Mercury Securities IPO: The Top 3 Reasons Why It Is Worth Subscribing

MelvinAng

Publish date: Sun, 27 Aug 2023, 03:49 PM

In the world of equity trading, there is always one winner in the market – it is not operator, but the brokerage house itself, which collects brokerage fees from your every BUY and SELL decision. YES, I mean EVERY TRANSACTION.

Mercury Securities Group Berhad (MSGB) is one of the leading brokerage houses in Malaysia. In this article, we will outline three (3) reasons why you NEED to subscribe to their IPO to win in the equity market.

Highly Regulated Market

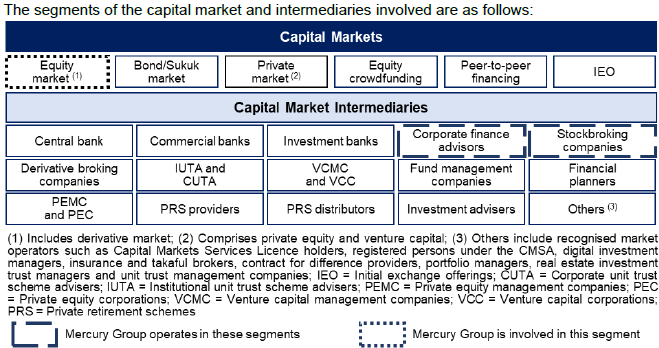

In the Prospectus Exposure of MSGB, the Independent Market Research (IMR) had outlined the market proposition of MSGB.

MSGB is involved in the corporate finance advisory services and stockbroking business, and the company is a licensed 1+1 broker*.

*The term “1+1 broker” means the company had acquired at least one (1) other broker house, which in Mercury Securities’ case, the company had acquired the CMSL license of PTB Securities Sdn Bhd back in 2003, which had made MSGB a 1+1 broker.

While many people may not know, there are only 12 1+1 brokers in Malaysia, and 1 Universal Broker (Acquired 3 broker houses CMSL license) in Malaysia, hence, it is close to impossible to acquire a new license in the industry.

Competitive Margins

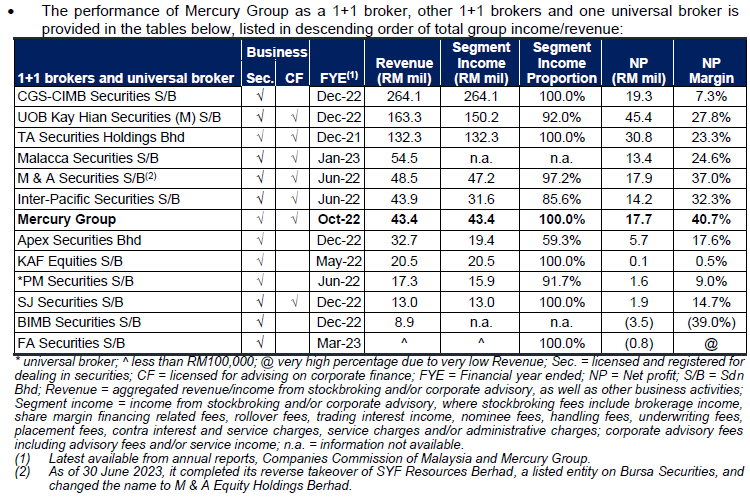

Below is a study on the competitive advantage of MSGB against other brokers in Malaysia.

MSGB had the highest NP Margin amongst all the 1+1 brokers and universal brokers, standing at a 40.7% NP Margin. It is easy to see that this remarkable achievement will continue for many years ahead, being the highest NP Margin financial advisory and stock broking firm. Despite staying low profile, market share and profit margin of MGSB can’t hide from the public after all. What we want to stress is MSGB has the highest NP margin with the least market share. It is strongly believed that once MSGB achieve its listing status, the market share will grow in tandem with increase of company visibility and profile strengthening.

