Fraser & Neave Holdings Bhd

ss20_20

Publish date: Sat, 08 Nov 2014, 05:44 PM

F&N - To be the top F&B player in Asia by 2020

FRASER & Neave Holdings Bhd (F&N) will be launching the first phase of its integrated property development, dubbed “Fraser Square”, in April next year. The property would comprise three high-end condominium towers to be developed on 5.14ha at Section 13, right at the heart of the Petaling Jaya, Selangor.

Its non-independent and non-executive director Datuk Ng Jui Sia said the project was expected to be completed in six years and would diversify the company’s portfolio.

“The first phase will see the launch of an initial 300 units and the next phase will depend on market response. “Despite some of the cooling measures currently in place, we are hoping that with the Fraser branding, consumers in Malaysia will have the confidence in purchasing the units.

“We foresee the second phase to be launched in the second half of next year. Although the show house is under construction, our sales gallery will be open soon.” Ng added that F&N has landbank remaining in Johor, Kota Kinabalu (Sabah), Butterworth (Penang) and Kajang (Selangor).

On the impact of Goods and Services Tax (GST), Ng said since it is a national tax policy, F&N will be affected as it is part of the value chain. “We will have no choice but to pass on the GST to consumers. But we will do our best to cushion the impact. “If we have to absorb some of the taxes, we will. You never know, some retailers may even decide to absorb it, but we will have to see how it turns out.”

The Fraser Square project will have a total gross development value of RM1.7 billion. The units in Phase 1 will be priced at between RM750 and RM1,000 per sq ft. Meanwhile, its property general manager Cheah Hong Chong said F&N is expecting mixed responses for the project as it is located in the prime area of Petaling Jaya. “We have units of various types and sizes to meet purchasers’ needs, including families, individuals or businesses. “Due to the GST implementation, we expect property price hike of only three to four per cent, which is minimal as properties are exempted,” said Cheah.

