(Tradeview 2020) Why is KLCI Bursa Stock Exchange Trading At Record High Volume?

tradeview

Publish date: Sat, 16 May 2020, 02:40 PM

Dear fellow readers,

Once again, these writings are just my humble highlights (not recommendation), feel free to have some intellectual discourse on this. You can reach me at :

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/

or Email me : tradeview101@gmail.com

1. Why is the KLCI stock exchange making new record high in terms of trading volume?

2. Who are trading and who are the net buyers?

3. Are we in a bull market?

4. What should we do?

I will attempt to give a reasonable explanation and answer to all of the above questions. Data and numbers will give us the answer we are looking for should we make a reasonable inference and hypothesis from it. Have a look at the data below :

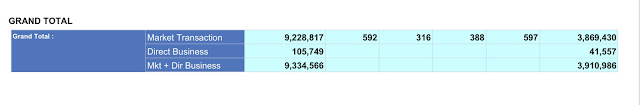

15 May 2020 : Volume 9.3 billion, Value RM 3.9 billion

After making a record high volume and value on Wednesday, 13 May 2020, the market once again return to a high volume and value on Friday, 15 May 2020. The last time the stock exchange hit such high volume and value would be back in August 2014. At that point, KLCI was making fresh record high and KLCI reached 1892 points. Where are we today? We are at 1403 as of Friday.

Logically, if your trading volume rises, your trading value should rise as well not fall. This shows the trades have moved from high value stocks to low value stocks. Or in layman terms, from first liners to third liners. In such situations, it would only mean one thing, funds are less active buyers (especially foreign funds) and retailers have taken over as net buyer. Well, I am sure some of the readers may not agree with me. Some may argue I am just making a general assumption. Thankfully, I have facts to show the data :

This is from April 2020 statistics :

Based on our findings and research, we have come to the following conclusion on why KLCI Bursa is hitting record high volume.

1. The record low interest rate environment following BNM rate cut to 2%

This has spurred retailers to move their savings / fixed deposit to equities market in search of higher returns. We saw the 12 months Fixed Deposit rate by Public bank is currently 2%. As a saver, many would not want to put their savings in the FD for a meagre 2% return and rather move the funds into equities which may give 4-5% dividend yield. With KLCI having beaten down badly in 2020, many think buying low is safe as value has emerged from stocks which would ordinarily be expensive in terms of valuation to consider a good investment.

Risk: However, I believe this batch of investors of prudent fundamental investors are the minority. Many punters or inexperience investors who are speculating in penny stocks with poor earnings & track record (ex - Ageson, Ho Wah Genting etc)

Risk: This is akin to using 6 months of borrowed money to speculate / invest in the share market. Should the market plunge again, those who are caught will lose money and face even greater challenge in repaying their loan obligations. Future savings in EPF for old age will also dwindle.

3. FOMO - Fear Of Missing Out

This issue is the same globally. When the market went through sharp rebound due to the large stimulus package by US Fed and Central Banks around the world to mitigate against the impact of Covid-19, the share market started to rebound. Investors who was worried about missing out this long awaited recession quickly set up trading accounts and rush into the market. This is like a stampede, where people are charging ahead in herd mentality without any sense of rationality moving with the flow. It is a vicious cycle. This stampede will only result in one outcome - blood. Speculative mania are signals of irrational exuberance which in effect are warning signs to all of us.

Risk: What happen when the music stops? I think you all know the answer to that

5. Extended Duration of MCO Lockdown And Lack of Income

The extended period of lockdown imposed by the government which was almost 8 weeks long meant many people were sitting home doing nothing. Businessman could not run their business. Employees would have more free time compared to having a fixed hour day job. Like many who have picked up cooking or baking as a healthy pastime, the time on hand allowed people to explore the possibilities of the share market. Additionally, the lack or fall in income has resulted in businessman and those affected to speculate in the share market hoping to make money to cover for shortfall and daily expenses.

