10 in 10 With Japan Foods - Home to a Thousand Tastes

MQ Trader

Publish date: Tue, 06 Jul 2021, 10:54 AM

Company Overview

Established in Singapore in 1997, Japan Foods is one of the leading Japanese restaurant chains in Singapore. As of 31 March 2021, the Group operated 50 restaurants in Singapore under various self-developed brands as well as franchised brands such as “Ajisen Ramen”, “Osaka Ohsho”, “Menya Musashi”, and “Konjiki Hototogisu” which earned one Michelin Star in Tokyo. Link to StockFacts Company Page

1. Could you elaborate on Japan Foods’ business segments and its focus.

- Japan Foods is one of the leading restaurant chains in Singapore with a focus on Japanese cuisine. The Group has a portfolio of over 10 franchised and selfdeveloped brands. Our focus is to bring quality Japanese food to Singapore and offer compelling dining concepts that will appeal to the masses.

- Our brand portfolio caters to different segments of the market from mass market brands such as the flagship Ajisen Ramen, which offers good quality and affordable meals to students and families, to premium brands such as Konjiki Hototogisu, which earned one Michelin Star and caters to those with more discerning tastes.

2. How does the Group differentiate the various brands such as “Ajisen Ramen”, “Osaka Ohsho”, and “Menya Musashi”? What is the main purpose for introducing various brands?

- Consumers’ tastes change and evolve constantly, therefore we need to continuously explore new brands that can be brought to Singapore. At the same time, by staying in touch with current food & beverage (F&B) trends, we can develop and create our own unique brands.

- Having multiple brands also makes us appealing to landlords as they know they are working with a single partner that can respond quickly to optimise store performance. We manage our restaurant portfolio by closely assessing the performance of each outlet and can swap out underperforming brands quickly to maximise earnings per restaurant.

3. Describe the Group’s financial performance over the past few years.

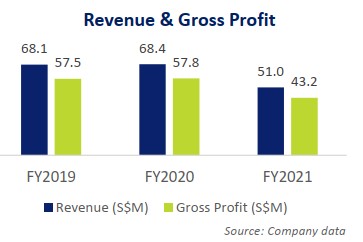

▪ Our revenue has grown steadily since our IPO in 2009 and despite the onset of COVID-19 pandemic, the Group achieved record revenue of S$68.4 million for the financial year ended 31 March 2020 (FY2020).

- During the subsequent financial year ended 31 March 2021 (FY2021), lockdown measures to curb the pandemic led to devastating impact on the F&B industry. Dine-ins, which contribute the bulk of our sales, were prohibited for several months and we had to rely on takeaways and deliveries. At the same time, the number of operating restaurants fell from 59 in FY2020 to 50 in FY2021 as the Group decided not to renew some leases in view of the situation. As such, our revenue declined to S$51.0 million in FY2021.

- Cushioned by various government grants, which amounted to S$10.3 million (registered as Other Income), the Group’s net profit attributable to equity holders came in at S$3.6 million in FY2021 as compared to S$1.0 million in FY2020. Despite the ongoing and fluid COVID-19 situation, the Group’s financial standing remained strong in FY2021 with cash and cash equivalents of S$23.1 million with no borrowings.

4. Does the company have a dividend policy? How has dividends grown over the years?

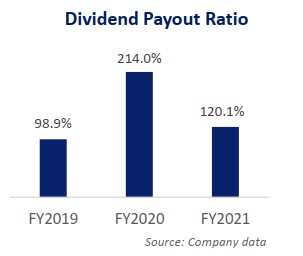

- The Group has consistently paid dividends over and above our dividend Dividend Payout Ratio policy1. Our Board of Directors have proposed final dividends of 1.75 Singapore cents per share for FY2021, which together with the interim dividends of 0.75 Singapore cents per share paid out in Dec 2020, brings total dividends to 2.50 Singapore cents per share, or 120.1% of net profit for the financial year.

- The Group recently announced intentions to revise our dividend policy to distribute at least 100% of net profit attributable to equity holders annually, applicable from the financial year ending 31 March 2022. This will be the fourth revision in our dividend policy (FY09: 35%; FY15: 40%; FY18: 50%).

5. With more than 50 restaurants operating across Singapore and in the region, does the Group have active plans in place to expand your geographical reach further?

- The Group aims to continue our expansion regionally and to manage each outlet to achieve good growth and traction. We are keen to enlarge our footprint and plan to do this prudently and sustainably.

- We have eight restaurants in Hong Kong, nine in China and one in Indonesia under the Menya Musashi and Konjiki Hototogisu brands, which are operated by our associate companies. We intend to expand across these markets should suitable opportunities and locations become available. The Ajisen Ramen brand is also present in Malaysia through sub-franchisees.

- To further broaden our geographical reach, we established a joint venture (JV) with Minor Food Group (Singapore) Pte Ltd (Minor Singapore). The JV plans to penetrate the Japanese market with Minor Singapore’s brands as well as the Thai and Chinese markets with Japan Foods’ brands. Unfortunately, these plans were delayed due to the pandemic.

- For now, the Group will be focusing on domestic growth as we wait for an opportune time to cautiously resume our overseas expansion plans.

