Top Glove Corporation Bhd - Reviews & Target Price

ss20_20

Publish date: Thu, 02 Jul 2015, 01:34 PM

展望2016‧CEO運籌決勝

Author: Tan KW | Publish date: Mon, 28 Dec 2015, 10:51 AM

頂級手套(TOPGLOV,7113,主板工業產品組)

主席丹斯里林偉才

鞏固壯大

2015年是頂級手套里程碑,這財政年在營收與盈利創集團和膠手套業新高,銷售營收按年增長10.3%至25億1千萬令吉,稅前盈利按年飆68.1%至3億6千370萬令吉,淨利按年升53.4%至2億8千160萬令吉。上個新高2010財政年所創,淨利達2億5千零40萬令吉。

持續素質與成本效益改善,生產自動化、研發等活動結出豐碩果實支撐卓越表現。集團從強勢美元、原料價低間接受益,惟不會賴此提振表現。

2015年2月,29廠房新設施啟用,尖端工藝有效設施特用作生產丁腈手套,擴大產能以迎合發達國需求;這類手套從上財政年佔24%銷售,上揚至2015財年的28%。

儘管大馬天然膠手套出口2015年上半年按年挫9.5%,頂級手套大馬出口揚5.2%跑贏大市,人造膠手套出口飆24.5%,超越大馬出口的15%的增幅。

這一年獲獎無數,包括膺選Frost & Sullivan亞太醫藥手套公司年度獎,在東盟企業監管卓越獎上市公司名列前兩名(餘獎省略),並成功在改進製造過程申請8項專利。

丁腈手套競爭加劇,更多同儕擴產,天然氣價上漲、化學與原油價走高為營運挑戰。

集團持續透過自動化和工藝轉型改善素質和成本效益,也藉此減少浪費、創新、改進製造程序,低成本、高盈利以維持競爭。

預期美元持續走強、原料價處低位,惟這不恆久、不長遠倚賴。同業紛擴大丁腈手套產能,或導致供過於求窘境,30年此週期不斷,正作好一切準備。市場供過於求,晉鞏固期,優勝劣汰而臻供需平衡,其間將湧現契機透過併購擴展。

儘管水電天然氣等成本和原料價可能騰漲,膠手套作為保健領域必需品之一,前景無可限量,需求年增長率達5%至6%。其中美歐日本佔全球13%人口,就消費全球手套的68%,其餘87%全球人口更具成長潛能。

2015年獲佳績鼓舞集團精益求精,躋身全球最大膠手套廠後,將透過高效益高端設施擴大產能,放眼成為全球最大丁腈膠手套廠商和獲利更大。擴展廠房包括盧骨27號廠、泰國6號廠,新設施為2017年2月竣工的30號廠房,使生產線增至540條,年產524億個手套。新興市場潛能大,並將深耕發達國。

未來,將透過內部或併購成長,開放探討併購契機,重點是要有協作性。同業間已有幾間丁腈手套廠關閉,競爭加劇也提供鞏固契機。截至2015年8月有1億8千650萬令吉現金,也可透過發股籌資以利併購。