Risk: Once the lockdown is over and all sectors are running, people would return to their daily jobs and have less time for the share market. This would result in reduction in participation in the market consequently downtrend.

7. Proliferation of Syndicates, Misleading Articles and Fake News

Due to the interest in the share market, we have observed a spike in nonsense promotional articles by unknown authors, rise in market cyber troopers / keyboard warriors, fake deals and news announcements by listed companies with poor track record and earnings. All for the purpose of pushing the share price of the stock and manipulating the market via pump and dump operations. Even syndicates appears so obviously unlike before, where it was more subtle.

Risk: Many inexperience and new investors who are in the market will unknowingly suffer substantial losses. In fact, when you look at August 2014 KLCI record high volume, many were penny stocks being played up. Many names are no longer to be seen today such as Sumatec, PDZ, it looks grossly similar to what it is today.

To be very frank, this is one of the decisions we are adamantly against. Free market forces are there for a reason. It is to ensure equilibrium exist. Having short selling will allow the market to function more efficiently and in fact reduce the ability of syndicates to conduct pump and dump operations. When the market is one way, not both ways, the tendency for it to go higher is there. However, if there are huge opposing force (short sellers), they function to clear the market of its inefficiencies hence resulting in a more reasonable and less speculative market. Also, without the fear of being forced into margin call, those who are using margin facilities will not worry and when the market continues upwards trend, their margin facility grows allowing them to push more funds into the same upwards direction without fear of the repercussion of margin call. That is extremely unhealthy.

Risk: Once short selling and margin call is reintroduce, the impact will be greater than before as the market is filled with greater inefficiency waiting to be corrected.

Our Advice To Readers :

On the contrary, it is the lousy speculative stocks with poor track record that is hogging the limelight today. Thematic plays have taken over news flows and fake misleading postings by syndicates are also being widely circulated and shared across platforms It has even come to a point where dubious MOU and deals are being announced by companies to Bursa. There was 1 day last week, I remembered reading 3 separate listed companies venturing into healthcare PPE / Covid testing kits business. In just 1 day. And what was common between these 3 companies? None of them had good track record, experience or ability to be in this field.

I am not bothered if funds or syndicates lose money. What pains me are ordinary people and retailers who are inexperience and new in investing losing their hard earned money in this extraordinarily trying times. Do be careful and not let greed take over your sense of rationale.

Telegram channel : https://telegram.me/tradeview101

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/or

Email me : tradeview101@gmail.com

Food for thought:

More articles on Trading With A View

Created by tradeview | Oct 18, 2021

Created by tradeview | Sep 28, 2021

Created by tradeview | Sep 15, 2021

Created by tradeview | Jun 01, 2021

Created by tradeview | Apr 08, 2021

Created by tradeview | Mar 17, 2021

Discussions

Thank you sir..with people keep pumping money, i wonder should i wait for their bubble to burst before i start collecting long term stock.being eyeing your stock recommendation.

2020-05-16 17:53

Malacca Securities Sdn Bhd said firm trading interest continues to linger within the healthcare sector, which may see gains extending over the foreseeable future.

"A breakout above the 1,400 psychological level may see the key index to re-test the 1,430 level. Downside risk remains pegged at the 1,360 level," it said in a note.

2020-05-16 21:14

An alert to investors in particular newbie. 'beware of high risks in share trading and enter at your own risk'.

2020-05-17 06:47

High volume means what, u ask yourself ??

It mean, there are alot of interest in stocks mah...!!

Then u ask yourself is stock price really overvalue leh ??

Some are like gloves stocks but majority are not loh...!!

Does the stock u buy got margin of safety, can it survive if business continue be poor for sometime? How about its balance sheet got huge borrowing or is it supported by fair liquid cash leh ??

Remember be prepare to invest for longer term about 3 years mah...!!

