KESM Industries – Cheap proxy to tech sector. Acquisition of minority interest to boost EPS by 50%

NOBY

Publish date: Mon, 20 Apr 2015, 11:44 PM

KESM Industries – Cheap proxy to the tech sector. Acquisition of minority interest to boost EPS by 50%

Disclaimer:- The purpose of this article is for sharing purpose only. It is neither a recommendation to buy or sell. Please do your own research before making any decision. At time of writing, I do own shares of this company.

Introduction

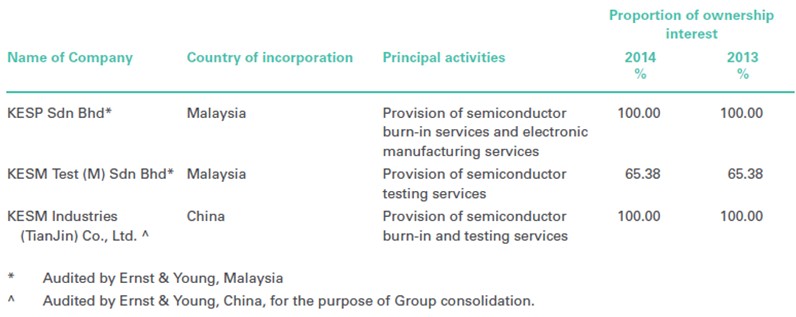

KESM has been engaged in specialized electronic manufacturing activities since 1978 is the largest independent burn-in service company in Malaysia. KESM's primary objective is in specialized electronic manufacturing activities and serves as sub-contractor to electronic multi-national corporations. In particular, it is in the business of providing burn-in services to the semiconductor industry. The company's customers are mainly from the global top ten semiconductor manufacturers in terms of market share including Intel, Samsung, Qualcomm, Micron, Toshiba and Texas Instruments. KESM has operations in Malaysia and China and a total of 3 subsidiaries as shown below:-

Historical earnings

I initially bought into KESM due to its strong balance sheet with huge cash hoard but am starting to see a growth story here. Let’s take a look at the historical figures for KESM

|

Year |

2015ttm |

2014 |

2013 |

2012 |

2011 |

2010 |

2009 |

|

Revenue,000 |

259014 |

254365 |

247605 |

236940 |

248113 |

226466 |

169315 |

|

Gross margin |

87% |

84% |

79% |

78% |

77% |

69% |

74% |

|

Operating margin |

7% |

6% |

3% |

1% |

8% |

7% |

5% |

|

NI |

18948 |

16340 |

9441 |

7383 |

16679 |

14020 |

11248 |

|

Net profit to common share |

12887 |

10883 |

4569 |

4161 |

12382 |

11746 |

9757 |

|

Net profit margin |

7% |

6% |

4% |

3% |

7% |

6% |

7% |

|

Year |

2014 |

2013 |

2012 |

2011 |

2010 |

2009 |

|

Operating cash flows, CFFO |

65695 |

56408 |

66902 |

29841 |

52965 |

30241 |

|

Capex |

-70753 |

-32679 |

-24246 |

-57825 |

-56241 |

-16401 |

|

Free Cash Flow, FCF |

-5058 |

23729 |

42656 |

-27984 |

-3276 |

13840 |

|

FCF/Revenue |

-2% |

10% |

18% |

-11% |

-1% |

8% |

|

CFFO/NI |

402% |

597% |

906% |

179% |

378% |

269% |

|

Year |

2014 |

2013 |

2012 |

2011 |

2010 |

2009 |

|

ROE |

4% |

2% |

2% |

6% |

6% |

5% |

|

ROIC |

7% |

3% |

1% |

8% |

7% |

6% |

A quick look at KESM’s historical profitability underlines the cyclical nature of the business it is in. While revenue was growing steadily hitting at an all time high in 2014, operating and net profit margins are razor thin and the net profits gyrates wildly, falling from a high of RM 16.7mil in 2011 to only RM 7.3mil in 2012. Since then however, net profit has grown steadily and more than doubled to RM18.9 mil as of the latest trailing 12 months results. KESM’s free cashflow is rather lumpy with high capex requirements every now and then, but overall, they are still generate positive free cashflow. Their CFFO is rather high due to their high depreciation cost of almost RM 53 million in the last financial year. Its ROIC is also average, at only 7% and ROE is even lower at 4% due to its large cash hoard.

