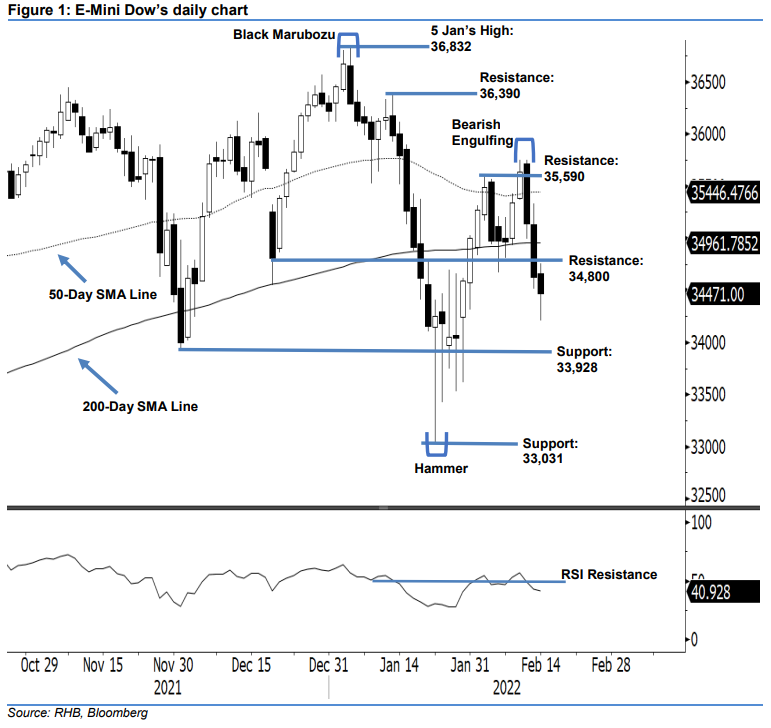

E-Mini Dow: Falling Further Below the 200-Day SMA Line

rhboskres

Publish date: Tue, 15 Feb 2022, 08:48 AM

Stay short positions. The E-Mini Dow continued its selling pressure yesterday after falling for a third consecutive session – it dropped 156 pts to settle at 34,471 pts. The index began the session at 34,665 pts and oscillated sideways to hit the intraday high of 34,755 pts before swiftly changing direction southwards. It then hit the day’s low of 34,205 pts during the European trading session. Strong buying interest emerged to recoup part of the losses towards the close. The black candlestick with long lower shadow beneath the 34,800-pt resistance suggests the bears remain in control and still overpowered the bulls during the intraday session yesterday. With the RSI pointing lower to the 40% threshold – suggesting weak momentum – the downwards pressure is expected to sustain in the medium term. With that, we keep to our bearish view.

We suggest traders maintain the short positions initiated at the closing level of 11 Feb, ie 34,627 pts. For risk-management purposes, the stop-loss threshold is placed at 35,590 pts.

The first support is revised to 33,928 pts or the low of 1 Dec 2021. This is followed by 33,031 pts, ie the low of 24 Jan. Conversely, the resistance levels are revised to 34,800 pts and followed by 35,590 pts, which was 2 Feb’s high.

Source: RHB Securities Research - 15 Feb 2022