10 in 10 With Memiontec Holdings - Water & Wastewater Management Solutions for Asia

MQ Trader

Publish date: Wed, 28 Jul 2021, 06:19 PM

Company Overview

Memiontec is a water treatment company in the field of water and wastewater management services, and has a presence in Singapore, Indonesia and the PRC. In 2016, the Group diversified into long-term operation and maintenance of water treatment facilities and supplying water through transfer-own-operate-transfer (TOOT) and build-own-operate-transfer (BOOT) projects, which involve partnerships or joint ventures with public or private entities.

1. What Are Some Focus Areas for Memiontec’s Business?

- Having over 20 years of experience in this industry, we see ourselves as the preferred partner for Asia’s total water solutions, serving both public and private entities such as Public Utilities Board (PUB), Obayashi Singapore, Petrochemical Corporation of Singapore, PDAM (Indonesia national water agency), PT Jakpro (Jakarta state-owned infrastructure developer), McConnell Dowell, PT PP, PT Abipraya Brantas, Sinarmas and Lippo.

- Aside from in-house capabilities to customise solutions specific to customers’ requirements, we also offer various water treatment structures such as the build-own-operate-transfer (BOOT) or transfer-own-operatetransfer (TOOT). We cater to the entire water value chain ranging from consultancy, EPC (engineering, procurement, and construction), O&M (operation and maintenance), and becoming an equity partner of water treatment facilities if practical.

2. What differentiates Memiontec from your peers in the water treatment industry?

- First, Memiontec has built a strong geographical presence across Asia with our subsidiaries in China, Indonesia and headquartered in Singapore. We also hold respective licences such as the BCA Specialist Workheads ME11 Grade L61 in Singapore, and the B1 and B2 construction licences2 in Indonesia.

- Second, we see ourselves as a one-stop integrated water technology total solutions provider with a diversified and synergistic business model. We value-add at each component of the water value chain based on customers’ requirements. We have also built up a strong database of proprietary customised management information systems, design know-hows, associated programmable logic control, standard operating procedures to manage and operate water treatment plants, allowing us to generate economies of scale and higher operating margins.

3. What Can Shareholders Look Out for or Expect in the Medium Term?

- Memiontec will continue to proactively target new projects in Asia to add to our order book which stands at S$81.6 million (30 Jun 2021). Management believes its projects in Southeast Asia remain strong, especially in Indonesia where there is increasing urbanisation, high population growth and more industrial development.

- Management views the team’s execution capabilities to deliver water treatment solutions on time and on budget as a key strength. As such, we may announce completed projects and work-in-progress as we move ahead.

4. Describe the Group’s financial performance in the recent years. How do you plan to build growth going forward?

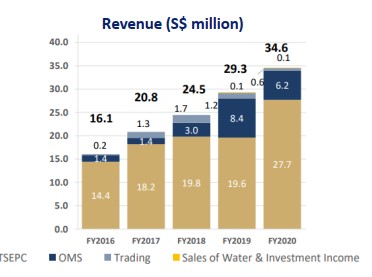

- Revenue has more than doubled from S$16.07 million in FY2016 to a record of S$34.61 million in FY2020. The Group has registered profitability for the past 5 years and on an EBITDA basis, it has grown 28.3% to S$1.63 million year-on-year in FY2020.

- Indonesia is one of our key growth markets and we have been building up our local team as well as establishing more partnerships and strategic alliances with Indonesian stateowned enterprises for more opportunities.

Progress has been encouraging and is evident in our order book, with 50% from Indonesia and the remaining from Singapore. Simultaneously, we are also proactively exploring water-related opportunities in other Southeast Asia markets.

5. Does the company have a fixed dividend policy? Are there any plans to start issuing dividends to shareholders?

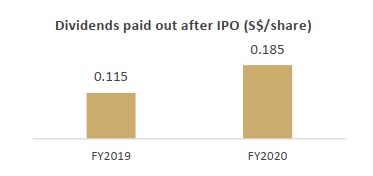

We have been distributing dividends to our shareholders for the past few years. The proposed dividend payout for FY2021 is expected to be maintained or improved, subject to the dividend policy mentioned in our IPO Offer Document on page 59 and shareholders’ approval in the next annual general meeting.

