M&G Bhd Makes a Comeback: A Look at Its Promising Future

thewisetrader

Publish date: Fri, 05 May 2023, 12:56 PM

The general business of Marine & General Bhd (M&G) has remained resilient despite the challenging economic environment. The company has a proven track record of delivering high-quality vessels and engineering services to customers across the globe. This has enabled them to build a strong reputation and customer base in the industry, which is a positive indicator of their future growth potential.

Business is on a positive growth trend

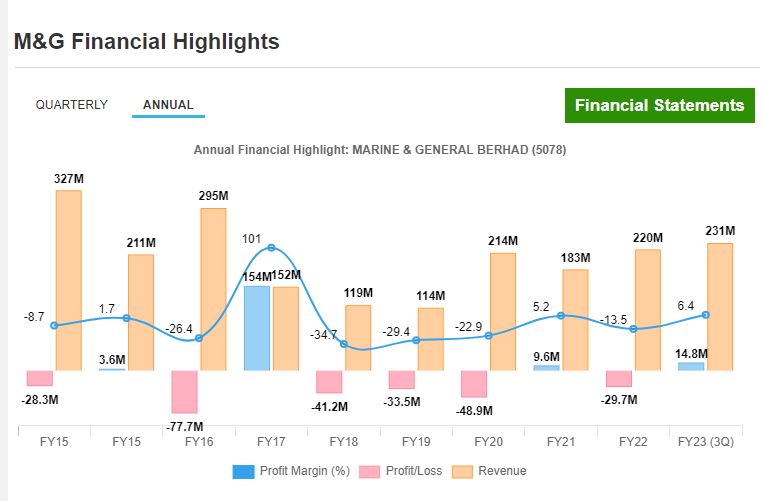

M&G underwent a remarkable financial upswing in 2023, with its revenue steadily increasing throughout the year since 2018 and eventually resulting in a significant boost in profits in the last 2 quarter. As per the data below, revenue of up to 3 financial quarter is already equivalent to past year annual revenue with net profit posted at RM 14.8 millions.

Recent Quarter report :

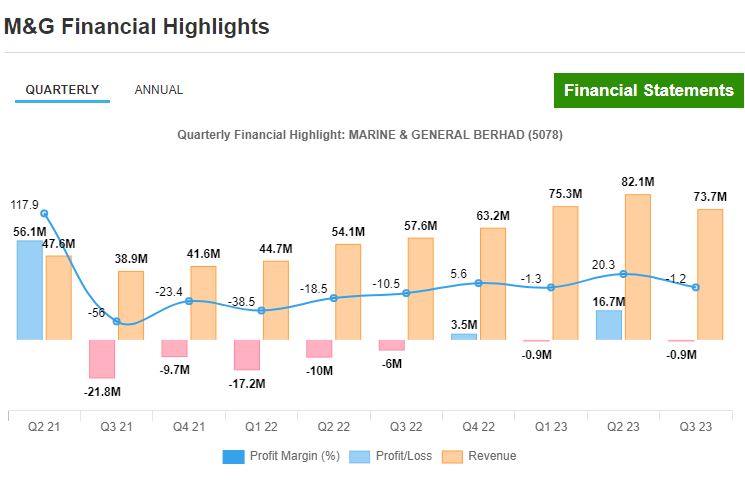

It is worth to note that on 27 march 2023, the company released its quarter report for Q3 with loss of RM 1.3 millions. this has resulted in significant sell offs by investor. However, its share price had a immediate rebound back to 0.16-0.18 levels resulting in a v shape recovery. We view that the recent sell offs was mainly due to knee jerk effect by traders not knowing the losses is merely due to its finance cost whereas the company core operations income reported a net profit of RM 7.4 millions.

- increases in administrative expenses and finance cost

According to our sources, this was due to its refurbishment of their vessels for the extension of OSV economic useful life from 15 to 20 years thus will bring significant savings to the Division from lower annual depreciation charges.

- another factor that resulted in lower revenue compared to Q2 2023 was mainly due to monsoon season with resulted in fewer vessels activities throughout the period.

Projection for future earnings

We are anticipating that M&G is poised for another positive profit for the upcoming quarter 4 2023 with net profit for FYE 2023 of around RM 20-RM 25 millions.

