(Tradeview 2016) - Value Pick No.10 (SCC Holdings Bhd.)

tradeview

Publish date: Tue, 17 May 2016, 03:41 PM

Dear fellow traders,

Once again, these writings are just my humble highlights (not recommendation), feel free to have some intellectual discourse on this. To join my telegram channel : https://telegram.me/tradeview101

_____________________________________________________________________________

Value Pick No. 10: SCC Holdings Bhd (Intial TP RM2.44)

It is fast approaching the end of 1H 2016. The volatility for the market in 2016 has shown that good times do not last forever. In fact, most local funds are barely in positive territory. Big time investors and notable investors have been struggling to provide the necessary returns. Through out the ups and downs, we are now in "Sell In May and Go Away" period. As a result, I have not been actively posting value picks in such times, because one is required to be extra careful in preserving the capital.

As we move towards the second half of the year, I believe there is still money to be made provided one is prudent. If you look at the index linked and also the bigger cap stocks, most are not spared from the selldown. The YoY performance is not worth a mention. However, I believe FA is still the way forward as it can withstand the cycles of the market so long one is patient.

As such, I intend to focus my strategic picks with counters that have certain defensive quality. Example: supported by yields through out the years as that is the only way to ensure the counters' value will not be eroded with the fluctuations of the share price.

One such counter is SCC Holdings Bhd. Many have asked me why I like to choose counters that have low liquidity of interest. Why not those with large volume? In all honesty, this is just coincidence. The counters I have chosen so far has good yields yet despite the case, funds do not buy in at large due to the limited quantity. The positive is that counters like this rise fast and drop fast but it is hard to manipulate.

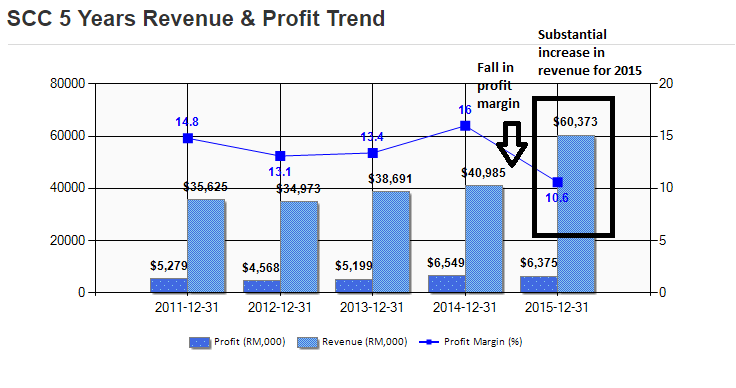

I consider SCC as it is one of those long standing Malaysian SMEs that have grown through the years patiently and shown consistent improvement in performance YoY. Additionally, it was able to deliver a huge jump in revenue for 2015 along with steady payout of average 4.5% dividend. Some key indicators, SCC at current price of RM2.04, the PE is 13.68x with ROE at 17.75%. The NTA is RM0.84 sens. All the numbers show it is quite fairly valued. What most people fail to notice is the growth story behind this counter.

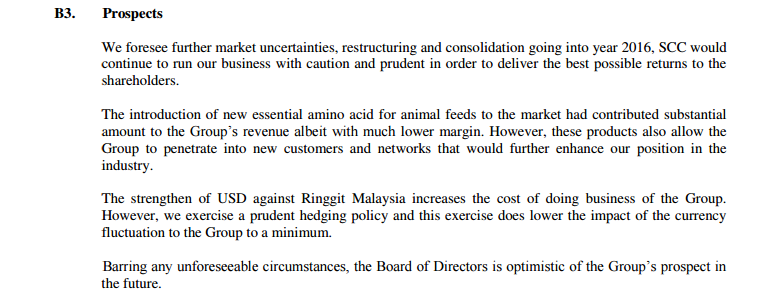

Traditionally, the average revenue for SCC stands between RM35-40 million. For 2015, there is a huge leap towards RM60 million. As a result the profit increase however not substantially. This is because there is a steep drop in profit margin. Without even going deep in the report, I suspected the reason was FOREX. MYR weaken substantially and as a result, the margin eroded from an average of 14 to only 10.6. We know for 2016, MYR has somewhat stablise. For many businesses, stability is most important as it allows the business to determine its pricing strategy. I believe for 2016, SCC will be able to navigate FOREX implications better than 2015. After reading deeper, I realise the reduced profit margin is also due to the fact SCC introduce a new product segment, which allowed the company to sucessfully increase revenue by a quantum leap. As a result, with the new product segment, I believe SCC will be able to maintain the current performance and obtain better growth moving forward. Once SCC find their footing in the new product profit margin, bottomline will reflect accordingly.

The latest full year results of 2015 showed revenue at record high of RM60 million arriving at EPS of 14.91 sens which was a slight decrease YoY. The next quarterly result would be likely out on 25th May and this is the dividend quarter (1Q2016). Usually SCC declares a generous 10 sens dividend which translates to around 4.5 yield at current price. Without taking in consideration of potential capital gain, the current price of the share is attractive for a growth counter.