希望個人和集團全體同仁身心健康為集團作貢獻,適當運動和適量飲食至關重要,也閱讀好書維持正能量。盼望同仁勤智上進,捎來佳績。

國家應強化經濟和帶來永續成長,不論公司或國家,應誠正信實和透明,這是成功之鑰。但願大馬安全和平、清廉顯績效、國民進取團結和樂,商業興旺。

Top Glove - Record breaking quarter |

| Source | : | MAYBANK | ||||||||

| Stock | : | TOPGLOV | Price Target | : | 16.60 | | | Price Call | : | BUY | |

| Last Price | : | 13.68 | | | Upside/Downside | : |

|

||||

Strong results reaffirm BUY

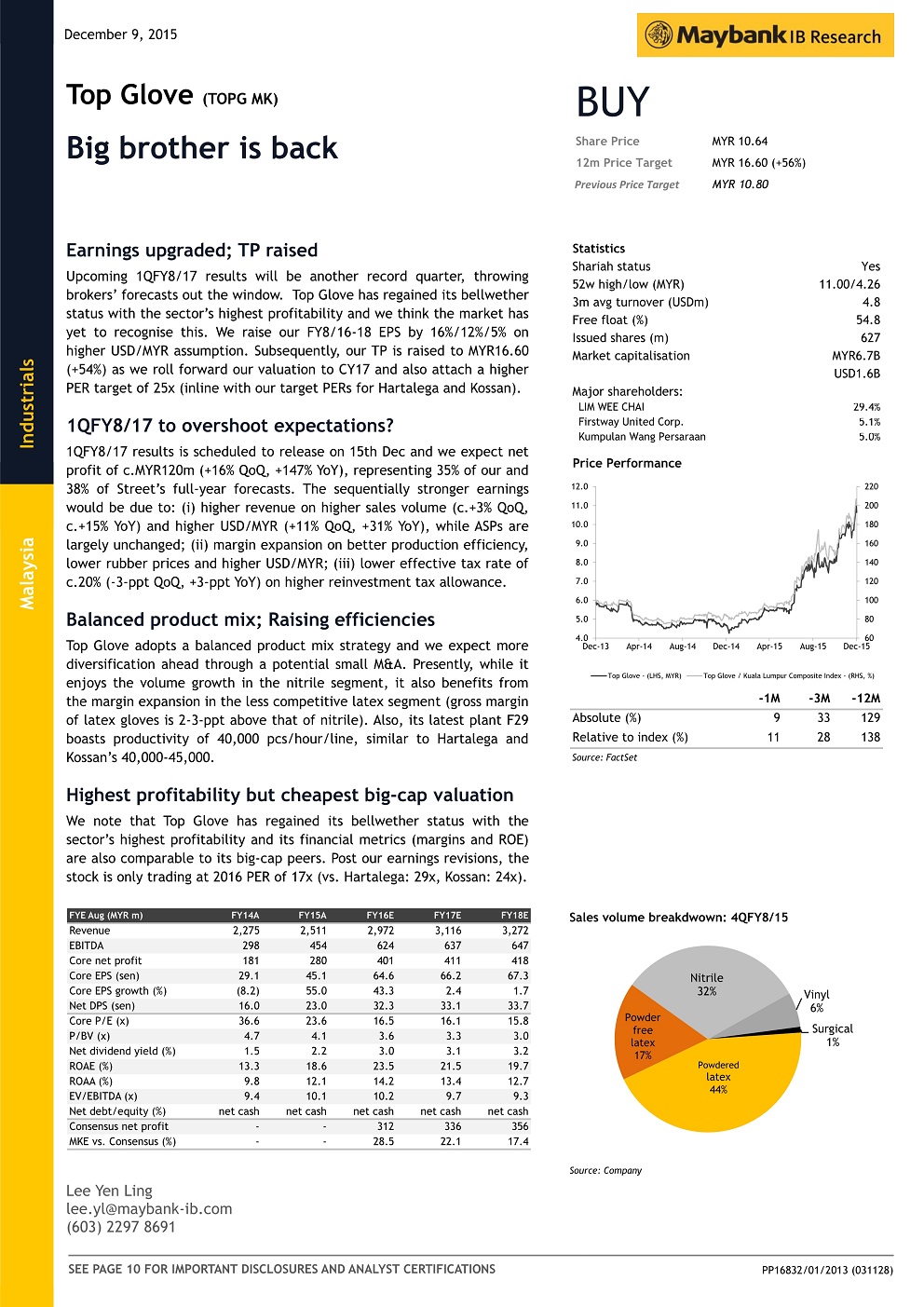

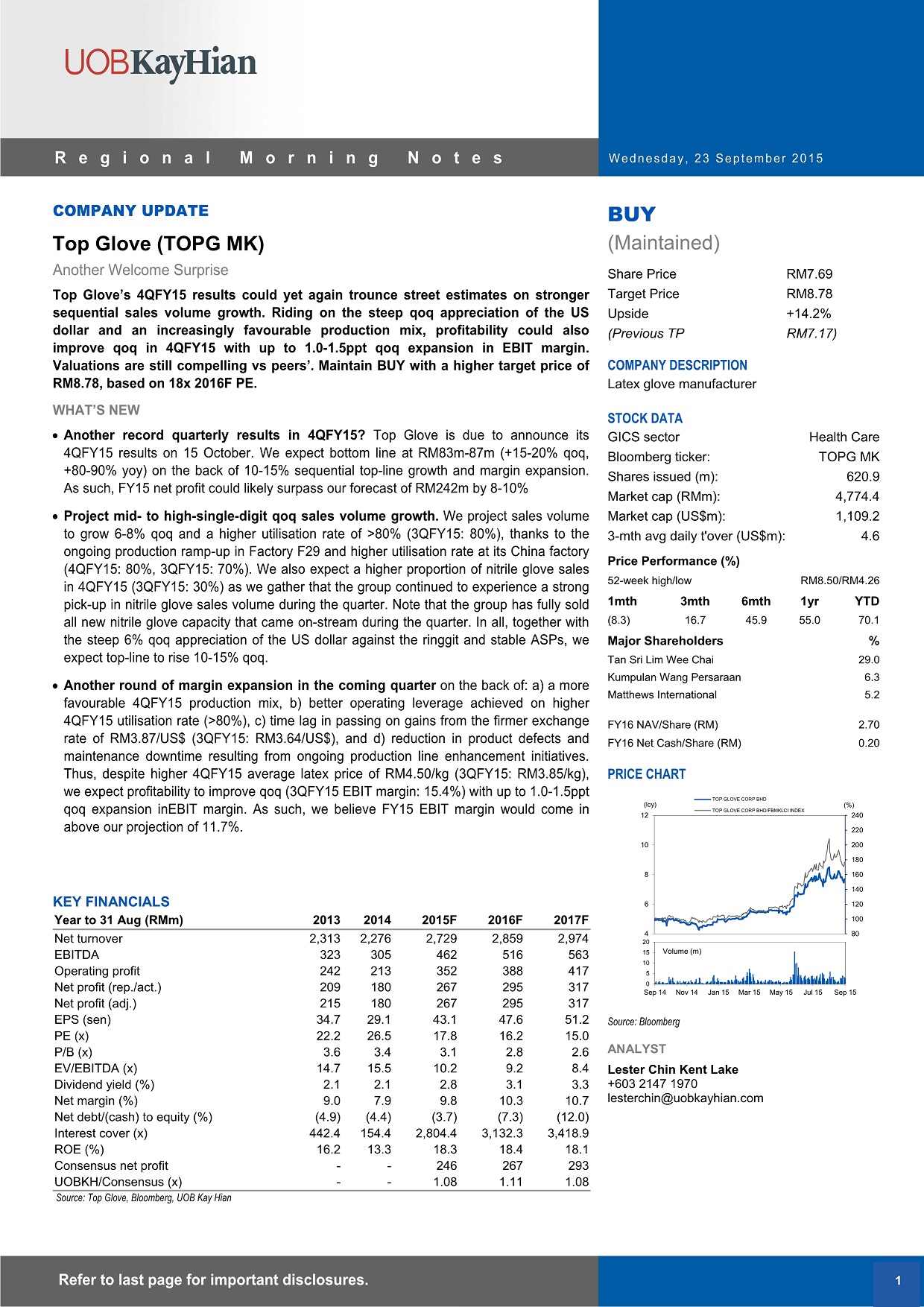

Core 1QFY8/16 net profit of MYR123m (+20% QoQ, +153% YoY) was within our expectation but substantially above street’s. We continue to like Top Glove as the sector’s new bellwether, yet it is trading at cheapest bigcap glove 2016 PER of 18x. Maintain earnings forecasts, BUY call and TP of MYR16.60 (25x 2017 PER).