2020-05-17 07:14

The operators are thankful to new fools in the market people have being told to hold for 3 years maybe the operators runners are trying to con new investors haha for commission earn a living

2020-05-17 08:11

If you say it is a trading market fair n square play with the operators must know how to cut loss happy trading on Monday

2020-05-17 08:15

If u bought sapnrg 6.5 sen very cheap hold for 3 years u r not worry mah..!!

Be prepare for few 100% gain over 3 years loh...!!

Posted by Cnlim > May 17, 2020 8:11 AM | Report Abuse

The operators are thankful to new fools in the market people have being told to hold for 3 years maybe the operators runners are trying to con new investors haha for commission earn a living

2020-05-17 08:30

Sapura is exactly the kind of stock tt the author is advising retailers 2 not buy. Y u promoting sapura here? Take it somewhere else.

2020-05-17 09:49

ha..ha...everyone has the motive of writing or involving in this forum. We can also inclined to think that fund manager from unit trusts are asking the investors be better to place it with trust fund managed by highly professional manager. For me no way as the administration fee is very high for buy and sell.

2020-05-17 09:53

So since there's tonnes of newbies (but very2 rich) money flowing into the market, they'll certainly choose their stocks based on rumors n news without proper TA n FA knowledge. Hence, we must do the same loh to benefit from the situation! My new trading strategy ho ho ho

2020-05-17 10:44

Reaching the 9 billion volume shows that many Ah 2, Ah 9 Ah Li are in the market. Be prepared for further wild swings among the penny stocks manipulated by the syndicates. Still got money to be made anyway but have to be alert . Happy investing and speculating.

2020-05-17 12:35

sapnrg is exactly the stock u can get very rich mah...!!

Posted by Erudite > May 17, 2020 9:49 AM | Report Abuse

Sapura is exactly the kind of stock tt the author is advising retailers 2 not buy. Y u promoting sapura here? Take it somewhere else.

2020-05-17 12:50

Let it be....after all it's free market what .

Don't expect BlueChip@cheat to give you 100 - 200 % gains like cheap warrants with in days but BlueCheat@Chip will give you merely chickenfeed@Peanut 5 % take months if not years .

#KEEPonGRABBING$$$$$ !

2020-05-17 13:36

do you seriously think these newbies don't know what they are doing? they are speculating or more correctly gambling. If people can make 20 -50% return in a few days, do they want to wait for months or years? In fact, many so called bluechip stocks are also penny stocks now. Cheat by the market or by the IB?

2020-05-17 14:00

I noted one of the stock moving around 20 to 30 cents shots up to 1.20 just a few days,many will get caught for sure

2020-05-17 16:48

During the technology bubble time one of the company’s producing lubricant can shot up to 70,and you can’t find it today

2020-05-17 16:51

I follow some advise from tradeview and other sites and so far doing ok, thanks

2020-05-17 18:21

You have the same thoughts as me. Thanks for reminding. Better put our feet firmly on the ground.

2020-05-17 19:15

I think our Bursa got high vol is bcos our Bursa is oredi infected with the deadly FOMO disease which cannot be cured by vaccine !

2020-05-17 19:34

This deadly FOMO disease can spread very easily among the mkt players even we all stay at home !

I am most worried I oredi got infected this FOMO disease which can cause us to become insane !

2020-05-17 21:29

Bursa high volume also wrong, low volume also wrong, sideways also wrong. Short selling when market is bear aggravated selling in one way also, that time didn't say short selling is wrong...whatever happen also always got doubts means how to make money in the market...haha. The only thing is to learn how to be strategic in the opportunities. If market volume is high and short selling is banned just make use of it in the right way. Why complain so much retailer kena tipu or become mangsa. That one is because they greedy and use wrong tactics le. Market where got so nice for naive people.

2020-05-17 23:30

Watch Out Warrants Below 3 sen for RAYA Jackpot 100 - 200 %

#The Cheaper the Warrants >> the Higher the % GAIN $$$$$

## 2020 SUPER BULL MARKET NOW ON GOINGG !

2020-05-18 06:18

zhangliang

V true indeed!

2020-05-16 16:28