SUPER BULL STOCKS

NOW SHOWING : THE TRILOGY OF FAST & FURIOUS SHOW - PART 15 - This stock is on pivotal breakout to new high

SEE_Research

Publish date: Wed, 27 Oct 2021, 06:00 AM

Super Positive Momentum Stocks

FOR

22 OCTOBER 2021 ---

KGB & KGB WB

Cardi B , Vin Diesel , Paul Walker or the strong man Mark Felix

SUPER BULL STOCKS

Super Positive Momentum Stocks

FOR 27

OCTOBER 2021 --- KGB & KGB WB

KGB will on the way to lauch a new high of challenging on the old current high and closed with great conviction above RM1.89 .

Will you be the ones , who enjoy the acceptance of joining the party to celebrate with joy.

![How? Invest in Stocks Malaysia [works GREAT from 2021]](https://www.howtofinancemoney.com/wp-content/uploads/2018/04/Stocks-investing-niching-down-micro-sector.gif)

========================================================================

|

Kelington Group Berhad./ 0151 Date |

Price Target

|

Upside/Downside

|

Price Call

|

Source

|

Link

|

|---|---|---|---|---|---|

| 06/10/2021 | 2.01 | 0.270 (15.52%) | BUY | MalaccaSecurities | |

| 06/10/2021 | 2.50 | 0.760 (43.68%) | BUY | KENANGA | |

| 01/10/2021 | 2.50 | 0.760 (43.68%) | BUY | KENANGA | |

| 30/09/2021 | 2.50 | 0.760 (43.68%) | BUY | KENANGA |

=========================================================================

LEFTOVER FOOD WASTE

Vin Diesel , Paul Walker or the strong man--- Mark Felix

--- Cardi B , Vin Diesel , Paul Walker or the

strong man Mark Felix

Which Fast & Furious Character Are YOU ?

The Good , The Bad , The Ugly

Which Fast & Furious Character Are YOU ?

Cardi B ,Vin Diesel , Paul Walker

or the

strong man Mark Felix

=======================================================================

" 2 " -

TOP PICKS POSITIVE MOMENTUM STOCKS IN SEPTEMBER 2021

KLSE KGB + KGB WB + OCB /5533

===============================================================

BREAKING NEWS

BREAKING NEWS

Kelington poised for rebound, says RHB Retail Research

KUALA LUMPUR (Oct 7): RHB Retail Research said Kelington Group is poised for a rebound from the recent pullback, after it bounced off the 21-day average line recently – it opened with a gap then headed towards the all-time high of RM1.88.

In a trading stocks note on Thursday, the research house said if the stock manages to breach that level, the momentum is expected to propel the stock towards the uncharted territory of the RM2.00 psychological level, before possibly hitting the RM2.10 threshold.

“However, this expectation will be cancelled if it falls below the support of RM1.70,” it said.