According to our sources, the company is looking at RM 35 - 40 million in net profit for next year FYE 2024. We believe this numbers are attainable considering the company orderbook and contracts they secured for all of their vessels.

To date, M&G owns 23 upstream vessels and 8 downstream vessels. quoted from their recent quarter report , In relation to the Downstream Division, the Division looks forward to more active charter operations in the current financial year, having added a new clean petroleum product tanker during the period and has already secured time-charter contracts for all of its vessels.

The above statements justified the company projection for its FYE 2024 earnings with all of its vessels has already secured contracts.

Upcoming Contracts for M&G

Hearsay , the company is in the midst of finalizing a long term contract with petronas trading group for petroleum products transportation via green tankers. Green tankers are used to support carbon zero journey initiatives by Petronas.What we know so far , this contract will generate a big portion of its revenue with a long term contract. We anticipate that this contract alone could add the revenue up to RM 50 millions. Also , it is expected to contribute another rm15- 20 millions for its Net Profit.

This could be a positive catalyst for the company way forward.

Fair Value Assumption :

Assuming for upcoming Q4 FYE 2023 will post another profit and expectation of annual profit to be RM 25 millions.

1. FYE 2023 earnings projection

-FYE 2023 Profit : RM 25million profits ; PE 20 : RM 0.69

RM 25.0 Mil / 723.89 mil number of shares = 0.035

RM0.035 x 20 PE : RM 0.690

2. Conservative of PE 10 : RM 0.35

RM 0.035 x 15 : 0.520

3. FYE 2024 earnings projection : RM 40 mil profits ; PE 20 : RM1.10

RM40.0 mil / 723.89 mil number of shares = 0.055

RM0.055 x 20 PE : RM 1.10

4 Conservative of PE 10 : RM 0.55

RM 0.055 x 10 : 0.55

Should we include the new contract we mentioned above by petronas which may generate of RM 60 millions annual net profit, we expect the fair price of M&G shares shall be RM 1.65 at PE 20 and even by conservative PE 10 it should be fairly valued of at least RM 0.82

RM60 mil / 723.89 mil number of shares = 0.082

RM0.082 x 20 PE : RM 1.65

Conservative PE 10 : RM 1.00

RM 0.082 x 10 PE : RM 0.820

No longer under PN 17 risk

previously, the company had triggered as PN 17 listed issuer mainly due to :

- its shareholders equity of M&G on a consolidated basis is 25% or less of its share capital and such shareholders’ equity is less than RM40 million based on the unaudited interim financial results of M&G for the quarter ended 31 July 2021

- The auditors highlighted a material uncertainty related to going concern in the audited financial statements for the financial year ended 30 April 2021 and the shareholders’ equity on a consolidated basis is 50% or less of its share capital.

however, on 4th april 2023, the company had addressed this issue by stating that Based on the unaudited management accounts of M&G as at 28 February 2023, the shareholders’ equity has increased from RM34.2 million as at 31 July 2021 to RM45.4 million.

Although the ratio of the shareholders’ equity to share capital on a consolidated basis as at that date is 16.8%, the amount of the shareholders’ equity has exceeded the minimum threshold of RM40 million.

hence, the company no longer triggers the prescribed criteria pursuant to Paragraph 8.04 and Paragraph 2.1 of PN17 of the MMLR of Bursa Securities and will not be classified as a PN17 listed issuer.

Technical analysis :

Generally , M&G is on uptrend movement whereby it is trading above ema200. We are comfortable with its MACD and stochastic indicating that it is oversold and pending for a next bullish signal. A strong support established at 0.160 with its 52 weeks high stood at 0.195.

we are expecting for a break out rally once it is trading above 0.20.

In summary , we are of the view that despite M&G Bhd improving financials and impressive growth prospects, the company's share price are oversold and undervalued. The increase in demand for vessels by Malaysian oil and gas operators is a positive development for M&G Bhd. As the demand for oil and gas continues to rise, there is a corresponding increase in demand for vessels to transport and support these operations which will contribute to the company future earnings.

note:

The article is merely our opinion and for educational purposes only. We do not recommend buy/ sell for any counters. Please do your own due diligence before investing your money in any counter!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|