10 in 10 With Koda Ltd - Redefining Lifestyle

MQ Trader

Publish date: Tue, 22 Jun 2021, 09:59 AM

Company Overview

Koda is an original design manufacturer of furniture specialising in affordable, readyto-assemble wood-based dining room furniture. It also produces other household furniture ranges such as for living room and bedroom. Its customers are located in about 30 countries comprising of wholesalers, distributors and major retailers.

1. Could you elaborate on Koda’s business segments and its focus?

- Koda started its humble beginning by producing wooden TV and speaker cabinets in 1972. The group has since progressed from being an Original Equipment Manufacturer (OEM) to an Original Design Manufacturer (ODM). The Group has two main business segments - manufacturing and retail.

- Manufacturing - Recognised for home furniture, Koda is well-known for its strength in design. Apart from being one of the largest dining room furniture exporters in Southeast Asia, Koda also exports furniture to about 30 countries across North America, Asia Pacific and Europe.

- Retail - Koda established Commune in 2011, the in-house retail brand which is managed by the third generation of the founding Koh family. Commune has a growing presence in Singapore, Malaysia, China, Philippines and Hong Kong, enabling it to serve as one of the key growth drivers of the Koda Group.

2. What notable developments can shareholders expect from Koda in the near future?

- With a unique scalable distributor-retail business model in China, Commune has grown exponentially since its creation and will continue to be the Group’s key revenue driver. We intend to leverage on the success of the brand’s business model and apply to other regions of our operations. We are pleased to say that the plan to open 100 stores in China by 2022 is well on track.

- On the manufacturing front, the Group is expanding our production capacity in Vietnam. As announced on 25 March 2021, the Group has proposed to acquire the land use right and a factory building (which is situated approximately 2km from the Group’s current main factory buildings in Vietnam) to expand

(i) the capacity for its mixed-materials furniture production facilities; and

(ii) store and warehousing in anticipation of increasingly more orders.

3. Describe the Group’s financial performance over the past few years.

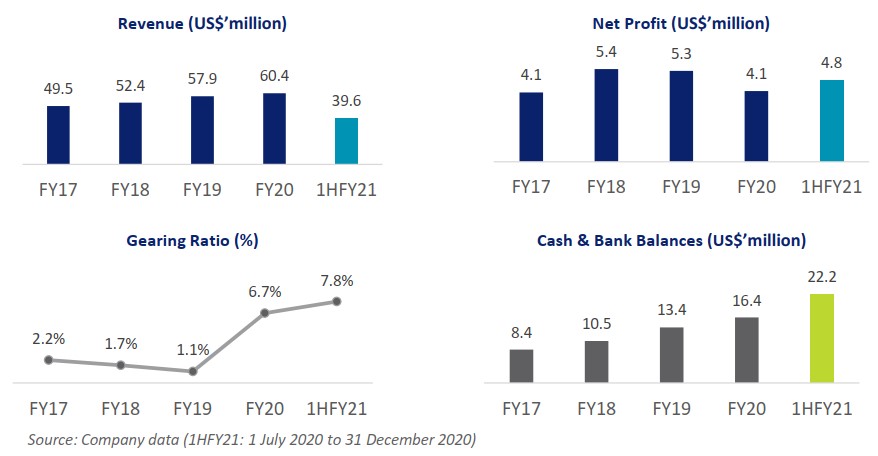

- Koda experienced consistent growth of revenue with high margins over the past years. Our net profit for half year 2021 has already exceeded the full year of 2020.

- Management believes that the Group’s strong balance sheet - low gearing ratio and high bank balances - reflects prudently managed financial position.

4. How has Koda evolved its business to target new customer segments/groups?

- The Group created an in-house brand, Commune, in 2011. We started Commune as a natural growth of Koda’s business. The downstream move from OEM to ODM and now to owning our own retail brands sets the stage for our future expansion. With the new third generation leaders helming Commune, we believe that the Group is set for growth in this area.

- Today, the Group operates 85 retail stores in the region, with four located in Singapore. Our strategy to focus on bringing the international brand into the Chinese market has seen results in recent years. Consumers and dealers have been embracing the Commune brand since we expanded into China.

- Tapping on this success, the Group created a new brand, ALT.O, in 2019 to further capture the more affluent segment in this region. The response to ALT.O has been encouraging and this allowed us to expand the brand to about 10 retail stores in operation currently. We plan to continue our regional and international expansion by leveraging on these two successful brands

5. With a global customer base, how does the Group engage and distribute to customers globally?

- Koda exports furniture to about 30 countries globally, including regions such as Europe, Asia Pacific and North America.

