(Tradeview 2018) Value Pick No. 1 : QL Resources Bhd.

tradeview

Publish date: Sun, 07 Jan 2018, 11:12 AM

This is my No. 10 Value Pick for 2017.

Once again, these writings are just my humble highlights (not recommendation), feel free to have some intellectual discourse on this. You can reach me at :

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/

or Email me at : tradeview101@gmail.com

_____________________________________________________________________________

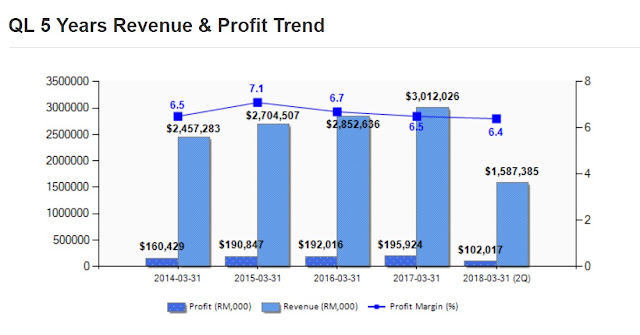

If we annualise the first 2Q of 2018, it would seem that QL may be able to achieve Rm3 billion in revenue + RM200 million in profits. Both are extremely good thresholds to break and it will only grow further in the coming years. Additionally, last year QL further declared a special dividend bringing the year dividend to 7.25 sens close to their record year. While the DY is not great, for the coming year, I will be more optimistic especially if Family Mart break evens. Additionally, a company that rewards shareholders albeit it is still expanding its business is better than a company that refuse to reward shareholders under the guise of expanding the business. Many good companies that are expanding even after doing well refuse to reward shareholders, QL management has maintained a consistent Dividend Policy through out the years.

This brings me to the next point, investing in QL is a also a valuation play. How so? Traditionally, QL has been valued as a poultry, surimi and feed company. Now with their convenience store business, their valuation will alter. This would be especially true if they can win market share from 7-11 or MyNews. If you look at both companies' valuation, you will be amaze with the premium attached to both companies. SEM (7-11 Malaysia) is trading at 43x trailing PER and MyNews is trading at 40x trailing PER. QL is only trading at 34x PER with an expanding convenience store business arm. Hence, to us, QL is a very solid mid to long term valuation play.

We would like to point out to all, another interesting business that was given premium valuation for a similar business model. Jaya Grocer reported a profit after tax of RM1.05mil on the back of a revenue of RM283.08mil for its FY14 ended June 30. This gives it a profit after tax margin of a mere 0.37%. The company has total assets of RM77.87mil. Jaya Grocer will be paid RM300mil for the grocery chain, valuing the entity at more than 30 times the price-earnings ratio (PER). It started in 2007 with its first outlet in Jaya 33 in Petaling Jaya. It has 16 outlets located mainly in the Klang Valley including The Intermark, Empire Shopping Gallery and KLIA2.

The reason we are sharing this is to indicate the valuation of grocery chain vs Family Mart. Although Family Mart business model would be more like 7-11, you can benchmark the business valuation to get an indicative value with discounts / premiums for store fronts and inventories. The similarity is the cash business and so long the cash flow management is strong, it will be a valuable gem.

https://www.thestar.com.my/business/business-news/2016/05/11/jaya-grocer-chain-sold-for-rm300mil/

Our initial valuation for QL will be RM5 based on the back of 12.65 EPS at 40x trailing PER. This is our prudent estimation without taking into account of the growth of the other businesses within the group. For those who likes a solid management, boring but fundamental business with a expansion horizon, can consider QL.

________________________________________________________________________________

Telegram channel : https://telegram.me/tradeview101

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/or

Email me at : tradeview101@gmail.com

Food for thought:

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trading With A View

Created by tradeview | Oct 18, 2021

Created by tradeview | Sep 28, 2021

Created by tradeview | Sep 15, 2021

Created by tradeview | Jun 01, 2021

Created by tradeview | Apr 08, 2021

Created by tradeview | Mar 17, 2021

Discussions

Wow, the empty vessel strikes back! I remember u da one who recommend Prolexus @ rm1.38 and told every1 to sailang right? FYI Prolexus 70 sens empty vessel! People Tradeview write article on QL such a good return stock but u attack...Y like tt?

2018-04-23 18:35

Jon, I like your research on rcecap (which by the way tradeview also called a buy on), but I think your criticism on QL is unfounded. Just look at the share price when it was called and the price today. I think tradeview did a good job in identifying a strong growth catalyst with family mart convenience stores

2018-05-01 20:09

I remember reading this before and thought trade view was a very smart fund manager.

Totally up 2x after comment by choivo capital. Basic brains but not enough business sense. But if you tell him he still won't know:

>>>>>

You guys insane ah.

