E.A TECHNIQUE : RETURNING TO THE BLACK

thewisetrader

Publish date: Fri, 30 Dec 2022, 03:29 AM

There's light at the end of the tunnel for Eatech

UPDATED (3rd Jan 2023) :

-Upon this article was published on 29 dec 2022, today 3rd january 2023 , another disposal of shares by substantial shareholder Dato Abdul Haq was announced. Based on our source of information, Dato Haq is no longer in the company. Most of his shares were forced sell by the banks. Heard that his stakes are almost 0 to date. Thats why we shall wait for the new whiteknight that soon will emerged as a new substantial shareholder.

-Besides, looking at the recently appointed management team, especially the CEO , Nasrul Asmi , he had extensive background in marine & shipping industry since he was a VP in marine & shipping specialist, RHB bank prior to join Eatech. On a side note, Nasrul was appointed by Jcorp as head honcho to spearhead Eatech's restructuring its business and financial performance.

-Despite the selling by Dato haq, no 1 substantial shareholder which is sindorra (subsidirary of jcorp) did not dispose a single unit. So no issue on that.

- also we have received another information on its pn17 status, the company has already finalised its regularisation plan for its financial conditions and now is waiting for the whiteknight anounncement. As we mentioned earlier, the white knight will soon surface as the new substantial shareholder of eatech and injecting fresh funds to company.

on 3rd Jan 2023 , eatech surge another 3 sen or 18% from 0.145 on friday 30 dec 2022 to higest 0.175 today.

- we expect that share price will move up prior to the white knight and pn17 upliftment status announcement.

The share price of Eatech has been bullish steadily since its first breakout of RM 0.055 in September 2022. To date , Eatech share price has surged almost 200% from 0.055 in September 2022 to 0.145 today (29 dec 2023) .

Previously on Nov 3, 2022, we have published an article about what's brewing in Eatech and it was trading at 0.105 at that point of time :

https://klse.i3investor.com/web/blog/detail/whatsbrewing/2022-11-03-story-h1651161019-E_A_TECHNIQUE_COMPANY_TURNAROUND_IN_THE_MAKING

In our previous post, we anticipated that the company is in the midst of restructuring its business to be declassified from PN 17 status. Today, with more information gathered, there is a great chance the company is on the right track to return in the black.

Below are the key points why we believe Eatech is going to be a superstock in 2023 :

1) Recorded net profit of RM 5.67 million in latest quarter 3 2022.

- Eatech has been loss-making since late 2020. According to the company, the profit was mainly due to better cost management and gain on diposal of its vessels. Despite the contribution from the vessel disposal, the profit was largely contributed by business operation which indicate a positive growth in the future.

2) Eatech has obtained approval by high court and its creditor for its proposed scheme of arrangement.

-further information gathered by our sources, it was reported that the creditor which is also the majority shareholder of Eatech granted a 70% haircut for the proposed scheme of arrangement.

- The company has no issues at servicing their bank borrowings.

3) The company is in positive cash flow.

- taken into consideration that next quarter will reflect proceeds from their recent sale of 3 vessels of another RM60mil , it would contribute to bigger cashflow in the company.

4) Positive future earnings of the business

-As per available information, on the business, as it is, the company should have no problem performing with similar QR as per FY 2022.

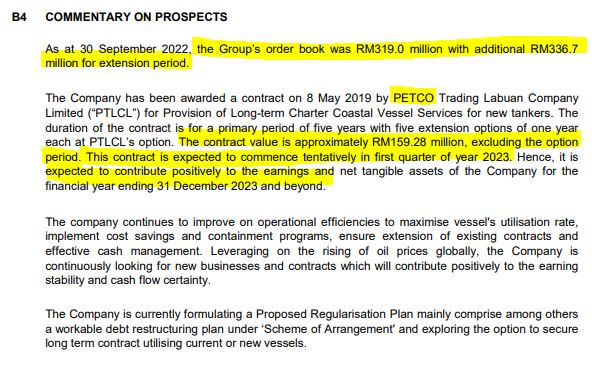

-Taking into consideration its impeccable primarry order book standing at RM 319 mil plus the additional RM 336Mil of extension contract.

-A contract that was awarded in 2019 by PETCO for RM 159m that will commence in 1st quarter 2023 will also contribute to higher earnings of the company for FY 2023. Assuming 159 mil contract for 5 years, it will tentatively contribute additional of RM 8mil revenue approx. every quarter starting 1st quarter 2023.

- Include the recent 2 contracts awarded by petronas on 27 October 2022 for FLNG totaling RM 53 mil for 2 years that has commenced in Nov 2022. These contracts will contribute another RM 6.7 mil approx in revenue. and should be reflected in the next QR.

- Hence, assuming Eatech profit margin is around 10-15% , PETCO and Petronas FLNG should easily generate in RM 1.2 mil -RM 1.5 mil additional profit per quarter.

