Alam Maritim Resources Berhad Is a Cancer Patient Requiring ICU with Diagnosis RM 0.02

Robert Waters

Publish date: Fri, 14 Jun 2024, 01:08 PM

First clear alarm bell of Alam Maritim’s grave condition as a company was the announcement from 30.11.2021 that it triggered PN17 criteria and became a distressed business. As misfortunes come in pairs, two conditions were triggered: disclaimer of opinion by the auditor of a material uncertainty, and the announcement that shareholders’ equity dropped below 50% of shares capital. There was another disclaimer from a new auditor the following year too. Shocked shareholders soon also found out that the debts are in default as well, triggering yet another criterion. Clearly the company was in a catastrophic state; however, covid pandemics allowed the management to do NOTHING about this, without the consequences from the Bursa.

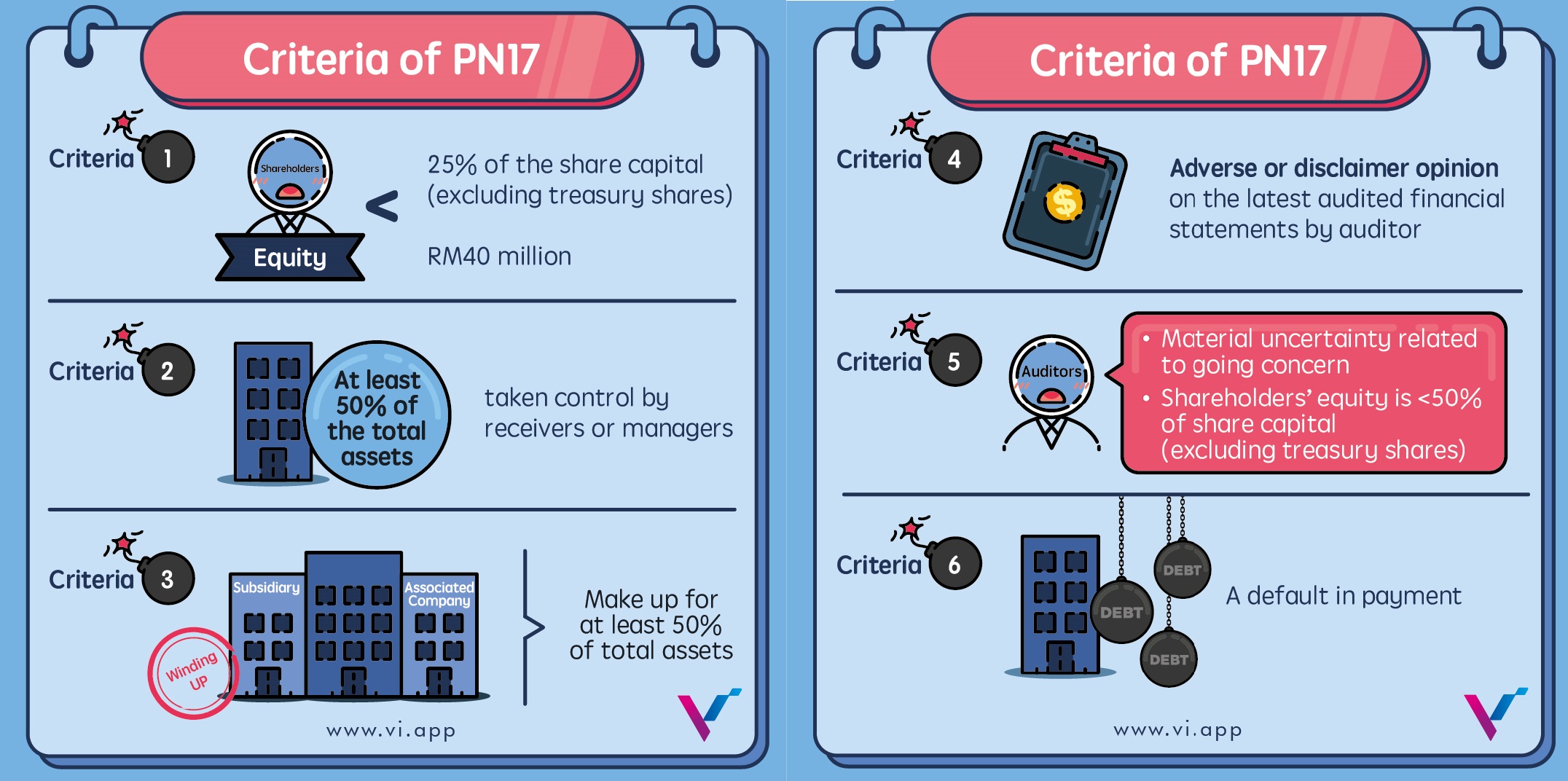

A very gloomy future formed for Alam. Bursa Malaysia has a special process for companies in distress when they meet even one crteria below:

1. Shareholders’ fund is equal to or less than 25% of the total issued and paid-up capital of the listed company.

2. Receivers or managers were appointed to take control of at least 50% of the total assets employed.

3. Winding up of a subsidiary or associate company which makes up at least 50% of the total assets employed of the listed company.

