(Tradeview 2017) Value Pick No. 2 : EG Industries Bhd. 8907

tradeview

Publish date: Thu, 12 Jan 2017, 09:50 AM

or Email me at : tradeview101@gmail.com

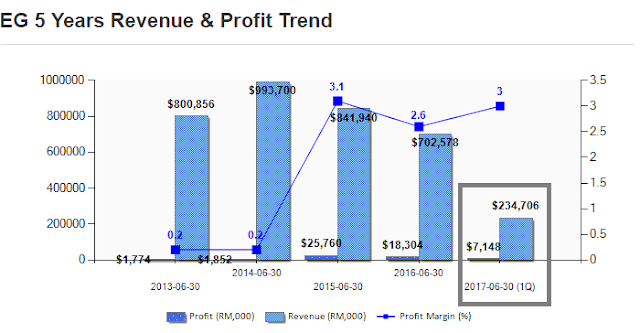

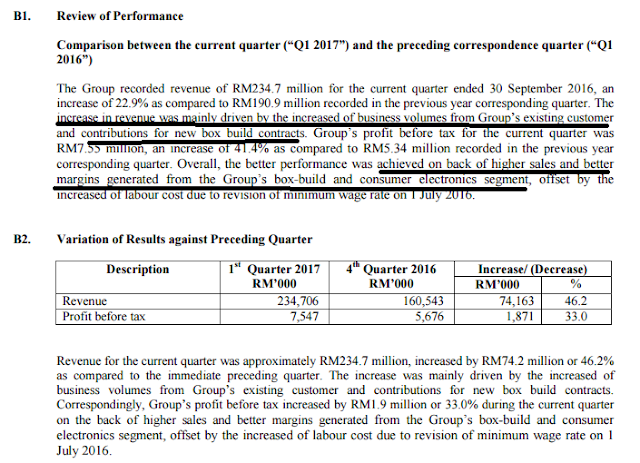

EG recent QR was nothing short of impressive. Revenue stands at RM 234 Mil and net profit stands at RM7 mil. Both figures for Q1 alone stands at 33% of the full year of 2016 Revenue and 40% of the Net Profit. If one were to annualise, EG may return the peak revenue of RM 936 million in Revenue and highest profit in 5 years RM28.4 million. However, I would not annualise as that is too aggressive. Even with a conservative estimation, I am confident that the management new direction will allow sustained increased in the profit margin for the company to around 3%.

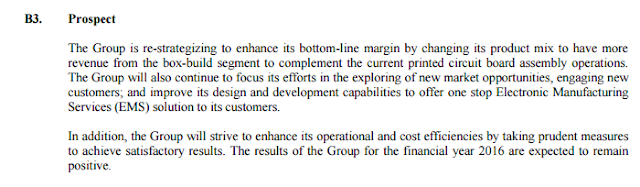

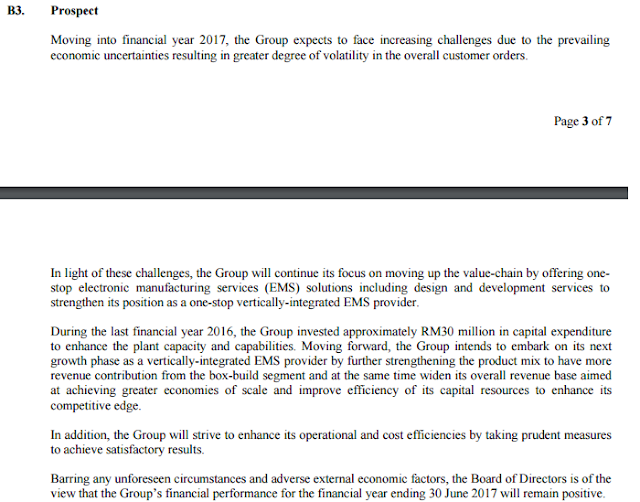

Most importantly, I am very impress with the Management's ability to keep to their words. Below was the management guidance on the future prospect 2 quarterly report back.

Today, the performance delivered shows the management actually kept to their words.

Fact of the matter is EG management manage to live up to their promise in their transition from EMS to Box Building. The new product mix helped increased both revenues and profit margin. As such, the company is indeed moving in the right direction. Many have asked me how did I come to discover Visdynamics, my question is look at details in the annual report that people do not. After which, cross check that information and verify if the management is indeed running the business well. Quite clear, EG is on the right track with their business plans and strategy.

