Hang Seng Index Futures : Falling to 2022’s Low

rhboskres

Publish date: Fri, 25 Feb 2022, 04:59 PM

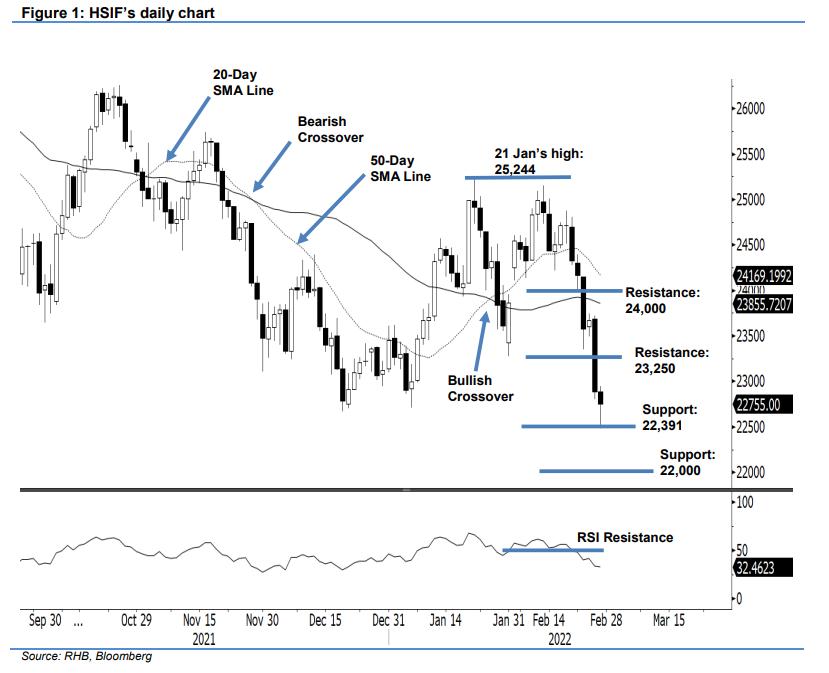

Maintain short positions. The HSIF continued to drift lower yesterday, on the back of strong negative momentum. It plunged 781 pts to settle the day session at 22,890 pts. After opening at 23,270 pts, it moved lower and reached the day session’s low of 22,801 pts before the close. The negative momentum continued in the evening session, dragging the index 135 pts lower. It was last traded at 22,755 pts. The RSI indicator is pointing downwards – this suggests that the negative momentum remains intact. The index may correct further until it finds an interim base or forms a candlestick with long lower shadow. The RSI also shows that the index is approaching an oversold level, and may stage a technical rebound. If this happens, the index may rebound to test the 23,250-pt immediate resistance level. As the bears are still in control, we retain our negative trading bias.

We recommend traders hold on to the short positions initiated at 24,323 pts or the close of 18 Feb’s day session. To minimise the trading risks, the stop-loss threshold is adjusted to 24,150 pts from 24,500 pts.

The immediate support is shifted lower to 22,391 pts – 24 Feb’s low – followed by the 22,000-pt round figure. The first resistance is pegged at 23,250 pts, followed by the 24,000-pt psychological level.

Source: RHB Securities Research - 25 Feb 2022