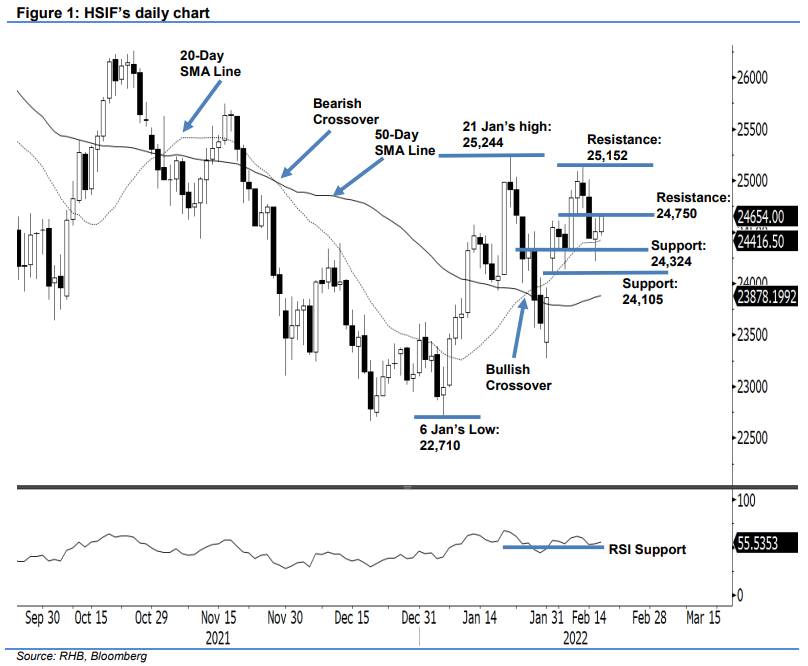

Hang Seng Index Futures: Bouncing Above the 20-Day SMA Line

rhboskres

Publish date: Wed, 16 Feb 2022, 05:38 PM

Maintain long positions. Following the recent correction, the HSIF rebounded from its intraday low yesterday, staying above the 20-day SMA line. It gained 64 pts to settle at 24,501 pts. After opening at 24,430 pts and diving lower to hit the 24,215-pt intraday low, the sentiment turned risk-on as the index switched its momentum to positive. It climbed higher towards hitting the intraday high of 24,636 pts. However, strong selling pressure then kicked in to drag the HSIF lower towards the close – but still above the opening. The positive momentum continued during the evening session, with the index adding a strong 153 pts. It last traded at 24,654 pts. The price recovery is in tandem with the improving strength of the RSI indicator – pointing upwards at the 55% level. If buying pressure persists, the HSIF may continue to rebound higher towards breaching the 24,750-pt resistance and followed by the 25,152-pt next resistance. As such, we keep to our positive trading bias unless the stop-loss mark is triggered.

Traders are advised to retain the long positions initiated at 24,704 pts or the close of 9 Feb’s evening session. For risk-management purposes, the initial stop-loss threshold is set at 24,000 pts.

The immediate support remains at 24,324 pts – 8 Feb’s close – and followed by the lower support at 24,105 pts, ie the low of 4 Feb. The immediate resistance is pegged at 24,750 pts and followed by 25,152 pts, which was the high of 11 Feb.

Source: RHB Securities Research - 16 Feb 2022