Within our expectation but above street’s

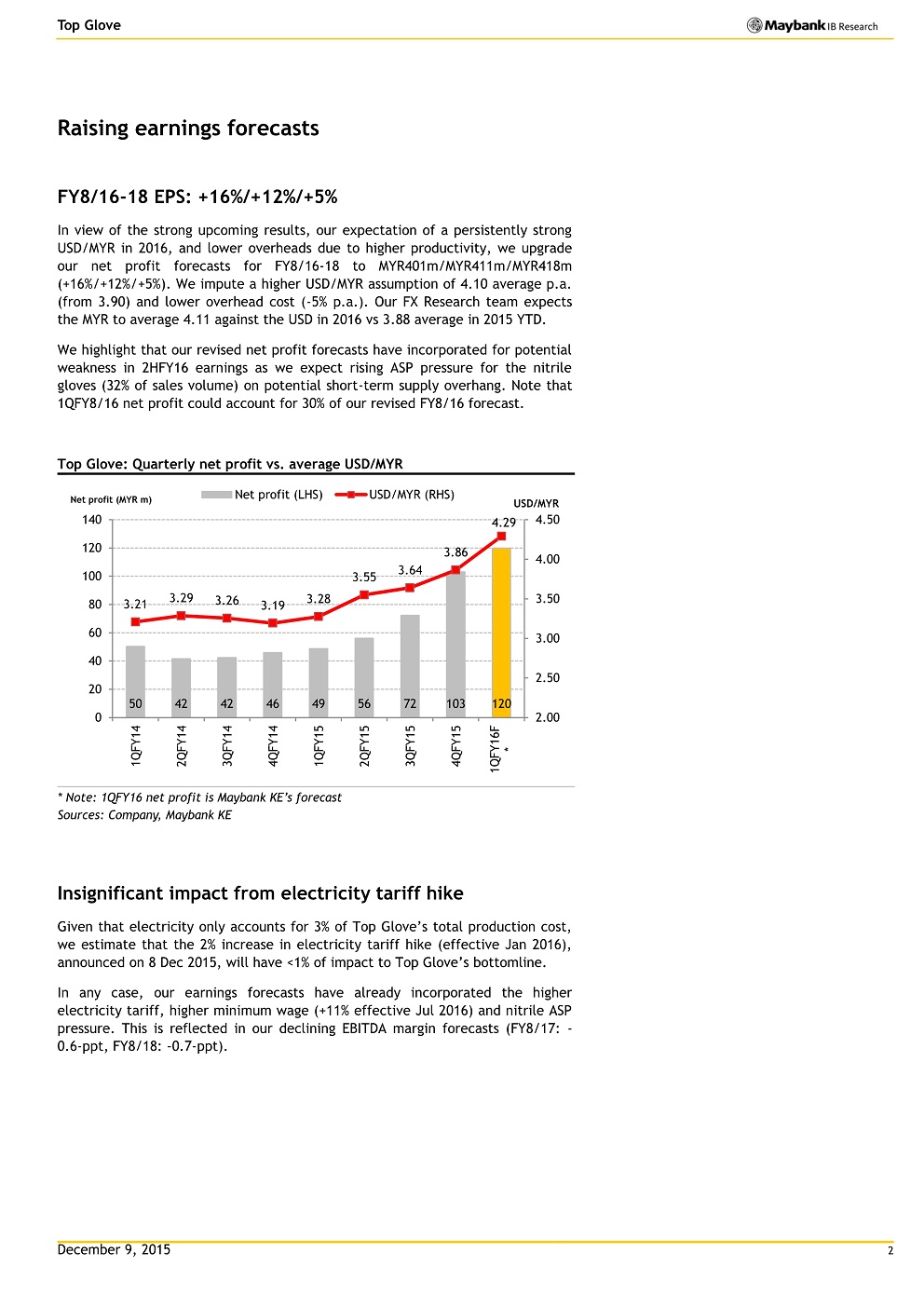

Excluding the MYR5m disposal gain on US bonds, 1QFY8/16 core net profit was MYR123m (+20% QoQ, +153% YoY) making up 31% of our and 38% of street’s full-year forecasts. The results is within our expectation as we see potential earnings weakness in the sequential quarters. Key takeaways on 1QFY8/16 results: (i) revenue was higher (+13% QoQ, +41% YoY) on better sales volume (+1% QoQ, +15% YoY) and higher USD/MYR (+11% QoQ, +31% YoY), while ASPs stayed largely unchanged; (ii) EBITDA margin improved (+0.4-ppt QoQ, +8.4-ppt YoY) on the USD/MYR strength and slightly lower rubber prices; and (iii) bottomline was further boosted by the lower effective tax rate of 20% (-2.9-ppt QoQ, +3.1-ppt YoY).

Hinges on USD/MYR rates

In our view, the strong 1QFY8/16 was largely driven by external factors (especially strong USD/MYR). Hence, the strength of USD/MYR is crucial in determining the sustainability of its strong 1QFY8/16 earnings. We maintain our earnings forecasts for now, expecting weaker earnings on potential USD/MYR volatility ahead. We have assumed an average USD/MYR rate of 4.10 in FY8/16-18 (vs. spot rate of 4.30 presently).