Last Updated 11 hours ago

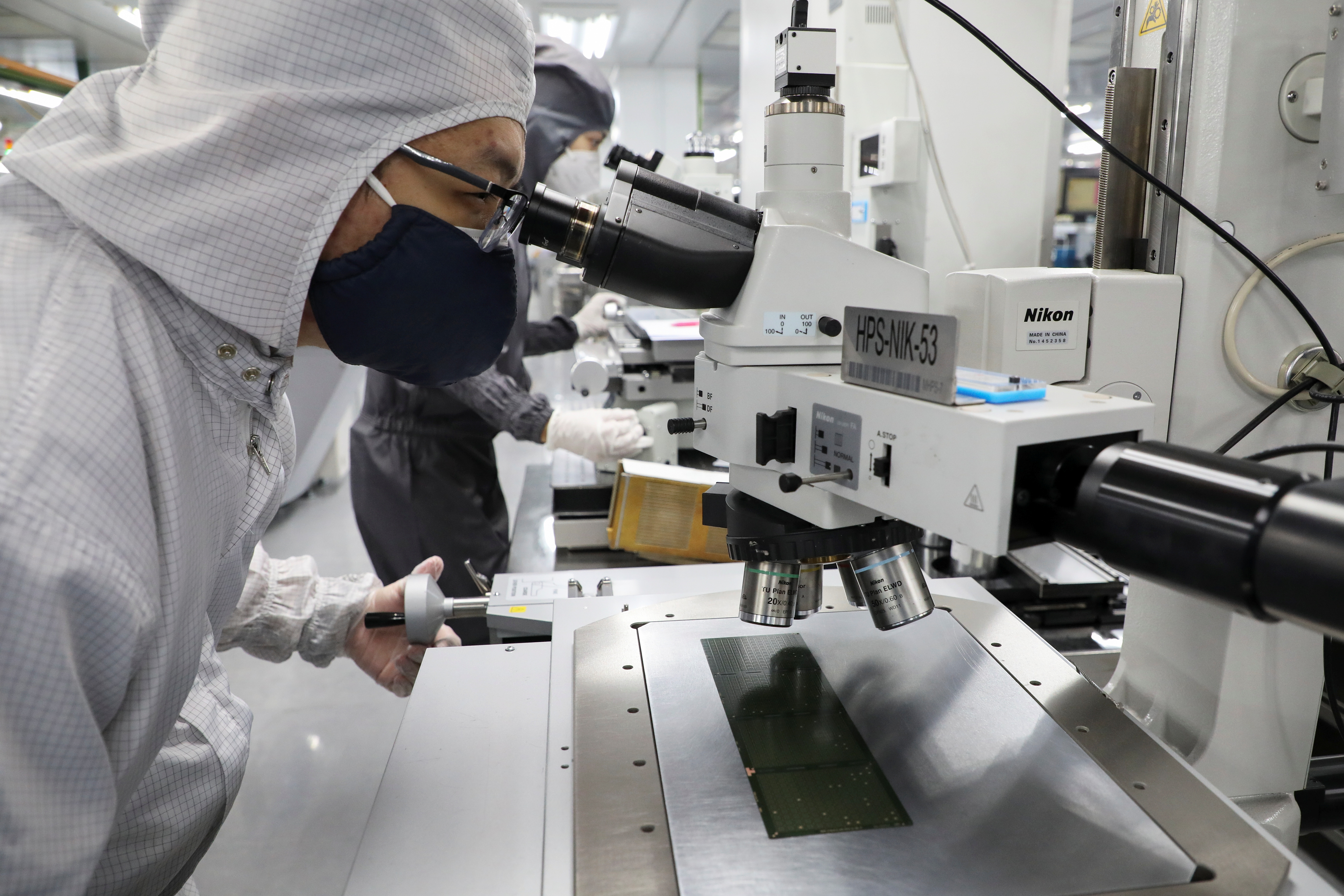

KUALA LUMPUR, Oct 20 (Reuters) - Malaysian electronics firms central to the supply of basic chips that drive the world's cars, smartphones and home devices say big-name customers are beating on their doors to lock in take-or-pay, longer-term deals - and happy to pay more if need be.

Manufacturers are rushing to replenish chip stocks depleted during coronavirus pandemic factory curbs - not least automakers who earlier cancelled orders expecting poor demand. That chip shortage has slammed their output, and still dislocates supply chains, just as consumer demand ramps up along with a global easing of COVID restrictions in everyday life.

At factories in Malaysia, operators like chip packaging firm Unisem (UNSM.KL) say that drive is leading buyers that sell chips on to auto and electronics manufacturers to become willing to sign up for big price hikes, some even asking for as many assembled chips as plants can produce - whatever the cost.

But Malaysia's chip assembly industry, accounting for more than a tenth of a global trade worth over $20 billion, warns that shortages - exacerbated by years of under-investment in basic chip production, while high-end semiconductors were favoured - will last at least two years.

Firms must marry the need to ramp up production with the imperative to avoid COVID-19 infections in factories that could trigger complete shutdowns.

"The shortage is very real," said John Chia, chairman of Unisem. "For CEOs (of our clients) to escalate their issues to me directly shows that this is a serious matter ... now they want to talk to me directly," he told Reuters.

Chia declined to provide names of clients requesting as much supply as they can get their hands on. Unisem's customers include suppliers to global carmakers and electronics firms like Apple (AAPL.O).