6. What do you foresee as opportunities and trends in the Group’s key operating markets in the coming years?

- While we have expanded our network overseas, through both associate and JV companies, Singapore will remain our main focus in the foreseeable future.

- Dining-out remains a major part of the local culture in Singapore as consumers here tend to be adventurous when it comes to trying out novel concepts and many are knowledgeable about popular foreign brands. However, such a culture also results in a highly competitive F&B landscape.

- Therefore, the Group has always closely monitored Japanese food trends and kept ourselves informed of restaurants that Singaporeans liked to frequent in Japan. Japanese cuisine is widely accepted and well-liked in Singapore, and the Group will continue to innovate and introduce food concepts and new brands.

7. What are some new consumer trends and behaviours you observed in recent years?

- With growing affluence in Singapore, customers are demanding higher standards, better quality as well as more sophisticated and unique tastes.

- To cater to these new trends, the Group brought in Tokyo ramen brand Konjiki Hototogisu in 2018, which at that time had already received mention in the Michelin Bib Gourmand Guide for three consecutive years and subsequently went on to receive one Michelin star in 2019. We received encouraging response when the chef owner of Konjiki Hototogisu introduced shellfish broths, instead of the usual tonkatsu (i.e. pork bone) broth, at our Singapore outlets.

- There is an increasing demand for healthier options. In 2019, the Group added Afuri Ramen to our portfolio. It is a well-known brand among ramen aficionados for its unique and light citrusy yuzu-flavoured broth and very popular in Japan with ladies and those who are health conscious.

- Another trend we observed is the rising popularity of “specialty” restaurants. Both Konjiki Hototogisu and Afuri Ramen cater to more discerning customers who seek out restaurants with a specialty. This is unlike Ajisen Ramen for example, which is popular among students and families because of the wide variety on its menu.

8. How has Japan Foods hinged on/or plan to tap on opportunities presented by the pandemic? What are some of these opportunities?

- Japan Foods always believed in innovation and exploring new concepts. Over the last year, we created two new concepts which were launched in Nov 2020.

- Tokyo Shokudo - our first Halal brand. We believe that the Muslim market presents great opportunities. In recent years, there has been a boom in Halal-certified restaurants offering international cuisine and the market is growing. Due to the slowdown caused by COVID-19, we had time to develop the Tokyo Shokudo brand with menu items that would appeal to the Muslim market. We received good response and opened the third Tokyo Shokudo restaurant within six months of our first.

- Pizzakaya - conceptualized together with our JV partner Minor Singapore. This is our first pizzeria and its menu is inspired by Japanese ingredients and street food. The response has also been encouraging and we opened a second restaurant within six months.

9. ESG have increasingly been a key focus for businesses and investors, how is the Group committed to ESG?

- As an F&B business, the Group is committed to the reduction of plastic waste. Our restaurants have stopped offering plastic straws for three years. We partner with the Movement for the Intellectually Disabled Singapore (MINDS) to provide employment opportunities for those under the programme for simple tasks at our central kitchen. We also work closely with the Yellow Ribbon Project to offer opportunities to ex-offenders.

- We are committed to uphold high standards of corporate governance. Our efforts have been recognised by the industry with awards from Securities Investors Association Singapore (three times between 2016 and 2018) and the Singapore Corporate Awards (two times in 2018 and 2019).

10. What is Japan Foods’ value proposition to its shareholders and potential investors? What do you think investors may have overlooked about it?

- Established market presence and brand recognition - Our Group Executive Chairman and CEO, Mr Takahashi Kenichi, introduced the Japanese ramen culture to Singapore with the launch of Ajisen Ramen, which became the first ramen chain in the country. Japan Foods now has over 50 restaurants under various established brands in Singapore as well as 19 restaurants overseas in Hong Kong, China and Indonesia through associate companies and one restaurant in Malaysia operated by a sub-franchisee.

- Continuous innovation and introduction of new concepts - The Group has been launching at least one new brand every year. Our extensive brand portfolio of compelling dining concepts and proven formula for restaurant portfolio management has enabled the Group to remain resilient even during tough economic cycles.

- Target annual dividend payout ratio of at least 100% - We are committed to protecting and growing the interests of shareholders who have invested in our Group.

10 in 10 – 10 Questions in 10 Minutes With SGX-listed Companies

Designed to be a short read, 10 in 10 provides insights into SGX-listed companies through a series of 10 Q&As with management. Through these Q&As, management will discuss current business objectives, key revenue drivers as well as the industry landscape. Expect to find wide-ranging topics that go beyond usual company financials. This report contains factual commentary from the company’s management and is based on publicly announced information from the company. For more, visit sgx.com/research. For company information, visit https://www.jfh.com.sg/

Click here for FY2021 Financial Results

More articles on SG Market Dialogues

Created by MQ Trader | Jun 26, 2024

Created by MQ Trader | Jun 19, 2024

Created by MQ Trader | Jun 11, 2024

Created by MQ Trader | Jun 10, 2024

Created by MQ Trader | Jun 05, 2024

Created by MQ Trader | May 29, 2024

Created by MQ Trader | May 15, 2024

Created by MQ Trader | May 14, 2024