QL – one year on, any changes?

teoct

Publish date: Sat, 25 Apr 2020, 04:26 PM

QL – one year on, any changes?

On 4 Jan 2019, I posted - QL what is the value?

Now, 25 April 2020, a year plus 3 over months and bored by MCO, I relook at the thesis and here are the findings.

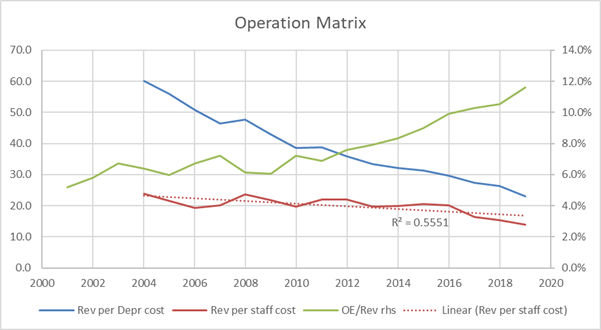

Operation Matrices

One of the important matrices would be staff cost – every ringgit spent on staff brings back how much revenue. Similarly, all things being equal, every ringgit depreciated of plants, properties and equipment (PPE) brings in how much revenue.

And the operating expenses to revenue, is it increasing or reducing.

Here is how they look like: -

The operating expenses to revenue are unfortunately increasing yearly. Diving into the cost make-up, the two biggest item is depreciation of PPE and staff costs.

Staff productivity is reducing, the trend is downward. Revenue to depreciation is dropping at a higher rate. That is, the more plant, properties and equipment bought is giving less revenue every year.

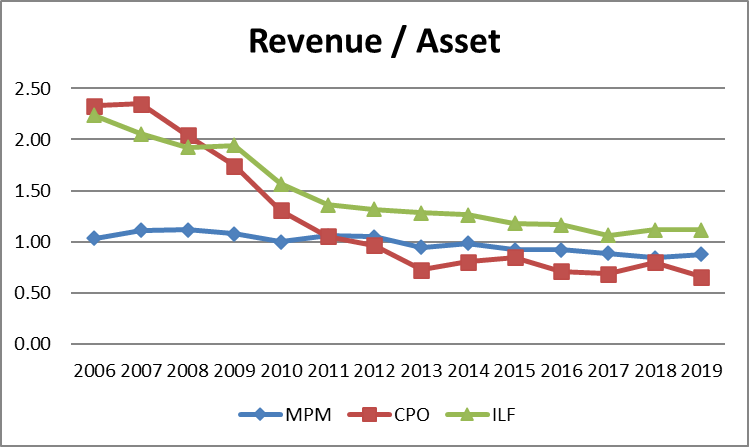

Looking at operating segments of the annual reports, one can obtain the revenue generated from the asset deployed for the various serments.

It does not look good at all. Palm oil is returning less than one ringgit (RM0.65) as well as marine products (0.88) while integrated livestock farming is above one ringgit (1.11).

The general trend of all is creeping DOWN.

