Gamuda 1Q2018 Result: Need to Secure The Rail Projects Fast!

Lau333

Publish date: Fri, 15 Dec 2017, 10:43 PM

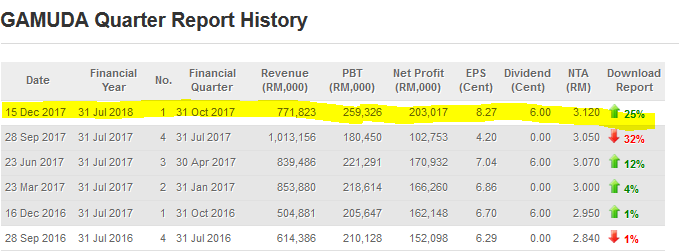

1Q2018 Results

Gamuda released its 1Q2018 result today. Revenue was at RM 771.8m, up by 52.9% YoY, but a reduction of 23.8% QoQ. Earning was reported as RM 259.3 m, which is up by 25.2% YoY and by 97.6% QoQ. EPS was 8.3 sen and Gamuda declared dividend 6.0 sen (ex-date 3/1/2018). On TTM basis, earning was up by 2.5% and revenue up by 64.5%.

Selected Sectorial Highlight

1. Construction: The outperformance was primarily due to construction segment with YoY Revenue increase by 49%, PBT increase by 95% with higher work progress from KVMRT 2 and Pan Borneo Sarawak. The outstanding construction book order is at RM 7.3b.

2. Property: Property segment recorded sales of RM903m, more than double the RM430m YoY. YoY Revenue increased by 88%, PBT increased by10%. Lower increase in PBT is due to higher upfront costs for new townships and products mix with higher share of affordable housing.

Outlook

Progress for PDP and Tunneling for KVMRT2 is currently at 11.7% and 19.5% respectively. Gamuda Gove, a property development with GDV of 129.3b is expected to be launched in Q1 2018. Revenue from infrastructure segment is stable. Although the near term earning outlook looks promising, job order for construction segment is depleting. 3 mega rail projects estimated at combined value of RM 150b is to be implemented over 2018-2025 period. To sustain the earnings momentum, Gamuda needs to secure the rail project fast!

Disclaimer:

A sharing of personal investment idea and thought and is not a recommendation to buy or sell.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-12

GAMUDA2024-07-12

GAMUDA2024-07-12

GAMUDA2024-07-12

GAMUDA2024-07-11

GAMUDA2024-07-11

GAMUDA2024-07-11

GAMUDA2024-07-11

GAMUDA2024-07-11

GAMUDA2024-07-11

GAMUDA2024-07-10

GAMUDA2024-07-10

GAMUDA2024-07-10

GAMUDA2024-07-10

GAMUDA2024-07-10

GAMUDA2024-07-10

GAMUDA2024-07-10

GAMUDA2024-07-09

GAMUDA2024-07-09

GAMUDA2024-07-09

GAMUDA2024-07-09

GAMUDA2024-07-09

GAMUDA2024-07-09

GAMUDA2024-07-09

GAMUDA2024-07-05

GAMUDA2024-07-05

GAMUDA2024-07-05

GAMUDA2024-07-05

GAMUDA2024-07-05

GAMUDA2024-07-05

GAMUDA2024-07-05

GAMUDA2024-07-05

GAMUDA2024-07-04

GAMUDA2024-07-04

GAMUDA2024-07-04

GAMUDA2024-07-04

GAMUDA2024-07-04

GAMUDA2024-07-03

GAMUDA2024-07-03

GAMUDA2024-07-03

GAMUDA2024-07-03

GAMUDA2024-07-03

GAMUDA2024-07-02

GAMUDA2024-07-02

GAMUDA2024-07-02

GAMUDA2024-07-01

GAMUDA2024-07-01

GAMUDAMore articles on Lau333's Journal

Created by Lau333 | Feb 26, 2018

pakatan_harapan2

Ini kalilah must ubah. We have GST now 6%. More projects 10% GST in future?

15/12/2017 22:58

2017-12-15 22:59