He said demand is so robust that its Chengdu plant in China is booked out for the whole of next year - and it will take months for it to clear backlogs for some automotive components.

|

ReplyForward

|

Latest Official Announcement in

KLSE

Announcement details

OTHERS KELINGTON GROUP BERHAD ("KELINGTON" OR "THE COMPANY") - AWARD OF CONTRACT WORTH APPROXIMATELY RM40 MILLION

| KELINGTON GROUP BERHAD |

| Type | Announcement |

| Subject | OTHERS |

| Description |

KELINGTON GROUP BERHAD ("KELINGTON" OR "THE COMPANY")

- AWARD OF CONTRACT WORTH APPROXIMATELY RM40 MILLION

|

|

Further to the earlier announcements dated 18 August 2021 and 6 September 2021 in relation to the award of contract, the Board of Directors of the Company is pleased to announce that Puritec Technologies (S) Pte Ltd (“PTS”), an indirect wholly-owned subsidiary of Kelington had on 4 October 2021 received an award of contract from the Customer who is a global leader in engineering and project management of high-technology facilities to undertake the supply and installation of process exhaust distribution ductwork for a global leading semiconductor manufacturer’s new fab in Singapore (“the Contract”).

The Contract value is worth approximately RM40 million. The works includes design, supply, delivery to site, installation, testing and handing over shall commence in mid-October 2021 and expected to be completed by December 2022.

The Contract is expected to contribute positively to the earnings and net assets of Kelington for the financial years ending 31 December 2022.

None of the Directors and/or major shareholders of the Company and/or persons connected to them have any interests, direct or indirect in the Contract.

The Company does not foresee any exceptional risk other than normal operational risk associated with the Contract.

This announcement is dated 5 October 2021. |

|

Announcement Info

| Company Name | KELINGTON GROUP BERHAD |

| Stock Name | KGB |

| Date Announced | 05 Oct 2021 |

| Category | General Announcement for PLC |

| Reference Number | GA1-05102021-00014 |

Kelington bags RM40m job to build gas systems distribution works for Singapore fab

KUALA LUMPUR (Oct 5): Kelington Group Bhd (KGB) has bagged a contract worth RM40 million to build specialty gas systems distribution works for a new fab in Singapore.

In a bourse filing on Tuesday, KGB said its indirect wholly-owned subsidiary Puritec Technologies (S) Pte Ltd had received the contract to design and build the exhaust distribution ductwork.

It said the works shall commence in mid-October 2021 and are expected to be completed by December 2022.

To recap, on Aug 18, KGB had said its unit Kelington Engineering (S) Pte Ltd (KES) had received an award of contract from a global player in engineering and project management of high-technology facilities to undertake the specialty gas systems distribution works for GlobalFoundries’ new fab in Singapore.

Subsequently, on Sept 6, KGB had said KES had secured a job worth RM49 million to undertake the bulk gas system distribution works for a global semiconductor manufacturer’s new fab in Singapore.

KGB said the contract is expected to contribute positively to its earnings for the financial year ending Dec 31, 2022.

KGB was last traded at RM1.65, valuing it at RM1.07 billion.

Kelington bags RM40m job to build gas systems distribution works for Singapore fab

KUALA LUMPUR (Oct 5): Kelington Group Bhd (KGB) has bagged a contract worth RM40 million to build specialty gas systems distribution works for a new fab in Singapore.

In a bourse filing on Tuesday, KGB said its indirect wholly-owned subsidiary Puritec Technologies (S) Pte Ltd had received the contract to design and build the exhaust distribution ductwork.

It said the works shall commence in mid-October 2021 and are expected to be completed by December 2022.

To recap, on Aug 18, KGB had said its unit Kelington Engineering (S) Pte Ltd (KES) had received an award of contract from a global player in engineering and project management of high-technology facilities to undertake the specialty gas systems distribution works for GlobalFoundries’ new fab in Singapore.

Subsequently, on Sept 6, KGB had said KES had secured a job worth RM49 million to undertake the bulk gas system distribution works for a global semiconductor manufacturer’s new fab in Singapore.

KGB said the contract is expected to contribute positively to its earnings for the financial year ending Dec 31, 2022.

KGB was last traded at RM1.65, valuing it at RM1.07 billion.

===========================================================================

Raytheon And GlobalFoundries Collaborate On New GaN Process

Strategic collaboration and licensing agreement will focus on technology for future wireless networks

Raytheon Technologies, an aerospace and defence firm, and the US foundry company GlobalFoundries (GF), will collaborate to develop and commercialise a new GaN-on-Si process designed for 5G and 6G mobile and wireless infrastructure applications.

