Mplus Market Pulse - 18 Dec 2024

MalaccaSecurities

Publish date: Wed, 18 Dec 2024, 11:34 AM

All Eyes On Fed

Market Review

Malaysia: The FBMKLCI (-0.59%) extended its losses, retreating below the key 1,600 psychological level, as Industrial Products & Services heavyweights like Press Metal Aluminium were weighed down by weakened global market sentiment, reflecting a typical off-season trend, which potentially pressured aluminium prices lower.

Global markets: While November retail sales data came in stronger-than-expected, amid the holiday season kicking off, Wall Street ended the day on a negative note ahead of tonight's FOMC meeting. Meanwhile, both the European and Asian markets closed in negative territory.

The Day Ahead

The FBMKLCI continued to trend lower for second session after PMETAL weighed on the sentiment. In the US, November retail sales exceeded expectations, indicating that the economy remains on a growth trajectory. This data had no impact on the FOMC meeting outcome and traders are pricing in a 25 bps cut. Furthermore, traders will closely monitor several key data releases, including (i) US GDP, (ii) Unemployment Claims, (iii) Core PCE Price Index, and (iv) the BoJ monetary policy conference. In the commodities market, Brent crude oil traded around USD72-73 as weak demand from China limited the upward momentum. Despite stronger retail sales, gold prices traded flat around the USD2,650 mark, while CPO prices continued to retreat for another session, trading below the RM4,700 level.

Sector Focus: We believe window dressing activities may continue to support overall market conditions. Also, under the strong USD environment, we like stocks within the export segment, while the data-center supply chain related stocks could see increased trading activities amid investments by MNCs earlier this year. Meanwhile, ARMADA has been building strong momentum following its agreement with MISC to explore merger of offshore business, which could lead to earnings expansion.

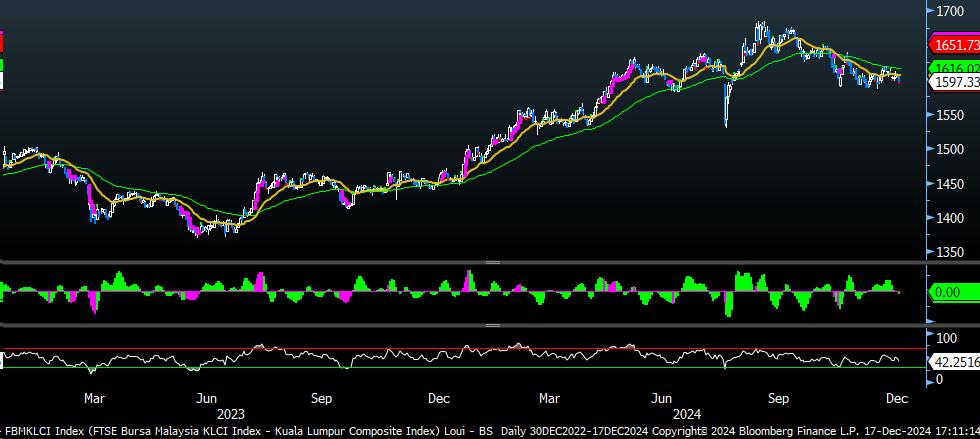

FBMKLCI Technical Outlook

The FBMKLCI continues to retreat after hitting the 60-day MA line. As the MACD histogram has formed a new negative bar and the RSI has trended below 50, this suggests that the momentum is negative at the current juncture. Resistance is anticipated around 1,612-1,617, and support is set at 1,577-1,582.

Company Briefs

Target 1 Sdn Bhd has accused South Malaysia Industries Bhd (SMI) of not cooperating in facilitating the extraordinary general meeting (EGM) scheduled for Jan 9, 2025 and the mandatory takeover offer for SMI. Target 1 requested SMI's record of depositors to dispatch the EGM notice but has not received the information. Despite this, Target 1 remains committed to ensuring the EGM proceeds and will take necessary legal actions to move forward. (The Edge)

Scientex Packaging (Ayer Keroh) Bhd (SCIPACK) reported a 62.4% decline in net profit for 1QFY2025, falling to RM2.9m from RM7.7m in the previous year, primarily due to foreign exchange losses. Revenue rose 3.6% to RM179.3m, driven by higher export sales, which contributed 48.4% of total revenue. However, operating profit dropped 51.1% to RM5.7m due to higher input costs and an unfavourable sales mix. The company experienced a RM3.9m foreign exchange loss, compared to a gain of RM687,000 last year, leading to a decline in operating margin from 6.7% to 3.2%. (The Edge)

Cash-strapped KNM Group Bhd's (KNM) German subsidiaries in the Borsig Group have secured a €60m (RM280.4m) credit facility from Landesbank Baden- Württemberg and other lenders, ensuring continued operations. The facility replaces a previous agreement with IKB Deutsche Industriebank AG that expired on Monday. It has a three-year tenure with two optional one-year extensions and an option to increase the amount by €40m. (The Edge)

