AGES RI: Dilution losses if No Action

BLee

Publish date: Sun, 10 Jul 2022, 02:45 PM

Without doubt, Right Issue (RI) will cause dilution losses if RI price below market price and No Action to Anti-Dilute.

Below is my discussion with a Forumer how action taken for the Anti-Dilute and bringing down the average investment cost.

"@Forumer: At current price, it is only 0.019 (0.285/15) prior to consolidation.

Still a very huge drop for those who bought months prior to the consolidation.

BLee: Hi Bro @Forumer, you are correct if you did nothing after the consolidation. Let's say before consolidation of 0.03 x 15 equal 0.45 and pick-up RI of 2 x 0.2, total cost will be 0.85. Average will be 0.28; that will be the present reached price.

The moral of this discussion is the need to act upon news of consolidation and RI.

If whoever has $ to pick-up RI and the excess shares, good for cost averaging. If whoever doesn't want to add capital can always cash out after RI news or sell AGES-OR during the five days offer period and reinvest the $. It is just a decision needed to make. There is a lot of chance to buy below the RI price of 0.2??

Happy trading and TradeAtYourOwnRisk"

"Forumer: Hi BLee: To have an average cost of 0.28 today, it means your cost prior to consolidation is around 0.03. This is assuming RM100,000 has been invested before consolidation and later subscribed the RI fully."

My cost is 0.145 before consolidation, and averaged down @0.200 (post consolidation) to arrive at cost around 0.5 today. I did not subscribe to RI but bought from open market at a volume higher than the rights subscription."

"BLee: Hi @Forumer, my average cost is very much lower than yours. I have cost averaging before consolidation but higher than 0.03 for mother shares. I also bought AGES-PA at the lowest of half sen as posted in one of my articles. After consolidation, I have done cost averaging again by buying AGES-PA. It is very difficult to calculate what the average holding cost due to 2 different investments; only can monitor by investment $. Instead of investing RI of 0.2, the $ from selling AGES-OR at half sen is enough to cover the earlier half sen AGES-PA investment and buy more. This lower cost investment is another way to bring down my average cost. Does it make sense?

Note: 5D-VWAP of the Shares up to and including 15 April 2022 (being the last trading day prior to the Price-fixing Date) of RM0.3581 which is lower than 0.03x15. If it reaches RM0.3581, most probably will be my break even cost.

Happy trading and TradeAtYourOwnRisk."

The Forumer is lucky as he is able to trade below the RI price 'volume higher than the rights subscription'. The best bet is to subscribe to the RI with excess shares if financial is not a problem.

My preference is to invest with lower value with high volume in a bearish market. Therefore I have traded in AGES-PA at the lowest of half sen prior to the consolidation as shown in my article link: https://klse.i3investor.com/web/blog/detail/AGESPA/2022-03-23-story-h1620415903-AGES_PA_The_risk_of_RI_adjustment_decoded

After consolidation, this half sen is equivalent to 7.5sen. Did I make a wrong choice? On value consideration is yes as AGES-PA traded around 4sen last Friday 8 July. Since AGES-PA is an Anti-dilution instrument, the conversion price has been adjusted from 1.95 to 1.03. The mother share price also went up from a few sen to 28.5sen.

Below are few snapshots for a clearer picture:

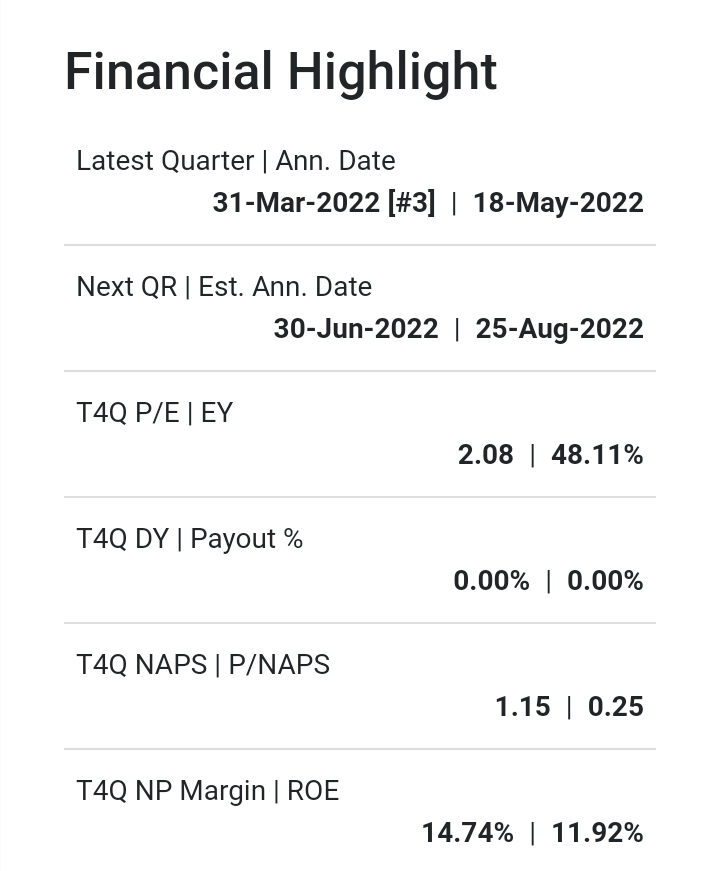

Snapshot 1: The Financial Highlight before Consolidation and RI. The next QR most likely 15/2 i.e. improved by 7.5 times considering 25sen NPS vs 20sen for RI.

