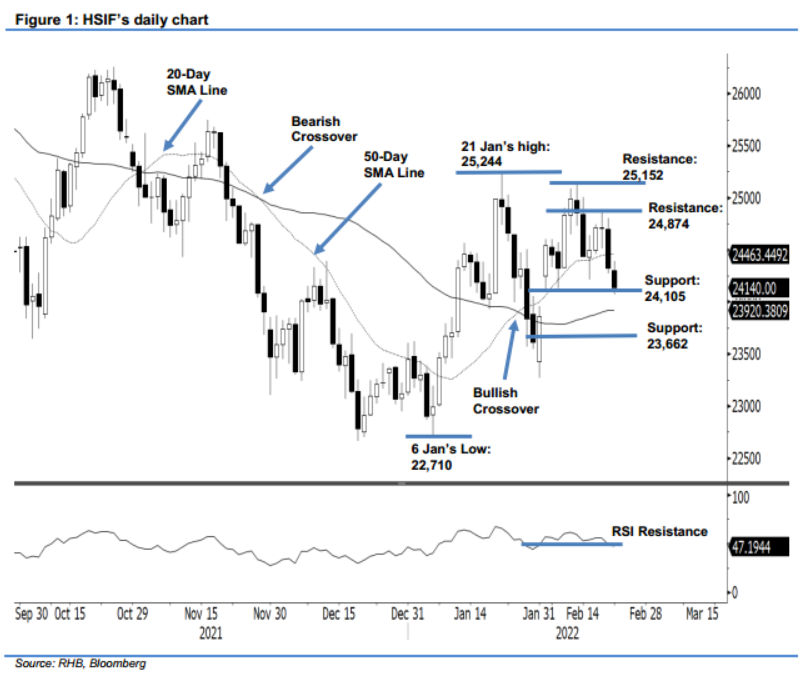

Hang Seng Index Futures - Retreating Below the 20-Day SMA Line

rhboskres

Publish date: Mon, 21 Feb 2022, 10:01 AM

Stop-loss triggered; initiate short positions. The HSIF gave up its position above the 20-day SMA line last Friday. It fell 392 pts during the day session to settle at 24,323 pts. Negative momentum continued to drag the index lower in the evening session, and it fell another 183 pts to settle at 24,140 pts. As it has fallen below the 20-day SMA line, the bears may attempt to test the 24,105-pt support level. A breach of the immediate support level may erase the gains attained since 4 Feb, and the index is poised to record a new low for February. Meanwhile, the bulls may come in to provide support near the 50-day SMA line. As the stop-loss has been triggered, we shift to a negative trading bias.

We closed out the long positions initiated at 24,704 pts or the close of 9 Feb’s evening session, after the stop-loss at 24,324 pts was triggered. Conversely, we initiate short positions at the close of 18 Feb’s day session, or 24,323 pts. For risk management, the initial stop-loss threshold is set at 24,874 pts.

The immediate support is marked at 24,105 pts – 4 Feb’s low – and then 23,662 pts, or 12 Jan’s low. Meanwhile, the immediate resistance is pegged at 24,874 pts (18 Feb’s high), followed by 25,152 pts, which was the high of 11 Feb.

Source: RHB Securities Research - 21 Feb 2022