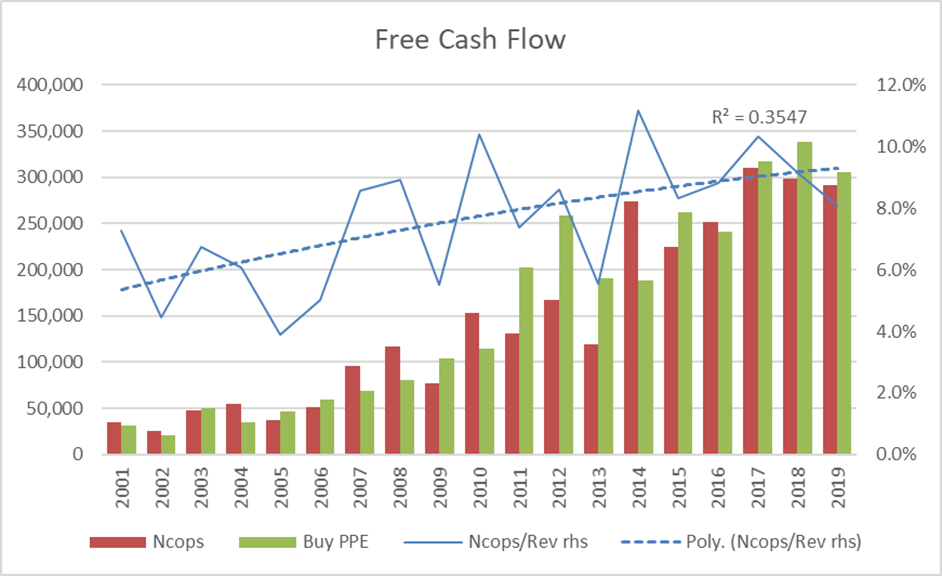

Cash flow

The next important aspect of a company is how much cash is it generating from operation and is it more than its need to purchase PPE, forget about investing in subsidiaries, associates and the likes.

QL does not generate enough cash (from operation) for investing in the necessary PPE. It takes loan and obviously the debt to equity ratio has been creeping up. Also, its ability to generate cash from operation is rather erratic (the blue line).

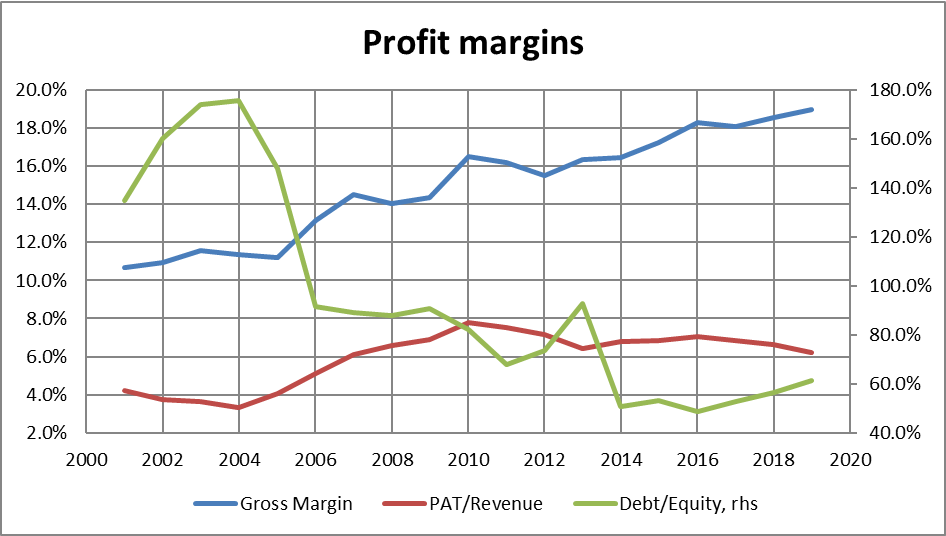

With all the above added together, the indication is that while gross margin is improving, the ever-lower staff productivity, low return of PPE plus increasing financing cost from higher debts all cut into the net margin that is now approaching 6%.

The trend is, net margin will reduce further going forward.