"This brings me to the next point, investing in QL is a also a valuation play. How so? Traditionally, QL has been valued as a poultry, surimi and feed company. Now with their convenience store business, their valuation will alter. This would be especially true if they can win market share from 7-11 or MyNews. If you look at both companies' valuation, you will be amaze with the premium attached to both companies. SEM (7-11 Malaysia) is trading at 43x trailing PER and MyNews is trading at 40x trailing PER. QL is only trading at 34x PER with an expanding convenience store business arm. Hence, to us, QL is a very solid mid to long term valuation play."

What kind of stupid statement is this? Value play? Siao ah.

Like that everyone go change business to car hailing company better? Those companies burn 2-4 billion a year but valued at 60 Billion.

In this case, if you make profit, your valuation mai hit infinity liao?

23/4/2018

This is Jon choivo

2019-01-28 07:46

Dear Mr. Philip,

I quote the report “QL Resources Bhd is one of our favourite back in 2015. When we called it at RM 2.40, we had a TP of RM 3.50 in mind. As it continued to be one of the Forbes best under billion company in Malaysia, we held on with a max FV of RM 4.30. We fully disposed at RM 4.30 in 2016. The key reason being the growth was stagnant. Their poultry, egg was doing alright but not great. The surimi business division is still the biggest contributor to the group. While we still had confidence in the company, especially under the stewardship of Chia Song Kun along with the other founding family members, there was a growth issue which indicates QL did not matter warrant the premium valuation with over 25x trailing PE.”

“The reason we are sharing this is to indicate the valuation of grocery chain vs Family Mart. Although Family Mart business model would be more like 7-11, you can benchmark the business valuation to get an indicative value with discounts / premiums for store fronts and inventories. The similarity is the cash business and so long the cash flow management is strong, it will be a valuable gem.

Our initial valuation for QL will be RM5 based on the back of 12.65 EPS at 40x trailing PER. This is our prudent estimation without taking into account of the growth of the other businesses within the group. For those who likes a solid management, boring but fundamental business with a expansion horizon, can consider QL.”

I agree with you “trade view was a very smart fund manager” so my question if trade view called it at RM RM2.40 with TP RM 3.50 in 2015 and sold all at RM 4.30 in 2016. Then what stop them call it in Jan 2018 with TP of RM5 PE 40X and sold all by now? And bought 2019 call (Tradeview 2019) Forward 6 Value Picks for 2019 (TM, PPHB, DKSH, Elsoft, BJ Food & Perstima)

Thank you

2019-01-28 08:57

Very true. No more QL in 2019 list by Tradeview bro. Different list and investment calls.

https://klse.i3investor.com/blogs/tradeview/192340.jsp

2019-02-03 15:24

His long term views and my long term views are different. We see different things, can different things. My question is why sell QL at all in 2016? When they grew the hutan melintang plant, and added more deep sea fishing fleets? I wouldn't be able to explain his analysis especially as he is not in the board of directors. I hold substantially more QL than he does and held it far longer. I'm happy with the dividends I get and the growth prospects I receive.

I bought ql in Dec 2018 at 6.25 because I thought that was a undervalued price that I would not normally be able to get.

For February quarter I will just take a look at the results before deciding.

I might skip investing in QL and reinvest more in topglov or STNE instead. Who knows? I don't know.

But I just think it is very stressful to keep pumping out buy calls and recommendations and hoping someone will buy your private subscription services. It makes one more willing to walk the safe road and not the adventurous one. Who would have die die buy call for Amazon at pe500?

Live by the sword. Die by the sword.

2019-02-03 16:17

the job of analysts and sifus is to convince u to take money from your pocket and put into their pocket , its also called commissions.

and ideas is the SOP and the KPI, not the customers well being....that is well known enough.

my analysts son KPI is the number of reports he churns out, not the accuracy of his reports........

2019-02-03 18:18

Jon Choivo

You guys insane ah.

"This brings me to the next point, investing in QL is a also a valuation play. How so? Traditionally, QL has been valued as a poultry, surimi and feed company. Now with their convenience store business, their valuation will alter. This would be especially true if they can win market share from 7-11 or MyNews. If you look at both companies' valuation, you will be amaze with the premium attached to both companies. SEM (7-11 Malaysia) is trading at 43x trailing PER and MyNews is trading at 40x trailing PER. QL is only trading at 34x PER with an expanding convenience store business arm. Hence, to us, QL is a very solid mid to long term valuation play."

What kind of stupid statement is this? Value play? Siao ah.

Like that everyone go change business to car hailing company better? Those companies burn 2-4 billion a year but valued at 60 Billion.

In this case, if you make profit, your valuation mai hit infinity liao?

2018-04-23 16:50