan’s high. Meanwhile, the first resistance is pegged at the USD100.00 psychological level and followed by the USD110.00 whole number.

Source: RHB Securities Research - 15 Feb 2022