4. Auditors expressed adverse or disclaimer opinion on the listed company’s latest audited accounts.

5. Default in payment; the listed company must announce its inability to provide a solvency declaration

6. Company was suspended or ceased all or a major part of its operations

Alam clearly triggered conditions 1, 4, and 5; and thus became a new Serba DK on the road to delisting. There are 30 or so other companies in that group today. Sapura Energy, Barakah Offshore Petroleum and Scomi Group Berhad are the peers on the list in various stages of the regularisation / delisting process.

As a PN17 company Alam must:

1. Remedy its condition.

2. Submit a regularization plan.

3. Implement the plan.

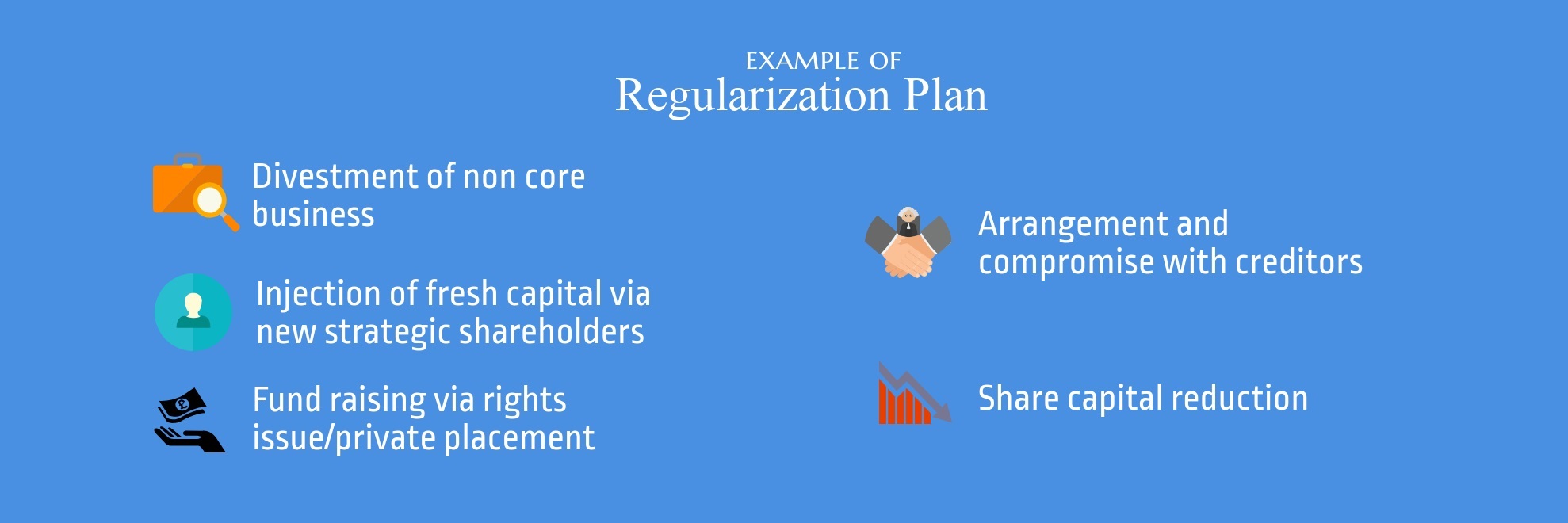

The contents of the regularisation plan need to address the triggering conditions. Typical exercises performed to regularize the conditions are:

1. Settlement of debts with creditors

2. Reduction of capital to cancel accumulated losses

3. Onboarding of new investors (white knights) via issuance of new shares

4. Sale of assets

5. Issuance of free warrants and right shares to retain old investors

6. Establishing an Employees Share Scheme (ESS)

It is common to compare a distressed company with an unhealthy person. The condition of Alam is that of a patient with severe heart problem and cancer on top of it, requiring immediate Intensive Care and surgery after stabilizing in the ICU.

The question before shareholders is what the Management of the Company is doing in face of such a calamity? Clearly, decisive actions shown above are required. Many experts maintain that the longer this state persists, the less chances for the successful return to normal operating status of the business.

Alam Maritim chose a different path. They delayed and applied for the extension of the time to submit a Regularisation Plan. Three years now passed and NOTHING was accomplished to exit PN17. A sad situation indeed.

According to an old Bursa report 7 out of 41 companies categorized as PN17 were successful in exiting the distress, while 34 were delisted. This gives a company statically a 17% chance of returning to normal operation, if actions are immediately taken. Alam may already be beyond that point. And as it was valued about 10 sen before troubles became apparent, it should return to this value after restructure. As the chances of it are 17%, Alam value per above statistics is now 0.17 x 10 sen = 1.7 sen

No wonder it was trading at 2 sen recently. Its fair value.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|