Under the agreement, Raytheon Technologies will license its proprietary GaN-on-Si technology and technical expertise to GF, which will develop the new process at its Fab 9 facility in Burlington, Vermont.

"Raytheon Technologies was one of the pioneers advancing RF gallium arsenide technology which has been broadly used in mobile and wireless markets, and we have similarly been at the forefront of advancing GaN technology for use in advanced military systems," said Mark Russell, Raytheon Technologies' chief technology officer. "Our agreement with GlobalFoundries not only demonstrates our common goal to make high performance communications technologies available at an affordable cost to our customers it continues to prove how investments in advanced defence technologies can improve lives, as well as defend them."

"This is a win for Vermont and a win for the United States," said Senator Patrick Leahy, chairman of the Senate Appropriations committee. "This collaboration between a world-class manufacturer, GlobalFoundries, and Raytheon Technologies, a leader in technological innovation, is good news for the nation's semiconductor supply chain and competitiveness."

"GlobalFoundries' innovations have helped drive the evolution of four generations of wireless communications that connect over 4 billion people. Our collaboration with Raytheon Technologies is an important step to ensuring the development and manufacturing capability of solutions for critical future 5G applications," said GF CEO Tom Caulfield. "This partnership will enable everything from AI-supported phones and driverless cars to the smart grid, as well as governments' access to data and networks which are essential to national security."

Combined with GF's manufacturing expertise and services in RF, testing, and packaging, the new GaN offering will increase RF performance while maintaining production and operational costs, enabling customers to achieve new levels of power and power-added efficiency to meet evolving 5G and 6G RF mm-wave operating frequency standards.

This collaboration with Raytheon is the latest of several strategic partnerships for GF.

GF employs nearly 2,000 people at Fab 9, and more than 7,000 people across the US. Over the past 10 years the company has invested $15 billion in US semiconductor development and is doubling its planned investment in 2021 to expand capacity and support growing demand from the US government and industry customers for secure processing and connectivity applications.

The leading global compound semiconductor conference and exhibition will once again bring together key players from across the value chain for two-days of strategic technical sessions, dynamic talks and unrivalled networking opportunities.

https://youtu.be/GlEX7WAxLrs

KELINGTON GROUP BERHAD

("KELINGTON" OR "THE COMPANY") -

AWARD OF CONTRACT WORTH ABOUT

RM420 MILLION

| KELINGTON GROUP BERHAD |

| Type | Announcement |

| Subject | OTHERS |

| Description |

KELINGTON GROUP BERHAD ("KELINGTON" OR "THE COMPANY") - AWARD

OF CONTRACT WORTH ABOUT RM420 MILLION

|

|

The Board of Directors of the Company is pleased to announce that Kelington Technologies Sdn Bhd (“KTSB”), a wholly-owned subsidiary of Kelington had on

14 September 2021 received an award of contract from a manufacturing company at

Sama Jaya Free Industrial Zone in Kuching to undertake the construction work with respect to their

Sarawak Expansion Project (“the Contract”).

The manufacturing company is owned by a

US multinational company,

a world leading

developer, manufacturer, and provider of data

storage devices and solutions.

The Contract value is worth about RM420 million subject to the actual amount of works carried out, depending on variation orders, scope options and value engineering. The works shall commence in mid-September 2021 and expected to be completed by 31 December 2022.

The Contract is expected to contribute positively to the earnings and net assets of Kelington for the financial years 31 December 2022 and 31 December 2023.

None of the Directors and/or major shareholders of the Company and/or persons connected to them have any interests, direct or indirect in the Contract.

The Company does not foresee any exceptional risk other than normal operational risk associated with the Contract.

This announcement is dated 14 September 2021. |

|

Announcement Info

| Company Name | KELINGTON GROUP BERHAD |

| Stock Name | KGB |

| Date Announced | 14 Sep 2021 |

| Category | General Announcement for PLC |

| Reference Number |

GA1-14092021-00053

|

Western Digital to build

RM1bil plant in Sarawak under

RM2.3bil Malaysian expansion

KUALA LUMPUR: American hard disk drive manufacturer

Western Digital has set aside RM1 billion

of its RM2.3 billion additional investment in

Malaysia to build a new plant in Sarawak.

