Lau333//Corrugated Packaging Industry: ORNA @ RM1.63

Lau333

Publish date: Mon, 05 Mar 2018, 08:19 PM

This article is the finale of the previous two articles on Corrugated Packaging Industry, which are accessible from here.

Lau333//Corrugated Packaging Industry: A New Dawn

Lau333//Corrugated Packaging Industry: MUDA, BOXPAX, ORNA, PPHB & MASTER

ORNA@ RM 1.63

ORNA is SIZZLING HOT! Today, the share price closed at RM 1.63 despite a very bearish market sentiment spooked by Trump’s tariff bombshell. The share price was already on the run since 27 Feb 2017, gapped up at RM 1.39 and closed at RM 1.52, which was a 15% jump from previous day closing of RM 1.32. The hike was ahead of the official release of its 4QFY17 as investor was looking forward to a superb quarterly result.

4QFY17Quarterly Result at a glance.

- Market Capitalization: RM127.2m, PE 8.1, DY 1.5%, NTA RM2.08

- TTM Earnings +101.4%, Revenue +21.6%

- Earnings YoY +590.8%, QoQ +42.7%, EPS 6.8 sen

- Revenue YoY +26.8%, QoQ +4.6%

- Declared dividend 2.5 sen (ex-date TBD)

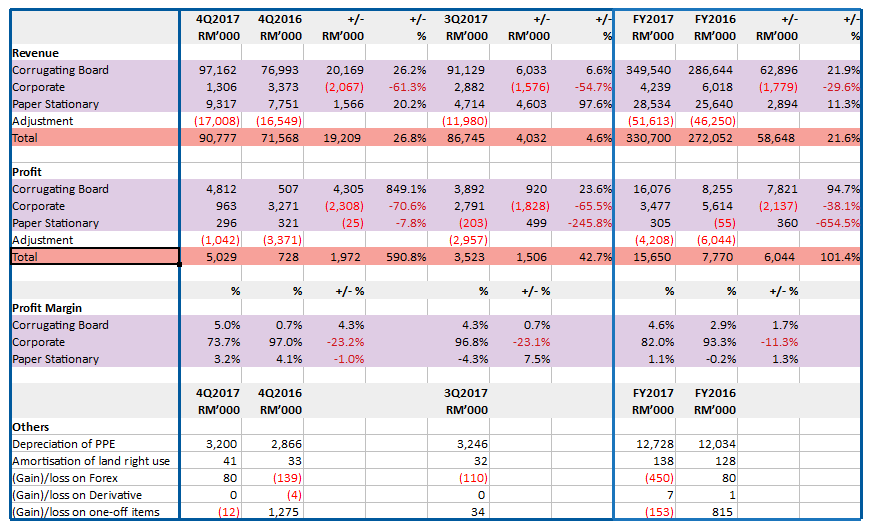

Segmental Results

Note: FY2016 is based on audited results in FY2016 AR and note 6 4Q2017 report which differs from the unaudited quarterly results 3Q2016 & 4Q2016.

Key Highlights

1. Reported all-time high record for quarterly revenue, profit and profit margin.

2. Dividend of 2.5 sen was declared for 2nd consecutive quarters. Total dividend payout for FY2017 is 5.0 sen or just 23.4% of FY2017 profit.

3. Corrugated cartons and boards have benefited on much higher average selling price (YoY +18.9%, QoQ +6.7%) and to a less extend the volume growth (YoY +6.6%, QoQ -2.0%)

4. Heavy capital spending on PPE in the last 2 years of average RM17.5m, which is almost 241% of average 2013-2015 spending. This bodes well for the expected strong demand in the coming months.

5. Registered negative cash flow of -RM11.1m for FY17, attributed partly to heavy capital spending as mentioned above and more on growth in receivables (+29.5%, inline with revenue growth) and inventories (+42.4%, raw material price increase in the earlier part of the year resulted in hoarding of raw material which peaked at 3Q2017)

Outlook

The Group maintains a positive outlook for the coming year. Will focus on managing and balancing the selling prices of cartons and material costs.

Final Thought

Of the five listed corrugating packaging companies as detailed in previous articles, ORNA performed the strongest with all-time high record revenue, profit and profit margin. MUDA's outperformance was primarily due to reinvestment allowance which resulted in RM17.9m tax income, excluding which PBT dropped -47.4% YoY. In line with international peers, the cost saving from the lower waste paper price has not yet filtered down to the downstream corrugating packaging manufacturers. Instead, the immediate impact is the resulting shortage of waste paper crimped production in China which in turn leads to worldwide increase in the price for paper and paperboard, which are used to make corrugated board. Going forward, the upstream players will not be in hurry to pass down the saving to downstream corrugated packaging manufacturers. Strong end user demand however means greater ability for corrugated packaging manufacturers to raise price in tandem.

Disclaimer: A sharing of personal investment idea and thought and is not a recommendation to buy or sell.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Lau333's Journal

Created by Lau333 | Feb 26, 2018

supersaiyan3

Totally agree! Muda is good, Orna is better!!

2018-03-05 21:40