Hang Seng Index Futures: Bulls Pausing Near the 24,750-Pt Resistance

rhboskres

Publish date: Fri, 18 Feb 2022, 06:39 PM

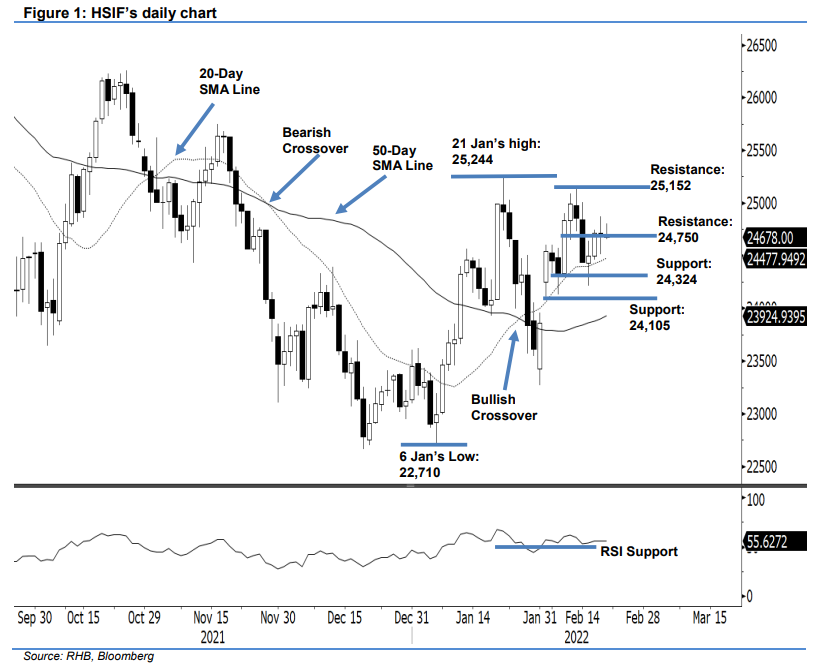

Maintain long positions. The HSIF moved in a volatile manner during the intraday session yesterday but closed on a neutral tone – it remained unchanged to settle at 24,715 pts. After opening at 24,710 pts and hitting the 24,515-pt intraday low, the index shifted direction and attempted to move higher as it climbed towards hitting the intraday high of 24,874 pts before retracing moderately towards the close. The bulls then attempted to jump higher during the evening session, but this was shortlived. The HSIF dragged lower by 37 pts and last traded at 24,678 pts. The neutral “doji” candlestick printed yesterday suggests the bulls are taking a breather above the 20-day average line while maintaining the “higher low” bullish pattern. If the buying pressure persists above the 24,750-pt resistance, the index may continue to propel higher. Hence, we keep to our positive trading bias unless the stop-loss mark is triggered.

Traders are advised to retain the long positions initiated at 24,704 pts or the close of 9 Feb’s evening session. For risk-management purposes, the initial stop-loss threshold is set at 24,324 pts.

The immediate support remains at 24,324 pts – 8 Feb’s close – and then 24,105 pts or 4 Feb’s close. The immediate resistance is pegged at 24,750 pts and followed by 25,152 pts, which was the high of 21 Jan.

Source: RHB Securities Research - 18 Feb 2022