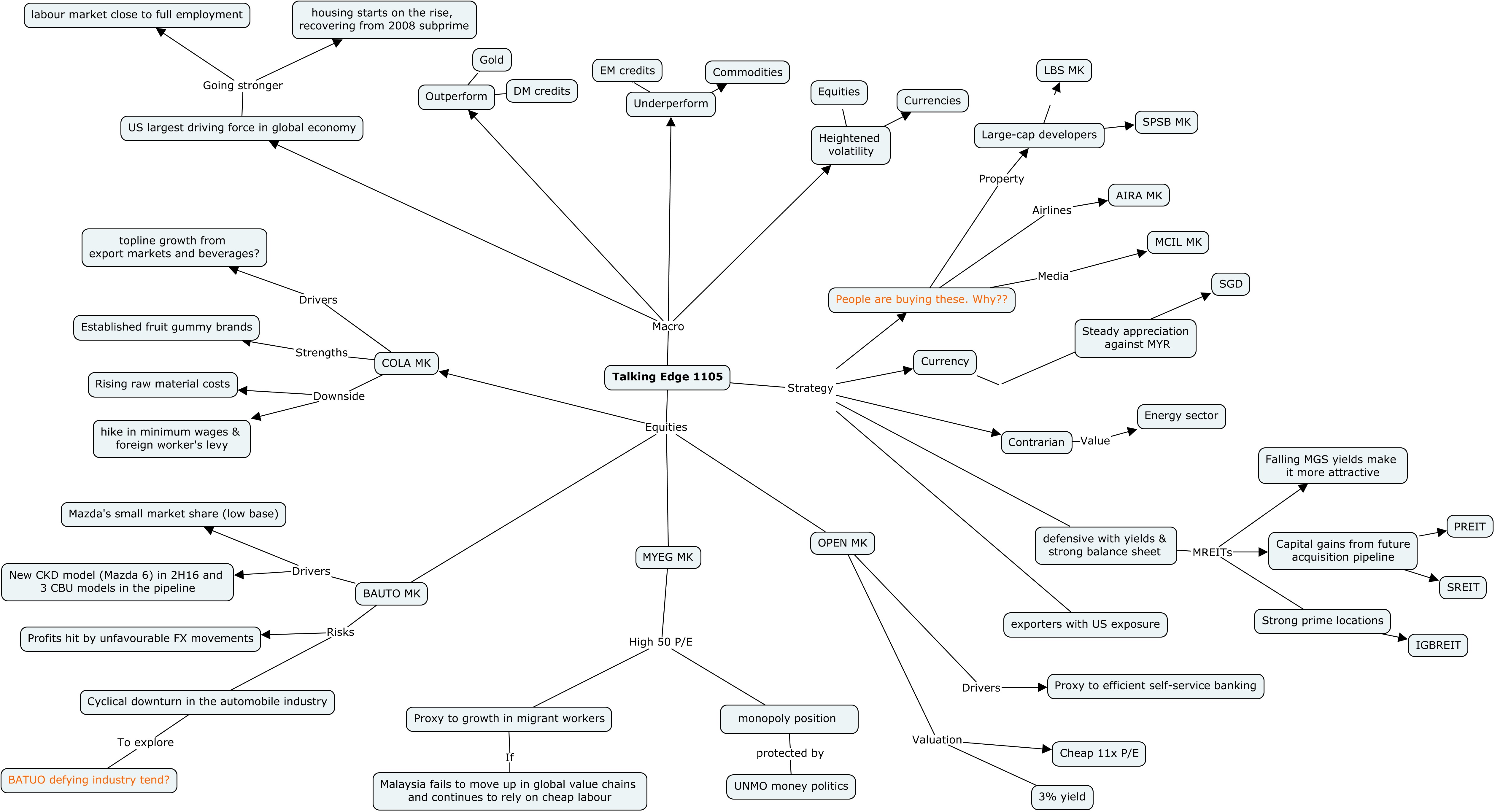

Talking Edge 1105 - Apr 9, 2016

talkcockbotakchek888

Publish date: Sun, 10 Apr 2016, 07:54 PM

[right click and select "open image in a new tab" to view the image in full size]

1. People are buying MREITs in 1Q16, particularly PREIT, SREIT and IGBREIT. This is thanks to the falling MGS yields which make this asset class more attractive. Yields are basically ok but buy quality REITs with prime assets and visible acquisition pipeline.

2. Undercovered ACE Market-listed OpenSys seems to riding on the efficient self-service banking trend. It's comparatively cheap (11x TTM P/E) with a decent 3% yield.

3. Protected by entrenched UNMO money politics, crony company MYEG will continue to grow in tandem with growing number of migrant workers in Malaysia amid the ongoing structural decline in Malaysia's manufacturing competitiveness.

4. Weaker ringgit and higher import costs aside, the automotive industry is now in cyclical downturn with almost everyone in it not doing so well, if not very badly. Thanks to Mazda's relatively low market share, Berjaya Auto will probably still see volume growth in the next few years. Its net cash balance sheet and 6% yield are also a plus.

5. Boosted by low raw material costs and forex gains, Cocoaland had a fantastic 2015. Interestingly the company distributed 20 sen dividend back to shareholders after two takeover deals failed to materialise. 2016 earnings should be lower on margin normalisation and higher labour costs.

6. The risk-on sentiments in 1Q16 also see people bottom fishing established large-cap developers like SP Setia and high yield media companies like Media Chinese International Ltd (5%).

7. Benefiting from lower fuel costs, MAS restructuring and ringgit appreciation, everyone kinda said AirAsia will fly higher in 2016. I just think it's beyond my risk appetite and my intuition is that industry fundamentals are not so favourable over the longer term.

8. Strategy wise, value + yields > growth. Fed will now take longer to hike the rates, due to lower commodity and energy prices which help to shave off some inflationary pressures. That said, equities, EM currencies and EM credits will continue to be volatile, as investors have pretty much become scaredy cats in a rate hike cycle. If history is any guide, SGD has steadily appreciated against MYR since the birth of time if anyone wants to hedge against another MYR scare.

buddyinvest

Besr

2016-04-10 22:03