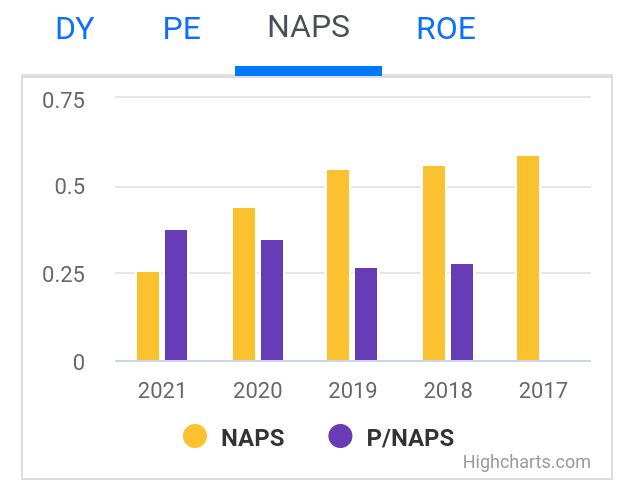

Snapshot 2: Very good trend NPS and P/NPS for the last few years.

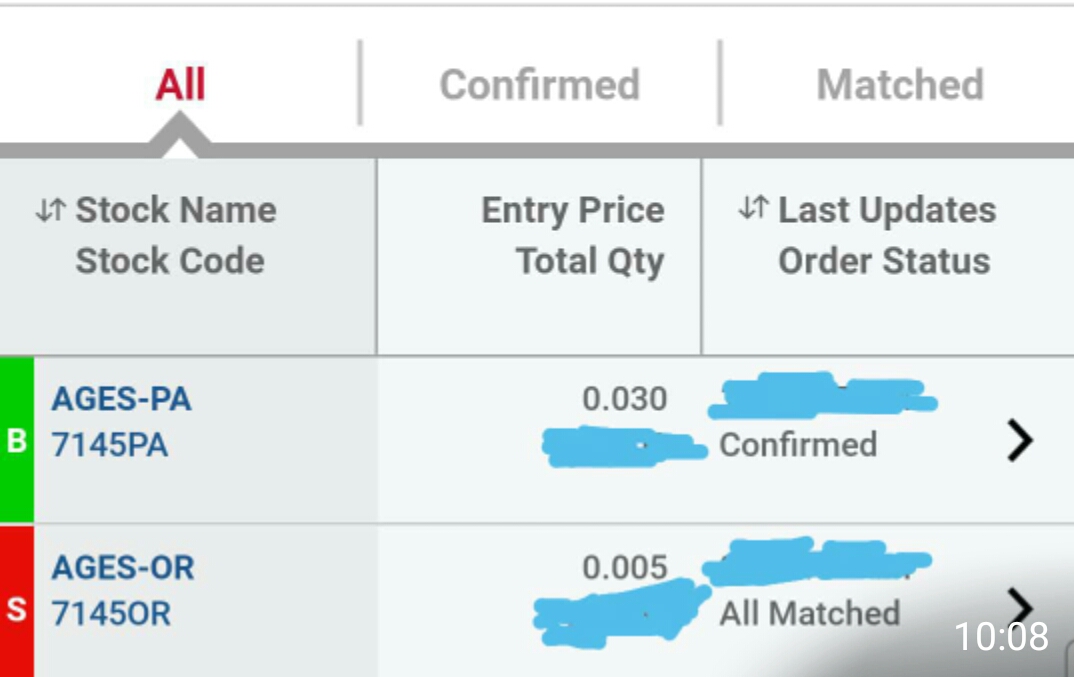

Snapshot 3: The flip from AGES-OR to AGES-PA

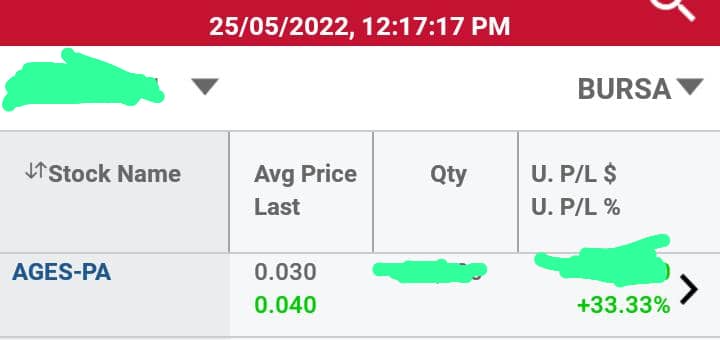

Snapshot 4: AGES-PA average cost with another IB beside the half sen traded earlier.

Sources: i3investor, KIBB and other internet surfing.

Happy trading and TradeAtYourOwnRisk.

Disclaimer: The above opinion does not represent a buy, hold or sell recommendation; just a personal opinion and for sharing purposes only. Any offences and errors are unintentional; my apology in advance.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|