UNIMECH GROUP BHD (7091) TOO CHEAP TO IGNORE!

TheAlphaTrader

Publish date: Thu, 18 Nov 2021, 06:32 PM

Today we will look at UNIMECH GROUP BHD (UNIMECH). It is exciting to discover a hidden gem such as UNIMECH as I like to get into trades/stocks before they become well known or hot stocks. Although market sentiment is currently soft, these are opportunistic times for the sharp-eyed investors.

FUNDAMENTALS

UNIMECH was founded in 1996 and made its listing debut on the KLSE Main Board in 2000. It is primarily involved in the making of industrial valves, instrumentation and fittings (VIF) as well as providing value add engineering services. Their clientele include those in palm oil, heat and ventilation, oil & gas and water. The majority of the revenue (53%) is derived locally while exports to Indonesia, Thailand, Australia, Singapore, Vietnam, China and the US account for the balance of 47%

UNIMECH trades at an undemanding PE ratio of only 10 times and trades below its NTA of RM1.92. It also has an attractive dividend yield of 2.35%. But what is even more impressive is that since listing, UNIMECH has NEVER posted a losing year!

From the time the stock was listed, UNIMECH has traded in a conservative range of RM0.36 (Oct 2005) to RM1.87 (Jan 2021). This might be because the stock is not covered by any Investment Bank and the low liquidity of the stock.

A notable catalyst or game changer for UNIMECH is the entry of KITZ CORPORATION (KITZ) in Sept 2019. KITZ is a globally recognized valve company, with a history of over 70 years and has global offices in US, Europe and Asia . It is listed on the Tokyo Stock Exchange, commanding a market capitalisation of JPY68.16B (USD600M) and trades at a PE of 20 times.

KITZ bought a 25% stake from the founder, Dato Seri Lim Cheah Chooi, for RM1.65 a share, which represented a 15% premium above the market price when the deal was announced.

TECHNICALS

It is quite remarkable to note that during the start of the pandemic, the selldown for UNIMECH was so shallow that it only hit a low of RM0.91 on 24 Mar 2020. This is very commendable if we compare to the stock performance of most other stocks during the same period. Since hitting the low point it has since recovered very nicely and in fact, reached a new ALL-TIME HIGH ( also a 21 year high) of RM1.87 on 21 Jan 2021! It has since retraced and has found strong support at the RM1.43 level.

As we mentioned before, new highs in a stock is very exciting for us as it usually signals that new fundamental drivers may be taking shape.

The Monthly chart shows that UNIMECH is in an uptrend since it hit its lows of RM0.36 in 2005. With most stocks hitting their all time lows during the pandemic induced selldown, UNIMECH was able to stay above the long term uptrend line.

INTERESTING OBSERVATIONS

1. SHARE BUYBACKS

When done responsibly, share buybacks is viewed as a positive corporate development since the company would know if the price of the buybacks represents a good value proposition in relation to its fundamentals.

From the latest Annual Report in 2020, from Jul 2020 to Apr 2021, UNIMECH purchased a total of 1.415 million shares from the open market at an value weighted average price (VWAP) of RM1.42 per share. Recent Bursa Malaysia announcements have shown that the share buybacks have continued with the most recent purchase made on 12 Nov 2021.

With this in mind the current price of RM1.52 seems pretty attractive in relation to what the company is willing to pay.

