Why Japanese Yen (JPY) weaken against USD so drastically?

nelsonlim

Publish date: Wed, 20 Apr 2022, 05:13 PM

The JPY depreciation has something to do with the Japanese Government Bond (JGB).

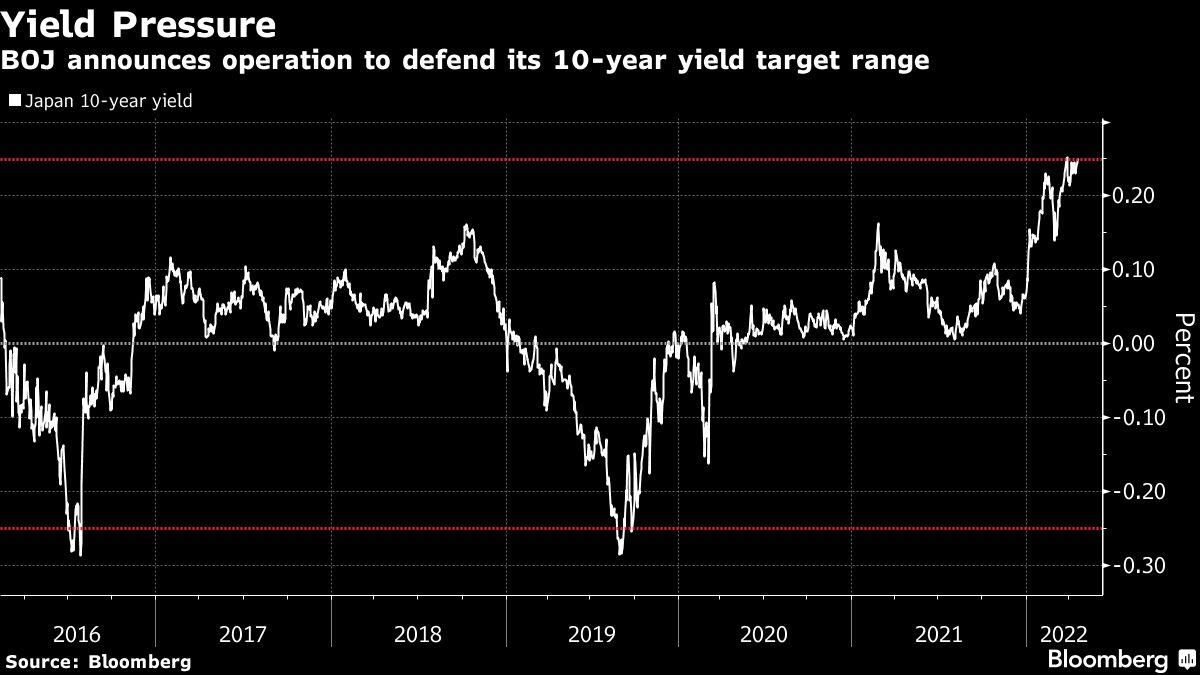

As this chart shows, the Bank of Japan (BoJ) has been operating with yield curve control since September 2016. The BOJ is is targeting the 10-year JGB yield at 0% with a 25-basis point band/range

Remark: In September 2016, the BOJ introduced QQE with Yield Curve Control (YCC)—a new program that targets both short-term and long-term policy interest rates, to resolve the issues created by QQE and QQE with NIRP, aiming at an inflation overshooting target of 2%.

The white line is the actual 10-year JGB yield. The 10-yr JGB yield has been pushing up to touch the top of this band (0.25%) and exceed it.

The BoJ has been intervening with unlimited buying to prevent the 10-yr JGB yield from exceeding 0.25%. But this JGB intervention is coming with a high cost.