Jewellery retailer Poh Kong Holdings Bhd's (POHKONG) 1QFY2025 net profit increased by 12.3% to RM21.34m from RM19m a year earlier, driven by higher gold prices. This is despite a 7.5% year-on-year drop in revenue to RM329.28m from RM355.98m due to lower demand for gold jewellery and investment products. No dividends were declared for the quarter. (The Edge)

Kumpulan Perangsang Selangor Bhd (KPS) has appealed a RM7.9m capital gains tax (CGT) assessment and penalty issued by the Inland Revenue Board to its subsidiary Bold Approach Sdn Bhd. The tax, based on proceeds from the divestment of Kaiserkorp Corp Sdn Bhd, includes RM5.44m in CGT and a RM2.45m penalty for non-filing. The amount must be settled by Dec 28. (The Edge)

The High Court has ruled in favour of Ahmad Zaki Resources Bhd's (AZRB) 51%- owned unit, Betanaz Properties Sdn Bhd, in a tenancy dispute with Aeon Co (M) Bhd. Aeon was found to have "wrongfully terminated" the agreement and was ordered to pay RM18.7m in damages, with a 5% annual interest from March 2021, as well as RM200,000 in costs within 45 days. Aeon's counterclaims were also dismissed and it was ordered to pay RM100,000 in costs to AZRB. Additionally, a separate bank guarantee suit filed by Aeon was dismissed, with damages assessment pending. (The Edge)

Loss-making PUC Bhd (PUC) is acquiring Alevate Solutions Sdn Bhd (ASSB) for RM100m, funded entirely by issuing 800m new shares at 12.5 sen each, a 212.5% premium to its recent closing price of 4 sen. This deal replaces an earlier RM200m agreement to buy both ASSB and Alevate Capital Sdn Bhd, which was scrapped over pricing disagreements. After the acquisition, ASSB's sole shareholder, Tham Lih Chung, will hold a 22% stake in PUC's enlarged share capital. (The Edge)

TXCD Bhd (TXCD), formerly known as Ageson Bhd - and before that Prinsiptek Corp Bhd - said its largest shareholder, Datuk Seri Liew Kok Leong, has sold his entire 15.56% stake, totalling 48.5m shares, to Chew Swe Siew on Dec 13. The shares, held directly and through Ukay One Sdn Bhd, were valued at approximately RM4.36m based on the company's 9 sen closing price. With Liew's exit, Chew becomes TXCD's sole substantial shareholder. (The Edge)

ACE market-listed VSolar Group Bhd (VSOLAR) plans a share capital reduction of up to RM100m to offset its accumulated losses of RM95.38m as of Sept 30, 2024. Following the reduction, the company will retain net earnings of RM4.44m. Its issued share capital currently stands at RM192.39m, comprising 497.25m shares and 168.05m outstanding warrants. (The Edge)

Infrastructure utilities engineering services provider Jati Tinggi Group Bhd (JTGROUP) will supply and install photovoltaic solar panel systems at 135 Public Bank branches for RM14.88m. The project, covered under an MOU between Jati Tinggi Holding Sdn Bhd and Public Bank, involves 333 properties and is expected to be completed within three years. (The Edge)

PT Resources Holdings Bhd's (PTRB) net profit for 2QFY2025 dropped significantly to RM1.68m, down from RM18.7m in the same quarter last year. The decline was due to lower local sales and a 50.9% increase in administrative expenses, which rose to RM12.2m. The company also experienced an unrealised foreign exchange loss of RM1.9m, compared to a gain of RM4.2m previously. Quarterly revenue dropped 18% to RM91.6m, mainly due to a change in product mix leading to the sale of lower- margin products. (The Edge)

Sapura Energy Bhd (SAPNRG) has received its fourth deadline extension from Bursa Securities to submit its regularisation plan to exit its PN17 status. The new deadline is May 31, 2025. The company entered PN17 status on May 31, 2022, and had an initial deadline of May 31, 2023, for the plan. Outgoing CEO Datuk Anuar Taib previously stated that the company aims to exit PN17 by 2026. (The Edge)

Source: PublicInvest Research - 18 Dec 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-01-18

SAPNRG2025-01-17

JTGROUP2025-01-17

JTGROUP2025-01-17

JTGROUP2025-01-17

JTGROUP2025-01-17

KPS2025-01-17

POHKONG2025-01-16

AZRB2025-01-16

AZRB2025-01-16

AZRB2025-01-16

POHKONG2025-01-16

POHKONG2025-01-16

POHKONG2025-01-15

SMI2025-01-14

SAPNRG2025-01-14

SAPNRG2025-01-14

SAPNRG2025-01-13

KPS2025-01-13

KPS2025-01-13

KPS2025-01-13

SAPNRG2025-01-10

SMI2025-01-10

SMI2025-01-10

SMI2025-01-09

AZRB2025-01-09

AZRB2025-01-09

AZRBMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Jan 08, 2025

Created by MalaccaSecurities | Jan 08, 2025