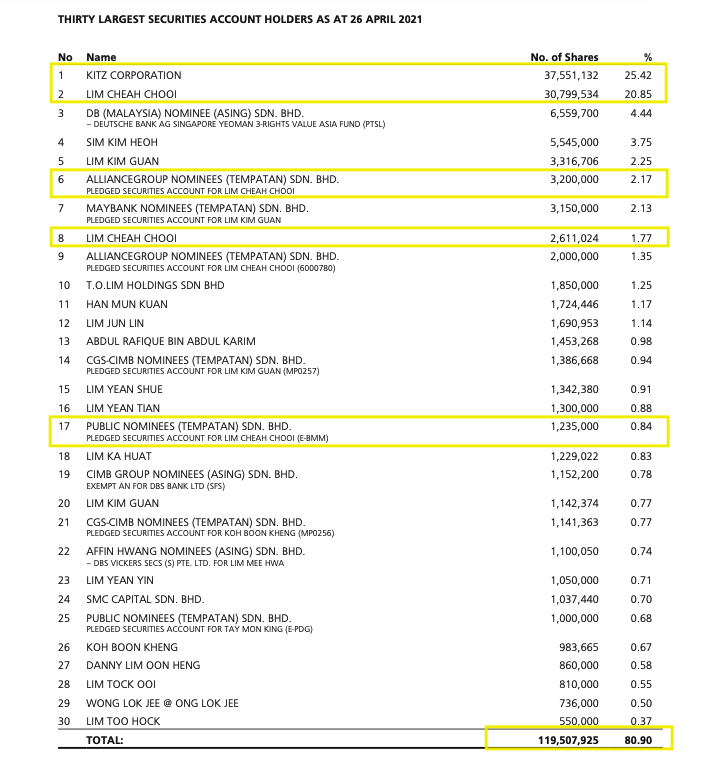

2. TOP 30 SHAREHOLDER LIST (As at 26 April 2021)

From the latest annual report, we can see the top 30 shareholders collectively own 80% of the company. Between Dato Seri Lim and KITZ, they already own 52% of the company. The public shareholding spread stands at about 29%.

As previously discussed in the Seremban Engineering Bhd (SEB) post, tightly held stocks with low levels of free float could lead to sudden explosive price action as observed for both SEB and UNIMECH in Jan 2021. All that is needed is a positive price catalyst.

3. ENTRY OF KITZ CORPORATION

For a low profile company like UNIMECH, the synergy with KITZ is tremendous including gaining access to new markets, products as well as leveraging on KITZ’s manufacturing and R&D expertise. Since KITZ is globally recognized as one of the top 8 valve manufacturers in the world, it is indeed exciting for UNIMECH to be part of this alliance. As part of the agreement, UNIMECH has been been granted the rights to distribute valves under the “KITZ” brand name in 2019.

4. REMINISCENCE OF SCOPE BHD

The entry of KITZ brings to mind a similar development in SCOPE BHD (Scope).

Scope has been one of the best hottest and best performing stocks on the KLSE. It recently hit an ALL -TIME HIGH of RM0.47 on 11 Nov 2021.

Scope recently underwent a Rights Issue in June 2021, which saw Inventec, a Taiwanese PLC with a market cap of TWD95.6 billion, increasing their stake in the company by buying 36.4 million shares from the controlling sahreholders Lim Chiow Hoo amd Lee Min Huat for RM0.22 per share. Inventec first bought into Scope in Mar 2019.

The huge stamp of approval from Inventec has already paid huge dividends to the Scope shareholders with the doubling in price of Scope in the span of just 5 months!

Will the same happen to UNIMECH with the entry of a world renowned company like KITZ?

5. NEW VALVE FACTORY IN WEST JAVA

The factory in Java commenced operation in late 2020 and the increased capacity is expected to contribute significantly to earnings growth in the near future. UNIMECH will also greatly benefit from the Indonesian government’s plan to expand its national shipping industry ability from 85,000 deadweight tonnes (DWT) to 300,000 DWT by 2025. (quoted from The Star 12 Jul 2021)

6. HIGH CRUDE PALM OIL (CPO) PRICE CATALYST

The current strong price of CPO bodes well for UNIMECH since its valves are widely used in the palm oil industry Strong CPO prices generally means palm oil output, resulting in higher orders for Unimec’s products.

CONCLUSION

It is indeed hard to ignore how incredibly attractive UNIMECH is at the current price. In my view, a company with such consistent performance, deserves to be re-rated to at least 15 times PE. KITZ is trading at 20 times PE while its peers in the USA (ie. Emeson and Flowserve) are trading at over 20 times PE multiples.

At 15 times PE should see UNIMECH trading at a new all-time high of RM2.30! The good thing about markets is how an undiscovered stock can enjoy a one off re-rating in a relatively short time frame.

On the matter of stock liquidity, this should not be too concerning as the management can easily increase liquidity by means of a bonus issue, which seems to be a very effective way in boosting prices these days. In fact, the price discovery process is usually very fast if a stock is fairly illiquid as the market would be forced to price in the rerating quickly!

If such a well established MNC like KITZ can see great value in UNIMECH at RM1.65, I would be very happy to buy at the current price of RM1.52 (since it has also retraced from the all-time high of RM1.87) and hold it until it reaches what I see as fair value!

Disclaimer: This blog is created for sharing of trading ideas only. It is not in any way or form meant to be an inducement or recommendation to buy or sell any stocks.Consult your financial consultant before making any financial investments.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on The Alpha Trader

Created by TheAlphaTrader | Nov 20, 2024

Created by TheAlphaTrader | Nov 01, 2024

Created by TheAlphaTrader | Oct 01, 2024

Created by TheAlphaTrader | Aug 16, 2024

Created by TheAlphaTrader | Jul 27, 2024

Created by TheAlphaTrader | Jun 21, 2024

Created by TheAlphaTrader | Jun 07, 2024

vision912

never heard of this stock but sounds interesting

2021-11-18 20:22