UNDERVALUED & FRONTRUNNER CSCSteel : Target Record High EPS On The Coming Quarter

Chelsea

Publish date: Tue, 18 Oct 2016, 11:51 AM

UNDERVALUED & FRONTRUNNER CSCSteel : Target Record High EPS On The Coming Quarter

Recently, shares on the steel counter have increase drastically and caught attention of many investors (Wealtwizard, moneysifu, smartrader2020, probabilty, KYY and OTB) The uptrend is just beginning due to reason as per below:

1)Global steel price rebound from the lowest

2)China’s decision to cut excess capacity by 45 million tones in Junes

http://themalaysianreserve.com/new/story/steel-prices-rise-over-10-china-cuts

3)Good outlook from Kenanga, MIDF, RHB and Thestar on end of 2016 and 2017 upward

http://klse.i3investor.com/blogs/kenangaresearch/105929.jsp

Although there are difference steel sector, what I would like to emphasize is CRC players. The major 4 CRC players CSCsteel, Mycron, YKGI and Eonmetal have risen to new high and the momentum uptrend will be continue as they going to announce the coming quarter result on November.

CSCsteel is the frontrunner which huge pile of cash flow, largest producer CRC and highest dividen yield. I have done a quick analysis on the coming quarter CcsSteel end 30/9/2015.

More upside potential for CSCSteel due to reason as per below:

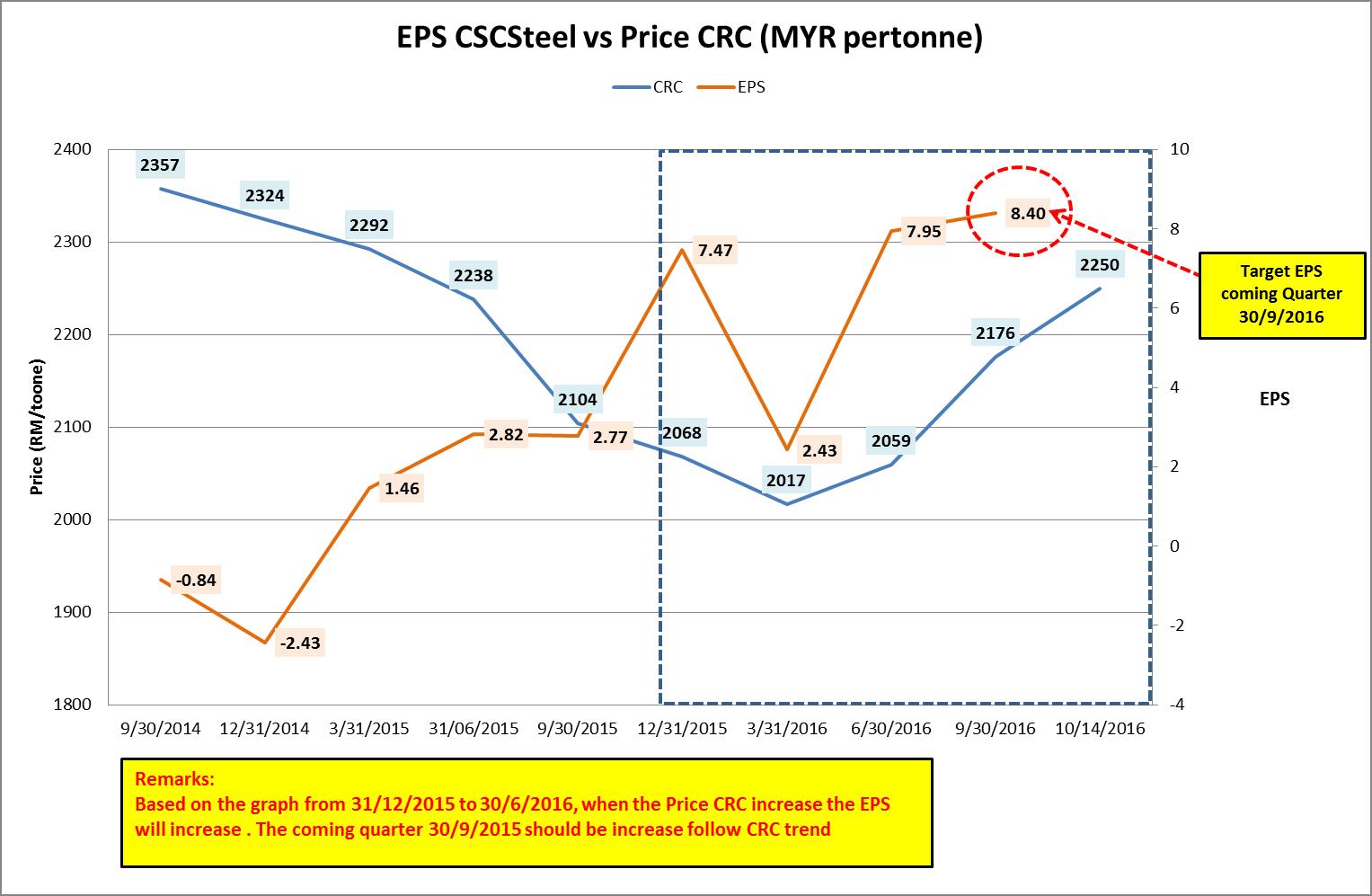

1)My target EPS for coming quarter (30/09/2016) is more than 8 (around 8.40) which increase 200% compare with previous quarter (30/09/2015) which is 2.77

When the price of CRC (31/12/2015) is 2068 and (30/06/2016) is 2059, the EPS is 7.47 and 7.95 respectively. The price CRC (30/9/2016) which higher at 2176 by logically will record EPS above than 8.

a)Table EPS versus CRC price (MYR/Tonne)

|

Quarter |

CRC price (MYR/Tonne) |

EPS |

Remarks |

|

30/09/2014 |

2357 |

-0.84 |

|

|

31/12/2014 |

2324 |

-2.43 |

|

|

31/03/2015 |

2292 |

1.46 |

|

|

31/06/2015 |

2238 |

2.82 |

|

|

30/09/2015 |

2104 |

2.77 |

|

|

31/12/2015 |

2068 |

7.47 |

|

|

31/03/2016 |

2017 |

2.43 |

EPS drop as CRC price drop to lowest |

|

30/06/2016 |

2059 |

7.95 |

EPS rise due to CRC price rebound from 2017 to 2059 and Megasteel halted production and supply in Feb 2016 |

|

30/09/2016 |

2176 |

8.40 (ESTIMATION) |

Estimation coming quarter > 8 due to increase 5.7% of CRC price from 30/6 to 30/9, antidumping start on 24 May 2016 to 23 May 2021, closure of Megasteel and bigger spread of CRC and HRC price |

|

31/12/2016 |

Need to monitor |

Will update on 31/12/2016 |

|

b) Estimation Coming Quarter EPS

2)By combine the estimation coming quarter EPS, the annualized EPS will be 26.25. Taking a very conservative PE 10 as a steel frontrunner, it will generate the FIRST TP RM2.60

3)Megasteel halted production and supply in February 2016 and The management's decision to fully shut down its RM3.2bil plant effective from Aug 30 until further notice. That mean, CRC player will save RM400 premium as they can source cheaper HRC raw material from China http://www.thestar.com.my/business/business-news/2016/09/10/megasteel-closes-banting-plant/

