E-Mini Dow: Attempting to Return Above the 200-Day SMA Line

rhboskres

Publish date: Wed, 16 Feb 2022, 05:38 PM

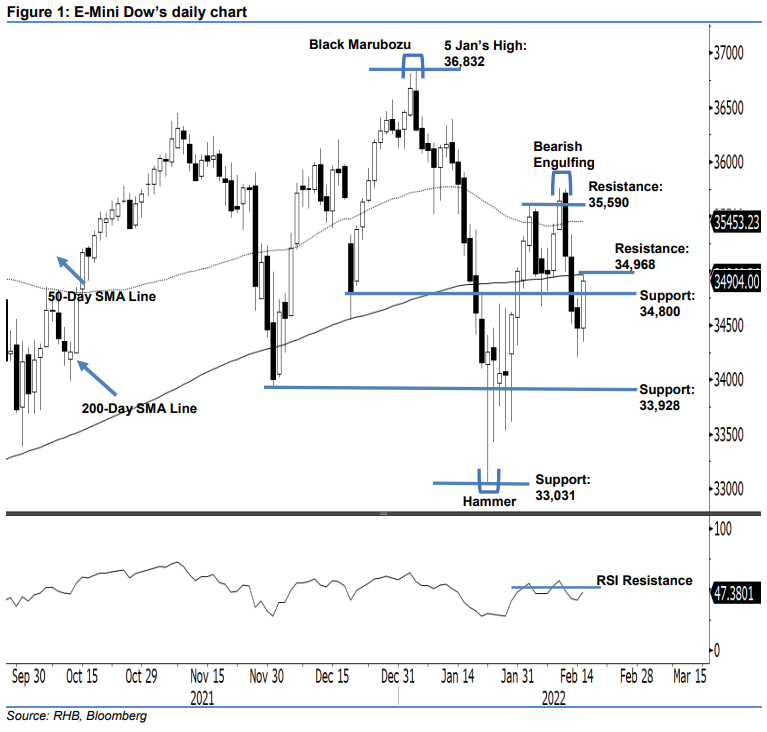

Stay in short positions. The E-Mini Dow saw selling pressure take a breather yesterday, with the index bouncing towards the 200-day average line. It closed 433 pts stronger at 34,904 pts. The index began the session at 34,472 pts and oscillated sideways to the intraday low of 34,345 pts, before jumping upwards early in the European trading session. It propelled strongly towards the intraday high of 34,968 pts before the close. The long white candlestick hitting the 200-day SMA line yesterday suggests that buying pressure is building up for an uptrend reversal, following the recent selldown. Despite the RSI improving towards the 50% level, it is still premature to assume an uptrend reversal will take place in the medium term, as the index is still trading below the 200-day SMA line. Unless it moves beyond the 200-day SMA line, we will keep our bearish view.

We suggest traders maintain the short positions initiated at the closing level of 11 Feb, or 34,627 pts. For risk-management purposes, the stop-loss threshold is revised lower to 34,968 pts.

The first support is revised to 34,800 pts, followed by 33,928 pts, or the low of 1 Dec 2021. Conversely, the resistance levels are revised to 34,968 pts – 15 Feb’s high – and 35,590 pts, which was 2 Feb’s high.

Source: RHB Securities Research - 16 Feb 2022