Of course there are two issues I would like to highlight to all. One is the impending rights issue / private placement. Two is the sell off by CIMB Small Cap fund recently.

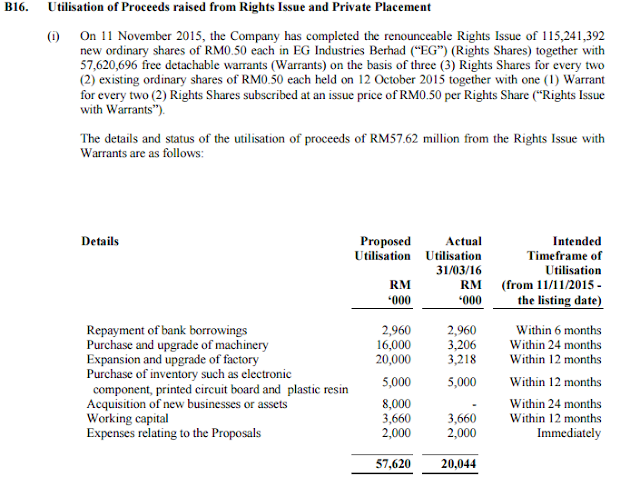

EG done a rights issue at 50 sens in 2015 and private placement at 80 sens. There is news recently that EG wants to do another round of rights issue / private placement. While I understand the company has financial needs to manage the cashflow, however, both timelines are too close. Raising funds from the public to expand business is good. Nonetheless, I would have preferred if the management plan their fund raising properly and think through a longer term business plan such as coming up with 5-10 years strategy instead.

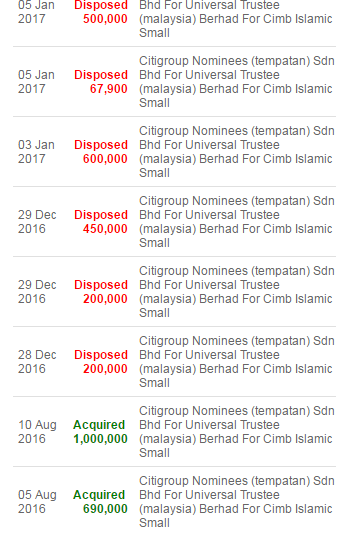

Secondly, the sell off by CIMB after this news surfaced does not exactly instill confidence in the market investors. While this is not pleasant, I am of the view that readjusting portfolio by funds are very normal especially at the end and at the start of the new year. EG has not been declaring dividends and the price has been stagnant for the large part of 2016. I cannot blame the fund manager who rather put their money elsewhere. However, as mentioned many times before, Tradeview is a value investing group that look long term beyond the immediate gratification. As such, I believe there is room for EG's business to grow. Measure taken by the company also shows that direction.

Blog : http://tradeview101.blogspot.my/

Facebook : https://www.facebook.com/tradeview101/

Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

More articles on Trading With A View

Created by tradeview | Oct 18, 2021

Created by tradeview | Sep 28, 2021

Created by tradeview | Sep 15, 2021

Created by tradeview | Jun 01, 2021

Created by tradeview | Apr 08, 2021

Created by tradeview | Mar 17, 2021

Discussions

Dear all, as EG Industries Bhd is one my value picks for 2017 when I called at 86 sens in my article, I feel I have the responsibility to give a bit of comment to calm the nerves. For those who have read my article would know that I have already taken into account of this corporate exercise by EG. Similar to all, I am not pleased with them raising cash from shareholders again because they did a private placement back in 2015 at around 82 sens. Now they opting for rights issue + bonus at 95 sens. All these was already part of my consideration and it is no surprise. You all can read the article here.

However, I would like to say 3 things good that came out of this rights issue announcement.

1. The rights issue is set to be fixed at 95 sens which is way above the private placement in 2015. This is good because the company own internal valuation is much higher than my own expectation.

2. They also tie it in with a bonus issue, which is good because it enlarge the shares which allows more liquidity for market activity.

3. The rights issue + bonus is primarily used for business expansion and acquisition. Not to pay off debts. So to me that is a plus.

16/02/2017 10:57

2017-02-16 10:58

VenFx

I'm in , EG has been my major pick as ViS.

Thx fir Tradeview article again .

2017-02-14 17:04