[5078] Marine & General Berhad [M&G]: Navigating Through Economic Tides towards a Promising Financial Horizon

thethinker

Publish date: Mon, 17 Jul 2023, 10:22 AM

Since its inception in 1996, Marine & General Berhad (M&G) has had a long and transformative history, evolving from a highway asset holding entity to an influential player in the marine logistics sector. The Company, through strategic acquisitions and business reshaping, is now capitalizing on the recovering oil market, generating increased revenues and profits, thus painting an intriguing picture for investors in Bursa Malaysia.

Before we proceed with further explanations, kindly click the link below to follow our official Telegram channel:

TYNKR LAB OFFICIAL TELEGRAM CHANNEL

A Cruise Through M&G's Journey

Originally incorporated as SILK Concessionaire Holdings Sdn Bhd, the company underwent several name changes reflecting the shifting focus of its business ventures. In 2009, M&G made a pivotal move by acquiring AQL Aman Sdn Bhd, the parent company of Jasa Merin (Malaysia) Sdn Bhd (JMM), a leading entity in marine logistics with a portfolio that includes offshore support vessel services for oil exploration and production activities.

Coupled with its ownership of Jasa Merin Labuan PLC (JML), which specialises in liquid bulk transportation for petrochemical and oleochemical industries, M&G established a strong footing in the marine logistics sector.

Navigating through Economic Waves

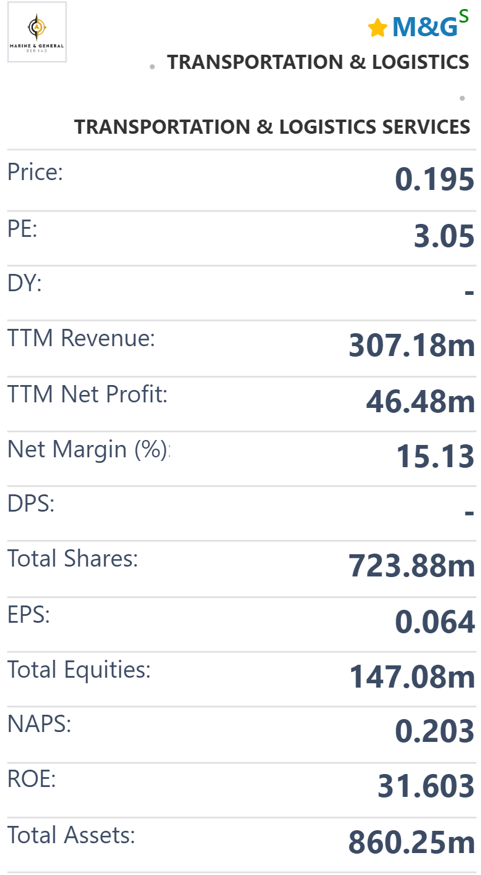

The Covid-19 pandemic significantly disrupted global economic landscapes, and M&G was no exception. However, as economies started recovering and oil prices resurged to pre-2015 levels, M&G's performance reflected an impressive rebound. Their Upstream Division, which supports offshore oil exploration and production activities, showed a 6% increase in fleet utilization, while overall group revenue witnessed a significant jump of 20% YoY, from RM63.2 million to RM76.1 million.

M&G’s impressive financial performance is underpinned by its two divisions. The Upstream Division, contributing 74% of the group's revenue, and the Downstream Division, accounting for the remaining 26%. A stark testament to the success of M&G's diversified operations.