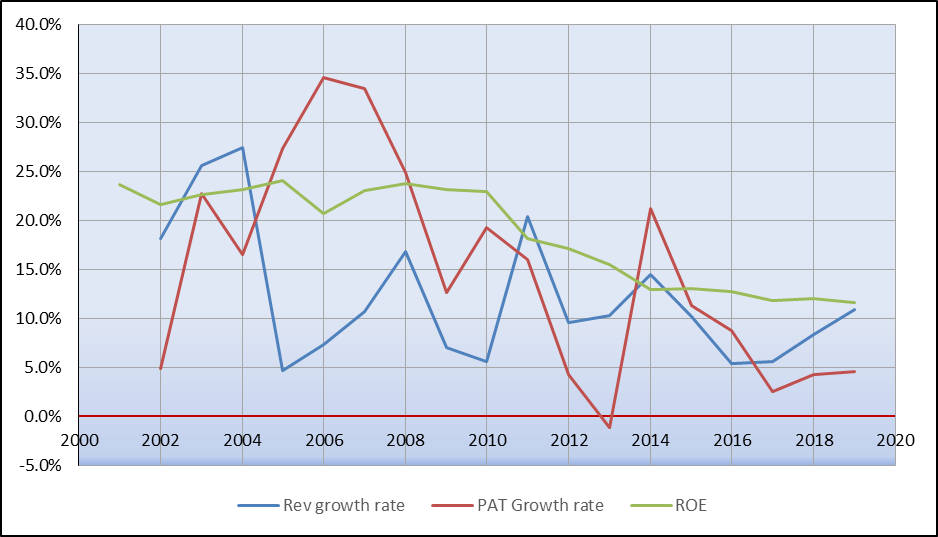

Looking at the charts, I do not get the warm feeling that net profit margin will rebound higher anytime soon. Yes, in absolute numbers, net profit will climb. The net profit growth rate is lower than the revenue growth rate in the past three years.

Return on equity (ROE) is also on a down trend.

Valuation

As can be seen from the above, revenue generated from ever newer plants, properties and equipment is getting lower year on year. Staff productive is also creeping down.

ROE is on the down trend too.

Operating expenses is increasing faster than the increase of revenue leading to lower nett profit margin. Higher debt financing cost is also not helping.

Another way to look at PE is the number of years one required to recoup the money used to buy the company, that is 54 years based on RM 8 per share (close 24/4/20).

Happy investing.

The usual disclaimer applies, this is for education purposes ONLY.

Me and my family no longer hold QL shares.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on TeoCT

Created by teoct | Jul 23, 2020

Discussions

Philip ( Random Walk Theorist)

Much kudos to teoct. I'll try to write an article explanation what I saw on it as a business.

To be honest, ever since I retired I have a lot more time to read and do valuation these days. The recent MCO had only compounded my time that I spend reading. I think I have been far more prolific recently on being able to look up stocks and buying stocks during this period.

Also, since I have been shooting fish in a barrel recently, it really wasn't that a hard a decision to make. The stock market has fallen to a very decent valuation recently, a lot of things are a screaming buy nowadays.

>>>>>>>>>>>

Posted by Rwkl > Apr 27, 2020 11:28 PM | Report Abuse

Wow,! The locals got wind of your position and pushed it up by 20 pct!

Anyway, Philip, mind to share what other salient points you noted which prompted this almost immeadiate action was to the first as you normally do a much through research?

It would be great if teoct can chip in too.

Thanks

2020-04-28 05:45

Good morning qqq3,

The problem with you is you talk the talk but never walk the talk. That is why your result is very poor.

2020-04-28 07:39

Interesting moral Question

Would you buy shares in a company selling Opium to China?

People without morals definitely would. Or is it integrity? To such people, money is the moral. Have money means have morals and integrity.

Would you buy shares in a company selling Opium to China? if it means you will make a Trillion RM?

Similarly would you buy shares in a Company that sells banned products to China? Again the answer is, have money means have morals and integrity to some people.

To me, the First Criteria is still Responsible Investing. Making money is Not Important at all.

2020-04-28 07:57

sslee

Would you buy a company selling banned products to China?

like say goat's milk infant formula had been banned in US, UK and Euro, but China imports it.

Would you buy shares in such a company and just fook China?

Is money more important to you than morals and integrity?