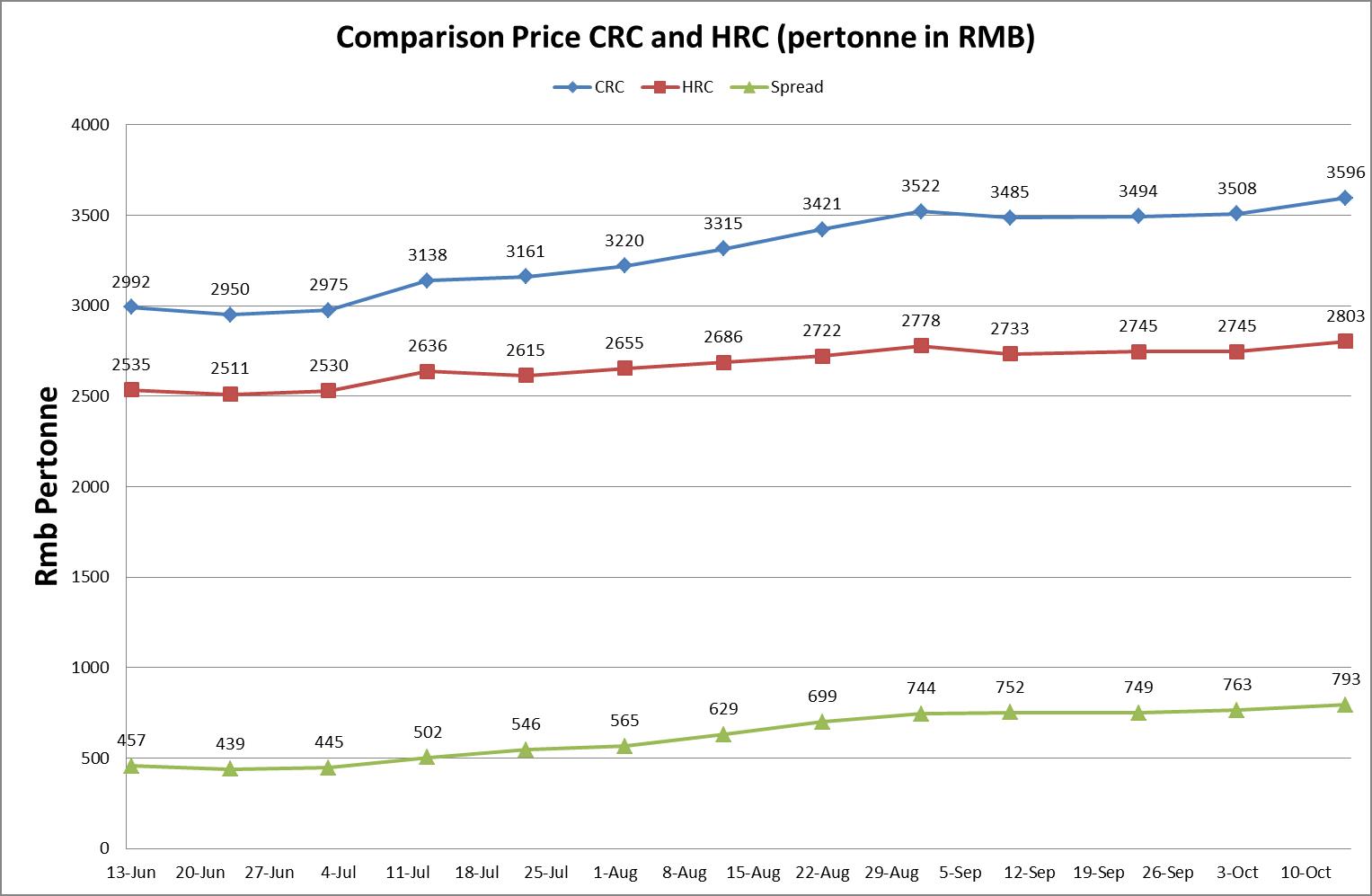

4)The spread CRC and HRC increase from 457rmb (13 Jun 2016) to 793rmb (14 Oct 2016) by 74%. The bigger spread the more profit as CRC player can use lower material price HRC to convert to higher price of CRC.

5)Believe now the cscsteel in wave 3 according to major 5 wave theory

Remarks : Technical Chart for Kenanga R1 (2.10) and R2 (2.25)

Thank you and happy invest

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

Discussions

Ricky Yeo, if a share price can solely be determined DCF or any kind of calculation/method, then you must be billionaire.

2016-10-18 23:11

Ricky, when a doctor said the chance of surviving is 80% for a simple surgery, what is the chance of dying?

2016-10-18 23:13

Or should I change my question, if doctor said chance of getting dead is 20%, will you still want to go ahead with the surgery?

2016-10-18 23:14

Fair comment, zefftan, many do not know, so when result out, time to collect again. It's always like that.

Posted by zefftan > Oct 18, 2016 11:09 PM | Report Abuse

beware of q3, might not up to expectation

2016-10-18 23:21

KLCI King, no one will be billionaire using DCF. But it is way robust than using PE 10, and that means richer. Trust me.

Well, of course I'll ask my probability of dying for not going ahead with surgery duh. If that's 90%, would be pretty dumb to go surgery right?

2016-10-19 06:57

Good, Ricky, so now, if the chance of going down is 40% & up is 60%, will you buy? Or you rather wait until 90% then only you buy?

