Star Media Group - Strong in energy efficiency

AmInvest

Publish date: Wed, 19 May 2021, 09:04 AM

Investment Highlights

- We maintain our BUY recommendation on Star Media (Star) with unchanged forecasts and fair value of RM0.53/share, pegged to a PB of 0.5x. We have make no price adjustments to reflect a 3-star ESG rating as appraised by us (Exhibit 3). Star is a constituent of the FTSE4Good Bursa Malaysia Index.

KEY ESG METRICS

o Energy efficiency: Star has put in key measures to monitor and manage raw material utilization responsibly in its printing business. These are: (i) printing on 100%-recycled newsprint; (ii) minimizing press run wastage; (iii) usage of eco-friendly ink; and (iv) monitoring the efficiency of raw material utilization such as the group’s move to 42 gsm (grams per sq metre) newsprint in 2016 which led to increases in its yield per kg. As at 2020, newsprint yield stood at 400.89 pages/kg. On top of general energy efficient initiatives, the group has a 500 kWh rooftop solar plant. Overall, the group saved an average of 40,430 kWh/month from its energy conservation initiatives.

o Recycling and waste management: Star complies will all applicable laws and regulations and engages in proper scheduled waste storing and monitoring practices. The group adopts recycling practices across the organization and reduces, reuses and recycles its waste whenever possible.

o Content management: To ensure fair and transparent content sourcing practices, the group has set up a Content Management Committee to oversee the purchase of responsible content for the defunct video-on-demand (VOD) offering dimsum.

o Digital transformation: The group has embarked on various digital transformation initiatives in order to improve its cost efficiencies including: (i) launching thestar.com.my paywall to diversify revenue streams; and (ii) launching various digital products an platforms such as TheStarmall, BeliLokal and Suria radio mobile application. Besides that, the group has prioritized upskilling of its employees to enable digital transformation via self-learning and classroom programmes.

o Customer reach and experience: Star remains the publisher of The Star, Malaysia’s leading English daily. In 2019, a media consumption report by Vase.ai reported that 69% of 1,031 respondents said that they read The Star newspaper frequently, while 76% said they read Star Online, the top English online site for news in Malaysia.

o Corporate social responsibility: The group’s Star Foundation, established in 2004, raises and administers fund for social causes, with key programmes in 2020 as follows: (i) RM575K donated to 25 NGOs, mainly for community welfare and development, and education; (ii) the Wheelchair Programme which donates to individuals and NGOs with mobility needs; (iii) Medical Fund Programme where RM154K was spent on four surgeries for children 7 years old and under; and (iv) Covid-19 initiatives which led to raising RM2.6mil to provide medical supplies to 34 hospitals and 15 state health departments and donation of RM100K to 3 Sabahan NGOs to support families affected by the pandemic. Star also has various educational initiatives such as: (I) the Star Education Fund which provides scholarships to students 17–25 years old; (ii) the annual Star Education Fair; and (iii) Kuntum magazine and workshops for students.

o Human capital development: In 2020, Star conducted 50 training courses with a total of 6,778 learning hours for 285 of its staff, an average of 24 training hours per employee. With its occupational safety and health practices in place, the group mandates regular trainings conducted throughout the year. The number of accidents halved to 6 in 2020 (from 11– 13 in the past two years) while total man-days lost to injuries were reduced to 1 (from 4–6 in the past two years).

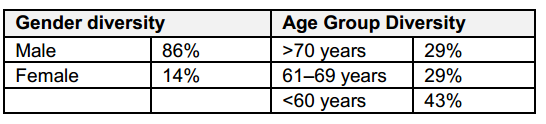

o Board composition: Star’s board comprised five non-independent non-executive directors including the chairman and two non-independent non-executive directors. The group’s board composition as at its 2020 annual report is as follows:

o Accessibility and transparency: Due to leadership changes in Star, management and the group’s investor relations have been less accessible to analysts for the past year. However, we are optimistic of improvements in accessibility with the recent appointment of Star’s new group CEO effective March 2021.

- We are still cautious on Star’s prospects due to its lack of diversification from traditional media segments relative to other players. However, the performance of its print, radio, and events segments is expected to recover following expectations of gradual improvement in consumer sentiments following the rollout of Covid-19 vaccinations. Furthermore, we view that its move to cease the operations of its VOD platform dimsum will lead to improvements in group performance.

Source: AmInvest Research - 19 May 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Nov 25, 2024

Created by AmInvest | Nov 21, 2024