2020-04-28 08:00

Good morning i3lurker,

Me, once bitten twice shy. I will never trust any Mainland Chinese again. Philip say I lose 2 million in Xingquan because I hold 3million+ shares that become toilet paper. I learnt my lesson and never again.

https://klse.i3investor.com/blogs/cscsc/2016-12-08-story111267.jsp

2020-04-28 08:37

sslee

fair enough

the spectre of the Ugly Chinese with no morals and no integrity

mainland Chinese have no issues selling banned products to their own motherland country coz they have no morals and no integrity.

Guess we just found out many Malaysians are also just like mainland Chinese

2020-04-28 08:54

sslee

have you noticed that both the cups are empty?

surely that is a sign from God?

A personal message to you. You should have dumped all back then

2020-04-28 09:00

haha i3lurker,

You should encourage Philip to sell his overvalue Malaysia Stocks and buy more international undervalue stocks.

By the way you too can recommend some undervalue international stocks for Philip consideration. Otherwise he will forever holding to his overvalue Malaysia stocks with PE50 and PEG 10 when you can got some very good growth international stocks of PEG below 1 to 2.5

2020-04-28 09:05

sslee

I have no interest in Philip at all.

He not worth my attention.

I tend my own garden

and everyday is a Guinness Stout with Lobster Day.

What Man is a Man who does not make this World a Better Place?

2020-04-28 09:11

Haha,

My biggest thanks to uncle Philip again.

My STAR TP of 40 cents reach.

Will hold for another 2 days because by 2th May i3lurker will short STAR to 26 cents again.

2020-04-28 09:14

Dear i3lurker,

Don’t be so hard on Philip after all he is human too with his character flaws but basically he is a good man.

As engineer he had contribute his fair share in building up company that benefited many people and society.

By the way no one is perfect.

2020-04-28 09:46

sslee..........I could have done better if I did not catch the falling knife too early...............but, no harm done............the market rebounded promptly since. ...........and that experience prompted me to write...........

the passport to success is written with words PROACTIVE, CONSISTENT AND CONFIDENCE

so what does proactive mean?

does it mean u must act very fast? faster than the next guy?

I would say, most of the time , that would be a mistake. Haste is not always best. I think it is ok to relax, most of time....

Proactive does not mean u have to react to every thing that happens....That would be called reactive which is a bad habit.

Proactive means u think through a problem and stay ahead of others, but do not react too often.....

Its like the virus....if u are proactive, u see it coming and u do some thing about it.

If are the reactive types, u only react to it when it hits u and reacts to every little signals.

Proactive means, u take a more medium term approach. And act only after u have think things through............

2020-04-28 10:10

i3lurker, I do not know whether to cry or laugh.

you said - "I dun buy on stock tips, definitely not from qqq3 or some other people who buy companies selling banned products"

Appreciate if you will illustrate more on why these products are banned (or rejected). Are you referring to infant formula milk (IFM) either from cow or goat or both that is banned in EU, UK & USA being sold in China. These products are formulated and blended with milk from the same sources in Netherlands (& Australia plus New Zealand) that a lot of other multinational companies procure their milk from.

The auditor, Ernst & Young i trust would not audit such a company knowingly importing banned products for sale. Also the many millions of Chinese (mother), that I don't think are so stupid after the 2008 melamine in milk incident to buy products that are banned in EU/UK/USA. And China's approving authorities allowing them to be sold is mind boggling.

Please, do point to the source(s) of information that led you to such conclusion. I would appreciate it very much as indeed I shared (construed as tips in your view) the company selling banned products (I and my family owned shares in the company).

You will be doing civic duty to correct my misguided morally reprehensible investment.

While I am in Malaysia, I believe I know among other things to surf the net and access information the world over just like you. Maybe I lack the assistance that you have, I could only access so many web-sites and I have yet to find any evidence that these products are banned in EU/UK/US. Not approved (yet) in US, that I know, as all IFM need to be approved by respective countries authorities on food before being allowed to be sold.

So laugh, the other interpretation to your statement is like a child crying over spilled milk (sorry, no pun intended - yes we are talking about a company selling milk here).