- Therefore, it is safe to say that we should see Eatech net profit every quarter starting next QR will increase to RM 6 mil - RM 7 mil for at least the next 24 months.

5) Future fair value assumption

- Assuming every quarter the company is able to generate of at least RM 6mil net profit, and RM 24mil for the whole year, we may calculate the fair value of the share price as below:

-the figure below does not include assumptions on future new jobs and new rates. Should the company can procure new contracts, we shall see big jump in quarter-to-quarter profitability.

Best Case Scenario : RM 1.00 per share

| RM 24.0 Mil / 530.5 mil number of shares = 0.04 RM0.04 x 25 PE : RM 1.00 |

Conservative PE : RM 0.60

| RM 24.0 Mil / 530.5 mil number of shares = 0.04 RM0.04 x 15 PE : RM 0.60 |

6) Huge opportunity for oil & gas (o&g) logistic players in 2023

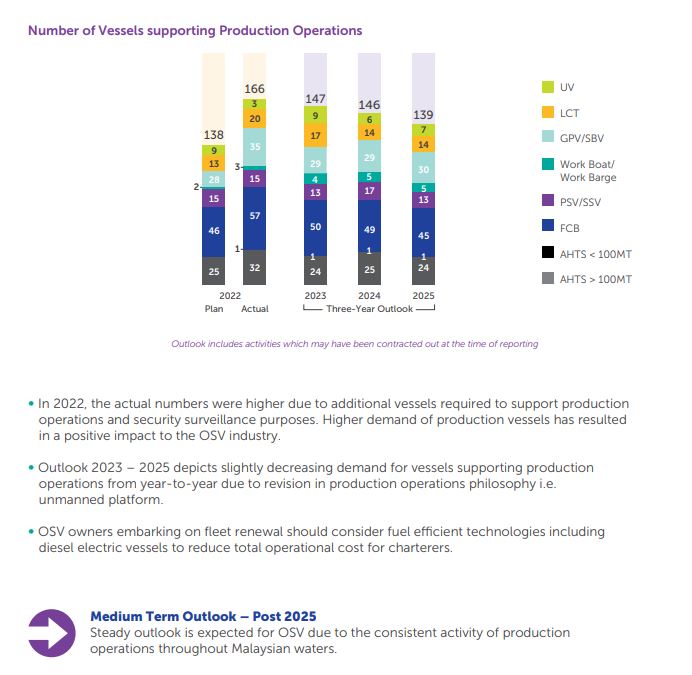

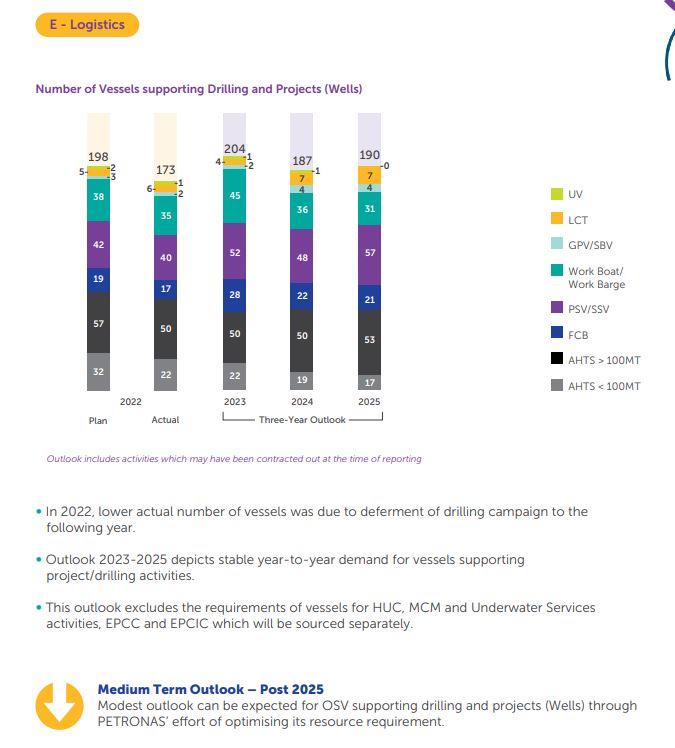

- Based on Petronas activity outlook for year 2023- 2025 below, it is clearly that o&g logistic players will have huge business opportunities.

- clearly we can see, Petronas requires of at least 330-350 vessels per year to support its production and drilling operation. Sources from o&g professionals, we are now in shortage of vessels and Petronas must prioritize Malaysian flag vessels.

