Stock on The Move - Bonia Corporation

AmInvest

Publish date: Mon, 16 Jan 2023, 11:27 AM

Company Background. Bonia Corporation (Bonia)’s core activities are product design, manufacturing, marketing, distribution and retail of luxury leather goods, footwear, apparel, accessories and lifestyle products under its in-house brands and licensed brands. The group’s key brands are BONIA and BRAUN BUFFEL. Bonia operates in Malaysia, Singapore, and Indonesia.

Prospects. (i) Focusing on 6 growth pillars for business strategies: product line extension, brand partnership & collaboration, store enlargement, digital enhancement, e-commerce expansion, and talent management. (ii) Opening of new boutiques at strategic locations and modernising boutique design concepts to enhance the shoppers’ retail experience. (iii) Continue to embrace on technological advancement by investing in digital performance marketing to create digital content and generate sales.

Financial Performance. In 1QFY23, Bonia posted higher revenue of RM91.7m (+1.1x YoY) with a net profit of RM14.2m (+3.9x YoY), primarily driven by the growth in volume as a result of the normalisation of business and the opening of new stores. In FYE22, the group recorded higher revenue growth of RM369.3m (+27.7% YoY) with a PAT of RM52.6m (+2.2x YoY). This was mainly attributable to the continuous brand-building exercise and product development in launching fashionable products.

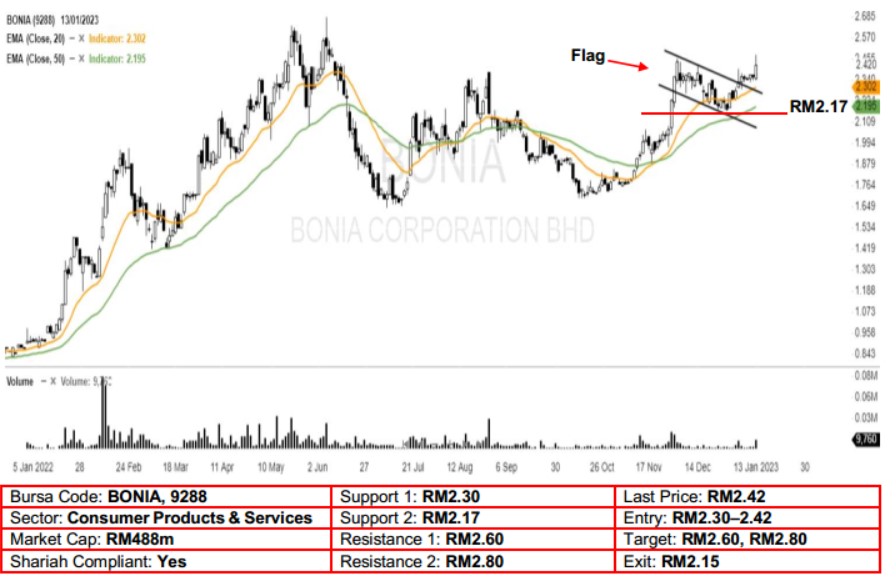

Technical Analysis. Bonia’s buying interest is back after it broke out of the 1-month bullish flag pattern a few sessions ago. With the 20-day EMA remaining above the 50-day EMA since the bullish crossover in early Dec22, the uptrend may continue in the near term. A bullish bias may emerge above the RM2.30 level, with a stop-loss set at RM2.15, below the 50-day EMA. Towards the upside, the near-term resistance level is seen at RM2.60, followed by RM2.80.

Source: AmInvest Research - 16 Jan 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on AmInvest Research Reports

Created by AmInvest | Sep 19, 2024