The balance of RM1.3 billion would be used to upgrade its existing facilities particularly in Penang, Western Digital (Malaysia) Sdn Bhd chairman Datuk Syed Hussian Aljunid said.

The RM2.3 billion will take Western Digital's total investment in Malaysia to almost

RM18 billion since establishing its operations here in 1973.

The Prime Minister's Office (PMO) had earlier announced that the new investment was agreed upon during a meeting between Prime Minister Tan Sri Muhyiddin Yassin and Syed Hussian on Thursday.

The new investment by Western Digital reflected the government's ability in managing the economy and bringing back investors' confidence despite the Covid-19 pandemic, PMO said in its statement yesterday.

Muhiyiddin welcomed any company wanting to invest in a high-impact and technology-based industry here, it added.

"The government through the Ministry of International Trade and Industry, Malaysian Investment Development Authority and other related agencies are always committed to attracting investment and convincing investors to invest or make additional investments in Malaysia.

"Western Digital's additional investment reflects high confidence of foreign investors towards the government in helping investors to expand their investment and operations in the country," PMO said.

Meanwhile, Syed Hussian said the company's decision to channel new investments was driven by the favourable operating conditions and support from the Prime Minister and government ministries.

"Western Digital Malaysia wants to express our profound gratitude to the Prime Minister and the government for their continued support of the local manufacturing industry especially during the Covid-19 pandemic.

"The unrelenting efforts to balance public health and the needs of manufacturers is a testament to the Prime Minister's unwavering commitment to the well-being of Malaysian citizens and its economy," Syed Hussian said at a press conference here yesterday.

He said the RM2.3 billion would be used to expand the company's facilities in Penang and Sarawak.

"Of the total, RM1 billion will be utilised to build a new factory in Kuching, Sarawak, which will add 30 per cent to our hard disk drive production capacity, and RM1.3 billion is for new equipment facilities," Syed Hussian added.

Western Digital currently has facilities in Penang, Selangor, Johor and Sarawak.

Syed Hussian said the new investment was expected to provide additional employment opportunities for 2,000 people.

He also said Western Digital's salary cost in Malaysia would increase by RM80 million annually.

"The company currently employs over 9,000 people in Malaysia whose contributions are critical to the global supply chain of storage devices, data centre systems and cloud storage devices," he added.

==============================================================================================================================================

Western Digital Market Cap:

17.76B for Sept. 14, 2021Historical Market Cap Data

| Data for this Date Range | |

|---|---|

| Sept. 14, 2021 | 17.76B |

| Sept. 13, 2021 | 18.06B |

| Sept. 10, 2021 | 17.90B |

| Sept. 9, 2021 | 18.14B |

| Sept. 8, 2021 | 17.93B |

| Sept. 7, 2021 | 18.65B |

| Sept. 3, 2021 | 18.96B |

| Sept. 2, 2021 | 19.03B |

| Sept. 1, 2021 | 18.85B |

| Aug. 31, 2021 | 19.51B |

| Aug. 30, 2021 | 19.16B |

| Aug. 27, 2021 | 19.53B |

| Aug. 26, 2021 | 19.32B |

| Aug. 25, 2021 | 20.22B |

| Aug. 24, 2021 | 18.76B |

| Aug. 23, 2021 | 19.23B |

| Aug. 20, 2021 | 18.54B |

| Aug. 19, 2021 | 18.39B |

| Aug. 18, 2021 | 18.84B |

| Aug. 17, 2021 | 18.83B |

| Aug. 16, 2021 | 19.05B |

| Aug. 13, 2021 | 19.45B |

| Aug. 12, 2021 | 19.21B |

| Aug. 11, 2021 | 20.55B |

| Aug. 10, 2021 | 20.17B |

| Aug. 9, 2021 | 20.82B |

| Aug. 6, 2021 | 21.18B |

| Aug. 5, 2021 | 20.66B |

| Aug. 4, 2021 | 20.00B |

| Aug. 3, 2021 | 20.37B |

| Aug. 2, 2021 | 19.92B |

| July 30, 2021 | 20.00B |

| July 29, 2021 | 19.85B |

| July 28, 2021 | 19.56B |

| July 27, 2021 | 19.21B |

| July 26, 2021 | 19.80B |

| July 23, 2021 | 19.64B |

| July 22, 2021 | 19.42B |

| July 21, 2021 | 19.85B |

| July 20, 2021 | 19.91B |

| July 19, 2021 | 19.40B |

| July 16, 2021 | 19.77B |

| July 15, 2021 | 20.61B |

| July 14, 2021 | 21.56B |

| July 13, 2021 | 21.58B |

| July 12, 2021 | 21.83B |

| July 9, 2021 | 21.61B |

| July 8, 2021 | 20.89B |

| July 7, 2021 | 21.35B |

| July 6, 2021 | 21.30B |

| July 2, 202 |

=======================================================================

Kelington Group - Bonanza! And More to Come |

| Source | : | KENANGA | ||||||||

| Stock | : | KGB | Price Target | : | 2.50 | | | Price Call | : | BUY | |

| Last Price | : | 1.66 | | | Upside/Downside | : |

|

||||

A huge surprise! KGB clinched its largest job win worth RM420m, doubling its existing order-book which was already at all-time high levels before this. The job entails a turnkey construction of a new semiconductor fab in Kuching for a US listed memory company which will begin immediately as the US client is scrambling for capacity to keep up with the surge in memory chip demand. This brings YTD order wins to a new high of RM764m while order-book hits a record RM822m, nearing its current market cap. KGB remains our top hidden gem pick owing to its healthy job pipeline and secular growth story. Maintain OUTPERFORM with a higher TP of RM2.50.

Largest job win; 4x its typical contract size. Kelington Group (KGB) surprised us with its single largest job award ever worth RM420m (4x the size of typical contracts) from a US listed semiconductor manufacturing company at Sama Jaya Free Industrial Zone in Kuching to undertake a turnkey construction for an entire new semiconductor fab, focusing on memory chip. KGB is tasked with handling the whole project, involving all three of its business segments (UHP, Precision Engineering and General Contracting). The job will begin immediately and is slated to be completed by end-2022 as the US customer is urgently in need of new capacity to accommodate the surging demand for its memory and data storage products. This is in line with our observation on the tech space that chip shortage will remain in the foreseeable future as the surge in semiconductor demand continues to outpace capacity expansion.

Orderbook nears current market cap. Inclusive of this recent win, KGB has secured a record-breaking RM764m (vs. FY19 of RM490m) new job wins in 2021, exceeding our expectation of RM500m. Meanwhile, its outstanding order-book has ballooned to another all-time high of RM822m, which is more than double of FY20 revenue. Interestingly, its order-book has grown very close to its current market capitalisation.

Sufficient resources to take on more jobs. The recent completion of one of its large projects in Penang couldn’t have been timelier as this frees up resources for the group to take on the new turnkey job in Kuching. Note that the relationship of higher revenue recognition and overhead expense is nonlinear, which means KGB is able to enjoy economies of scale and better margin as we anticipate the group to achieve back-to-back record revenue and earnings for FY21 and FY22.

Still, more to come. Reiterating our positive view, we expect more fab expansion to come and KGB is in a favourable position to benefit from more UHP jobs, with the management showing no signs of slowing down in terms of securing new jobs. The group’s tender-book remains elevated at RM1.1b.

Raise FY21E-22E earnings by 4% and 33% to RM32.3m and RM47.0m, representing growth of 85% and 46%, respectively.

Maintain OUTPERFORM with a

higher Target Price of

RM2.50 (previously RM1.50)

on FY22E PER of 33x (+1SD to 3-year peer mean), justified by the group’s healthy job pipeline and secular growth story.

Risks to our call include: (i) slower revenue recognition due to Covid-19, (ii) downturn in semiconductor sales, and (iii) delay in liquid CO2 ramp up.

Source: Kenanga Research - 15 Sept 2021

=========================================================================

Please note : the number of huge

quantities of shares

the main directors are buying in

KGB WB , with official disclosures .

=======================================================================

=======================================================================

BREAKING NEWSBREAKING NEWSBREAKING NEWS

Technology - Riding on the Chip Crunch |

| Source | : |

KENANGA |

||||||||

| Stock | : | KGB | Price Target | : | 2.50 | | | Price Call | : | BUY | |

| Last Price | : | 1.73 | | | Upside/Downside | : |

|

||||

In line with global move towards 5G adoption, Malaysia is also switching off its 3G connectivity to free up the 2100Mhz and 900Mhz for redeployment towards 4G and 5G. With demand for consumer electronics and automotive (especially EVs) showing no signs of slowing, wafer fabs in Asia continue to see the need to expand their capacity, further reinforcing our investment thesis on Kelington Group (OP; TP RM 2.50 ), as a prime beneficiary.