Earnings Surge: A Deeper Look

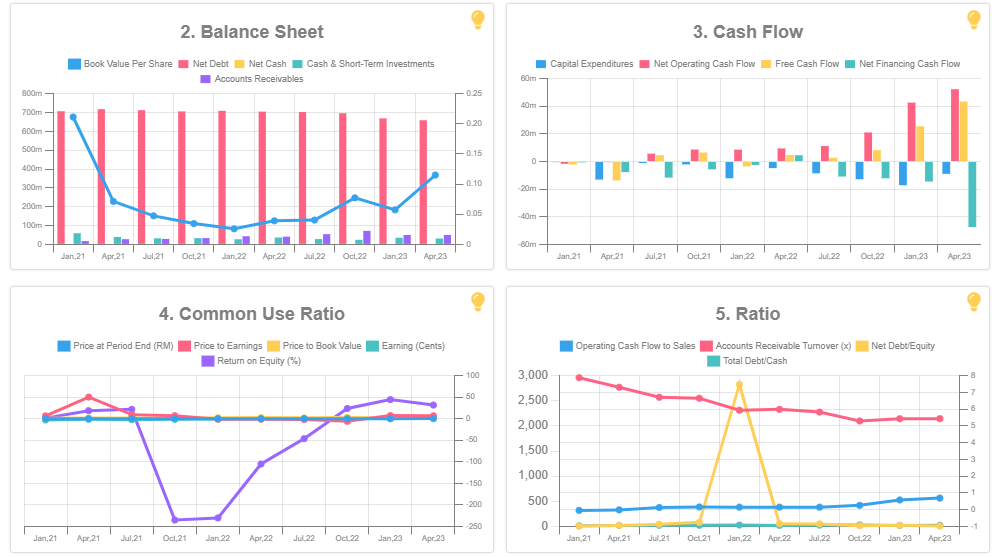

Drilling down into the numbers, M&G's profit before taxation leapt to RM47.1 million in the recent quarter compared to RM5.9 million YoY. This surge was primarily fueled by the resumption of drilling activities leading to higher charter activities and rates, a net reversal of vessel impairment, and lower depreciation expenses following the extension of vessel service life.

The robust performance continued on a year-to-date basis with the group revenue surging by 40% to RM307.2 million, driven by both the Upstream and Downstream Divisions. This impressive increase led to a turnaround from a loss before taxation of RM36.6 million last year to a profit before taxation of RM68.3 million in the current financial year.

Sailing Ahead: Divisional Performance

M&G's Upstream Division reported a revenue increase of 17% for the current quarter and a 41% hike YoY. Profits mirrored this trend, reflecting the successful resumption of drilling activities and favorable economic conditions.

On the other side, the Downstream Division posted an even more significant YoY revenue growth of 31% for the current quarter and 38% for the financial year. The division turned losses into profits in both the current quarter and the financial year, primarily due to higher charter activities and a reversal of vessel impairment.

Charting the Course: Comparing Quarterly Results

M&G's most recent quarter saw marginally higher revenue compared to the immediate preceding quarter. While the Upstream Division saw an 11% increase in revenue, the Downstream Division saw a decrease due to vessel repairs and dockings.

However, the company's profitability greatly improved, with profit before taxation of RM47.1 million compared to a loss of RM1.4 million in the preceding quarter, primarily due to the recognition of net reversal of vessel impairment.

A Favorable Financial Forecast

The financial seas seem to be in M&G's favor, with an impressive forecasted earnings per share (EPS) of 0.096 and an attractive Price to Earnings (PE) ratio of 2.03. Additionally, the forecasted profit after tax (PAT) for M&G is predicted to be in the region of RM 70 million. These encouraging financial forecasts provide strong indications of the company's potential growth, making M&G a vessel worth considering for investment.

Anchoring a Long-Term Deal with Petronas

Word on the dock is that M&G is on the brink of announcing a transformative 15-year contract with Petronas. This substantial contract, if confirmed, could significantly boost M&G's financial performance and provide a consistent revenue stream for the foreseeable future.

Charting a Sustainable Course with Green Tankers

In an era where sustainable practices are not just appreciated but expected, M&G is reportedly leading the charge in Malaysia with the introduction of green tankers. Taking inspiration from Japanese and Korean counterparts, these eco-friendly vessels are designed for reduced emissions and greater energy efficiency. This pioneering move could provide M&G a competitive edge, expanding its appeal to eco-conscious partners and investors.