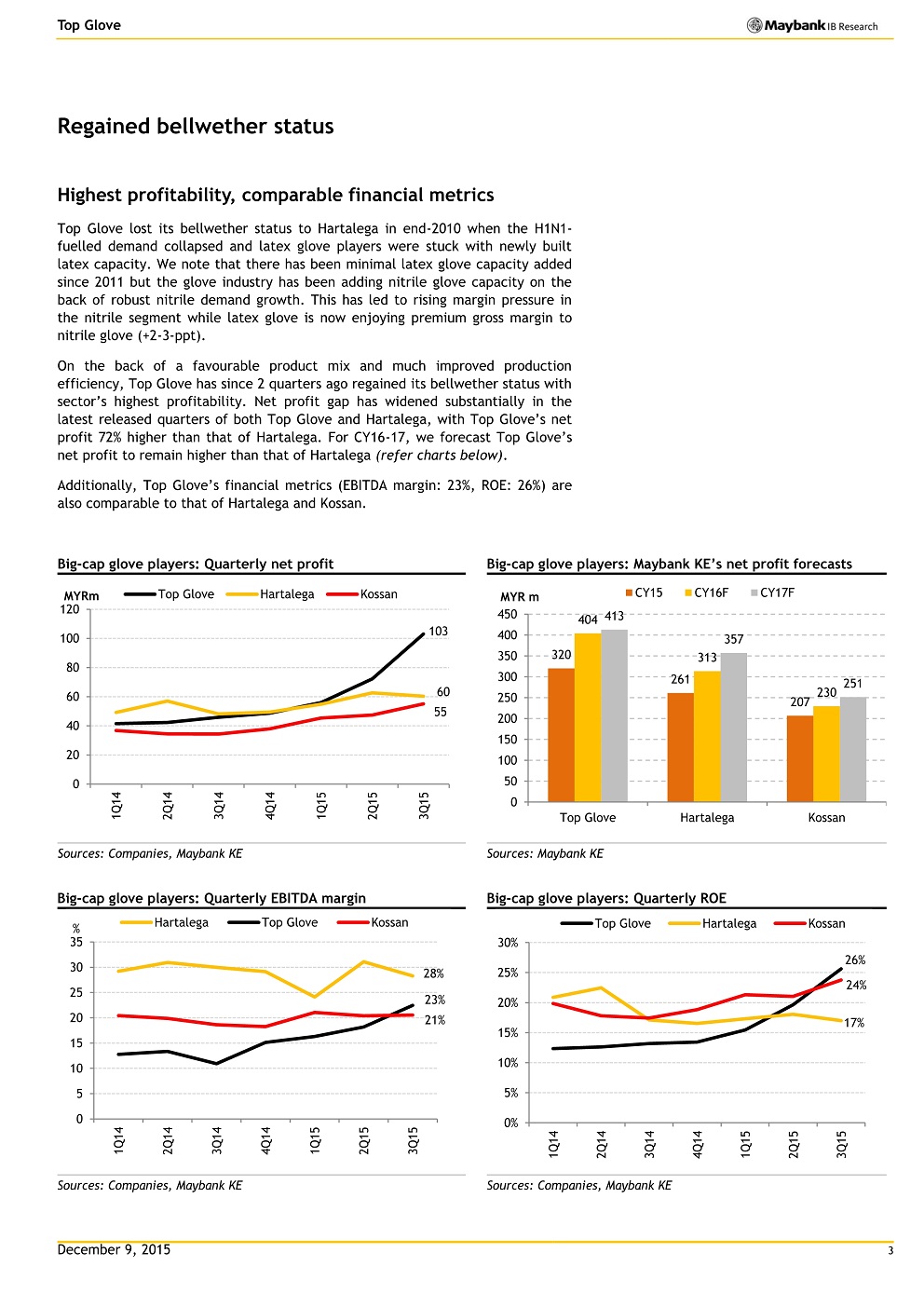

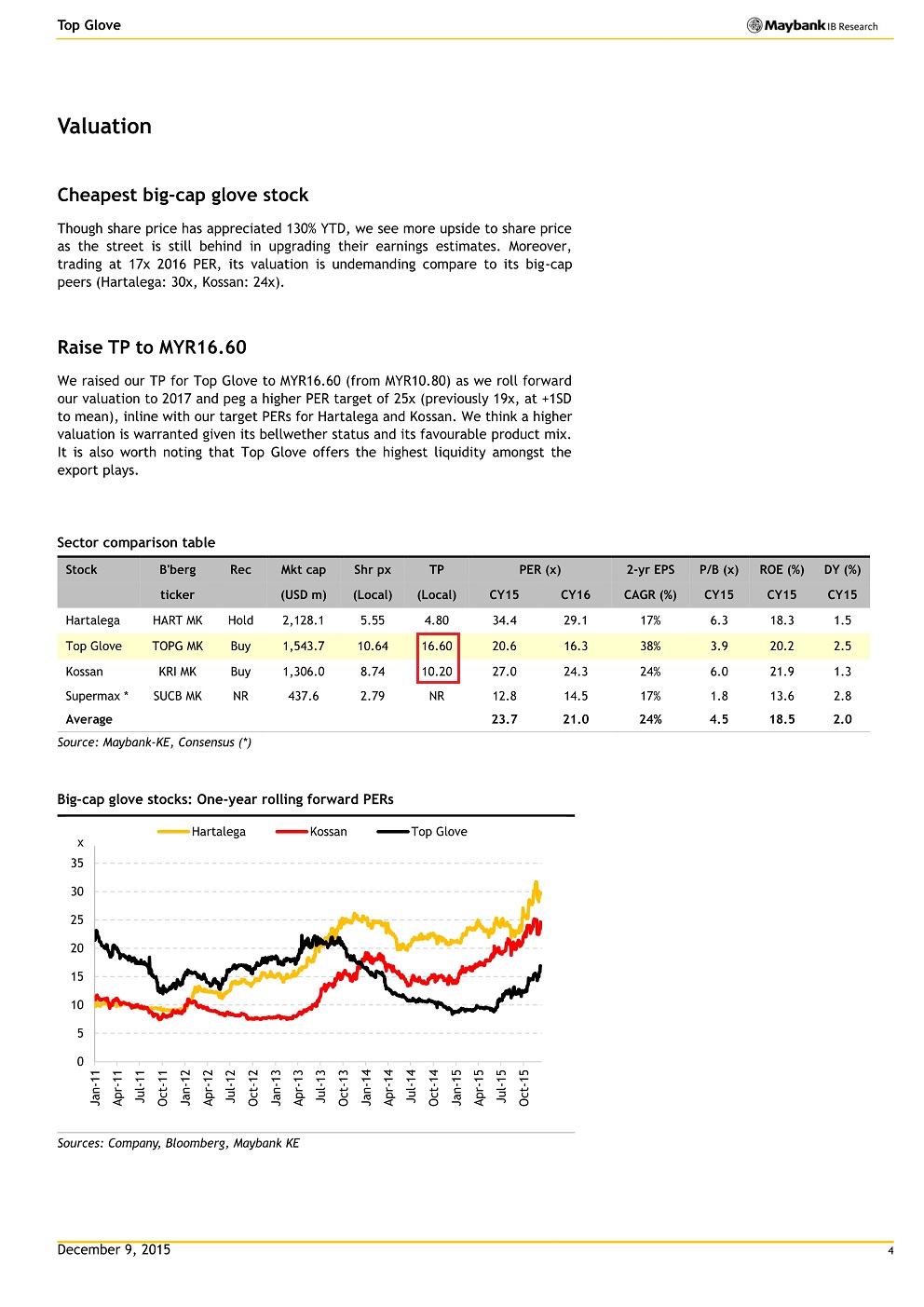

Highest profitability yet cheapest valuation

Trading at 2016 PER of 18x, Top Glove’s valuation is undemanding considering that it is now the sector’s new bellwether (highest profitability) yet still cheaper than its big-cap peers (Hartalega: 30x, Kossan: 25x). Its 1-for-1 bonus issue (target completion in mid-Jan 2016) could provide additional impetus to share price.

Source: Maybank Research - 16 Dec 2015

(吉隆坡25日訊)

受馬幣兌美元匯率升破4.20令吉打擊,早前在“強勢美元”主題下備受追捧的手套股週三慘遭拋售,股價全面淪陷,使投資者惶惶不安,擔心強勢美元投資風可能正醞釀轉向。

手套股受惠於強勢美元和產能增加,成了今年馬股的“搶手貨”之一,也是美元投資風下的代表股類,開年至今平均上揚近70%;然而,雖然業績報捷、繼續廣受證券行看好,但隨馬幣近期轉強,手套股股價遂顯得有氣無力,紛紛出現調整。

頂級手套跌36仙

其中,近期氣焰最盛的頂級手套(TOPGLOV,7113,主板工業產品組)就在週三大跌36仙或3.73%;高產尼品(KOSSAN,7153,主板工業產品組)也跌48仙或5.66%;賀特佳(HARTA,5168,主板工業產品組)則跌34仙或5.88%,全數入圍10大下跌榜。

此外,速柏瑪(SUPERMX,7106,主板工業產品組)也下跌9仙或3.7%;康复手套(COMFORT,2127,主板工業產品組)和業績遜色的加護手套(C A R E P L S,0163,創業板工業產品組),也各跌1.28%和5.75%。

無論如何,估值高企和股價今日回調讓投資者擔心手套股已陷入“高處不勝寒”窘境,甚至擔心“強勢美元”再無法獨自撐起手套股估值。

未來6至9個月仍有看頭

《星洲財經》向行內人士查詢後發現,在原料成本低企和美元走強等雙重利好的支持下,手套股未來6至9個月的業績仍有看頭,但由於股價已提前反映利好,出現套利是正常的結果。

“馬幣近期重新站穩,兌美元匯率從4.40令吉下滑至4.20令吉,影響了強勢美元主題股的投資情緒,驅使投資者趁高套利,因此相信若馬幣繼續走強,靠強勢美元撐場的公司股價短期內還有回跌空間,尤其是那些估值偏高和股價累積可觀漲幅的公司。”