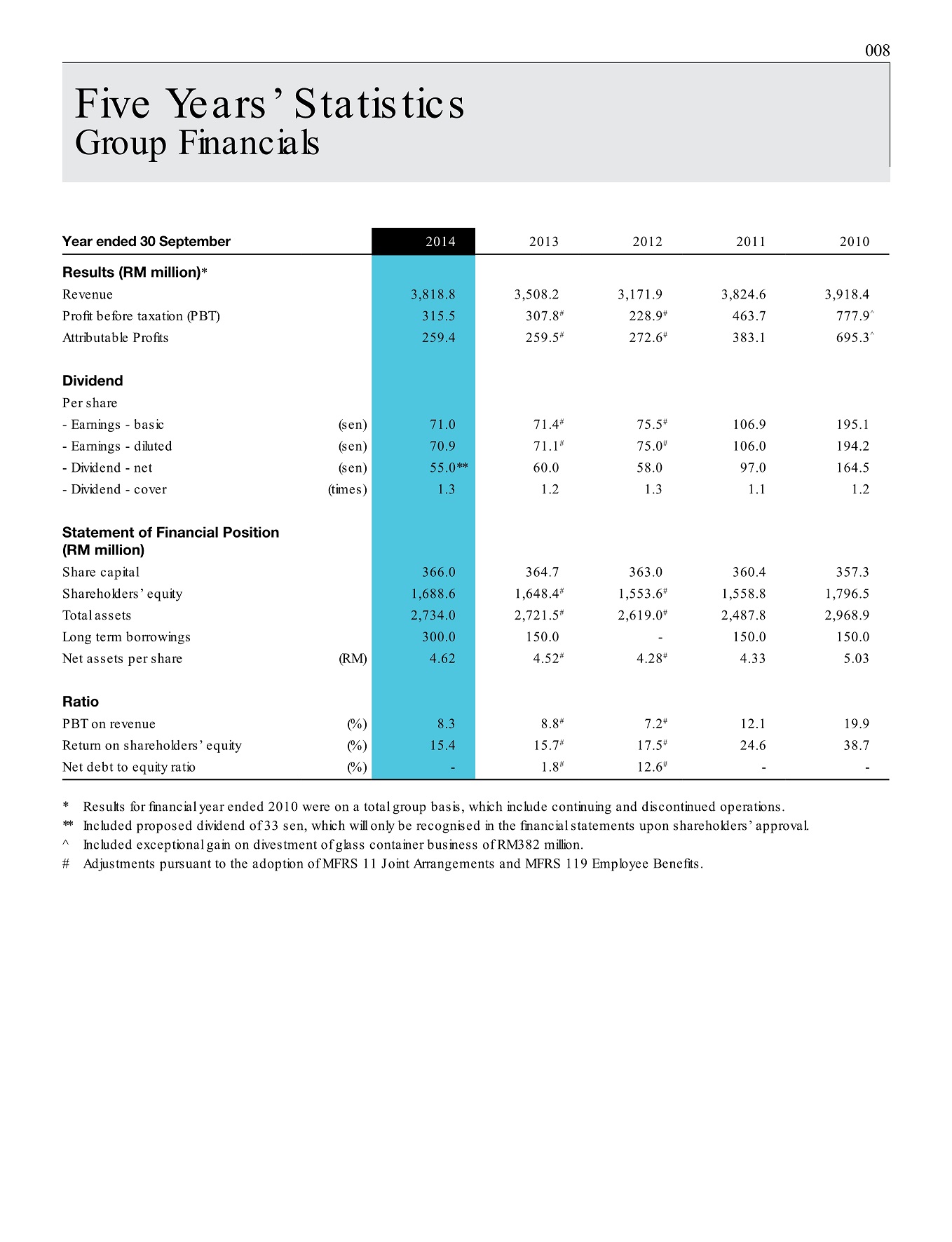

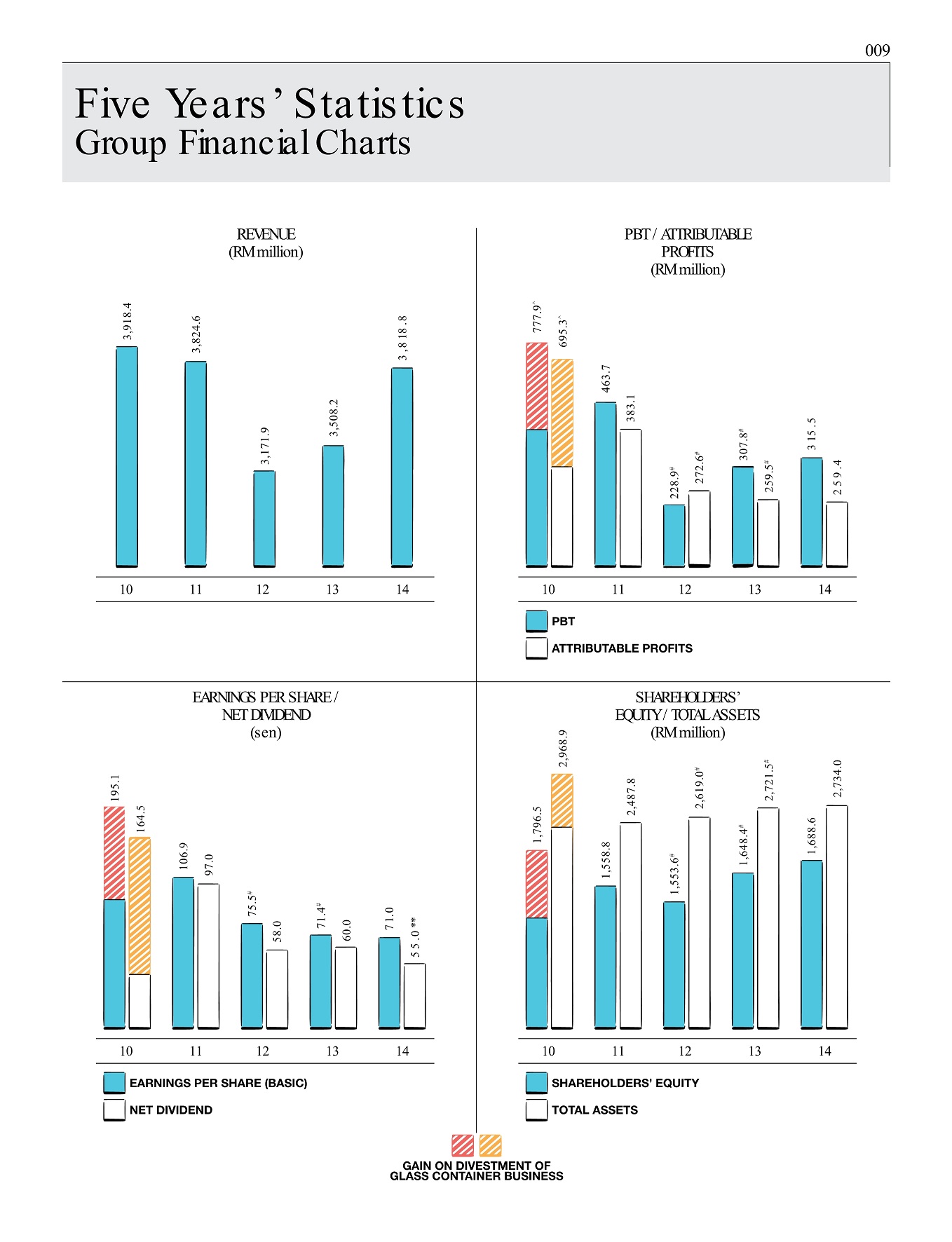

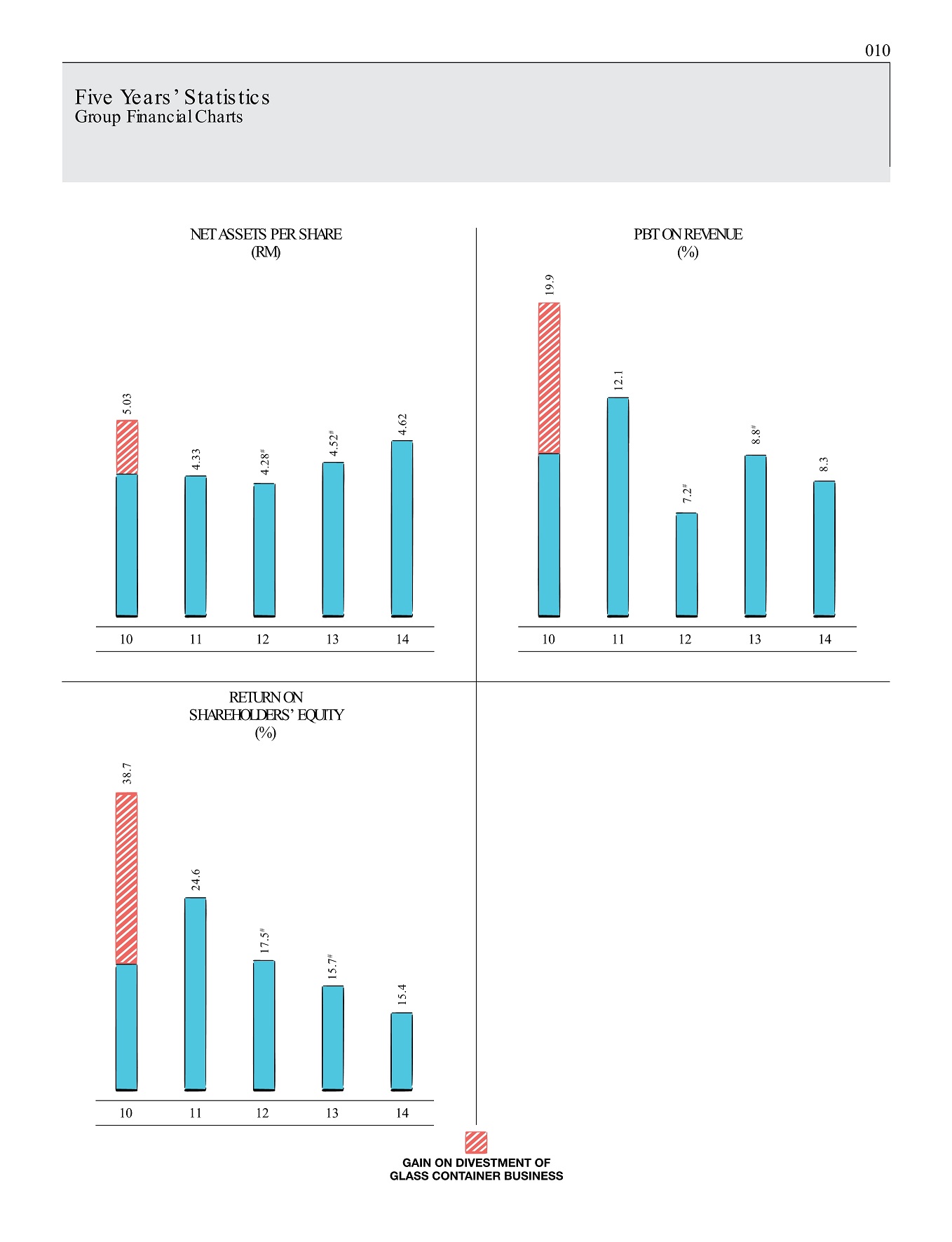

For the fourth quarter ended September 30, F&N’s recorded lower earnings at RM62 million against RM80 million a year ago. Its revenue for the period was higher at RM965 million against RM897.5 million a year ago. F&N said solid performance and higher contributions from all its business units, driven by Dairies Thailand, had helped to contribute to the increase in the group’s total revenue.

Meanwhile, F&N is also eyeing to become Asean’s No. 1 player in the food and beverage (F&B) business through acquisitions. Ng said as one of its strategies moving forward and narrowing the gap with its competitors, the company is in talks with several parties. “We expect to see continued revenue growth for the financial year 2015 and it should surpass our yearly average. “Next year’s performance will depend on the market sentiment and our brand resilience,” he added.

“By 2020, we should be able to reduce the gap in our bid to become the top F&B player in Asia.”

Yahoo Malaysia 08 Nov 2014

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|