Astro Malaysia - Extensive reach underpins its resilience

AmInvest

Publish date: Wed, 19 May 2021, 08:55 AM

Investment Highlights

- We maintain our BUY recommendation on Astro Malaysia Holdings (Astro) with unchanged forecasts and fair value of RM1.83/share (WACC 8%, terminal growth rate 0%) after attributing a 3% premium to share price to reflect a 4-star ESG rating as appraised by us (Exhibit 3). Astro is a constituent of the FTSE4Good Bursa Malaysia Index.

KEY ESG METRICS

o Energy efficiency: In reducing its environmental footprint, Astro has managed to: (i) reduce its annual greenhouse gas (GHG) intensity by 8.9% to 5.2 tCO2 in per RM mil of revenue in 2019; (ii) harvest over 1.7 million kWh of photovoltaic energy utilising its solar panel system; (iii) reduce electricity and energy consumption by 16% to 33.7 million kWh (equivalent to 10% reduction in GHG; (iv) commission rainwater harvesting system in its new office building with a capacity of 13.5K litres; and (v) reduce water consumption by 8% to 130,560m3.

o Recycling and waste management: Astro refurbishes and redeploys set-top boxes (STBs) with improved design to reduce its environmental footprint and engages an eWaste disposal and recycling partner certified by the Department of Environment. The group has recycling bins within its compound and uses shuttle buses for daily commute between offices and the nearest public transport station, equivalent to the benefits of planting over 2,300 trees or recycling 31 tonnes of waste. The group also implements 3R (reduce, reuse, recycle) at its cafeteria to minimize the use of plastic.

o Content management: The group invested over RM360mil in FY20 in the production of local content and commissioning to hone local talents’ skills and strengthen the local ecosystem. Astro also works closely with regulators in tackling digital piracy and educating the public to consume only legitimate content. Astro commissioned and produced 11.3K hours of content in FY20, making it Malaysia’s No. 1 content creator.

o Digital transformation: Astro has established its Strategy and Business Transformation Committee (SBTC) that meets up monthly to oversee its strategies and transformation projects. The group also embarked on a 3- year programme with Singapore-based General Assembly to enhance the digital skillset of its workforce.

o Customer reach and experience: The group has an extensive reach among Malaysians across TV, radio, digital and commerce with a 75% household penetration through pay TV and NJOI in FY20. In FY20, the group chalked up a strong radex share of 80% with its radio brands maintaining their No. 1 position in every major language. Its top digital brands include Awani, Gempak, and Xuan. Meanwhile, its home shopping registered 2.2mil customers in FY20 (up 25% YoY) with over 1 million monthly active users on digital despite the softer economic sentiment. Astro harnesses its data models and analytics to predict and better manage churn rates, offer insights into customer behaviours, product performance and service measurement.

o Corporate social responsibility: The group has long-term programmes run by its foundation Yayasan Astro Kasih which was set up in 2012 to focus on lifelong learning, community development, sports and environment. Among them are: (i) Kampus Astro, a learning programme that is free to all government schools, 76 pediatric and oncology wards, schools in hospitals and military hospitals; (ii) complimentary 24-hour access to learning channels on Tutor TV via its pay TV and NJOI platforms; and (iii) the 8th instalment of Astro Kem Badminton in FY20 which has seen participation of 16K children since inception, where more than 70% of the current batch of 77 junior national players graduated from the programme.

o Human capital development: Implemented its Safety Passport programme which mandates installers and vendors with high-risk tasks and services to undergo the relevant occupational safety and health (OSH) training organised by the National Institute of Occupational Safety and Health (NIOSH). This has led to a low accident rate of 0.19 per 1K employees vs. the national average of 2.93 with no fatal accidents reported in the last 3 years. The group conducts in-house training and online courses to develop its corporate talent, clocking 5.5 hours of training per employee in FY20. Astro has won the Most Popular Graduate Employer in Broadcasting and Media Sector award for the 8th time in 2019, among other accolades which show that it is the employer of choice for top talents.

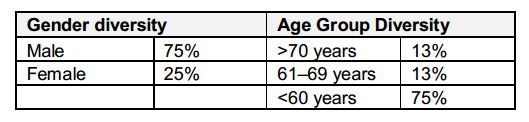

o Board composition: As at 31 January 2020, Astro’s board comprises eight directors of which three are independent nonexecutive directors including the chairman, and five non-independent non-executive directors. The group’s board composition as at its 2020 annual report is as follows:

o Accessibility and transparency: Management and the group’s investor relations team are accessible and respond in a timely manner. The group usually provides quarterly updates and details of its financial performance complete with presentation slides and press release.

- We continue to like Astro for its: (i) strength in vernacular content and high household penetration rate of 74% as at FY21; (ii) its move to expand its offerings by aggregating streaming services via OTT partnerships and launching of its own Sooka OTT; and (iii) attractive dividend yield of 7-9%. Risks to our call include: (i) lower-than-expected subscription uptake; (ii) softer adex due to Covid-19 restrictions and impact on consumer and business sentiments; and (iii) intensified competition within the OTT space due to piracy and illegal streaming alternatives.

Source: AmInvest Research - 19 May 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on AmInvest Research Reports

Created by AmInvest | Nov 25, 2024

Created by AmInvest | Nov 21, 2024