數據顯示,馬股手套股今年至今全數報漲,漲幅介於16至113%之間,平均漲幅為70%,明顯跑贏大市,其中漲最兇的是頂級手套,漲最少的則是今年中剛脫離PN17的康复手套。

不過,Arena資本首席執行員黃德明受訪時認為,全球手套需求量持續走高、原料價格疲弱,再加上美元持強,手套業今年表現預計會相當不錯。

他認為,只要馬幣兌美元匯率無法在2016年恢復至3.30令吉水平,手套公司的淨利都不會受太大影響,即使馬幣匯率回揚至3.60至3.80令吉之間,因手套業者的淨利主要由營業額成長帶動。

“美元走強,對手套業者而言只是錦上添花而已。”

輝立資本首席策略員潘力克表示,手套領域的估值雖已有高估跡象,雖然需求走高仍可持續扶持股價,但若未來業績低於市場預期,則可能面對賣壓風險。

最新一季業績顯示,上月公佈業績的頂級手套單季淨利飆漲123%至1億零311萬9千令吉,創史上最高紀錄。而本月初公佈業績的高產尼品及賀特佳,淨利則各揚60.35%和25.43%,繼續受惠於強勢美元。

不過,加護手套昨日公佈的業績表現平平,雖按年轉虧為盈,但淨利只有32萬3千令吉。

目前,尚未公佈業績的手套股只剩速柏瑪和康复手套,兩家公司料在未來幾天內發佈業績。

Rubber Gloves - Positive surprise from Budget 2016 OVERWEIGHT

Author: kiasutrader | Publish date: Tue, 27 Oct 2015, 11:05 AM

- We see the rubber glove manufacturers as prime beneficiaries of Budget 2016 in view of the proposal for a Special Reinvestment Allowance (RA) Incentive for companies that have exhausted their eligibility to qualify for RA. The rate of claim is at 60% of qualifying capex and can be set off against 70% of statutory income from year of assessment 2016 to 2018.

- This proposal is particularly significant for the rubber glove players as most had expired their RA incentives (valid for 15 consecutive years from the year of assessment RA is claimed) between 2012 and 2014 considering their long operating history.