6. What do you think are some key drivers for the water treatment industry?

- Water is an essential part of our lives and is a key building block for industrial activities. According to Euromonitor’s sustainability database, water withdrawals have been increasing by an average of 1% per year since the 1990s and will continue to grow by 30% in 2050. Despite 70% of the earth’s surface being covered by water, only 3% is fresh water and 0.5% accessible.

- In Southeast Asia, nearly all countries are water stressed. With increasing urbanisation, higher population growth and more industrial activity, demand for water will continue to rise.

- In Singapore, water demand is expected to double by 2060 from today. In the municipal section, water recycling and desalination capacity is expected to supply 85% of future water needs in 2060. Indonesia, being the most populous country in Southeast Asia, sees 1 in 2 lacking access to safe water and over 70% relying on potentially contaminated sources.

7. Has COVID-19 affected your operations or business?

- We are in the business of water treatment which is essential for public and private entities, downstream endusers and communities. With the pandemic outbreak, the health and safety of our employees, customers and business partners are of priority and we had to adjust our operations and workflow to safe management requirements.

- There were disruptions at the initial stage which we have adapted and developed more resiliency in our activities. We also took the opportunity to evaluate and calibrate our business continuity plans, identify potential problem areas that need to be addressed. However, the pandemic is still very fluid and unpredictable especially in Indonesia and it may still disrupt our business and operations related to supply chain, manpower availability, and potential delays in order fulfillment.

8. How has Memiontec hinged on or plan to tap on opportunities presented by the pandemic?

- With COVID-19, Environmental, Social and Governance (ESG) topics have been gaining significant attention and are becoming important considerations for investors. Governments and business enterprises must be able to demonstrate how they are committed to better ESG practices.

- Good water quality is essential to human health, social and economic development, and the ecosystem. A major part of the solution is to produce less pollution and improve the way we manage water assets. As such, we have seen more government agencies and business enterprises in Southeast Asia accelerating their plans for water treatment.

- With a good track record in Southeast Asia, particularly in Singapore and Indonesia, we see more opportunities related to water treatment solutions where we are able to provide solutions on a cost-effective basis.

9. What are some ways Memiontec is working towards supporting a sustainable economy?

- Globally, 80% of wastewater flows back into the ecosystem without being treated or reused, hence ensuring that there are sufficient and safe water supplies for everyone is becoming increasingly challenging and a focus.

- For Memiontec, we are a strong believer that water must be carefully managed at every part of the cycle – from freshwater abstraction, use, collection and post-treatment, to the use of treated wastewater and its eventual return to the environment. A key part of our solution is helping customers evaluate and identify the key issues of their water assets and providing the best solutions to maximise the usage of their water assets in a sustainable manner.

- We provide consultancy to government agencies in Asia to share insights on innovative and best practices in water treatment solutions in order to enhance their water infrastructure and systems. The Group views this as indirectly contributing towards a sustainable economy and environment for future generations.

10.What is Memiontec’s value proposition to its shareholders and potential investors?

- We have 3 BOOT and TOOT projects in Indonesia, which provide recurring income for the next 20+ years through the sale of water. In addition, our track record and business network in Indonesia makes the Group well-positioned for more opportunities.

- The Group believes that Memiontec could be a proxy to ESG trends with its industry credibility in total water solutions, sustainable business model, healthy order book with geographical mix, strong market prospects, and clear business strategies.

10 in 10 – 10 Questions in 10 Minutes with SGX-listed companies

Designed to be a short read, 10 in 10 provides insights into SGX-listed companies through a series of 10 Q&As with management. Through these Q&As, management will discuss current business objectives, key revenue drivers as well as the industry landscape. Expect to find wide-ranging topics that go beyond usual company financials.

This report contains factual commentary from the company’s management and is based on publicly announced information from the company.

For more, visit sgx.com/research.

For company information, visit www.memiontec.com

Click here for full year FY2020 Financial Results

More articles on SG Market Dialogues

Created by MQ Trader | Jun 26, 2024

Created by MQ Trader | Jun 19, 2024

Created by MQ Trader | Jun 11, 2024

Created by MQ Trader | Jun 10, 2024

Created by MQ Trader | Jun 05, 2024

Created by MQ Trader | May 29, 2024

Created by MQ Trader | May 15, 2024

Created by MQ Trader | May 14, 2024