Hang Seng Index Futures: Breaching Below the 24,000-Pt Level

rhboskres

Publish date: Wed, 23 Feb 2022, 05:06 PM

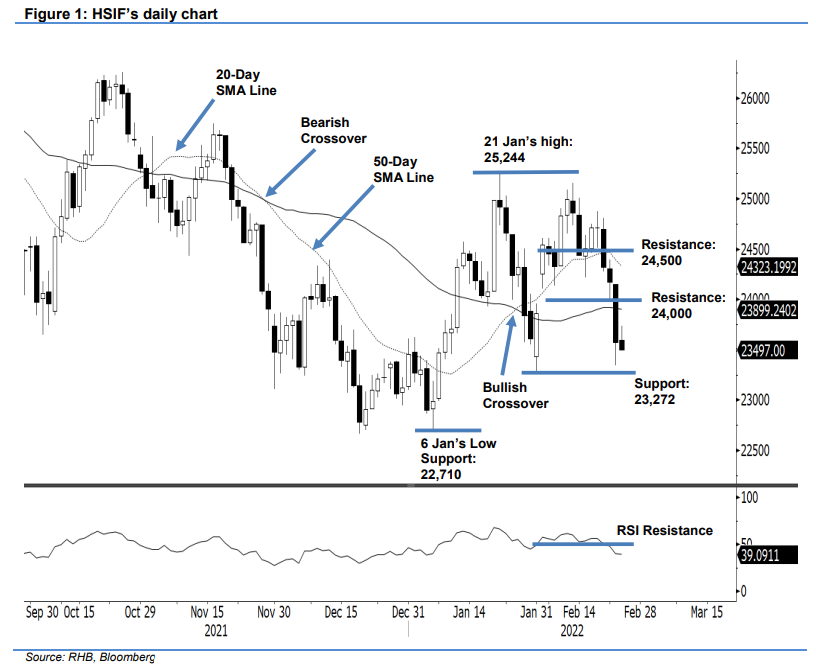

Maintain short positions. The HSIF continues to see weakness in its trend, plunging 594 pts yesterday and settling the day session lower at 23,574 pts where it breached below the 24,000-pt psychological level. The index opened at 23,838 pts and progressed lower towards the 23,346-pt day low. It then closed at 23,574 pts after printing a long bearish candlestick. The negative momentum dragged the HSIF lower by 77 pts during the evening session – it last traded at 23,497 pts. Yesterday’s price action indicates the bears remain in control of the trend. The index also fell below the 50-day SMA line, reaffirming a bearish setup. For now, the 50-day SMA line will act as a resistance. With the negative momentum in play, we stick to a bearish trading bias.

Traders are advised to keep the short positions initiated at 24,323 pts or the close of 18 Feb’s day session. To minimise the trading risks, the stop-loss threshold is adjusted to 24,500 pts from 24,874 pts.

The first support is revised to 23,272 pts – 31 Jan’s low – and then 22,710 pts or the low of 6 Jan. Conversely, the nearest resistance is pegged at the 24,000-pt psychological level and higher resistance of the 24,500-pt whole number.

Source: RHB Securities Research - 23 Feb 2022