- Such an incentive is also timely for the glove manufacturers given their current capex upcycle. Against the backdrop of robust global glove demand (+9% YoY), we understand that the top four glove manufacturers have allocated capex of RM150mil to RM400mil p.a. for the next three years to boost installed capacity by ~11% p.a.

- The reinstatement of RA essentially means that the effective tax rates of glove companies could be lowered, leading to higher earnings moving forward. Historical data show that the effective tax rates for the top four players averaged at 16% prior to the RA expiries vs. the current 23%. Assuming a conservative 4ppts reduction to the forward effective tax rates, i.e. at 19%, we estimate an average earnings upside of 4%-7% p.a. for the rubber glove players.

- This announcement lends further credence to our OVERWEIGHT call on the rubber gloves sector. We expect the sector to enjoy another round of PE re-rating, with its premium valuations justified by its prime position as exporters operating in a defensive sector and the fact that it is one of the few industries in the market that is experiencing positive earnings upgrades from volume growth and margin expansion.

- While other points in the budget referred to potential cost inflations for the glove manufacturers, namely the 11% hike in the Peninsula Malaysia minimum wage from RM900 to RM1,000 and increase in the floor price of SMR20 and cuplumps, we are not too concerned as:- (1) labour costs make up only ~10% of the glove manufacturers’ total operating costs; (2) the industry has a cost pass-through pricing mechanism; (3) there is an eight-month grace period to the implementation date; and (4) usage of imported bulk latex vs. domestic SMR20 as inputs.

- The latest rally of the rubber glove counters last week saw their share prices once again exceeding our fair values (all except Top Glove’s and by 9% on average). This was despite our constant upward revisions (between two to six times) since our sector upgrade in December 2014. Pending further details from the managements and the share price overshoots, which we view as a positive testament to our BUY calls, we are placing our current fair values for Top Glove Corp (RM10.60/share), Kossan Rubber (RM8.40/share), Hartalega Holdings (RM4.70/share) and Supermax Corp (RM2.05/share) under review.