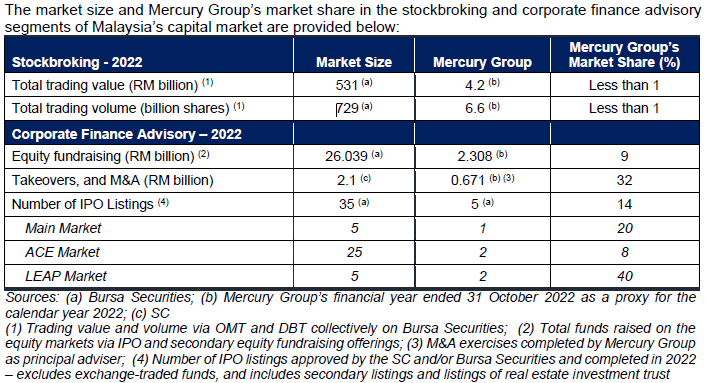

As you can see, MSGB had approximately 9% market share in equity fund raising in 2022, 32% market share in takeovers and M&A, 14% in total numbers of IPO (20% in Main Market, 8% in ACE Market and a stunning 40% in LEAP Market). This represents a strong market proposition of MSGB in Bursa Malaysia. It also shows there’s a big space for growth for MSGB.

Attractive Valuation

While this is not official, but we had heard market rumours where MSGB will be listing at a PER of 15 times or below.

(Refer to the chart above) Most of the peers of MSGB are either non-listed as the owners wanted to preserve the highly regulated CMSL license, or the valuation of the companies are extended. A PER of 15 times or below – should it materialise in the upcoming prospectus launching, will be a bonus to all the subscribers.

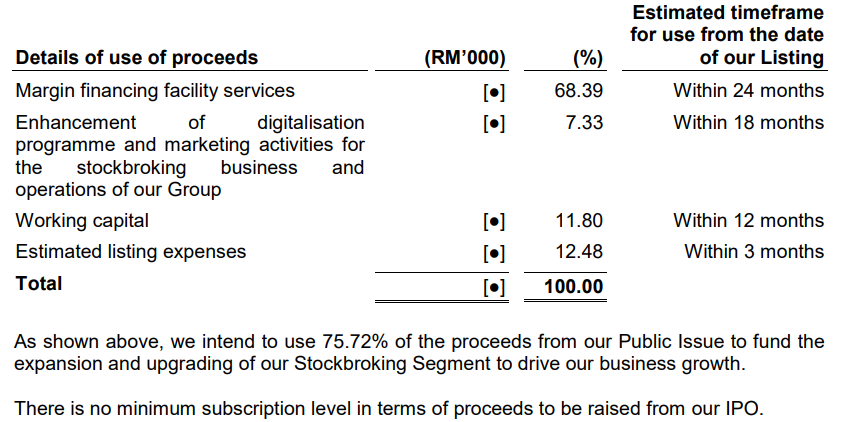

Moreover, the company plans to utilise most of the proceeds for margin financing facilities. For me personally, having been in the industry with more than 10 years of experience, it is relatively hard to get good margin financing at attractive rates. MSGB, with the proceeds of IPO, will not only able to extend their margin financing capabilities, but also able to enhance their trading platform.

On a side note, the company collaborated with Well known investment platform for promotion of their online account onboarding. This is expected to expand the market share of MSGB in Malaysia.

Conclusion

This is an extremely rare opportunity where investors could invest in the highly regulated broker industry – which every BUY/SELL transaction of the clients (Fun Fact: Public Mutual is the key client for MSGB) would be beneficial to the shareholders of MSGB.

According to MITI subscription, the IPO price of MSGB is in the bandwidth of RM0.250 ~ RM0.300, which is extremely reasonable based on the EPS of 1.98 cents for FYE2022.

Honestly, I urge you not to miss out on this rare investment opportunity with MSGB, and it is critical to subscribe to their up-and-coming IPO. Investors, are you ready?

.png)