Stock on The Move - Shin Yang Shipping Corporation

AmInvest

Publish date: Wed, 02 Nov 2022, 05:05 PM

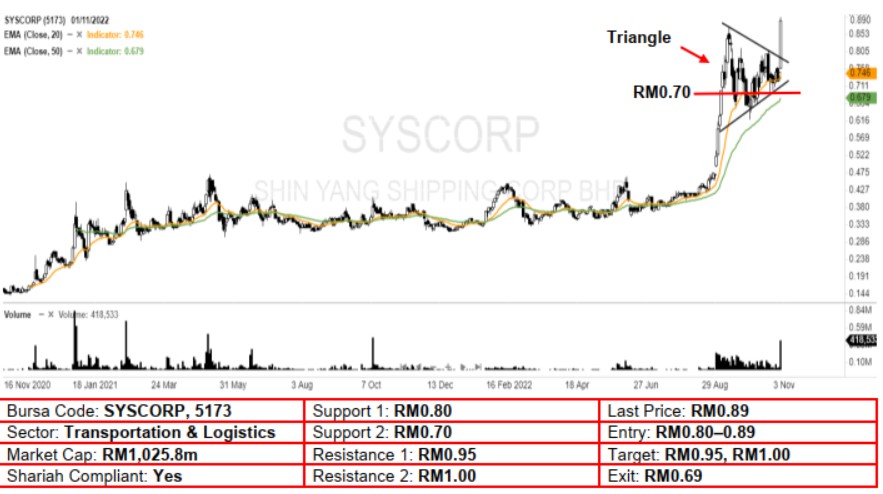

Technical Analysis. Shin Yang Shipping Corporation broke out from its 2-month bullish triangle pattern with a long white candle, implying that its previous uptrend may have resumed. As the stock also surged to a fresh new multi-year high and coupled with all of its rising EMAs, a bullish outlook can be expected here. A bullish bias may emerge above the RM0.80 level, with a stop-loss set at RM0.69, below 20 Oct’s low. Towards the upside, the near-term resistance level is seen at RM0.95, followed by RM1.00.

Company Background. Shin Yang Shipping Corp’s core businesses are shipping, shipbuilding, ship repair as well as shipping and forwarding agency. The group’s shipping operations cover both Malaysian and International waters; ranging from South East Asia, East Asia and the Far East regions. Currently, the group is supported by its fleet of 225 vessels.

Prospects. (i) Domestic and coastal shipping were the major growth contributors from both the infrastructure and resource-based sectors. (ii) Shipbuilding sector showed signs of stable recovery path from the operating expenditures by the oil and gas industry players. (iii) The order books for ship repair and docking effect maintenance has shown a gradual recovery with a few new vessels were being ordered. (iv) The group is expected to increase its containers shipping by establishing strategic alliance with business partners to provide efficient and effective port services.

Financial Performance. In FYE22, the group recorded improved revenue of RM893.5m (+48.55% YoY) with a net profit of RM142.8m (+706.78% YoY). This resulted from a combination of factors, coupled with a high utilisation of shipping spaces for the container vessels and bulk carriers as well as the sale of newly built vessels.

Source: AmInvest Research - 2 Nov 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Jul 26, 2024

Created by AmInvest | Jul 26, 2024

Created by AmInvest | Jul 26, 2024