Source: AmeSecurities Research - 26 Oct 2015

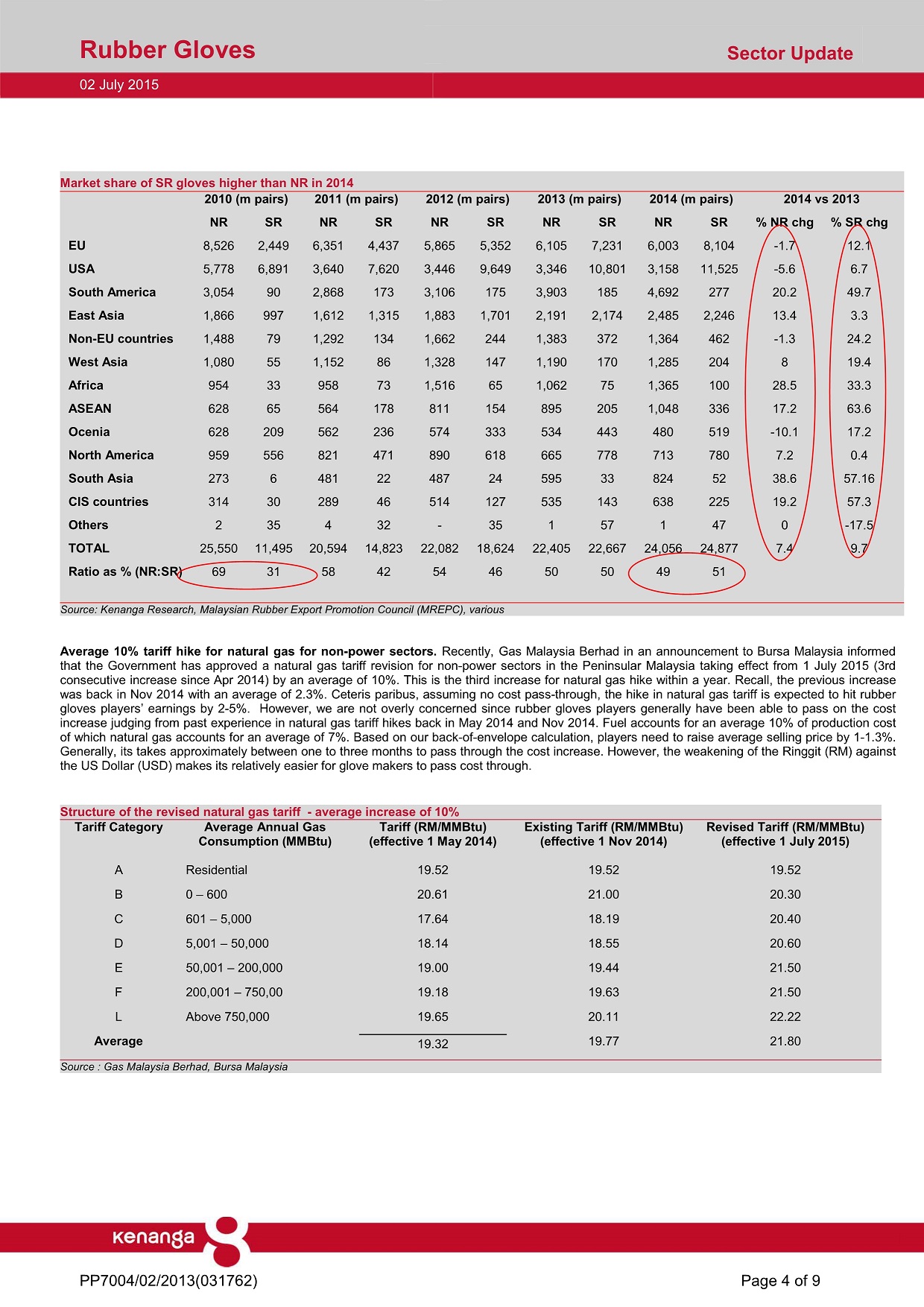

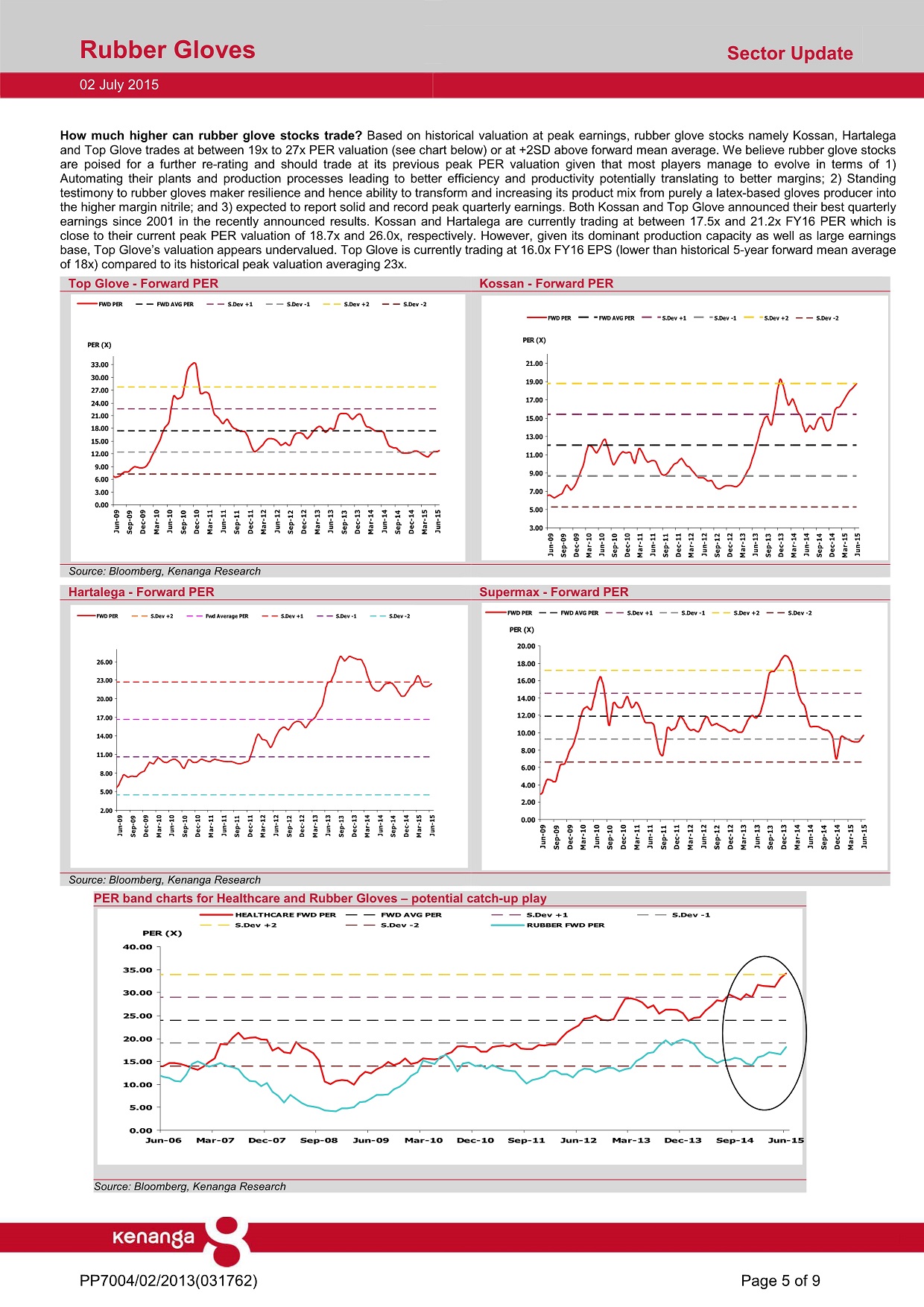

