Google books biggest day in history, adding $66.9B

ss20_20

Publish date: Mon, 20 Jul 2015, 12:39 AM

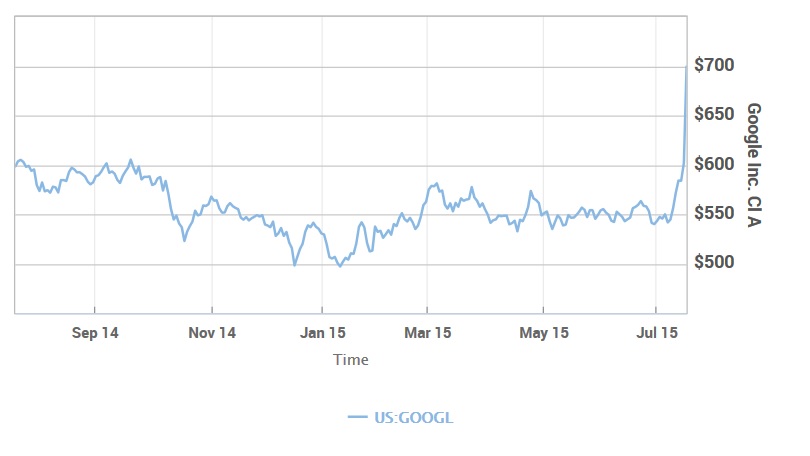

Google Inc.’s stock closed at a record $699.62 on Friday, delivering $66.9 billion to investors in one day - a record for Wall Street.

Shares of Google GOOGL, +16.26% GOOG, +16.05% skyrocketed 16.3% on Friday, the company’s biggest one-day percentage gain since April 2008. The increase raised Google’s market capitalization by $66.9 billion to $478 billion, according to FactSet.

The one-day market cap gain is the largest on record, eclipsing Apple’s one-day market-cap gain of $46 billion on April 25, 2012, and Cisco Systems Inc.’sCSCO, -0.49% $66.1 billion valuation gain on April 17, 2000, according to The Wall Street Journal. The market-cap gain is bigger than the valuations of more than 400 companies in the S&P 500, including major corporations such as Caterpillar Inc. (market cap: $50 billion) CAT, -0.72% Ford Motor Co. ($58 billion) F, +0.82% and Netflix Inc. ($49 billion) NFLX, -0.90% .

And at least five brokerages — J.P. Morgan, Bernstein Research, Nomura Research, Jefferies and Evercore — think Google’s stock will can and will go still higher. After Google reported a sharp rise in earnings and sales that trumped Wall Street’s expectations, they all raised their 12-month targets on the company’s stock Friday morning to $800. At that price, Google’s market cap would catapult above the half-trillion-dollar mark to $547 billion, making Google only the second company, along with Apple AAPL, +0.86% to be valued above the half-trillion-dollar threshold. Apple is currently trading at a $740 billion valuation.

“Google hasn’t delivered a quarter like this in a long time,” said J.P. Morgan analyst Doug Anmuth, reiterating an outperform rating on the stock.

A number of other banks raised price targets for Google shares beyond the $700 mark, including Deutsche Bank, which lifted its target to $780 from $625; Wells Fargo, to $780 from $760; RBC Capital, to $750 from $640; Pacific Crest, to $745 from $675; Raymond James, to $720 from $625; and Cantor Fitzgerald, to $720 from $625.

BMO Capital Markets was the only brokerage to upgrade Google’s stock on Friday, to buy, but the vast majority of analysts already rate Google the equivalent of buy, according to FactSet.

A few banks kept their targets below $700, including Morgan Stanley, Goldman Sachs, UBS, Barclays and Morgan Stanley, which raised their targets to $620, $660, $670 and $675, respectively. Those targets would have represented slight increases from Google’s closing price of $601.78 on Thursday, but they all represent declines from current trading prices. The average price target among 40 analysts surveyed by FactSet is $711.62.

The most recently completed quarter marked a reversal from the four prior periods in terms of paid-clicks growth, which came in above the consensus estimate at more than 18% on a year-over-year basis versus the forecast 14% growth.

Nomura analyst Anthony DiClemente, who currently rates Google a buy, said the quarterly results debunk the major bear cases against Google, including that desktop search is declining, that expense growth is expanding faster than revenue growth and that YouTube growth is stalling (viewership is growing at the fastest pace in two years, in fact, with YouTube viewing hours jumping 60% on a year-over-year basis and expanding on mobile).

Analysts applauded Google’s new chief financial officer, Ruth Porat, for her comments on reducing expenses and hinting at capital returns down the road, saying that those remarks back up the company’s commitment to improving margins and delivering value to shareholders.

“We believe this will be a thesis-changing quarter for many as margins stabilize and likely expand,” Anmuth said.

In the less bullish analyst camp, Goldman Sachs’s Heather Bellini reiterated a neutral rating on Google, pointing to a cost-per-click decline that, at 11%, was steeper than anticipated; the consensus forecast saw that figure declining by 4.5%.

Morgan Stanley analyst Brian Nowak, who reiterated an equal-weight rating on Google’s stock, said he remains on the sidelines as his firm gauges “the sustainability of top- and bottom-line beats” in the back half of 2015 and 2016.

Marketwatch | 17 Jul 2015

More articles on Google Inc

Created by ss20_20 | Aug 11, 2015

.png)