Trading With A View

(Tradeview 2018) Value Pick No. 2 : Poh Kong Holdings Bhd.

tradeview

Publish date: Wed, 21 Mar 2018, 03:30 PM

Dear fellow readers,

This is my No. 2 Value Pick for 2018.

Once again, these writings are just my humble highlights (not recommendation), feel free to have some intellectual discourse on this. You can reach me at :

Telegram channel : https://telegram.me/tradeview101

Facebook : https://www.facebook.com/tradeview101/

or Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

_____________________________________________________________________________

Value Pick No. 2 : Poh Kong Holdings Bhd. (Initial Valuation RM 0.65 sens)

The global markets have been quite volatile with some retracement since President Trump announcement on protectionist tariffs. On top of that, Malaysia is facing GE14 in the next 2 months. With a series of unpredictable events, we are looking at Poh Kong currently at RM0.54 sens.

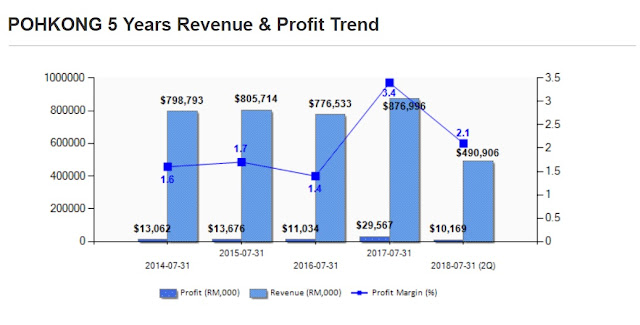

This is an old company in Malaysia with many years of experience in the industry. Well run management holding down a traditional family business. It has over 102 outlets nationwide and many sub brands like Hemera, Love etc. Fundamentally it is a sound company that has solid dividend policy over the years. In a way, the growth is rather stagnant with some narrow margins until 2017, they started showing bigger revenue and margin in the same year. Traditionally, it is around 1.4%, as of 2017, the margin has rised to 3.4%. This is an encouraging sign for us as it may seem there is a growth path there.

This is an old company in Malaysia with many years of experience in the industry. Well run management holding down a traditional family business. It has over 102 outlets nationwide and many sub brands like Hemera, Love etc. Fundamentally it is a sound company that has solid dividend policy over the years. In a way, the growth is rather stagnant with some narrow margins until 2017, they started showing bigger revenue and margin in the same year. Traditionally, it is around 1.4%, as of 2017, the margin has rised to 3.4%. This is an encouraging sign for us as it may seem there is a growth path there.

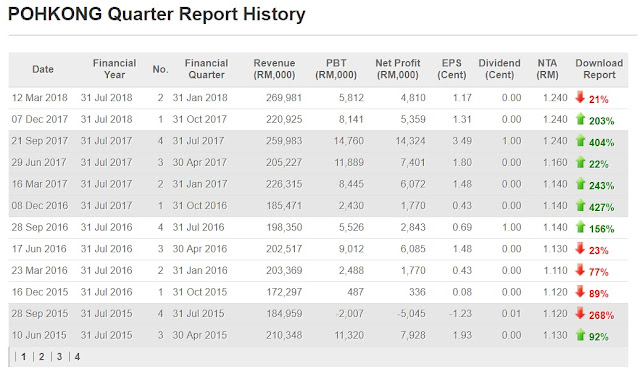

Additionally, if you look at the 5 year track record, as of half year 2018, the revenue is close to RM 490 Million, which is more than 2017. The diversified product range, new brands and different market segment penetration is enlarging the customer base for Poh Kong from the traditional ones of the past. Also, if you look at the NTA of Poh Kong, it is worth RM1.27. The current share price is RM0.54. With market cap of Rm220 million but net value of RM363 million and generating free cashflow of Rm60 million per annum, the balance sheet of Poh Kong is extremely strong.

Poh Kong is trading at a substantial discount on PTBV and PER compared to regional peers like Hong Kng jewelers such as Chow Tai Fook despite similar operations albeit a smaller brand name. If we take trailing earnings, Poh Kong is trading at 7x PER and PTBV of 0.44x. While the DY is not great at aroud 1.85%, at least the company has been declaring consistent dividend over the years. Many good companies that are expanding even after doing well refuse to reward shareholders, with 0 Dividend Policy through out the years. So far, first 2Q of 2018 have exceeded first 2Q of 2017, this in effect shows a steady path of grow for the company and may further solidify its market leader position in Malaysia.

________________________________________________________________________________

Telegram channel : https://telegram.me/tradeview101

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/or

Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

Food for thought:

More articles on Trading With A View

NST Business x Tradeview No.3 - Adam Yeap, Owner of 212 Hospitality and co-founder of Wonderbrew

Created by tradeview | Oct 18, 2021

NST Business x Tradeview No.2 - Muzahid Shah, CEO of SteerQuest Sdn. Bhd.

Created by tradeview | Sep 28, 2021

News Straits Times Business x Tradeview - Sharing Stories of Retail Investors & the Stock Market

Created by tradeview | Sep 15, 2021

Tradeview (2021) - Peterlabs Holdings Berhad Long Term Value Stock (Update)

Created by tradeview | Jun 01, 2021

Tradeview Commentaries - The Glove Surge, A Mirage or A Path To Oasis?

Created by tradeview | Apr 08, 2021

(Tradeview 2021) - Are Research Analysts' Reports Worth Their Salt?

Created by tradeview | Mar 17, 2021

.png)

paperplane

tradeview seldom buy call nowadays. trade cautiously, good example

2018-04-18 08:24