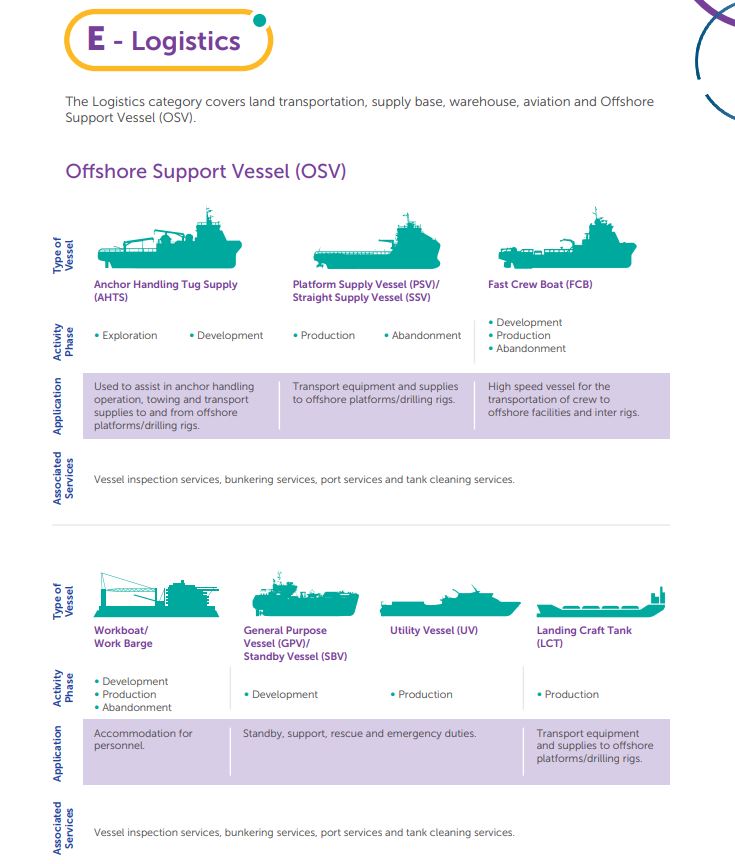

- if we look at Eatech business segment below, they do have the ability to cater for Petronas jobs in the future. As we can see, Eatech had already secured 2 contracts from petronas on 27 oct 2022.

7) New "white knight" will be investing in Eatech,

- Market talk has it that there is a new white knight that will inject a fresh fund into Eatech and bringing in new projects onto their pipeline. The new investor shall drive Eatech for a turnaround and transformation of the company in the long run.

- Should this will materialize, we believe, together with future business projection, we may see a tremendous reward upside.

8) Upliftment of PN 17 status

- as we know, bursa requirement is to have 2 consecutive QR + 1 QR in profit. as per available information, the company is in the midst of their regularisation plan.

- however, the last QR is already in profit, and based on our point no. 4 above, it is high likely that Eatech can produce another 2 net profit quarter.

9) Coverage by analyst

-Since the last QR released, an article by NST business stated that analyst believe there is more room for eatech share price upside.

https://www.nst.com.my/business/2022/12/857830/more-room-ea-techniques-share-price-upside

10) Technical Analysis:

Daily Chart comments:

- since it was highest at 0.16 on 13 dec 2022, price has been consolidating between 0.13-0.150. Support can be considered at 0.130 / 0.100

- should it break RM 0.16 again, it will create another 52 weeks high

-technical indicators such as RSi and MACD is currenly at safe level, particularly the MACD wich is at oversold condition.

weekly chart comments :

-critical and psychological resistance at 0.20 , all technical indicators are on strong bullish momentum. we may see a rally once it trade steadily above 0.20

In summary :

We are of the view, Eatech may provide an exquisite reward in the near future.

With a bright future ahead, we believe that the current share price is well below its fair value. The energy sector was badly affected since covid in 2020, and together with China's easing its covid policy, we shall see the energy sector booming again in 2023.

note:

The article is merely our opinion and for educational purposes only. We do not recommend buy/ sell for any counters. Please do your own due diligence before investing your money in any counter!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on What's Brewing?

Discussions

Good and mybe will buy for future, but why share holder keep on selling?

2023-01-01 23:37

I think once they announce major announcement and pn17 uplift, it can limit up like comcorp hehe

2023-01-02 11:37

substantial shareholder Dato Abdul Haq is no longer in the company. Most of his shares were forced sell by the banks. Heard that his stakes are almost 0 to date. Thats why we shall wait for the new whiteknight that soon will emerged as a new substantial shareholder.

Besides, looking at the recently appointed management team, especially the CEO , Nasrul Asmi , he had extensive background in marine & shipping industry since he was a VP in marine & shipping specialist, RHB bank prior to join Eatech. On a side note, Nasrul was appointed by Jcorp as head honcho to spearhead Eatech's restructuring its business and financial performance.

Despite the selling by Dato haq, no 1 substantial shareholder which is sindorra (subsidirary of jcorp) did not dispose a single unit. So no issue on that.

2023-01-02 22:41

Whiteevoque

Great article! I am so bullish with oil and gas counters for 2023 and 2024. Oil price will rally with China is opening up.

Expect brent to go above usd100 and more offshore activities will be activated.

All oil and gas related companies will get the benefits including supply vessels companies like eatech.

Between all of them my top pick is eatech because of the turnaround story and attractive valuation. I think it will give 400-500pct yield from current price range

2022-12-30 22:46