Fully Utilized Fleet: An Indicator of Demand

Another promising rumor is that all of M&G's vessels are currently contracted. This full utilization, ranging from short to long term, reflects robust demand for the company's services and bodes well for future growth.

Smooth Sailing with Reduced Capital Expenditures

M&G has reportedly addressed all its docking maintenance requirements last year. This implies a clear financial horizon for the next five years, with no significant capital expenditures (CapEx) anticipated for docking. This strategic position allows M&G to reallocate these funds for growth opportunities or returns to shareholders, further boosting its investment appeal.

Charting A Path Forward: The Conclusion

As we plot our course towards the horizon, it's essential to appreciate the transformative journey that Marine & General Berhad (M&G) has embarked on since its inception. Having navigated through various economic tides, the company stands today as an innovative and forward-thinking entity in the marine logistics sector. With a steadfast commitment to growth and sustainable operations, M&G presents a compelling narrative for investors.

Embracing the winds of change, M&G's transition from a highway asset holding entity to a marine logistics powerhouse represents a masterclass in strategic business evolution. The acquisition of Jasa Merin (Malaysia) Sdn Bhd and ownership of Jasa Merin Labuan PLC underpin M&G's formidable presence in the marine logistics sector.

M&G's resilience in the face of global disruptions, like the Covid-19 pandemic, has been commendable. The company not only weathered the storm but capitalized on the recovering oil market. With an increase in fleet utilization and a significant leap in overall group revenue, M&G's financial performance underscores its adaptive prowess.

Looking at the financial forecasts, M&G sails in promising waters. The forecasted EPS, the attractive PE ratio, and the predicted PAT reflect a favorable outlook, illuminating M&G as a viable investment consideration. In addition, the potential 15-year contract with Petronas could anchor a consistent revenue stream, further solidifying the company's financial foundation.

Additionally, M&G's decision to embrace sustainable practices through the introduction of green tankers aligns the company with global sustainability goals. This proactive move not only enhances M&G's environmental stewardship but could also broaden its appeal to partners and investors who prioritize green initiatives.

Lastly, the full utilization of M&G's fleet, coupled with a five-year horizon free of significant docking capital expenditures, reflects the company's operational efficiency and strategic financial management. These factors further enhance M&G's attractiveness for potential investors.

As we drop our anchor here, it's clear that Marine & General Berhad offers an intriguing voyage for investors. While the waters of the investment world are often turbulent and unpredictable, M&G's strong financial forecasts, sustainable initiatives, and strategic business decisions create a course of potential growth and success. Nevertheless, like all voyages, this one warrants careful navigation. Investors are encouraged to conduct their due diligence, keep a keen eye on developments, and be ready to adjust their sails as necessary.

This journey with M&G serves as a reminder that the most exciting investment opportunities often lie beyond the safe harbor. And for those willing to venture out, the potential rewards may well be worth the voyage. As always, remember, the sea might be vast, but with the right tools and understanding, it can be conquered.

It is my hope that the information provided in this article will be useful for all investors. My intention is simply to share information about a company that has the potential to bring profit to investors. Ultimately, any decision made is up to the individual.

if you are interested in becoming a part of The Thinker Syndicate, please join our private group to get the latest updates on how you can become a investor who always gets early information in trading.

JOIN NOW

OFFICIAL TYNKR LAB TELEGRAM PUBLIC CHANNEL

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on The Thinker Touch

Created by thethinker | Aug 24, 2023

Created by thethinker | Jul 04, 2023

The information provided here is for educational and informational purposes only. It should not be considered as financial or investment advice.

Created by thethinker | Jun 27, 2023

Created by thethinker | Jun 19, 2023

Trading carries risks. Information provided is for educational purposes only, not financial advice. Conduct research and seek guidance from a financial advisor.

Created by thethinker | Jun 14, 2023

Created by thethinker | Jun 12, 2023

Created by thethinker | May 23, 2023

Created by thethinker | May 22, 2023

This article is for informational purposes only and should not be considered as financial advice.

Created by thethinker | May 15, 2023