Lau333// 9 things from Gadang 3QFY2018 Results

Lau333

Publish date: Tue, 24 Apr 2018, 06:35 AM

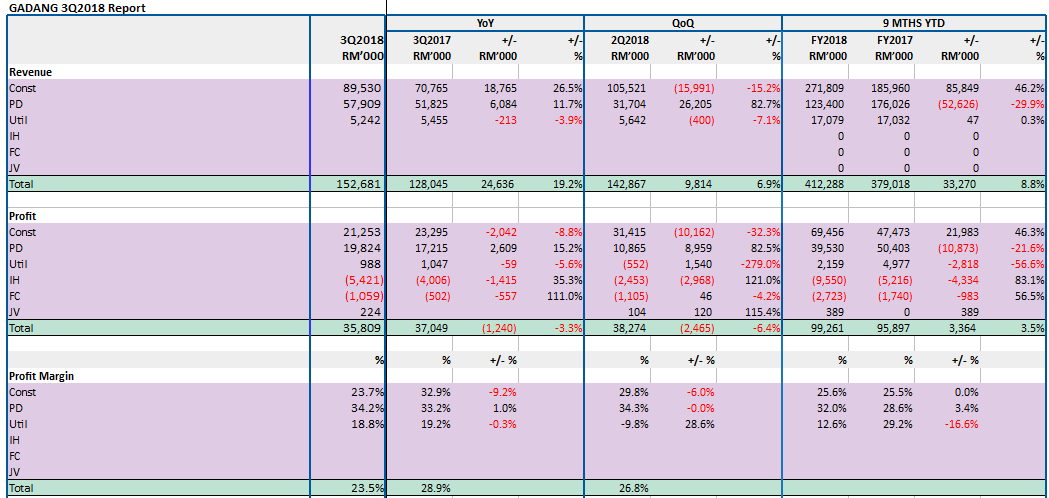

1) Not much surprise in the earnings report. Excluding one-off ESOS expenses of RM5.0m, forex loss of RM1.2m due to IDR depreciation & Fair Value Gain of RM2.0m, PBT actually increased 7.9% YoY.

2) Construction revenue increased 26.5% YoY in line with acceleration of works for RAPID 301/402, TRX, MRT2 V206 and Cyberjaya Hospital. Construction margin contracted 9.2% YoY and 6.0% YoY due to aforementioned ESOS expenses and tail-end of higher margin earthwork for RAPID 301/402 project.

3) One notable thing is the resilience of the construction margin which remains above 20%. This is in spite of rising raw materials and fuel price in addition to foreign worker levies and Employee Insurance Scheme implemented beginning 1 Jan 2018. For comparison, construction margin for major listed construction companies latest results:- IJM (3Q2018) 8.8%, GAMUDA (1H2018) 18.9%, SUNCON (FY2017) 7.1% and KERJAYA (FY2017) 13.2%

4) Construction book order remains at RM1.59b (3Q2018) vs RM1.62b (2Q2018). No new project was secured during the quarter.

5) For Property Development, unbilled sales at RM134m (3W2018) vs RM133.2m (2Q2018) with current projects consist of Laman View, The Vyne @Sungai Besi, Bandar Puncak Sena and Capital City

6) Yellow flag for inventories which rose significantly from RM980k (4Q2017) to RM69.1m (3Q2018), likely due to unsold completed properites arising from recently VP-ed The Vynes @Sungai Besi.

7) Expected cash bonanza from Capital Mall was not realised in the quarter. Capital Mall 21 is currently at ID (Interior Design) stage and is expected to open on 8/8/2018. Crucially, does Gadang elect for payment in kind in lieu of cash?

8) Utility division continues to bulk up in size with 9MW mini hydro project in Indonesia expected to commerce operation in 2QFY2019.

9) Financial wise, Gadang swinged from net cash position (4Q2017) to net debt (3Q2018), largely due to ramp up in spending for utility division and the completion of RM55.7m Damansara Perdana land purchase. Net debt to equity remains low at 2.6%.

Gadang is trading at relatively low valuation of TTM PE of 5.4, DY of 3.6%, Price/NTA of 0.81 and TTM ROE of 15.0%. However, construction sector is currently in the avoid list with the construction index trading well below 50 SMA, 100 SMA and 200 SMA.

Disclaimer:

A sharing of personal investment idea and thought and is not a recommendation to buy or sell.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Lau333's Journal

Created by Lau333 | Feb 26, 2018