ESG

nelsonlim

Publish date: Tue, 19 Apr 2022, 08:27 PM

What’s ESG criteria?

ESG is known as Environmental (E), Social (S) and Corporate Governance (G). ESG criteria is a popular set of standards to help investors find companies with values to invest on.

Who initially started ESG criteria?

United Nation. In 2004, Kofi Annan, then the UN Secretary, asked major financial institutions to partner with the UN and the International Finance Corporation in identifying ways to integrate environmental, social, and governance concerns into capital markets.

The UN Principles for Responsible Investment (PRI) is an international organization that works to promote the incorporation of ESG factors into investment decision-making.

More detailed of ESG criteria?

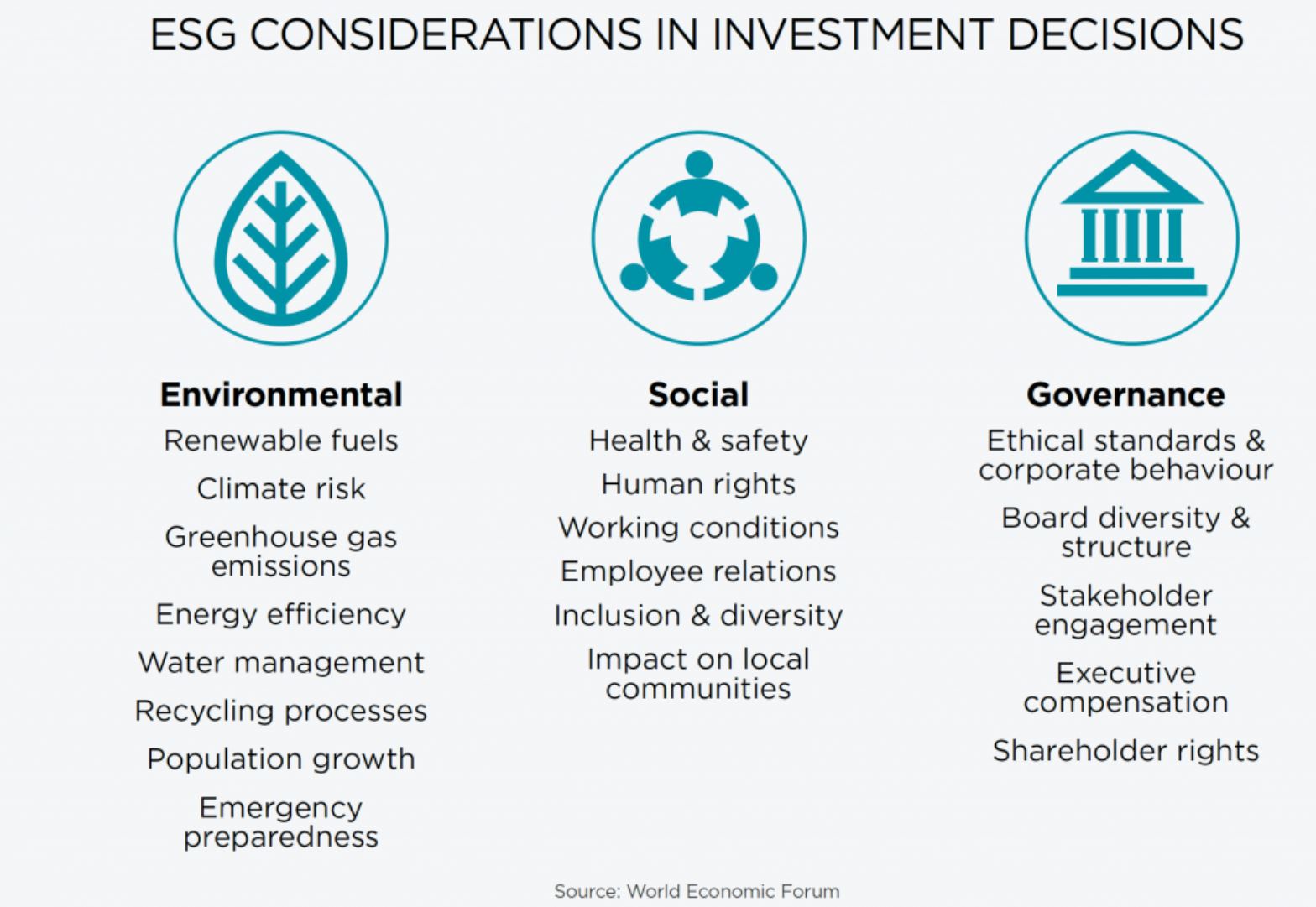

E - Environmental criteria consider how a company performs as a steward of nature.

S - Social criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates.

G - Governance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights.

Why is ESG criteria becoming increasingly important?

Companies that adhere to ESG criteria tend to have lower chance exposure to financial risks. For example recently listed co in Malaysia ATAIMS, Dyson has cut ties with ATAIMS following the termination of three contracts from Dyson due to forced labours allegation. Forced labours falls under Social (S) and it posted significant financial risk as 80% of ATAIMS sales are derived from Dyson.

ESG Reporting?

23 March 2022, Bursa Malaysia Securities issues a public consultation paper proposing that all listed issuers to provide climate change disclosures aligned with the Task Force on Climate related Financial Disclosures (TCFD) recommendations. Moving forward we will see more companies have such disclosures on their annual report. It has became compulsory at EU companies to have the relevant disclosures as part of their reporting.

ESG Investing?

The fund size (AUM) of investing in ESG compliant companies is forecasted to reach USD20trillion. Meaning that companies that have compliance to ESG criteria likely to be invested by fund manager be it ESG Mutual Funds, Green Bonds, etc. It is named as “Sustainable Investing”.

Difference between CSR and ESG?

While ESG and CSR are both concerned with a company's impact on society and the environment, the major difference between them is that CSR is a business model used by individual companies, but ESG is a criteria that investors use to assess a company and determine if they are worth investing in.

Any listed co in Malaysia comply with ESG criteria?

Yes it is. In last weekly The Edge feature, United Plantation Berhad is the highest performer on ESG scorer among Malaysian listed co, seconded with Sime Darby Plantation, and Hap Seng Plantation, Kuala Lumpur Kepong Berhad and IOI Corp.

For me, I am seeing a trending on ESG. ESG is not something new, it happens way earlier than 2022. However I am seeing more and more companies exposed to ESG non-compliance, if you are familiar with KLCI, be it political motivated or whatever reason, it is good to comply to ESG and do good deeds.