TSMC and other wafer fab players had in recent earnings call stated that they are planning to build more capacity for the automotive industry which typically takes 12-18 months, this explains why automotive semiconductor players (e.g. Infineon, ST Micro and Renesas) are already locking in orders 1-2 years in advance.

Such development continues to favour our

hidden gem pick, KGB / 0151

Kelington Group (OP; TP: RM2.50),

as a prime candidate to benefit from fab expansions in Asia. Even with share price surging more than 3.2x (inclusive of free warrants) since our non-consensus initiation report on 11 Nov 2020, it still remains as our

***high conviction buy ***

as the group is expecting more ultra-high purity gas system (UHP) job awards from fabs in China and Singapore.

Market Chat - 4Q21 Outlook & Strategy - Recovery begins with an ENDemic

Author: MalaccaSecurities | Publish date: Mon, 27 Sep 2021, 11:01 AM

- We believe Covid-19 may turn endemic as more than 80% of the adult population has been vaccinated. That may provide potential economic recovery going forward and we are anticipating some goodies for the construction, tourism, and consumer sectors in the upcoming Budget 2022 to boost the economy.

- Recovery theme play should be interesting under the NRP from 4Q2021 going into 2022 as business activities are likely to return to normalcy by then.

- Also, we like technology and telco on the back of higher adoption for 5G and IoT devices, electric vehicles as well as the 5G rollout story in Malaysia.

Covid-19 status

- Subsiding Covid-19 sub-indicators. Despite the daily cases on the local front still hovering above 15k mark, most of the important indicators such as death toll, hospitalisation rate, ICU occupancy are on a declining trend since two weeks ago.

- Smooth vaccination progress. Nearly 60% of the total population has achieved fully vaccinated status (2 doses), while about 70% of the total population have done at least 1 dose. Meanwhile, Klang Valley (KV) is getting nearer to the 80% mark on the fully vaccinated status.

- Malaysia in gradual recovery mode… Kedah is currently under Phase 1 and most of the states are in Phase 2 and Phase 3. Meanwhile, Labuan and Negeri Sembilan are the regions with Phase 4 status under the National Recovery Plan. PM has announced that offices will be allowed to operate under certain conditions from 17th Sept 2021 if their workforce is 40-60% fully inoculated. Also, interstate travel and tourism activities are allowed when adult vaccination rate is above 90%.

- Crucial 80% target. Although most of the indicators are pointing for a recovery, the downside risk could be the Delta variant. Hence, the 80% fully vaccinated target for Malaysia citizens will be important for the economic recovery going forward. Still, wearing facemasks and social distancing should continue to reduce daily infections.

Economic review and outlook

- The Federal Reserve is less dovish. The Fed maintained its interest rate and asset purchase programme direction, but signals potential interest rate hike by end-2022. However, the next meeting in November may send more clues to future monetary policies. Do note that the Fed is purchasing at least USD120bn of bonds monthly.

- Stimulus packages should be cushioning the downside risks.

- Over the past 1.5 years, Malaysia has put

- in efforts releasing stimulus packages,

- worth roughly RM380bn to support the

- economy. We opine these measures are

- able to cushion the downside risk.

- However, to reboot the economy to the

- fullest potential we think the government

- will need to provide more boosters in the

- upcoming Budget 2022.

- Near term domestic focus. Domestic driven catalysts are likely to be seen in Budget 2022, as the travel borders remained restricted. Thus, higher development expenditure is expected and may benefit the construction sector, while measures or policies related to domestic tourism, automotive and property sectors could be crafted to rekindle the domestic consumption activities.

- Lower expectation on economic growth. In 2020, Malaysia’s GDP contracted -5.6% YoY. Based on Bloomberg consensus, Malaysia’s GDP is projected to grow at a rate of 4.1% and 5.7% in 2021-2022. Do note that MoF has toned down their projections for 2021 to 3-4% (vs. 6.5-7.5% in Budget 2021), and this will be a realistic target as we are coming out of the Covid-19 pandemic environment.