What interest me is the business has been around for a long time. The management is steady and have weathered various economic cycles since 1974. It is also one of the few companies in Malaysia that has the ability to do well in the animal feed segment. Most people think of Thailand CP group when we talk about animal feed. SCC is in the same kind of business with some level of diversification. Additionally, the business is not cyclical in nature as it is involved in the following activies:

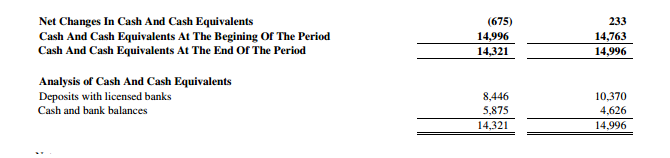

I am also keen due to the solid balance sheet. The NTA stands at RM0.84 sens per share and current price is at RM2.04. However, looking deeper, the company is a net cash company following a corporate exercise to raise funds. It would mean the company is in the business of using cash for expansion and not a lame duck company holding on to cash without giving rewards to shareholders or failing to expand.

SCC should be able to maintain their constant growth YoY due to their continuous innovation and recent success in launching new product segment to break into new customer reach. I conservatively estimate SCC is able to maintain their growth of around 7% for the revenue for 2016 and lift their profit margin to around 12. As such, the target EPS for 2016 is around 18 sens. Applying a multiple of 13x, the fair value would be RM2.34. Coupled with the annual dividend payout of 10 sens, the intrinsic value should be around RM2.44. This is an extremely conservative forecast assumming no funds interested in collecting this low volume counter. Some may ask why I am proposing this value pick now as the market is volatile etc. 3 reasons, this company is very safe, it has a growth story and this is the dividend quarter. As simple as that.

To join my telegram channel : https://telegram.me/tradeview101

Email me at : tradeview101@gmail.com

Food for thought:

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trading With A View

Created by tradeview | Oct 18, 2021

Created by tradeview | Sep 28, 2021

Created by tradeview | Sep 15, 2021

Created by tradeview | Jun 01, 2021

Created by tradeview | Apr 08, 2021

Created by tradeview | Mar 17, 2021

Discussions

"The NTA stands at RM0.84 sens per share but current price is only RM2.04"

hello...MEAN now damp expensive

2016-05-17 16:08

Muscle i suggest u stop commenting without substance. Please refer to my records if required. The april record is open for publish. i4 investor. NTA is one of the metric. Look at net cash portion thank you. NTA is only one of the many metrics for valuation. DY / ROE / PE CAGR are among the other metrics to see if it is cheap or expensive

2016-05-17 16:27

Just curious:

Nestle Price = RM74.50

NTA = RM3.60

http://klse.i3investor.com/servlets/stk/fin/4707.jsp

2016-05-17 16:37

the coffeeshop no openone mana can buy. later donate for them todo business only

2016-05-17 16:42

Apollo, that is the problem with low liquidity counters. However, if you think the value is above its current available selling bid, you can collect. Especially if one is confident the counter is overvalued. IF not just have to wait for opp to collect on weakness. Good point moneySIFU. Rightly pointed out! The underlying value of a counter is not dependent solely on NTA as some companies are asset light businesses. SCC is in the business of animal feed. Hence, NTA definitely lower. However, do look at the ROE / DY to determine. Additionally the growth story makes this a value gem.

2016-05-17 16:46

Revenue up so. Many but profit hard

HardlY improve....is this good? Lower margin is a big no no to me

2016-05-18 01:07

muscle very well, please dont read because clearly u know nothing bout investing. Empty vessel makes the most noise. I shall not dignify you with any response. But please dont read thank you.

2016-05-18 11:18

Muscle i notice u are always chasing tradeview bro call. U were following his call for FFHB and Gadang. Then u make money. Ever since then you rubbish him after tradeview sold his FFHB. How come you make money still call people rubbish? And notice you go around other forums attacking the sifus in the forum also. I think you enjoy causing trouble. Better dont do tt if not no one will welcome you anymore

2016-05-18 11:56

i have collected this counter from 0.90 cent ,and keep buying untit it cost 1.4.the time of my buying it was yielding 11% ,(10 cent dividend , 90 cent of share price )

This is the business come with moat,from it high gpm it tell you cleary, .The GPM is around 40+ %,and the npm is around 15+%, the gap of gpm and npm will be narrow when the production volumn is increase because volumn will bring down the fixed cost/unit , (go back to study your costing).

Thus,Scc is belong to blue ocean business with quality and pricing power.

Non-antibiotic feed , US mcdonald are stop using chicken grown with antibiotic feed.

Their businessis dealing with poultry ,it is a non cyclical in nature.it fulfill sustainability criteria,it is having high earning quality and it is long established track record around 40 plus year of it prudence management without sacrifice of grow and innovation (new product).

Because of it strong recurring earning (and the amount of revenue to be sustain is actually really small ),it sales risk is very low.

healthy balance sheet,it is 0 debt, eliminate financial risk.

Performance -ROE more than 15%

This is why i choosing scc.i have invested 90% of my total capital in this share .

2016-06-01 00:42

I agree with you fully jeckcw. If only I spotted earlier like you! kudos to you

2016-06-03 17:33

Apollo Ang

the coffeeshop noopen until now. 3.54pm untraded at all

2016-05-17 15:54