OPCOM [0035] : Things You Need to Know and Expect in the Future

thethinker

Publish date: Fri, 20 Jan 2023, 04:19 PM

It appears that Opcom has taken the initiative to improve their capabilities by signing several business agreements to further expand the company's business sector since last year.

Among the initiatives they have taken is diversifying into the telecommunications network business in September 2022.

Reference: Opcom proposes to diversify into telecommunication network business

Opcom Holdings Bhd has announced plans to expand its business by providing telecommunications network infrastructure solutions. To do this, the company will be purchasing the entire equity interest in T&J Engineering Sdn Bhd (TJE) for a price of up to RM90 million. This acquisition will be paid for through a combination of cash (30%) and new shares (70%). TJE is a company that provides telecommunications network infrastructure solutions, which include civil, mechanical, and electrical engineering telecommunications infrastructure deployment. They have previously been sub-awarded contracts for the implementation of the Jalinan Digital Negara (Jendela) Phase 1 project in various locations across Sarawak. The company expects this new telecommunications network business to contribute 25% or more of Opcom's net profits. The acquisition will enable the group to offer more comprehensive solutions for the telecommunications industry, from fiber optic cables to telecommunication network infrastructure solutions and will also provide Opcom with an opportunity to expand its footprint in East Malaysia.

On October 13th, 2022, Opcom announced that Eddie Ong has increased his stake to 20.7%.

: Hextar CEO Eddie Ong ups stake in Opcom to 20.7%

Opcom Holdings Bhd announced that the CEO of Hextar Group, Datuk Eddie Ong Choo Meng, has increased his stake in the company from 17.78% to 20.69%. Ong acquired 8.12 million shares in the open market in three separate blocks over the last three days. This increase in ownership comes after Opcom announced its plan to diversify into the telecommunications network infrastructure solutions business via the acquisition of T&J Engineering Sdn Bhd for RM90 million. T&J Engineering is known to have been sub-awarded contracts for the implementation of the Jalinan Digital Negara (Jendela) Phase 1 project in various locations across Sarawak. Ong began increasing his stake in Opcom on September 29th. He has been a substantial shareholder in the company since February of last year and is also a major shareholder in other listed companies such as Rubberex Corp (M) Bhd, KIP Real Estate Investment Trust, Pekat Group Bhd, SWS Capital Bhd, and Classic Scenic Bhd.

On December 20th, 2022, Opcom received approval from shareholders for the RM90 million acquisition and diversification into the telecommunications infrastructure business.

Reference : Shareholders green-light Opcom's RM90 mil acquisition, diversification into telecom infra biz

Opcom Holdings Bhd shareholders have approved the company's proposed acquisition of T&J Engineering Sdn Bhd for RM90 million and the subsequent diversification into the telecommunications network infrastructure solutions business. The purchase price will be paid through a combination of cash and new shares in the company. The acquisition will allow Opcom to expand its core business to include telecommunications infrastructure solutions such as setting up new telecom-related infrastructure, supply chain management, warehousing, network maintenance and other value-added services like connectivity services, security services, data centers, and cloud services. The move is in line with the company's strategy of diversifying into income-generating businesses that are profitable and sustainable over the long term. The independent non-executive chairman of Opcom, Datuk Mazlin Md Junid, stated that the purchase comes with a profit guarantee of RM60 million from the financial year ending March 31, 2023 (FY2023) until FY2025, which gives the group an additional income stream in the near term. The acquisition and diversification are expected to be completed in the first half of 2023.

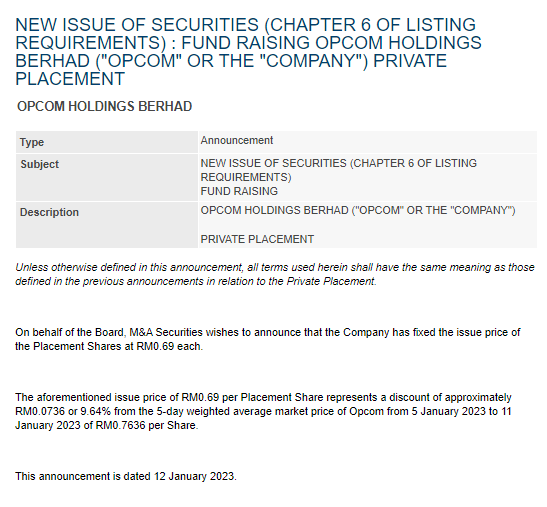

On January 12th, 2023, Opcom announced that the company has fixed the issue price for the placement shares at RM0.69 each.

In conclusion, we can see that Opcom is actively working to improve the performance of the company. At the same time, the addition of shares from Eddie Ong is a positive indication that the price of Opcom's shares will increase in the future. Additionally, with the announcement of the fixed issue price of the placement shares at RM0.69 each, we can get an idea of the target price for Opcom's shares in the mid-term.

It is my hope that the information provided in this article will be useful for all investors. My intention is simply to share information about a company that has the potential to bring profit to investors. Ultimately, any decision made is up to the individual.

if you are interested in becoming a part of The Thinker Syndicate, please join our private group to get the latest updates on how you can become a trader who always gets early information in trading.

JOIN NOW

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on The Thinker Touch

Created by thethinker | Aug 24, 2023

Created by thethinker | Jul 04, 2023

The information provided here is for educational and informational purposes only. It should not be considered as financial or investment advice.

Created by thethinker | Jun 27, 2023

Created by thethinker | Jun 19, 2023

Trading carries risks. Information provided is for educational purposes only, not financial advice. Conduct research and seek guidance from a financial advisor.

Created by thethinker | Jun 14, 2023

Created by thethinker | Jun 12, 2023

Created by thethinker | May 23, 2023

Created by thethinker | May 22, 2023

This article is for informational purposes only and should not be considered as financial advice.

Created by thethinker | May 15, 2023