Market review and outlook

- Global markets look overvalued, while the local market is at a discount. The MSCI World Index and S&P500 are trading at 24.2x and 26.7x vs. 10Y avg PE of 19.7x and 19.5x, respectively, while the FBM KLCI is trading at 14.9x PE (10Y avg PE of 17.7x).

- Trading activities slowed down, but foreign funds are returning. YTD average daily trading value (ADTV) dropped 26.2% to RM3.75bn in 2Q21 (1Q21: RM5.08bn). QTD, ADTV has declined further to RM2.85bn. Nevertheless, foreign investors have turned net buyers for the month of August, scooping up RM1.05bn in equities, while MTD registered another RM847.9m of buying flows in the local exchange.

- Big caps were flat, but small caps gained strength. In 3Q21, the FBMKLCI was flat, while FBM Small Cap and FBMACE added 3.0% and 3.1%, respectively. Overall, technology (+23.0%) was the leading sector, followed by the industrial products (+7.7%) sector. Meanwhile, the healthcare and energy sectors lost -13.7% and -9.9% respectively.

- Supercycle commodities are still upward trending. Most of the commodities that have rallied under this Covid-19 pandemic due to shipping disruptions and supply constraints could remain elevated. However, technical readings on Bloomberg Commodity Index might be forming bearish divergence signal.

4Q21 Strategy – Recovery begins with an ENDemic

- Covid-19 induced recession to regain momentum. Economy contracted in 2020, but we opine that the recovery is on its way. With the help of a smooth vaccination drive, 80% of Malaysia’s adult population are fully vaccinated with Covid-19 vaccine and it will be meaningful for businesses to operate under comfortable conditions with less severe Covid-19 conditions. Eventually, rebooting the economic activities in a broader manner and returning to normalcy by 2022.

- Restarting the construction is crucial… Given the international travel restrictions are not uplifted, we expect more infra works to be seen in the upcoming Budget 2022 and that should kick start the economy at least for the domestic front. Also, we favour the building material segment, which is the proxy to the construction sector.

- …and revitalising the domestic economy. While waiting for the international borders to be uplifted, domestic tourism will be important in stimulating the economy. With the Langkawi travel bubble pilot project started recently, we feel the revenge spending is surfacing in a significant manner and that should be a decent catalyst for tourism, aviation and consumer related stocks.

- Technology sector is likely to be the winner.

- Technology sector continues to rise despite the chip shortages issues

- globally; the Bursa Technology Index rose 39% YTD.

-

Technology: KGB

- We believe the adoption in 5G and IoT devices, as well as higher demand in electronic gadgets under the Covid-19 environment will remain as the main catalysts for the sector. Meanwhile, the hype in electric vehicles will continue to provide positive sentiment for the sector.

- Progressive 5G rollouts in Malaysia. Malaysia has setup the National 5G Task Force in Nov 2018 and introduced Jalinan Digital Negara (JENDELA) in Aug 2020 to provide wider coverage and better quality of broadband experience for the Rakyat and it was further supported by the Digital Economy Blueprint – MyDIGITAL that focuses on the rollout of 5G technology going forward, where Malaysia’s 5G network and infrastructure across the whole nation will be done by Malaysia’s single wholesale 5G-network operator - Digital Nasional Berhad (DNB).

RM 2.00 and

https://www.bing.com/videos/

https://www.youtube.com/watch?

|

========================================================================================================================================================================================

Kelington records

11-fold hike in 2Q netprofit

=========================================================================================================================================================================================================================================================================================================================================================================

NEWSFLASH ON NASDAQ

NEWSFLASH ON NASDAQ

NEWSFLASH ON NASDAQ

In the financial , stock market theme in US is the technology sector ,

Nasdaq with the 52 weeks , low is 10,519 points and the high is 15,385 points , the closing for 2 September 2021 is near the historical high ( 15,390 points )

14,836 points and now KLSE - technology stocks in

Technology sector enjoy positive momentum ,

and the spillover strong positive effects included

3. KGB / 0151 Warrant for High Conviction Buy

3.1 KGB /0151 , one of their key business is

===================================================================

|

More articles on SEE_Research

Created by SEE_Research | Jun 08, 2024

THE FAST & FURIOUS MODE ON

Super duper momentum stock for

June 2024 /

KGB / Kelington Group Berhad

Created by SEE_Research | Feb 26, 2023

.png)