But, i3lurker, I am dead serious about the first part of my assertion and that is bordering on calling my integrity into question that I don't think you are doing. But if you are, please substantiate with facts, thank you very much. I will be the first to apologies to all readers that I knowingly mislead them if your facts are correct.

RWKL - you will need to do your own due diligent and also wait on i3lurker clarification on the banned products (true or false), you do not want to be morally bankrupt do you.

sslee - I am sorry you had such bad experience with the red chips - those were crooks IMHO. But that doesn't mean that this bunch in the milk company is not. However, their professional response to the assertion that their sells was manipulated recently by a hong kong specialist analyst firm that i3lurker pointed to (much) earlier is telling.

And as usual happy investing all.

2020-04-28 10:22

Dear Teoct

Thank you for your understanding for my mistrust and bitterness with Mainland Chinese CEO. I did not harbor any ill-will on your stock picked Ausnutria (HKG: 1717) as I have not yet study this company and would like to wish you well and success with your investment.

I am actually learning from all the i3 Sifu and had make back some of my losses doing trading. My biggest holding now is INSAS and I make an effort to attend AGM and getting to know the BOD and external auditor.

Hence I do not understand why Philip insist INSAS core business is helping people buy and sell stocks, so it is easy for INSAS to game the system by setting the accounting up so that it ALWAYS looks nice on paper and his made up INSAS BOD to be crooks without even knowing them.

Thank you

2020-04-28 11:18

Haha qqq3,

May I correct your sentence, “sslee..........I could have done better if I did not catch the falling knife too early...............” You are catching the falling knife too early or actually chasing high on Kpower and SCIB and got yourself trapped?

Remember what you wrote:

the only smart ones are those who sold all several weeks ago...never look back,....do not get tempted.........

I am not among those............

In theory that is what I should have done, told my self that before the mess, even write about it. Told friends I am prepared for all eventualities...........

But 1 or 2 weeks of negligence, all the good work done in last 2 years all gone.

19/03/2020 12:04 PM

2020-04-28 11:21

Dear i3lurker,

They do the same to calf too.

So you better convert to vegan and no more lobster for you anymore.

2020-04-28 11:57

There are more than SCIB and Kpower......

I was caught with about 10 counters catching the falling knife too early, even though nothing about the virus surprised me.......

but its ok...........all rebounded 50% to 100% from the lows (that is when I wrote that.)

2020-04-28 12:35

Teoct,

Thanks for Ausnutria call, its looks very interesting. Quick question, whats your thoughts on the Blue Orca Short reports?

https://static1.squarespace.com/static/5a81b554be42d6b09e19fc09/t/5d54bfbfea0ead000106fd1b/1565835219670/Blue+Orca+Short+Ausnutria+Dairy+Corp+%28HK+1717%29.pdf

https://static1.squarespace.com/static/5a81b554be42d6b09e19fc09/t/5d59f1cab04c87000103d53c/1566175694543/Blue+Orca+Issues+a+Rebuttal+to+Ausnutria+Dairy+Corp.pdf

https://www1.hkexnews.hk/listedco/listconews/sehk/2019/0816/ltn20190816033.pdf

2020-04-28 13:00

Hi Choivo Capital - been a while since we last chat.

Management quickly appointed an independent review committee (IRC) (consisting of all independent directors) as well as an independent consultant (Deloitte Advisory (Hong Kong) Limited) reporting to the IRC (only) to carry out investigation on the allegations.

One can find the reports on the allegations https://doc.irasia.com/listco/hk/ausnutria/press/p191029.pdf.

Basically, there is no truth in the allegations made by Orca. Nonetheless, there are some improvement to be made that the company will do.

The quick response by management restored confident in the company. That is what a Chinese saying: 脚正不怕鞋歪 (an upright man is not afraid of gossip).

This quick response, nothing to hide attitude, to me is very important.

Hope that provided some answer - whatever it is you are looking for.