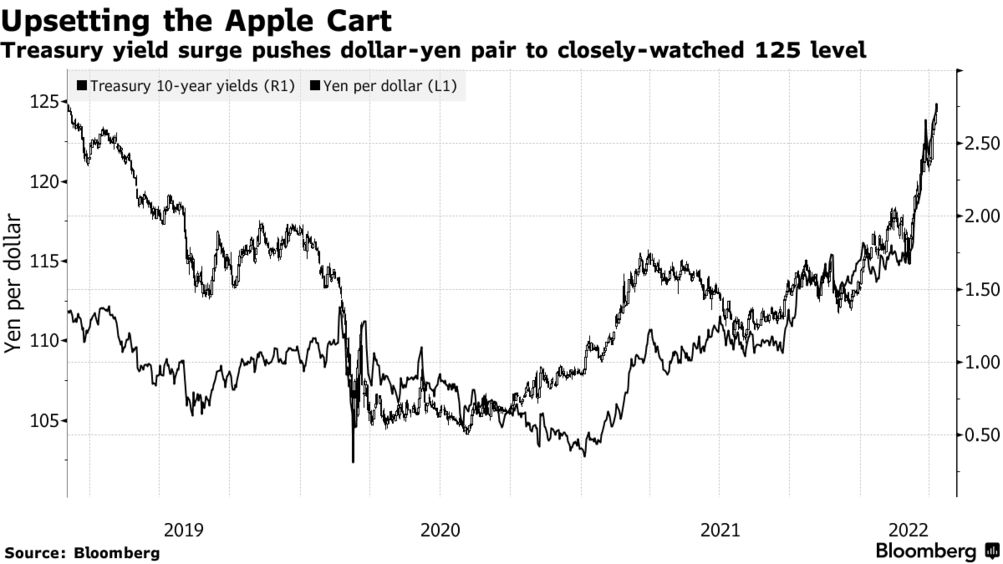

The JPY has been collapsing. It is now trading at 129.337 JPY convert to 1 USD. This is one of the biggest one month moves ever in the JPY.

A weakening JPY is very bearish for the US 10-year Treasury.

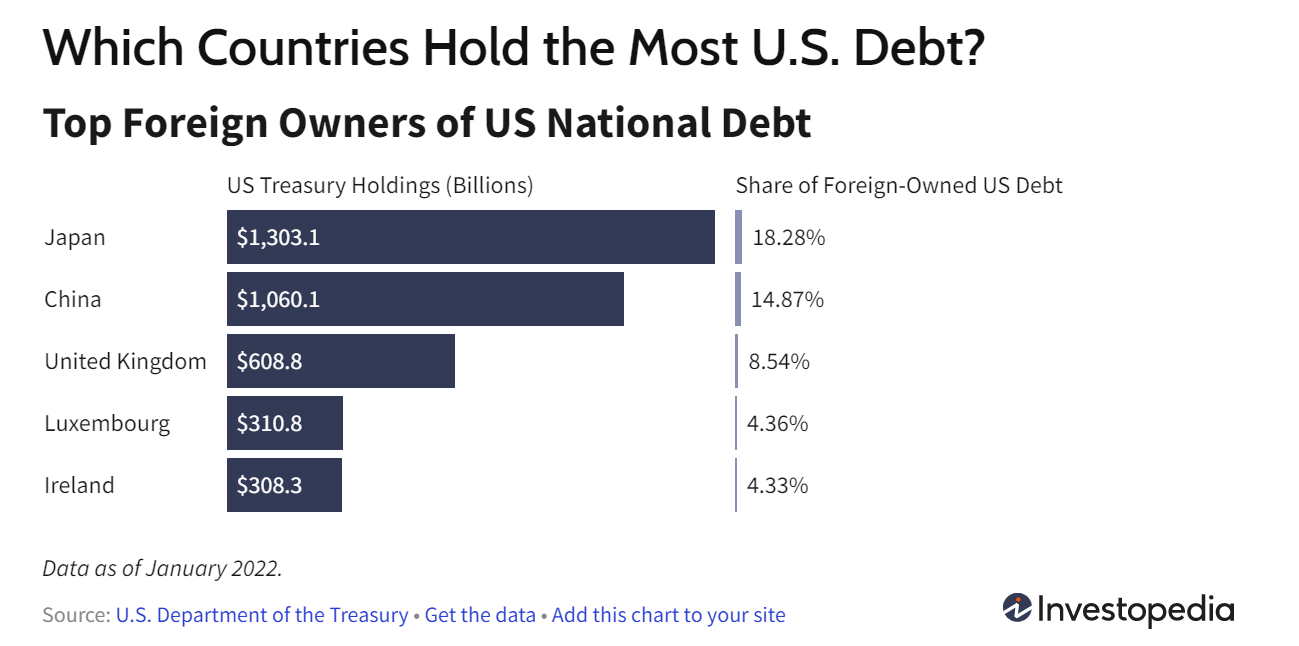

Japan owns more US Treasuries than any other country, even China (chart above).

More and more countries are facing issues now. For Japan, they are still recovering from recession and covid. Hence they have to maintain low interest rate to support the economy. So, the BoJ can prevent the 10-year JGB from rising but in the risk that the JPY will collapse further. To save JPY, will they abandon the yield curve control? In addition, with weakening of JPY, they can't buy more US Treasuries.

If JPY furthen weaken, it will trigger economic fallout as well. Two swords pointing at Japan now..

https://www.aljazeera.com/economy/2022/4/19/japan-warns-of-economic-fallout-from-weakening-yen

For more information and news, can follow my channel: https://t.me/thinkaheadacca