2016-10-19 10:38

As you have mentioned somewhere that market is part art part science, sometimes % is just a general calculation for chance, it does not guarantee anything.

See the one who died on the dental clinic, no one expected that but it just happened this way.

When it is too relying on % to make investment, it will divert the attention from looking at the bigger picture.

I believe most successful businessmen are taking risks on their daily business decisions, after calculating all risks & rewards.

That's the job of accountants to advise. That's the reasons most accountants are working for businessmen.

2016-10-19 10:46

Yea you're right, one needs to have a good grasp of the magnitude and frequency of both upside & downside. All business looks at the bigger picture, the story or narrative ie. let's move into adjacent market, expand etc, but ultimate they have to simplify it to a yes or no answer to go ahead. How do they do that, most use net present value NPV, by calculating capital outflow on year 0 (present) and cash inflow from the investment return every year after for say, 10 years. NPV applies the same principle as DCF.

2016-10-19 10:57

Ricky, thank you for reply, we as investors are always handicapped when come to investment in stock markets.

Most people don't realise that many of us have to rely on all information made available via newspapers, announcements & reports from the management and we have to rely on the credibility of the those so called directors, even though we know that many of them are having low morale.

2016-10-19 11:07

All calculation/methods are merely tools used to reduce the risks of making mistakes but these are not decisive when come to share investment. People is still the key factor.

2016-10-19 11:09

KLCE King, Yes, you are right, beside looking at the figure, you have to look at chair person and the management team. For CSCsteel so far very reliable

2016-10-19 11:26

Tools are not be all end all. You're right the person using the tool is the key. Anyone can manipulate a tool to work the way he wants, PE 10 would win the most abused tool in financial industry hands down.

If a person choose to be ignorant, no tools save that man, not even Thor's hammer. And look at this page, how many people is expressing constraint and thread carefully? None.

2016-10-19 11:36

From the spread alone, 13jun RMB457 12sep RMB752 difference is RMB295 equivalent to RM183/ton which is the figure CSCstel capable of making profit for coming quarter.

Taking 70% capacity utilization, coming quarter CSCsteel will able to produce 108500 ton. The equivalent additional profit should be 19.8 millions or EPS 5.2 sen

If average of EPS is assumed with additional profit, the next quarter EPS should be 9.35

2016-10-19 11:43

aiya Ricky...if i am sure about the near term earnings...whats the harm in giving PE 10? Its kinda useful when you estimate your rewards giving a dividend payout of say 50%....

and in no way anyone can predict correctly long terms returns....

if one is to really use the correct-realistic figure...i dont see why they should use a figure more than the GDP growth rate of say 4% only...as the ROC itself....unless they have the ability to make an in-depth analysis of the business...and its long term competitive advantage. Who can do that?

I think 99% investors cant...and they are not interested also...furthermore what certainty we have on the long term returns?

...the uncertainty builds up exponentially the longer - your 'time frame' of estimates.

2016-10-19 11:58

no doubts, company share price will be reflected by the company management. all business will be subject to up and down but a good management will do their best to protect the company interest which will flow to shareholders finally;

one good indicator for a company, is the amount of dividend paid to shareholders. this reflect the company commitment to all shareholders.

csc steel dividend record;

2006 - 5 sen less 28% tax

2007 - 10 sen less 27% tax

2008 - 18.5 sen less 27% tax

2009 - 2 sen less 27% tax

2010 - 20 sen less 26% tax

2011 - 13 sen

2012 - 7 sen

2013 - 7 sen

2014 - 7 sen

2015 - 3 sen

2016 - 8 sen

csc should be treated as a blue chip as

1) market leader in cold roll coil in malaysia

2) never fail to pay dividend even during bad/difficult times

3) the management remunarations are extremely reasonable. pls check yourself. even some lousy losing money ACE companies COO salary is higher.

there is only ONE risk investing in CSC.

(UNFAVOURABLE LOCAL BUSINESS CONDITION LIKE THE PAST WITH MASSIVE DUMPING FROM CHINA)

WITH THE ANTI DUMPING EFFECTIVE FOR 5 YEARS DOWN THE ROAD FROM 2016, THE ROAD IN FRONT IS CLEAR OF UNNNECESARY HURDLES

2016-10-19 12:09

The idea of assigning a PE multiple is because you think the market will agree with your view and push the share price to that multiple right?