But do be careful, you might be participating in a morally reprehensible investment.

Stay safe.

2020-04-28 13:44

Haha qqq3,

You give away yourself too much when you like to comment in everything.

Still remember what you wrote in JAKS forum:

Mar 14, 2020 12:51 PM | Report Abuse

I no more bullets, want to buy some thing got to sell some thing already

Mar 14, 2020 12:35 PM | Report Abuse

me? this market crash means I find myself having both Jaks and dayang and several others... my portfolio not been as spread out as now for a long time

Mind telling us are you still looking at many % book losses?

2020-04-28 13:46

Haha i3lurker,

Many people jump down from the top floor of Genting hotel when they lose all in the Casino.

Then why still got big funds and many people buying Genting shares?

Time for your afternoon nap and later we can go happy hour Guinness Stout with Seaweed.

2020-04-28 14:02

right...that was march 14.........now its April 28.............the rebound was fast and furious..............I am ok now..........

2020-04-28 14:06

when the market was crashing, you go nimble nimble..........soon also find u get 10 counters and all the bullets gone...........so, it shows diversification also no use when market is crashing..................

2020-04-28 14:11

eventually , the main thing to take away is this......

the passport to success is written with 3 words....

PROACTIVE, CONSISTENT, CONFIDENCE.

2020-04-28 14:13

Haha qqq3,

I nimble nimble Gkent, Notion, Dayang, Naim, Hib all already sold for profit. Now still got Star not yet sold.

2020-04-28 14:19

No harm....gloves will make back every thing....and than Kpower and Scib will become billion $ companies.............

2020-04-28 14:26

Teoct,

Thanks. Now time for me to dig for a copy of that report haha.

2020-04-28 14:44

Philip ( Random Walk Theorist)

Hi teoct, I concur. I finished reading the last few years of audited financial of feihe,mengniu, yili and junlebao, all the competitors are having a good room to grow.

The allegations I think is not long term damaging, and the short selling has in fact pressed the price to a reasonable valuation that thanks to you, I was able to take advantage of.

While I believe feihe may be the right call in the long term, as you have done a lot of research and decided to invest in ausnutria compared to feihe, I will defer to you on this end and nibble nibble a bit on ausnutria while I monitor further.

Let's see how in the next quarter results.

>>>>>>>>

Posted by teoct > Apr 28, 2020 1:44 PM | Report Abuse

Hi Choivo Capital - been a while since we last chat.

Management quickly appointed an independent review committee (IRC) (consisting of all independent directors) as well as an independent consultant (Deloitte Advisory (Hong Kong) Limited) reporting to the IRC (only) to carry out investigation on the allegations.

2020-04-28 14:51

Philip ( Random Walk Theorist)

Instead of using a one brush to paint everything, I invite you to look at the circumstances of selection and a simple fact: why would a Chinese company doing business in China, with assets and management in China decide to do IPO in Malaysia? The associated costs and inefficiency must give them some certain earnings for them to producer that kind of effort.

But in buying a company based in a foreign land, we can apply the same qualitative and quantitative analysis to decide if the business is something that you would like to invest in.

>>>>>>>>>>

Posted by Sslee > Apr 28, 2020 8:37 AM | Report Abuse

Good morning i3lurker,

Me, once bitten twice shy. I will never trust any Mainland Chinese again. Philip say I lose 2 million in Xingquan because I hold 3million+ shares that become toilet paper. I learnt my lesson and never again.

2020-04-28 14:57

Posted by Philip ( Random Walk Theorist) > Apr 28, 2020 2:57 PM |

why would a Chinese company doing business in China, with assets and management in China decide to do IPO in Malaysia?

============

hahaha........Its not China's fault...........Its our own incompetent regulators.

By the time they came to Malaysia, they have been kicked out of America......................................

2020-04-28 15:21

At that time our regulators think they have found a formula to turn Bursa into an international center with listings from around the world...................