- The Group primarily deals directly with wellestablished retail brands in the global market.

- We leverage on our design capabilities and expertise to provide designs that are current and at an affordable price.

- This is achievable as our manufacturing facilities in Malaysia and Vietnam can manufacture these designs at a very competitive price.

6. How does the Group manage its subsidiary, Commune, to ensure that it does not hinder the Group’s operating relations with other retailers?

- Commune operates at arm’s length to Koda. Though a subsidiary of Koda, Commune runs entirely on its own.

- Since inception, Commune has been able to independently source from third parties, have its own marketing team and is run by a different set of management.

7. What are some of the key opportunities/trends you foresee in the Group’s key operating market in the coming years?

- The Group plans to continue strengthening our position in existing markets by offering different product lines to existing customers while, at the same time, targeting new customers. With strong trend analysis of our customers and manufacturing capabilities, the Group is confident of our global expansion in the coming years.

- We also intend to bring our flagship brand, Commune, globally by looking into new markets such as Europe, India and Indonesia. Other focus areas include strengthening our position in China by opening more stores in first and second-tier cities, while moving into the third-tier cities. As these third-tier cities mature, we believe that more consumers will be able to appreciate the Commune style.

8. What are some opportunities presented by the Covid-19 pandemic? How has Koda tapped on these opportunities?

- The Covid-19 pandemic and efforts to contain its spread have led to possibly the worst economic contractions for many countries in history. Meanwhile, the New Economy and certain specific sectors have done well and the furniture industry is one of those pulling through quietly.

- As consumers adapt to the stay-at-home and work-at-home norm, there has been an increase in demand for our furniture and led to procurement of healthy export orders. We foresee work-from-home trends to persist post Covid-19, and believe that this will continue to be a demand driver in the future.

9. Sustainability has increasingly become a key focus globally, how is the Group committed to sustainability?

- Koda’s sustainability approach is to mitigate and manage our most significant economic, social and environmental impacts in our own operations as well as in our supply chain.

- Perceiving sustainability as an entire ecosystem instead of in isolation, allows for a more dynamic effort. Koda’s commitment to sustainability also serves as an economic advantage by increasing our customer base amidst the growing emphasis on sustainability.

- We closely watch evolving consumer preferences as an increasing number of customers look for sustainable furniture and we remain committed to working closely with our trade partners to offer sustainable choices to end customers.

10. Why should investors take a closer look at Koda?

- Experienced and passionate management - Our management team has aligned values with over 150 years of combined experience in the furniture industry.

- Outlook remains bright - Based on 1HFY21 financial results for the six months ended 31 December 2020, we continue to see encouraging growth in export orders and expect capacity utilisation rates for our key factories to remain optimal, barring unforeseen circumstances.

- High gross profit margins and strong balance sheet position - Notwithstanding the rise in raw material costs for timber, fabric, metal frame, foam and leather etc., we believe that we should be able to maintain gross profit margin of around 27% - 32%. This is amid strong customer demand as well as improvements in internal labour efficiency and manufacturing overheads. Based on 1HFY21 results, Koda’s cash and bank balances stood at US$22.2m (as at 31 December 2020) with low gearing ratio of 7.8%.

- Revenue drivers - Commune will be Group’s next revenue driver for our retail business. For our manufacturing segment, the expansion of production capacity is expected to improve the Group’s revenue.

- Consistent dividends - The Group has been consistently paying dividends to shareholders and our dividend payout ratio ranged between 18% and 25% in the period of FY2017 to FY2020.

10 in 10 – 10 Questions in 10 Minutes with SGX-listed companies

Designed to be a short read, 10 in 10 provides insights into SGX-listed companies through a series of 10 Q&As with management. Through these Q&As, management will discuss current business objectives, key revenue drivers as well as the industry landscape. Expect to find wide-ranging topics that go beyond usual company financials.

This report contains factual commentary from the company’s management and is based on publicly announced information from the company.

For more, visit sgx.com/research.

For company information, visit www.kodaonline.com

Click here for 1HFY2021 Financial Results

More articles on SG Market Dialogues

Created by MQ Trader | Jun 26, 2024

Created by MQ Trader | Jun 19, 2024

Created by MQ Trader | Jun 11, 2024

Created by MQ Trader | Jun 10, 2024

Created by MQ Trader | Jun 05, 2024

Created by MQ Trader | May 29, 2024

Created by MQ Trader | May 15, 2024

Created by MQ Trader | May 14, 2024