Lau333//Corrugated Packaging Industry: A New Dawn

Lau333

Publish date: Sun, 18 Feb 2018, 06:21 PM

China's shock decision to impose ban the import of 24 solid waste materials, including certain types of plastic and unsorted waste paper on July 2017 is like an earthquake to the recycling industry. Simply put, China is the world’s largest importer of foreign waste and there is no country which has capacity and capability to be alternate decisions, at least in the short to medium term.

Demand collapse leading to substantial input costs drop..

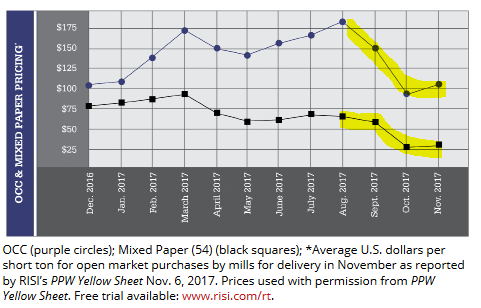

On the wastepaper recycling front, the initial reaction was an impasse even when the ban was to take effect only on 1 Jan 2018. Mountains of paper waste were piled up at deports and collection points abroad. Two months later, Old Corrugated Container (OCC) price, which is on rising trend before the announcement, reversed and dropped as much as 40% from the peak to around US$100 per ton and is consolidating around the price since then. The price reversal is the market adjustment to the ban of waste paper imports, which eliminates a key market and altered the global supply and demand dynamic.

OCC basically is used boxes and sheet of corrugated boards of various quality. It is a significant source of wood pulp fiber for paper packaging industry, ie direct raw material. On average, a corrugated box contains roughly 50 percent recycled fiber. From the cost perspective, around 80% of Cost of Goods Sold (COGS) is due to raw material, of which 95% is the paper cost.

And explosive e-commerce growth...

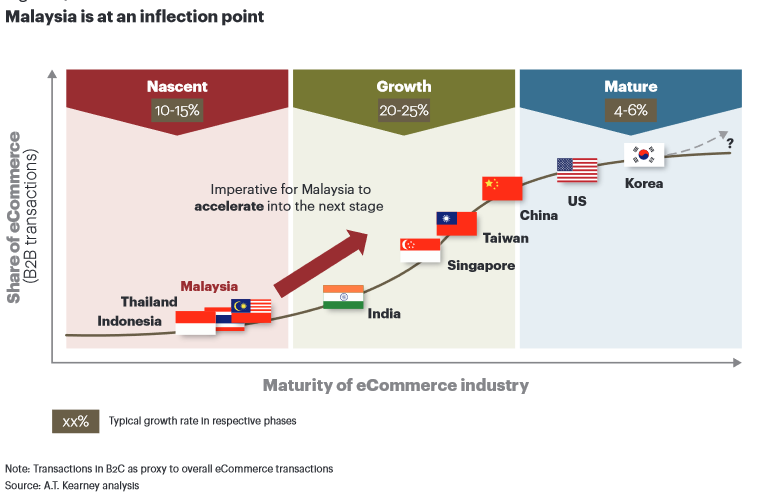

Along with a maturing Internet infrastructure, online payments and young demographics, Malaysian e-commerce is set to enter the explosive growth stage. AT Kearney estimated in 2016 that Malaysian e-Commerce is expected to grow at 11% pa from 2015-2020 under the current course and could potentially rise as much as more than double the rate with focused government interventions. Since then, digital economy has only sped up with the establishment of DFTZ while Lazada Malaysia's recorded growth of more than 100% YoY with US$250m in gross merchandise value (GMV) for its 12.12 Grand Finale Sale gives an inkling of the future potentials. The corrugated packaging industry should reap the maximum benefit from this trend. Think of it this way, in traditional retailing, one corrugated box will be used to transport several items, whereas now, each item has its own corrugated packaging and is shipped directly to customers.

The survey

A quick survey on 4Q2017 results focusing on the international peers in paper packaging industry for 4Q2017 results. The take-aways are strong demand, upward ASP but only partial benefit for raw material input decline (OCC Price topped around Aug 2017)

A new dawn on the horizon

When an equilibrium state is being unbalanced, there will be profound impacts to the competitive landscape. History is replete with examples even within the small universe of Bursa Malaysia – The collapse of oil price 2015-2016 wrought havoc and misery to O&G industries while plastic packaging players were laughing all the way to the banks; US Housing market recovery, turbocharged by ringgit depreciation 2014-2016 heralded a new golden era for local furniture industry; Under MITI protective shield imposed in 2017, local steel players found renewed vigour and prosperity. Riding on the longer-term wave of e-commerce growth with the medium-term tailwind of lower input costs due to China's recycling policies, the corrugated packaging companies, e.g Master, Muda, PPHB & Orna are poised to sail into a new dawn. These are the earlier days...stay tuned for Part 2 for insights on local corrugated packaging industry.

Disclaimer: A sharing of personal investment idea and thought and is not a recommendation to buy or sell.

More articles on Lau333's Journal

Created by Lau333 | Feb 26, 2018

Discussions

This is old corrugated container (OCC), raw material for making kraft paper roll.

http://cosmosgreenfze.com//wp-content/uploads/2017/10/OCC-Medium.jpg

And this is kraft paper roll. The raw material for making corrugated box.

https://sc01.alicdn.com/kf/HTB1uUPTHFXXXXb7XFXXq6xXFXXXa/200351047/HTB1uUPTHFXXXXb7XFXXq6xXFXXXa.jpg

There is only one listed company in Bursa will be benefit from cheap OCC price, it's MUDA PAPER. They turn OCC into kraft paper roll. (And turn kraft paper roll into corrugated box too).

Another three which named ORNA, MASTER and PPHB buying kraft paper roll and turn it into corrugated box. Their raw material is paper roll, NOT old corrugated container (OCC).

Anyway, cheap raw material (OCC) will benefit all these four companies. BUT MUDA will be benefited the most.

Let's see what MUDA management said in their previous quarter's prospect.

. Commentary on Prospects

Against the backdrop of higher sales volume, higher selling price and lower raw material cost, profitability of the Group in the next quarter is expected to be better. The Board is confident that the Group will deliver better profit in 2017.

2018-02-19 09:42

Good sharing from Lau333. Old corrugated container (OCC) which is raw material for paper roll drops a lot, almost 40% from its peak.

Corrugated Packaging Industry: A New Dawn

http://klse.i3investor.com/blogs/20102017/147710.jsp

MUDA drops from RM1.80 to RM1.20. With good prospects ahead, I think it's a good buy now.

2018-02-19 09:48

OCC recycling process. (Turn OCC into paper roll)

https://www.youtube.com/watch?v=Bx0ozMweqoU

Corrugated box manufacturing process. (Turn paper roll into box)

https://www.youtube.com/watch?v=C5nNUPNvWAw

2018-02-19 10:39

supersaiyan3

Great!

2018-02-18 21:14