2020-04-28 15:24

It was an audacious plan by lochins from China ( every country also got lochin) who took advantage of the loophole to collect millions from their IPO....and even more audacious when they collected from rights issues later.............hahahahaha.............

2020-04-28 15:30

Philip ( Random Walk Theorist)

Sslee, I did not INSIST. I only stated a fact. And I only posted it one time. Unlike those who keep repeating INSAS assets over and over and over.

I did not like INSAS business model from the minute I saw it. As Teoct has tactfully said, let us agree to do disagree. As you u cannot convince me to like INSAS and invest in it, just as you cannot convince me to hate QL and divest it, let's just move on. You think INSAS is a wonderful company. I think it is an average one. As the only thing that can be said as minority shareholder is the long term stock performance and dividend yield, all we can do is let time show who is right or wrong.

For me, it is simple. I have take a 2 year Bak kut teh bet with stockraider and CharlesT to which investment carried the best 2 year returns. I hope that will settle the matter on INSAS.

As I understand it, INSAS main business model is capital allocation. All I am saying is I do not like how they structured their financial report and accounting methodology which unnecessarily complicates proper valuation of the company. If you have construed my statement as saying that I said INSAS BOD is a bunch of crooks, then I apologize to you.

>>>>>>>>>

Hence I do not understand why Philip insist INSAS core business is helping people buy and sell stocks, so it is easy for INSAS to game the system by setting the accounting up so that it ALWAYS looks nice on paper and his made up INSAS BOD to be crooks without even knowing them.

Thank you

2020-04-28 15:32

Philip ( Random Walk Theorist)

As I never once said that INSAS BOD are crooks, please do not put words in my mouth. The information I meant to convey is that too much information is spent on other details and very little spent on explaining the revenues and earnings of the the business units so that we can track more detailed performance. The earnings and revenues of tribecar, numoni, roset, and all the other growth units. In Warren's buffets letter, he explains in detail what he bought, why he bought it, the revenues and earnings and growth projections.

Vigsys and vigcash were little more than a footnote of losses. Was roset sold for a profit or for a loss? Is done, melium group growing revenues, flatlining or reducing in revenue and earnings.

This is what I meant about setting up accounting so that it looks better on paper than it really is. Not that INSAS BOD are crooks, but relevant information ( at least to me) that would contribute in long term growth of INSAS is not translated and monitored quarterly.

>>>>>>>>>

It's ALWAYS a bargain price. For the last 5 years INSAS has remained a bargain.

Why?

When your core business is helping people buy and sell stocks, it is easy to game the system by setting the accounting up so that it ALWAYS looks nice on paper.

2020-04-28 15:42

the audited accounts of the Pte Ltd China companies may be correct.....but the lochins exploited the legal loop holes and lack of prosecution......

2020-04-28 15:44

Philip ( Random Walk Theorist)

When I look at a company, this is always the first things that catch my view,

Quarter. Revenue. PBT. NP

31-Dec-2019 1,107,349 97,650 74,975 melium group

30-Sep-2019 1,072,852 84,330 69,872 melium group

30-Jun-2019 993,213 62,161 49,340 melium group

This is how I would like transparency in viewing the performance of a company.

With INSAS, I cannot find the transparency of the proper breakdown of all it's business units without inari share sales and dividends muddying everything up.

Simplified, what I meant to convey is I cannot have a feel of INSAS profit/losses of it's many startups and business units.

I did not say INSAS BOD is crooks. I just can't see the how much money the other business units are sucking up or generating back towards parent, and I don't like that particular reporting method.

That is all.

Thank you

2020-04-28 15:51

Philip, do invest in Feihe if your research/analysis dictate it to be.

I knew Ausnutria first before Feihe as it was only listed recently. But man, I only have so much fund.

In Hong Kong Exchange, companies are allowed to provide profit alert (either up or down). Yesterday, Ausnutria issued a (positive) profit alert that caused the share price to advance +15%.