The operating margins although improving, are still low and suggest that KESM probably has no moat, but even a moat-less company can be a good investment if it is cheap enough. KESM’s balance sheet is strong. It has a net cash of RM1.25 per share (RM 54 mil) which makes up close to 44% of its market capitalization based on its last closing price of RM2.83. KESM’s enterprise valuation metrics suggest that it is not expensive

Net cash /share = RM 1.25

Excess cash/share = RM 3.27

EV/EBITDA = 1.4x

EV/EBIT = 6.1x

Despite its cheapness, market has probably not discovered KESM because from P/E standpoint, KESM appears more expensive at around 9.4x 2015ttm earnings. The divergence of the P/E and EV/EBIT is mainly caused by the high excess cash and minority interest carried in its balance sheet.

Acquisition of minority interest to boost EPS by more than 50%

In February 2015, KESM proposed to acquire the entire remaining minority interest stake of KESM Test (M) Sdn Bhd from the major shareholder for RM 35 million. The rationale provided by the CEO for this exercise was to streamline the operations of the subsidiaries by allowing the major shareholder (Sunright Limited) to focus on test and burn in equipment innovations (RnD) while KESMI group focuses on providing burn in and test services. The table below summarizes the EPS contributions of the minority stake and what shareholders of KESM would stand to gain.

|

In thousands (‘000) |

2015ttm |

2014 |

2013 |

|

Total net profit |

18948 |

16340 |

9441 |

|

Net profit to common shareholders |

12887 |

10883 |

4569 |

|

Net profit to minority interests |

6061 |

5457 |

4872 |

Based on the acquisition cost of RM35 million and using the average minority interest net profit contribution over past 3 years, the effective P/E of the acquisition works out to 6.4 x which is a good deal. If we inverse the P/E ratio of the acquisition, the earnings yield is about 15.6%, which implies that this is a good use of its excess cash to enhance returns to shareholders. The subsidiary KESM (M) Test Sdn Bhd also appears to be the major driver of earnings for the group judging from the high percentage of the minority interest contribution to total earnings. This acquisition which was recently approved in the AGM, will also boost its EPS by more than 50%,

Price = RM2.83

EPS pre-acquisition = RM 0.3

EPS post acquisition = RM 0.44

P/E pre-acquisition = 9.4x

P/E post acquisition = 6.4x

Although the acquisition cost was RM35 mil, net net, the acquisition is expected to reduce the net cash holdings of KESM group overall by only RM10 million after taking into account the cash holdings of the subsidiary, dividend payments from the subsidiary and the expenses related to the proposed acquisition. The earnings contribution from the acquisition of the minority stake is expected to be reflected in the group’s FYE 2015 results.

Barring any unforeseen negative earnings surprises, I believe that the exercise above will crystallize the valuations of KESM in the coming quarters and re-rate the stock price as what similar exercise has done for companies like Latitude Tree. If we assume that P/E ratio of 9x is fair for KESM, then after the exercise, KESM share price is looking at least a 40% upside from current levels.