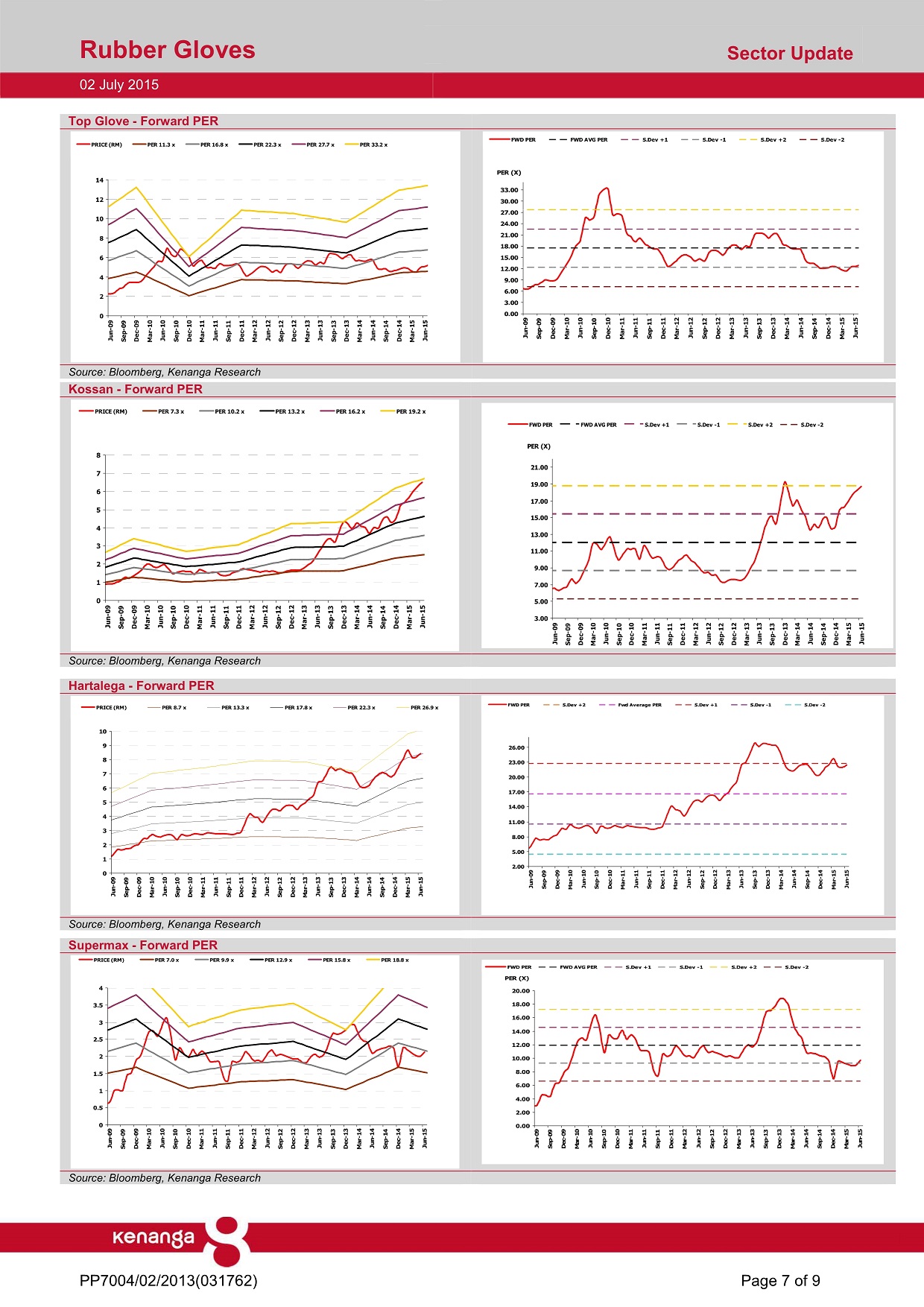

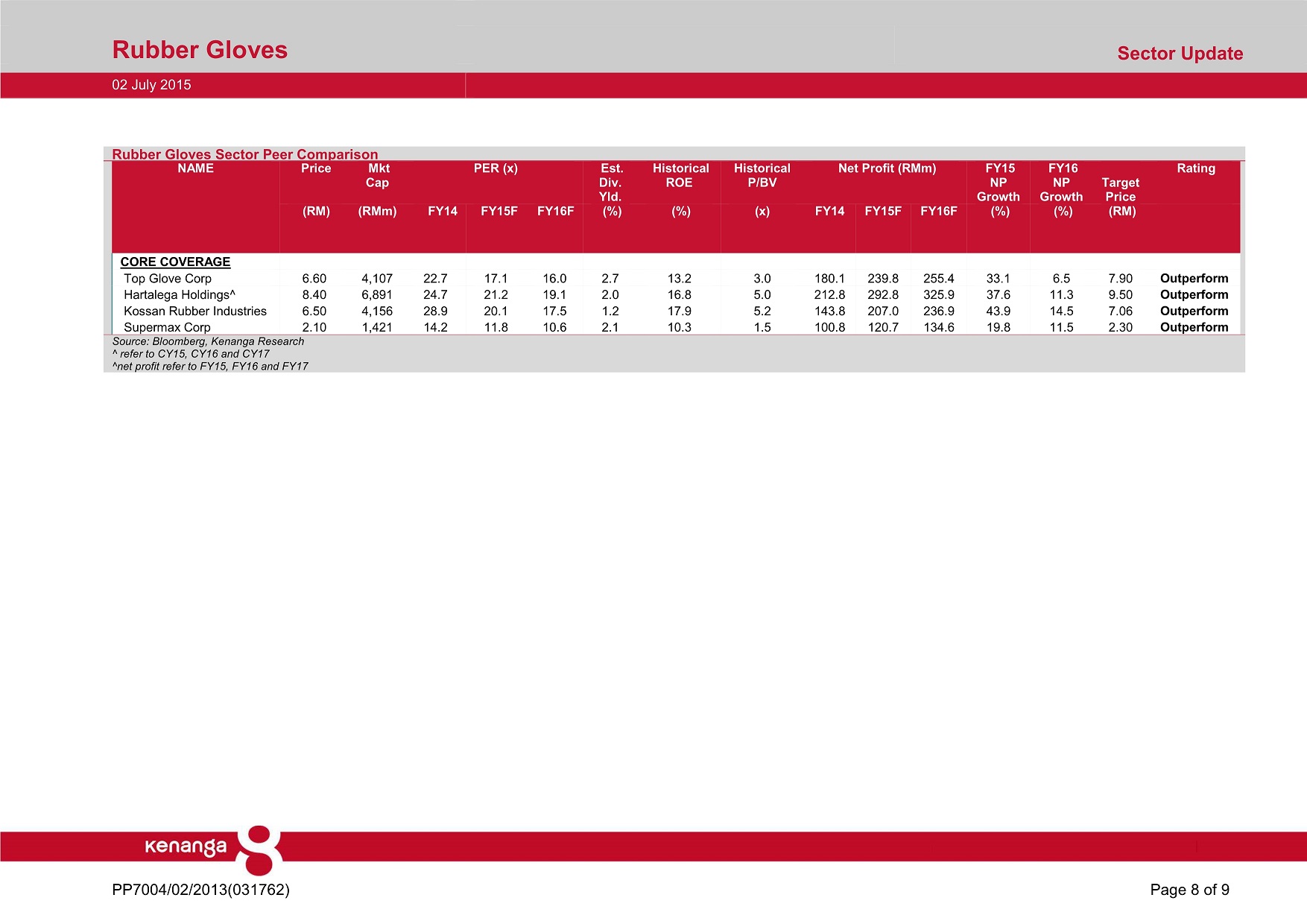

Kenanga Research | 02 Jul 2015

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|