Nonetheless thanks for sharing on Feihe.

2020-04-28 15:53

Dear Philip,

Thank you for your explanation on what you mean on INSAS. I happen to know the BOD personally hence trying to defend their integrity as they are loaded down by legacy issues/business they try to solve/rationalization and expand/acquire 5G related businesses and putting their cash hoard to good use.

I already get over with INSAS and will only top up when I can get a really good discount.

I’m now waiting to collect for long term investment some dividend stock at discount day sales (Genting, Btoto, Magnum, Orient, Pchem and etc)

Meanwhile I will try my luck trading some penny stocks.

Thank you

2020-04-28 16:22

Haha qqq3,

Karim already run out of gas and your Kpower and SCIB will drop to penny stock again.

2020-04-28 18:13

Kpower and SCIB is Serba with a beta of 3X...............

Serba up, they go up

Serba down, they go down.......

2020-04-28 20:25

Dear teoct,

Had a look on Ausnutria as well after you recommended it. But I personally didnt invest in it for the few reasons below :

- They only command a 5% market share for infant milk formula in China. Competitors eg Nestle, Feihe, Danone, Abbott, Junjebao collectively have 50% market share. I think competition would be stiff.

- The infant formula industry in China looks like reached a mature growth stage, dont think there would be exponential growth in this area.

- China has been having a slowdown in birth rates despite the relaxation in the one child policy. The birth rates have declined since 2017, and fertility rates in women have dropped. Many women now marrying later/ not marrying at all, so less babies are born.

- The rates of exclusive breastfeeding for 6 months in China is still much lower compared to other countries dt heavy marketing of infant formula. China are taking steps to encourage exclusive breastfeeding for their infants eg increasing babycare rooms in public spaces, breastfeeding flash mobs, extended maternity leave in some provinces. They might tighten the rules on infant milk formula advertisements. Demand for infant formula will reduce if there is a shift towards exclusive breastfeeding for the first 6 months of life.

2020-04-29 12:13

Having said that, I believe the growth would come from their goat milk formula segment

- Goat milk formula gaining popularity because of benefits eg easier to digest, less likely to cause lactose intolerance, and a whey:casein ratio that is closer to human breastmilk compared to cow milk formula.

- Goat milk formula consumption could increase in EU because many of their population there are lactose intolerant.

- They have the highest whey:casein ratio in their formula compared to competitors in Europe. Whey:casein ratio in human breastmilk is 7:3. (Kabitra 5:5, Holle 2:8, Nanny care 2:8)

- Kabitra also has DHA which the other 2 formulas lack

- But many parents (including myself) have traditionally fed our kids with cow milk formula. It might be hard changing these habits.

2020-04-29 12:16

I personally bought Vitasoy in the past few weeks. Dali foods seems better from a quantitative standpoint, i'm not sure why they command much lower PE value compared to peers. Would be grateful if anyone here could give their input. Tq

2020-04-29 12:21

David, please let me clarify - I did not recommend, I just share the name with Philip since he inquired.

Nevertheless, many thanks for reading and especially for sharing your thoughts on the cow and goat milks.

Yes, the number of babies is reducing for the last 3 years to just over 15 millions. And yes competition is stiff. It is a threat indeed and thank you for the head-up, will need to monitor closely.

Once again, thanks for reading and commenting.

2020-04-29 13:07

thanks for sharing. i've not been on i3 for some time. but found many good articles here which I've missed.

2020-04-29 13:17

qqq33333333

its financial market vs realists

financial markets bullish, realist bearish.....

so if you are realist like me, what are u going to do?

u can stay out of the market

or u can buy QL which after all is stable food and unaffected by the virus/ lockdowns.

or u can buy gloves, which logically is the only game in town. And,so if money is being poured into this sector and out of other sectors....the shear weight of money means u will potentially make money..................see..........stock market not so hard one.

2020-04-28 01:12