Target price based on P/E of 9x post acquisition = RM 3.96

Growth to be underlined by its focus in the automotive semiconductor segment

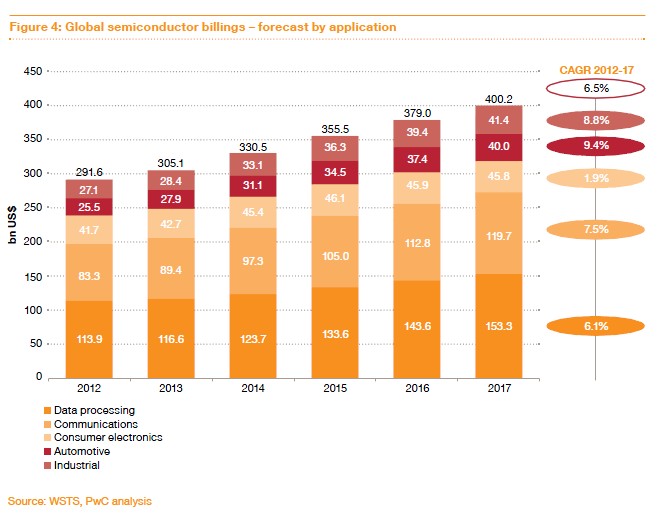

Aside from this exercise, it is also worth noting that KESM is expected to see better earnings growth moving forward with its focus in automotive semiconductor testing. Over the years, it has invested heavily in new equipment and machinery to support this direction. Automotive semiconductors are generally subjected to more stringent quality requirements due to safety reasons and potential costly product recalls. More cars are being equipped with increasingly more complex electronics and automotive semiconductor segment is expected to grow at a rate of 9.4% p.a based on a report by PWC semiconductor. Even the tech giant NXP semiconductors recently acquired Freescale Semiconductors for USD 11.8 billion with the objective of increasing its market share in automotive chips. KESM appears to be well positioned to take advantage of this new area of growth as its plants are currently at 70-80% utilization rate and space ready to take off any expansion in the future.

Valuation of KESM using DCF method (post acquisition of minority interest)

|

Current stock price |

$2.83 |

|

|

Share outstanding (Mil) |

43015 |

|

|

This year FCF |

$6,013 |

|

|

Next year's FCF (mil) |

$6,615 |

|

|

Growth for the next 5 and 10 years |

10.0% |

3% |

|

Teminal growth rate, g |

3.00% |

|

|

Discount rate, R |

10.0% |

10.0% |

|

PV of FCFF of core operations |

$119,000 |

||||

|

Non-operating cash |

$130,557 |

||||

|

Investment properties |

$0 |

||||

|

Interest in associates |

$0 |

||||

|

Debts |

($87,516) |

||||

|

PV of FCFE |

$162,041 |

||||

|

Less minority interest |

$0 |

32.0% |

|||

|

FCFE |

$162,041 |

||||

|

Number of shares |

43015 |

||||

|

FCF per share |

$3.77 |

33% |

higher than |

= |

$2.83 |

|

MOS |

25% |

The 5 year average free cashflow was used as a starting point. As semiconductor up-cycles are short, I conservatively estimate a 5 year period of super-normal growth in FCF of 10% believing that its push towards automotive sector will start bearing fruits soon and conservatively a 3 % growth thereafter to adjust for inflation. As KESM has a healthy balance sheet and has generally been profitable over the years, I used a discount rate of 10%. I adjusted excess cash by RM10mil and zeroed out minority interest as the assumptions after the acquisition. Using these assumptions, I arrived at DCF derived intrinsic value of RM3.77 which presents a 25% margin of safety from current prices.

Summary

Strengths/Opportunities

- Strong balance sheet with net cash of RM1.25 / share limits downside

- Re-rating of stock price post acquisition of minority interest stake

- A cheap proxy to ride the automotive semiconductor boom due its large multi-national client base

Weakness/Threats

- Sharp increases in electricity and labour costs

- Capabilities limited to testing and burn in services only. May be less appealing to clients who prefer OEM able to provide an end to end solution (contract manufacturing + test services)

References

|

1. http://www.pwc.com/gx/en/technology/publications/semiconductor-report-spotlight-on-automotive.jhtml |

||

|

2. http://themalaysianreserve.com/new/story/kesm-sets-sight-car-electronic-future 3. KESM Annual report 2014, press releases and circulars to shareholders 4. Company website (http://www.kesmi.com/) |

||

NOBY

17 APR 2015

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Stock Talk

Discussions

Thanks for the write up, but the ROE is very low about 3-4% only. Doesnt seems to be attractive

2015-04-21 07:10

Wish to throw a few question:

a) is ROE 2% ~ 6% considered good?

b) Gross profit margin is about 4% ~ 9%, while Net profit margin is 2% ~ 5%, is it satisfied?

b) who are the competitor? how does KESM stands up in the competition?