If market disagree with you what's the point of this whole exercise.

I don't make the market, no one wants or can predict long term but that is how a market is. Market says it is extremely hard to make money following the 95%, yet no one wants to be a contrarian.

2016-10-19 15:08

By looking at the article & all comments, am I too conservative?

CSCSteel = PE7

Mycron = PE5

http://klse.i3investor.com/files/my/blog/img/bl2751_table_2_1.jpg

http://klse.i3investor.com/blogs/wealth123/103812.jsp

2016-10-19 15:17

Under estimate with over deliver FAR SUPERIOR than over promise with under delivery.

I like your conservative ways of projecting things, realistic targets.

2016-10-19 15:22

For your information the price update from http://www.sunsirs.com/uk/prodetail-318.html is always late one or two day.

To get the fastest update, please get the value from the graph http://www.sunsirs.com/uk/prodetail-318.html

Latest hrc is 2820 and crc is 3670 (approximate value from the graph)

Spread increase to 850

2016-10-19 17:38

does contrarian wait for margins to be negative again?

http://www.bloomberg.com/news/articles/2016-10-19/chinese-steel-mills-defy-calls-for-cuts-as-production-expands

2016-10-19 18:54

does contrarian believe all the margins will eventually revert to mean..4%?

Say now the margin is only 2%....we estimate based on long term returns of 4%... and found it to be dirt cheap - say its selling one third of its Intrinsic Value...does that ensure we will get a good return in the future? Is that contrarian thinking?

Is it not possible for the company to turn out to be like Megasteel & close-shop?

Megasteel was build 20 years ago....didnt the businessman have ability to forecast its long term competitiveness? If he cant....how can investors like us do?

How do we know we are contrarian to the majority?

2016-10-19 19:45

You dont become one by doing the opposite of the majority; you become one when you know how little you know

2016-10-19 20:36

ykloh, ttb will be right one day, only not sure WHEN, may be 1,2 or in next 10 years. Then he will shout loud loud: SEE, I TOLD YOU GUYS, MARKET CRASH

ykloh king of the contrarians : ttb.

19/10/2016 21:09

2016-10-19 23:16

lets not apply 'contrarian' on anyone. Ego aside, TTB managed a fund, something you should respect him for.

The message im trying to deliver is - look for contradictory information. You don't need to encourage a teen to have more sxx do you

2016-10-20 06:33

I respected him before 2000, lost total confidence after 2000, that's fact.

Yes, optimus.

2016-10-20 07:29

Can u make rm6m+ every year by helping people to invest their money in fd?

2016-10-20 08:03

Lastest update (Rough estimation from graph)

CRC 3710 rmb (RM2300 based on conversion 0.620)

HRC 2830 rmb (RM1755 based on conversion 0.620)

Spread 880 (Break record)

RM2300 (Break record)

Thumbs up for Cscsteel and Mycron

2016-10-20 17:19

Not only the Spread helps....

if they report on re-valuation gain on their Inventories..due to the rising HRC / CRC / Steel rice generally....it will be phenomenal!

2016-10-20 18:10

but...all these information are very easily available to the majority....we have to be 'contrarian' and find information that is not easily accessible to everyone & only then buy if its a positive information.

So...dont buy...how on earth did you get a sky high PE of 10?

2016-10-20 18:15

coming 1/4 wont beat previous 1/4 buy y2y still a mark of improvement...mark my words 4/11/16

2016-11-04 09:28

Chelsea....y2y basis it'll be good...this q results will be slightly lower compare to previous...that what I can say. Just wait for the results and see...it'll be good to start buying into it again after this q results...

2016-11-07 09:55

Is EPS(F) of 8.4 sen for this coming 3rd quarter worse than the previous 2nd quarter of 7.95 sen?

2016-11-07 20:41

so the results is out...it didn't beat last quarter right?...where do we go from here? For those who are holding I say sell and wait for cheaper entry.

2016-11-17 08:45

my email is henli.chin@gmail.com. really appreciate your kind favour if you can give some hints. tq in advance. :)

2016-12-20 18:09

zefftan

beware of q3, might not up to expectation

2016-10-18 23:09