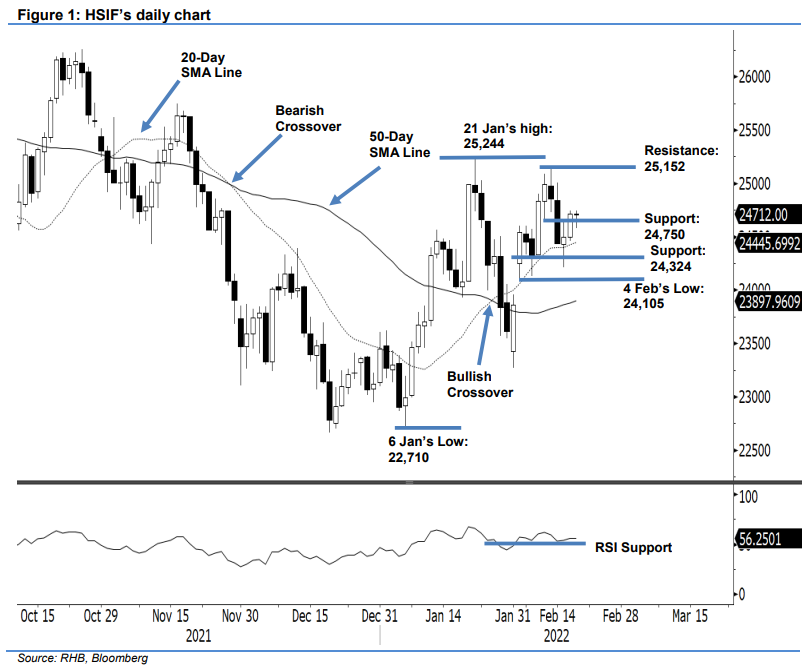

Hang Seng Index Futures: Breaching the 24,750-Pt Immediate Resistance

rhboskres

Publish date: Thu, 17 Feb 2022, 04:28 PM

Maintain long positions. The HSIF bounced higher yesterday, gaining 214 pts to settle at 24,715 pts. After opening at 24,501 pts and hitting the 24,462-pt intraday low, the sentiment shifted into positive territory as the index climbed higher towards hitting the intraday high of 24,746 pts before the close. The bulls then took a breather during the evening session, with the HSIF moving in a neutral direction to inch lower by 3 pts. It last traded at 24,712 pts. The strong rebound that breached the immediate resistance yesterday was in tandem with the improving strength of the RSI indicator, which is pointing above the 55% level. If the buying pressure persists, the index may continue to propel higher towards the 25,152-pt resistance and followed by the next resistance at 25,244 pts. As such, we keep to our positive trading bias unless the stop-loss mark is triggered.

Traders are advised to retain the long positions initiated at 24,704 pts or the close of 9 Feb’s evening session. For risk-management purposes, the initial stop-loss threshold is set at 24,324 pts.

The immediate support remains at 24,750 pts and then 24,324 pts, ie 8 Feb’s close. The immediate resistance is pegged at 25,152 pts or 11 Feb’s high and followed by 25,244 pts, which was the high of 21 Jan.

Source: RHB Securities Research - 17 Feb 2022