2015-04-27 20:05

wintermelon, KESM is cheap for a reason. And you mentioned the correct points. My view is that its earnings are on upward trajectory, I m OK with the average ROIC for now (note the ROE is low because of the high cash holding), expecting it to improve further if their plants utilization improves in future.

The main catalysts are its acquistion of minority interest which will boost the EPS by 40% and its venture into automotive semiconductor testing which should show decent growth. P/E of 6x post acquisition is too cheap to ignore despite its mediocre ROE.

I did not run a comparison cause KESM is the only independent test house listed in Malaysia. There are others like INARI and UNISEM but these companies have other businesses also which may not make it apple to apple comparison. Furthermore, I m very sure these companies are already pretty expensive as they are widely followed.

2015-04-28 00:02

Noby,

Thank you for what you have shared.

As per Annual Report 2014, KESM’s main operating expenses are (i) Labours (34.9%); (ii) Electricity (25.4%); & (iii) Depreciation of property, plant and equipment (22.3%). These three constitute about 83% of the total operating expenses.

TNB has revised the tariff downwards, offering a rebate of 2.25 sen/kWh for the period starting 01-03-2015 to 30-06-2015. The electricity tariff for the Industrial Category has been reduced from 42.7 sen/kWh to 40.45 sen/kWh or a 5.3% reduction to be precise.

http://www.therakyatpost.com/business/2015/02/11/electrictiy-tariff-cut-march-1/

Assuming the all other variables in the Annual Report 2014 remain unchanged, a cost saving of RM3.0 can be netted from the revised tariff (EPS enhanced by 7sen).

This burn-in business has a high entry barrier given that there is a need for constantly rolling out expensive capex that must be dealing with high depreciation costs. Any ideas who are competitors to KESM?

2015-05-01 13:36

matakuda, thanks for that information. I do agree that the barrier of entry for this business is the huge capex needs. I dont know of any listed pure burn in test provider in Malaysia aside from KESM. As I said if you look in terms of contract manufacturers like UNISEM may also provide such service but they also provide the manufacturing service so its not an apple to apple.

If looking internationally, there are 2 based on my google results, and they are pretty expensive. From Reuters

Avi-Tech Electronics (P/E=24.34x ROE:2.93%)

Trio-Tech International (TRT) (P/E=28.76x ROE=1.84%)

2015-05-01 16:07

The Edge Weekly just did a piece on KESM this week. Nothing new in terms of info provided by the TA securities write up and mine but seems like this company is starting to surface....

2015-05-02 12:56

@Noby,

The Edge Weekly confirmed your earlier statement there is no direct competitor to its now 100%-owned KESM Test (M) Sdn. Bhd. as this entity is concentrating on automotive segment.

The Weekly also cited about the high capex required in the burn-in industry. According to KESM Annual Report, the PPM is fully depreciated between 1.5 year to 5 years. Prospect wise, semiconductors for car segment are gaining momentum. Electronic circuits may become obsolete rapidly but the replacements (new circuits) must be subject to the same or more complicated test. The high capex therefore should not be a concern at least for the next few years.

Now, really hope that our handsome boy Samuel Lim can do something to increase the efficiencies in their another 2 entities, i.e. KESB Sdn. Bhd. & KESM Industries (Tianjin) Co. Ltd. Will be great if handsome boy can shed some lights on what he is going to do with these 2.

2015-05-05 12:19

matakuda

Thanks Noby. KESM is new to me, and it looks good.

2015-04-21 06:34