WTI Crude - the Bulls Are Struggling Below the Immediate Resistance

rhboskres

Publish date: Mon, 21 Feb 2022, 09:04 AM

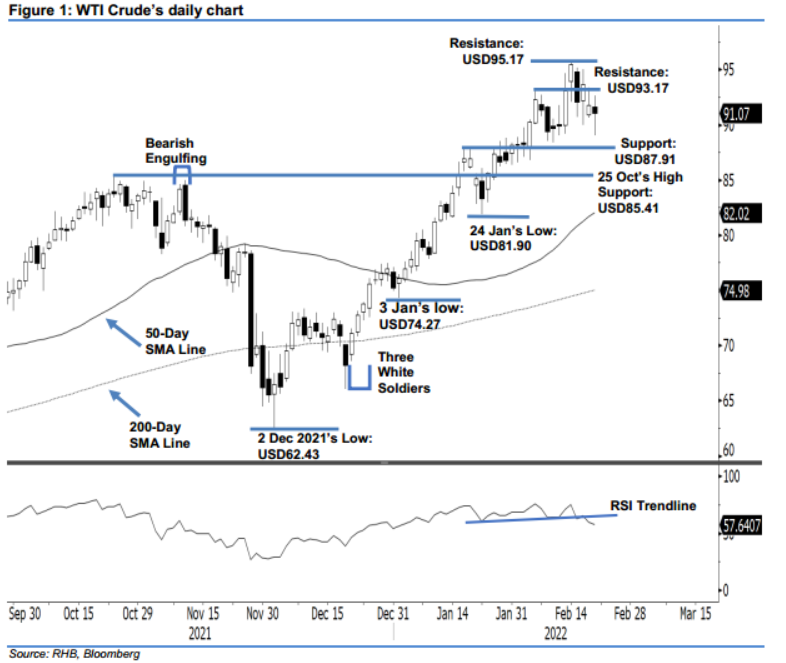

Maintain long positions. The WTI Crude whipsawed in a negative direction last Friday – it then closed USD0.69 lower at USD91.07, ie below the USD93.17 immediate resistance. The commodity opened lower at USD91.63 and then whipsawed in a volatile fashion between the USD92.66 high and USD89.03 day’s low throughout the sessions. The WTI Crude then bounced off strongly from the day’s low towards the close, ie below the opening. The latest small black body candlestick with long lower shadow suggests that, despite the late buying pressure during the intraday session, the bulls were not able to settle above Friday’s opening. Hence, we think the immediate-term buying momentum remains weak – we now expect the black gold to fall lower towards the USD87.91 support. Nevertheless, the medium-term bullish momentum remains intact, as the WTI Crude has yet to breach below the immediate support to form a “lower low” pattern. As such, we keep to our bullish trading bias until the trailing-stop point is breached.

Traders are recommended to maintain the long positions initiated at USD73.79 or the closing level of 23 Dec 2021. To manage the trading risks, the trailing-stop threshold is set at USD87.91, ie the high of 19 Jan.

The immediate support is marked at USD87.91 – 19 Jan’s high – and followed by USD85.41 or 25 Oct’s high. The resistance level is revised to USD93.17 – 4 Feb’s high – and followed by USD95.17, which was 15 Feb’s high.

Source: RHB Securities Research - 21 Feb 2022