FOCUS LUMBER BHD (5197) - THE TREND IS YOUR FRIEND

TheAlphaTrader

Publish date: Thu, 06 Jan 2022, 11:07 AM

BACKGROUND INFORMATION

Focus Lumber Bhd (FLB) is involved in the maufacturing and sale of plywood, veneer and laminated lumber. The company also reuses bulk waste to generate biomass energy to supply electricity for its operations. FLB’s products are mainly targetted for the export market (95%) mainly to the USA, Taiwan, Thailand, Hong Kong and Japan. The USA market accounts for about 76% of the exports and growing.

FLB was incorporated in 1989 and listed on the Main Board of the KLSE in 2011 with an IPO price of RM0.60 per share. The major shareholder of FLB is owned by Mr. Lin Fong Ming and his family members, accounting for 27%. Mr Lin, a Taiwanese, is also one of the founders of the company.

POINTS OF INTEREST

1) VERY SOLID CHART STRUCTURE

From the daily chart, we can see a very nice uptrend in motion. The current move started to take shape after the long-term pivot point of RM1.00 was broken to the upside on 18 Nov 2021 to reach a high of RM1.17 on 22 Nov 2021. A successful retest of the RM1.00 level on 7 Dec 2021 paved the way for the current motive move which is still making new 52-week highs.

What is impressive about FLB’s price movement was, despite the overall weak market sentiment in Nov and Dec 2021, FLB continued to show strength. Further confirmation of this new motive move was when prices broke through the previous 52-week high of RM1.22 on 22 Dec 2021 and continued to make new highs with hardly any price retracements.

Looking at the weekly chart of FLB from the time of its listing, we can see a wide range in price from an all-time low of RM0.50 to an all-time high of RM3.10. A clear downtrend line breakout has occurred on 5 Dec 2021 and continues to trend nicely with little price retracement so far.

If the same momentum of the move persists, it seems like a test of RM1.90 (1st resistance) and RM2.50 (2nd resistance) could be on the cards in the coming weeks.

2) RECOVERY THEMED PLAY

FLB is a good proxy to the recovery themed play through the USA recreational vehicles (RV) sector. About 60% of FLB’s revenue in the USA is derived from the RV sector. With stock indices in the USA trading near the all-time highs, this bodes well for the strong consumer spending to continue in the near future.

3) NET CASH COMPANY

FLB has a very healthy net cash position of RM88.7 million or RM0.83 per share with no bank borrowings. That is impressive gven that the market capitalisation of the company is only at RM149 million!

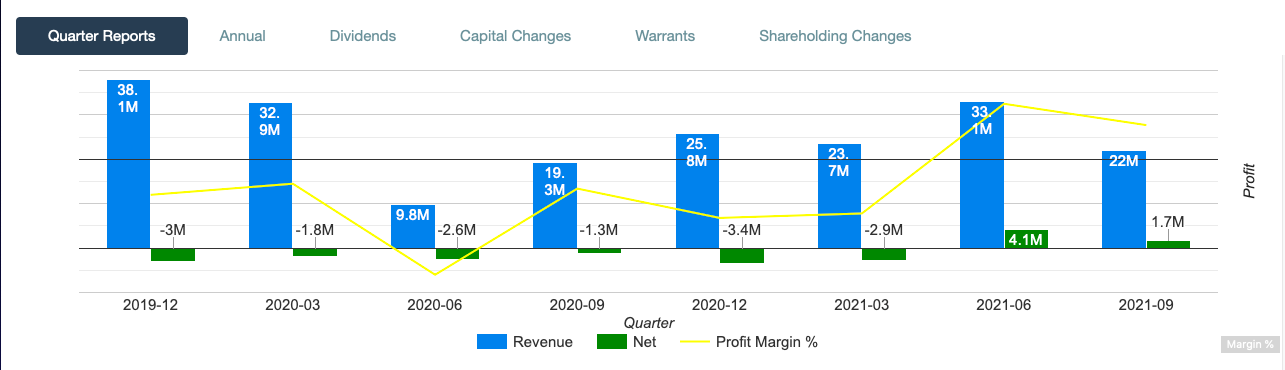

4) IMPROVING FINANCIALS

After showing a dismal consecutive 8 quarters of losses, FLB has managed to turn around good profits in the last 2 consecutive quarters of RM4.1 million and RM1.7 million, respectively. The next quarterly profit is expected to release in Feb 2022 and judging by the recent price action, the market seems to be betting that it will be a good one.

FLB is also trading below its NTA of RM1.63 and offers a decent dividend yield of 3.62%.

CONCLUSION

FLB is showing a very promising price structure that seems to be only at the beginning stage of a big move. At the present time, there does not seem to be any market moving news for this stock but price always precedes news flow. The first resistance is at RM1.90 followed by RM2.50with only a break below RM1.22 would invalidate the current chart structure.

Disclaimer: This blog is created for sharing of trading ideas only. It is not in any way or form meant to be an inducement or recommendation to buy or sell any stocks. Consult your financial consultant before making any financial investments.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on The Alpha Trader

Created by TheAlphaTrader | Nov 20, 2024

Created by TheAlphaTrader | Nov 01, 2024

Created by TheAlphaTrader | Oct 01, 2024

Created by TheAlphaTrader | Aug 16, 2024

Created by TheAlphaTrader | Jul 27, 2024

Created by TheAlphaTrader | Jun 21, 2024

Created by TheAlphaTrader | Jun 07, 2024

Discussions

morivae what point are you actually trying to bring? As far as I know it is operating it business mainly at Sabah. They live in company office to work 24/7???

2022-01-07 09:41

morivae

1) Do you know where's the company office located?

2) Do you know that the company's directors actually "LIVE" in the company office?

3) Do you know the company management style?

2022-01-06 14:10