Nasdaq Composite Closes at Record Again, Powered by Google

ss20_20

Publish date: Mon, 20 Jul 2015, 12:10 PM

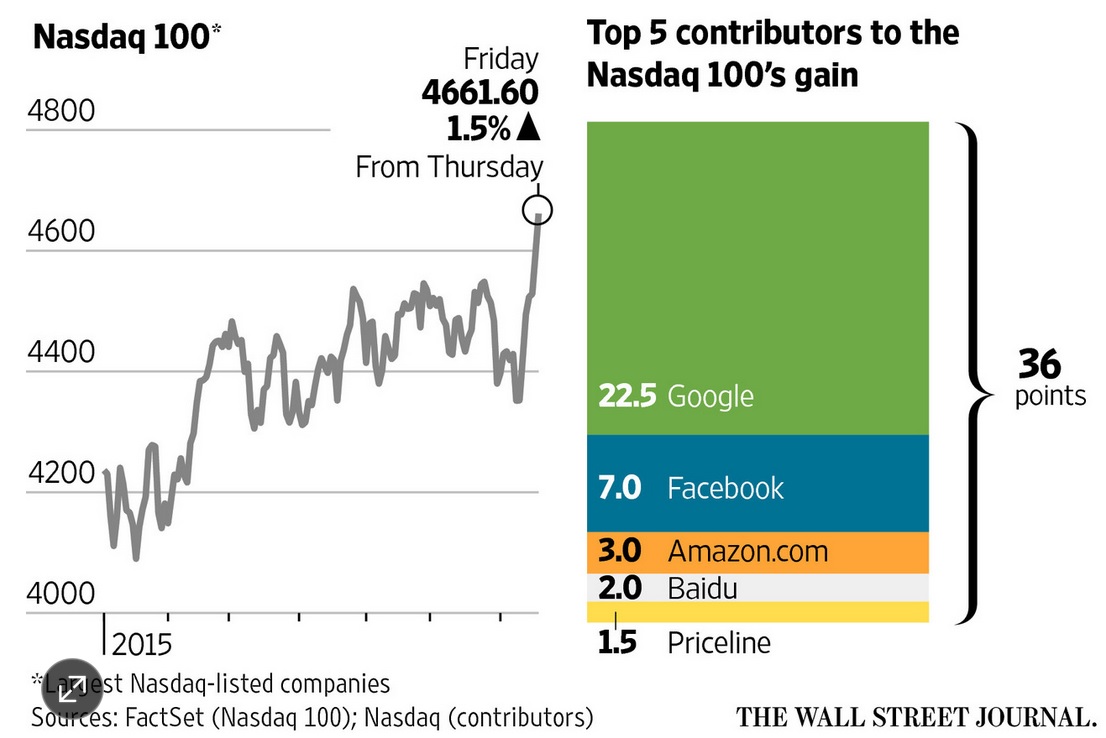

The Nasdaq Composite Index extended its record-setting run to a second day, boosted by strong earnings from Google.

The Nasdaq gained 46.96 points, or 0.9%, to 5210.14, as Google Class A stock surged 16%. Shares of the world’s largest Internet-search provider reached a fresh record close after it posted quarterly results that topped analysts’ expectations late Thursday. Google shares had their third-largest daily gain ever in percentage terms.

The Dow Jones Industrial Average fell 33.80 points, or 0.2%, to 18086.45, while the S&P 500 gained 2.35 points, or 0.1%, to 2126.64. Technology was the only S&P 500 sector to close higher for the day.

Even as the technology sector rallies, portfolio managers say they aren’t overly concerned about high valuations for tech stocks. In March 2000, the Nasdaq Composite’s value compared with the last 12 months of earnings was 175. Currently, the index’s trailing price/earnings ratio is 24.1.

Some investors played down the idea that there was a bubble in tech stocks.

“Bubble is a very loaded term,” said Gavin Baker, manager of the $9.3 billion Fidelity OTC Portfolio mutual fund, 80% of whose assets trade mainly on Nasdaq or an over-the-counter market. “Is the market more expensive than it was? Yes. But to me there’s a big difference between the market being more expensive than it was three to four years ago and the market being in a bubble.”

Major U.S. stock indexes have advanced in the past two weeks, with gains driven in part by hopes that Greece and its creditors would reach a bailout deal and avert the country’s exit from the eurozone. On Wednesday, Greece’s Parliament passed austerity measures needed to secure a fresh bailout, and Germany’s Parliament on Friday voted to approve bailout negotiations. Those steps were necessary for the eurozone’s bailout fund to approve the start of talks to hammer out the details.

For the week, the Dow rose 1.8% and the S&P 500 gained 2.4%. The Nasdaq Composite jumped 4.3% for the week.

The Nasdaq Internet Index, which tracks large U.S.-listed, Internet-focused companies, rose 7.1% this past week, marking its best week since 2011. Netflix ended up 18% for the week after releasing better-than-expected results Wednesday.

Despite these recent moves, U.S. stocks broadly have failed to make big gains so far this year. The Dow is up just 1.5% year to date, while the S&P 500 has gained 3.3%. Some analysts attribute this to a slowdown in earnings growth.

“We’re in a world where the economy is growing, but not as fast as anyone would like, and earnings are growing, but not as fast as anyone would like, so I’d expect stocks to crawl forward, not to run forward,” said Kate Warne, investment strategist at Edward Jones.

Including results from 59 companies in the S&P 500, earnings are on track to slip 3.6% in the second quarter, according to FactSet. Ahead of the reporting season, analysts had expected earnings to decline 4.5%.

On Friday, Honeywell International said profit in its June quarter rose more than expected, as lower costs outweighed a revenue decline. Its shares rose 1.9%.

With U.S. corporate earnings season in full swing, now investors can focus more on domestic news rather than news out of Europe or Asia, according to Mark Luschini, chief investment strategist for Janney Montgomery Scott. “Front and center is earnings season, and so far the news has been better than expected,” he said.

On Friday, data on U.S. home building, consumer prices and consumer sentiment were released, giving investors a fresh look at the health of the U.S. economy. U.S. housing starts rose 9.8% from a month earlier to an annual rate of 1.17 million in June, the Commerce Department said. Housing starts were forecast to rise 7.1% in June to an annual pace of 1.11 million, according to economists surveyed by The Wall Street Journal.

The consumer-price index, which reflects what Americans pay for everything from clothes to computers, rose 0.3% in June from a month earlier, according to the Labor Department, in line with expectations. Data also showed that the University of Michigan’s preliminary index of consumer sentiment dropped more than expected to 93.3 for July from June’s final level of 96.1.

Reaction to the economic data was muted, traders said. “I don’t think they were robust one way or the other,” said Stephen Carl, head equity trader at Williams Capital Group, referring to the economic reports. “I think they were mixed, if anything.”

wsj.com | 17 Jul 2015

More articles on Google Inc

Created by ss20_20 | Aug 11, 2015

.png)